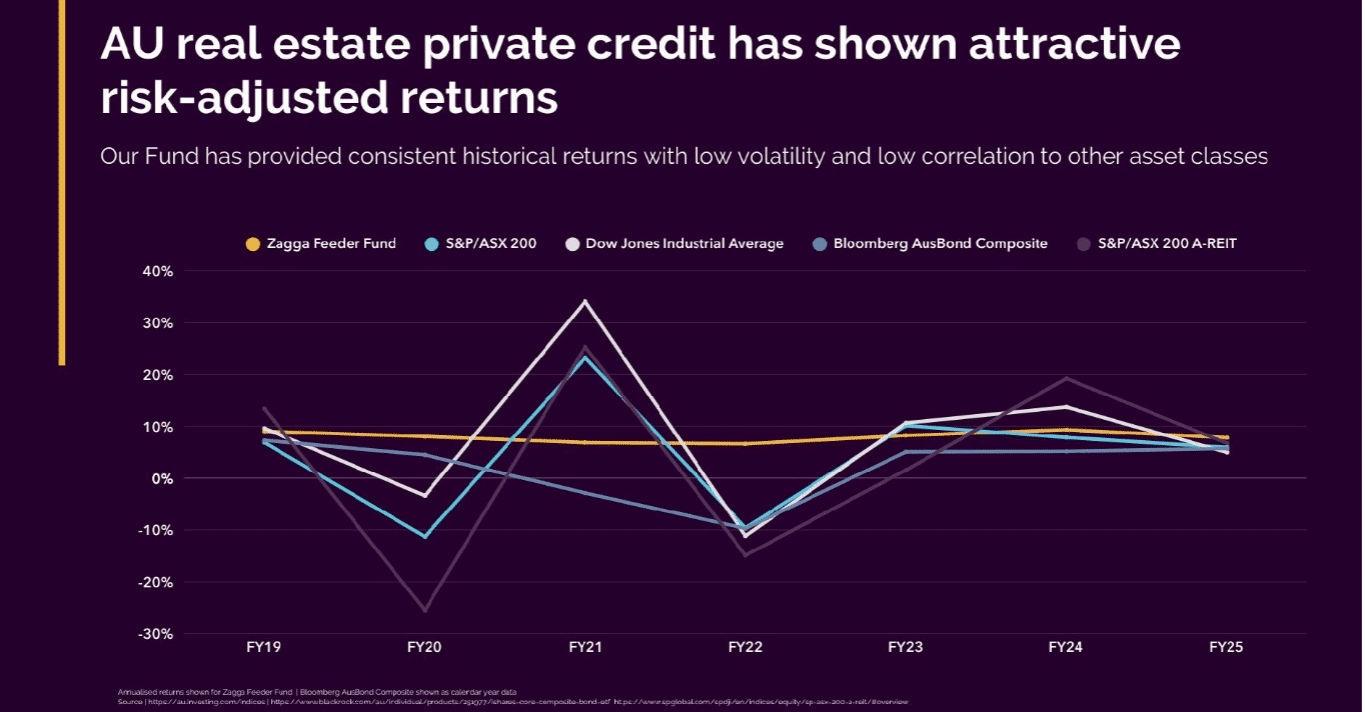

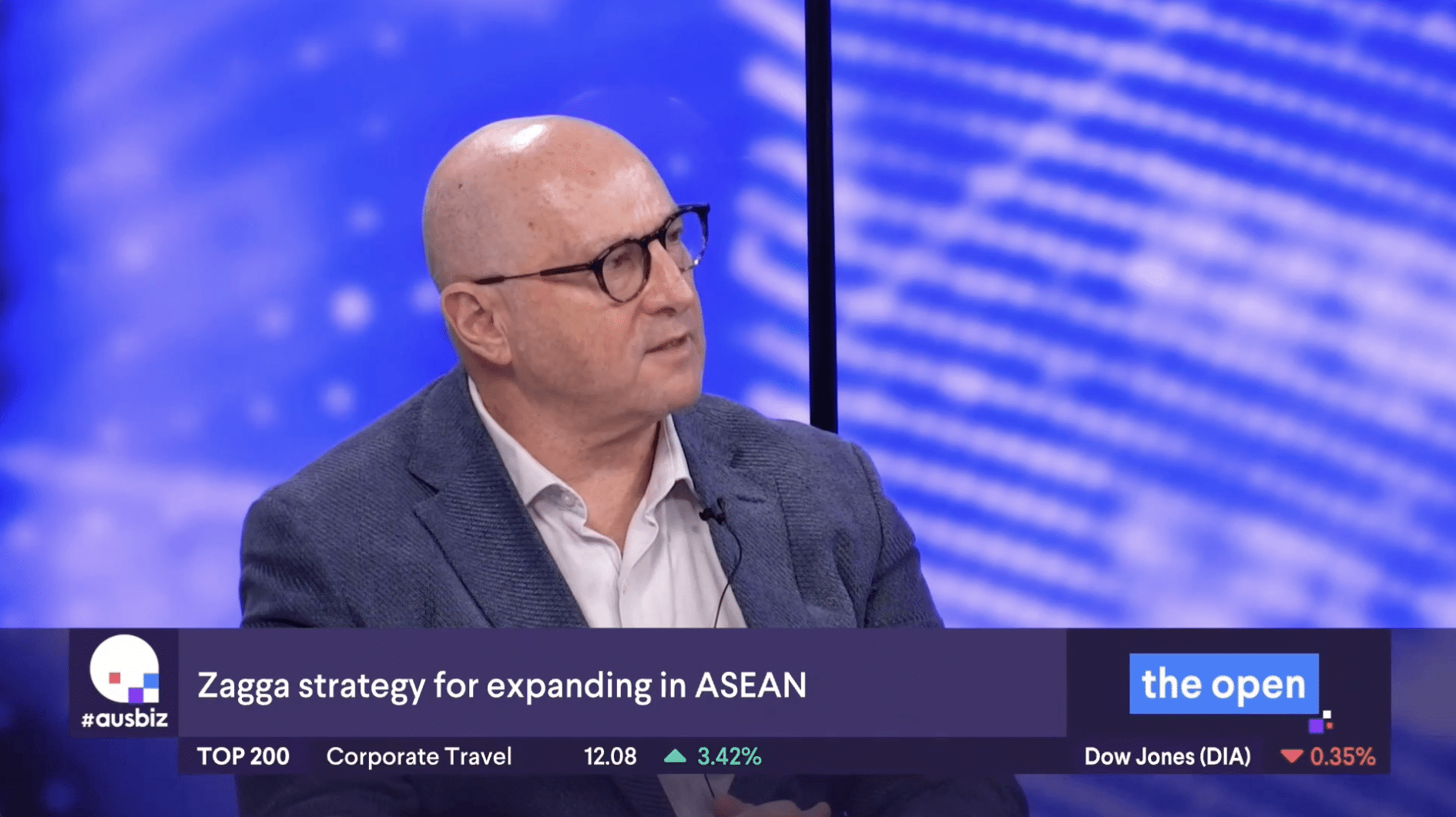

Real estate private credit hits its stride as Zagga keeps scaling

STOCKHEAD & THE AUSTRALIAN

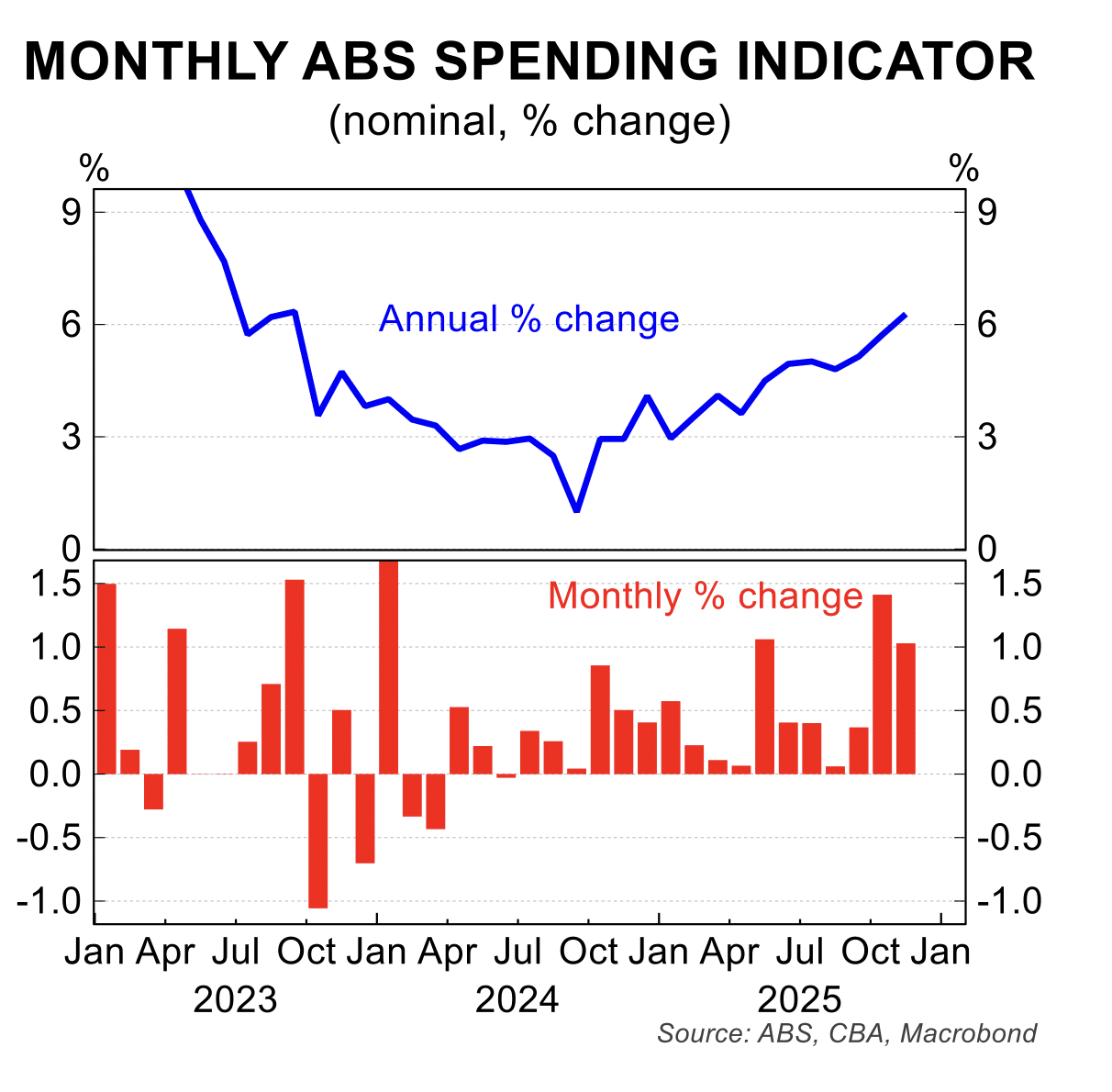

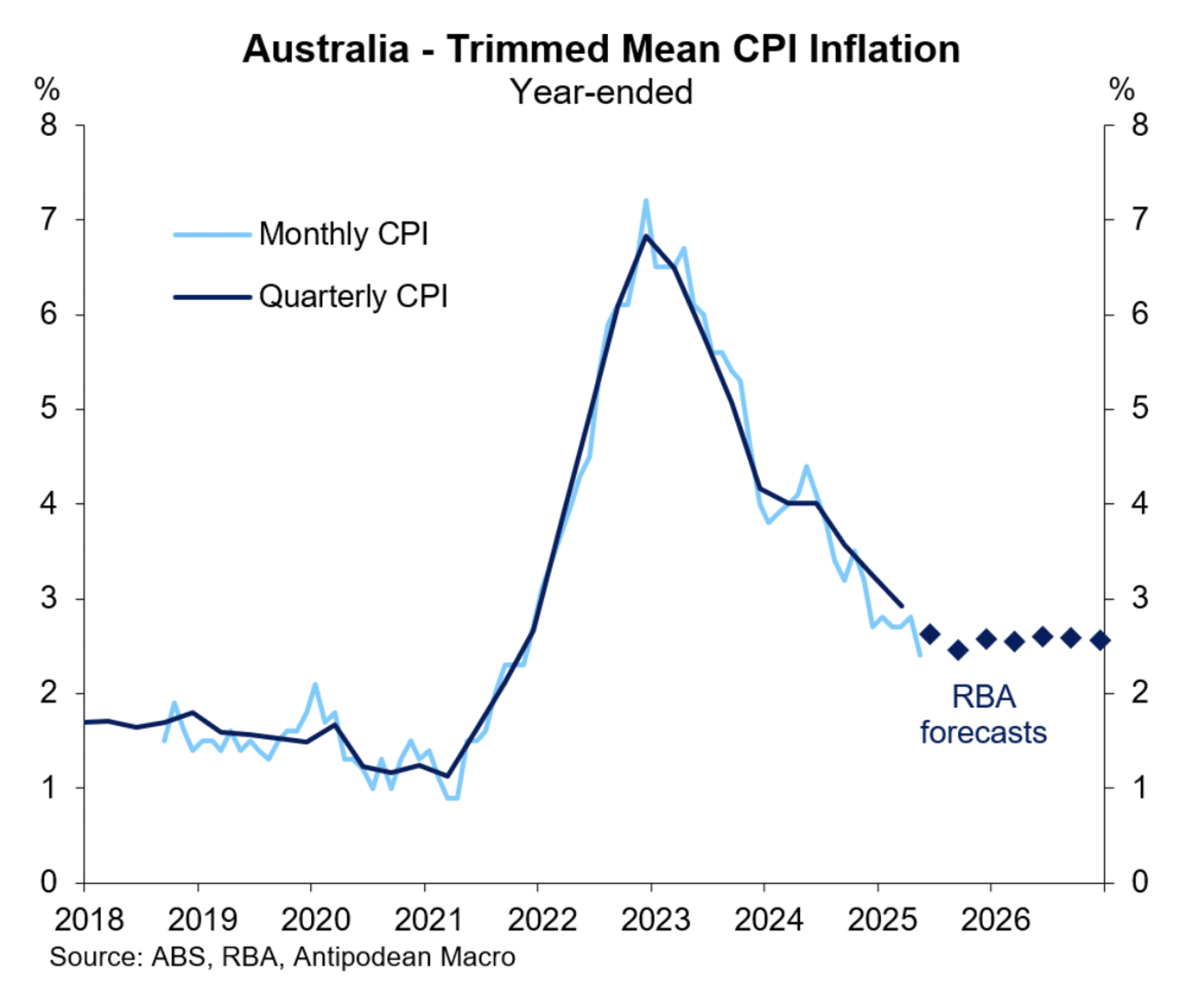

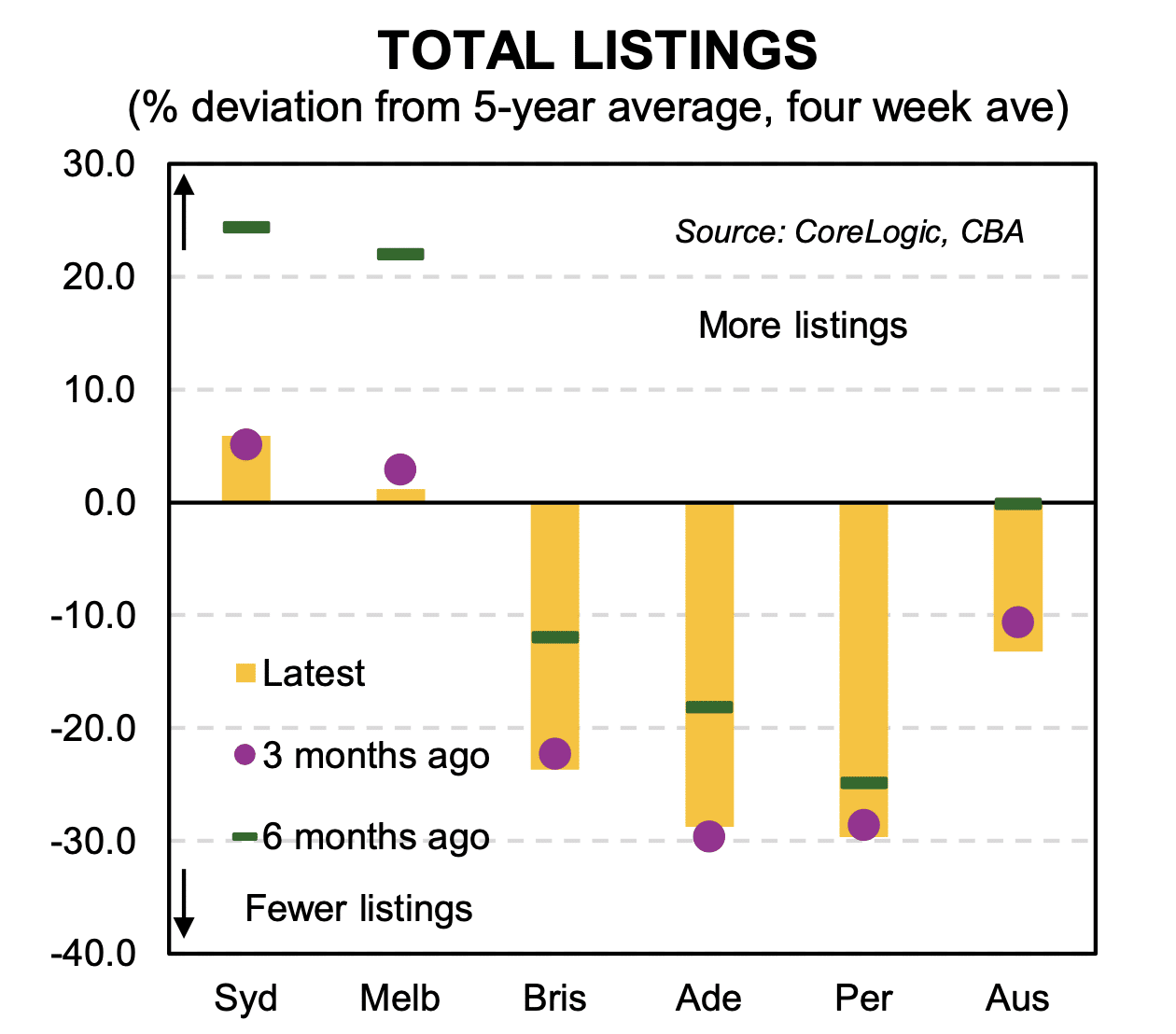

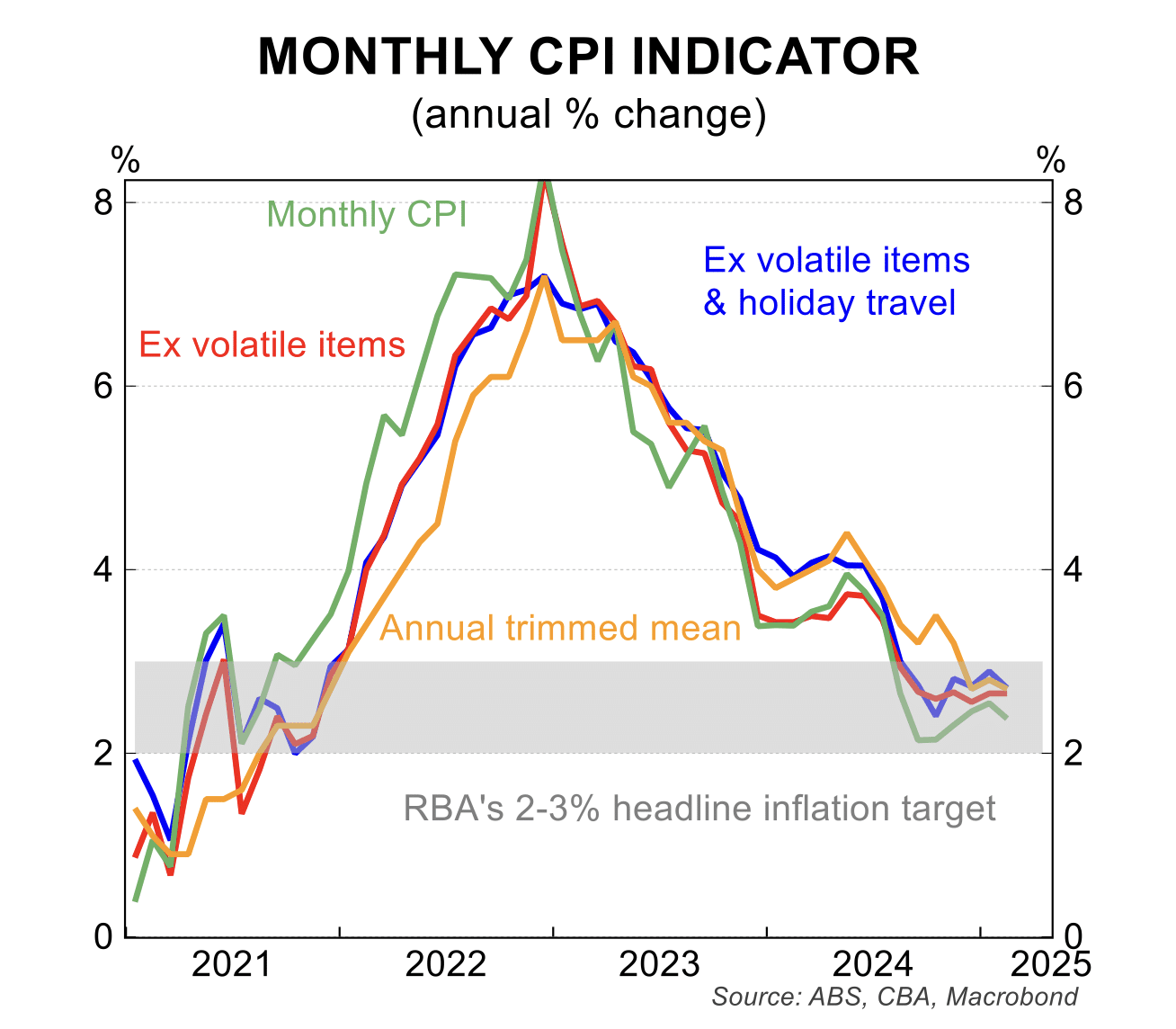

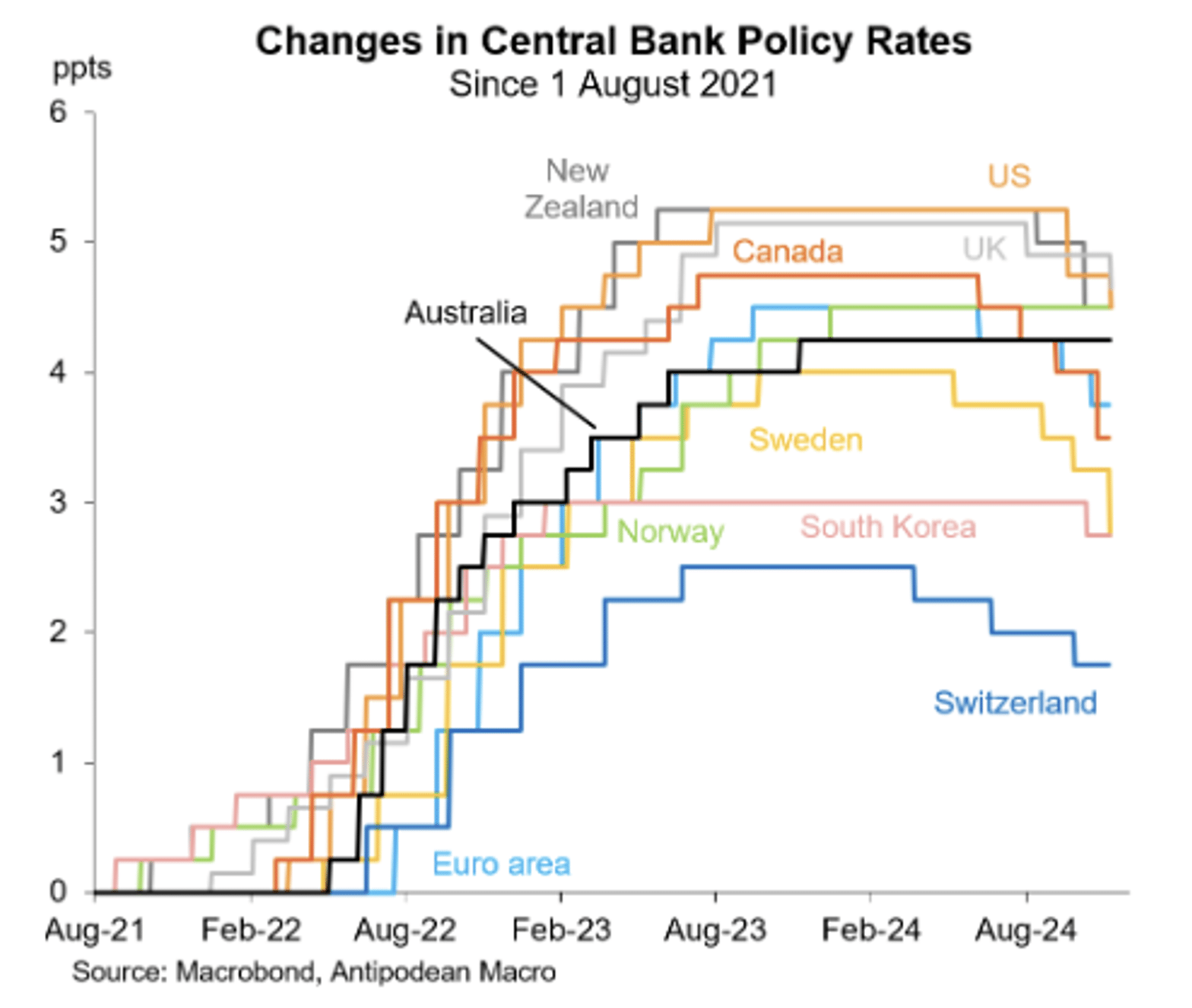

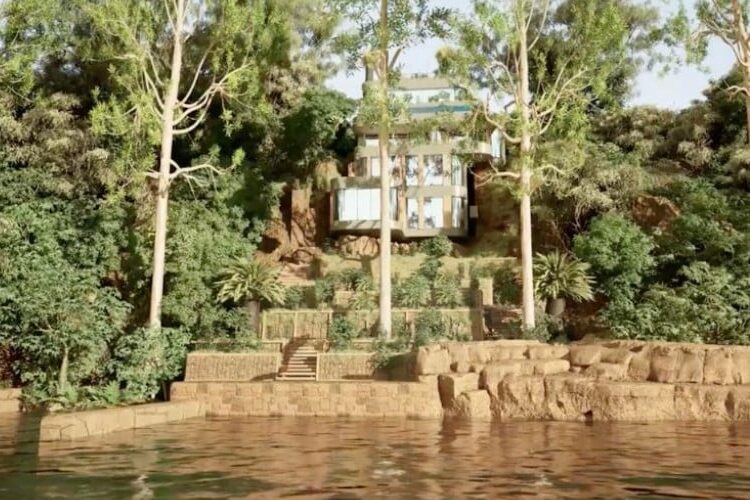

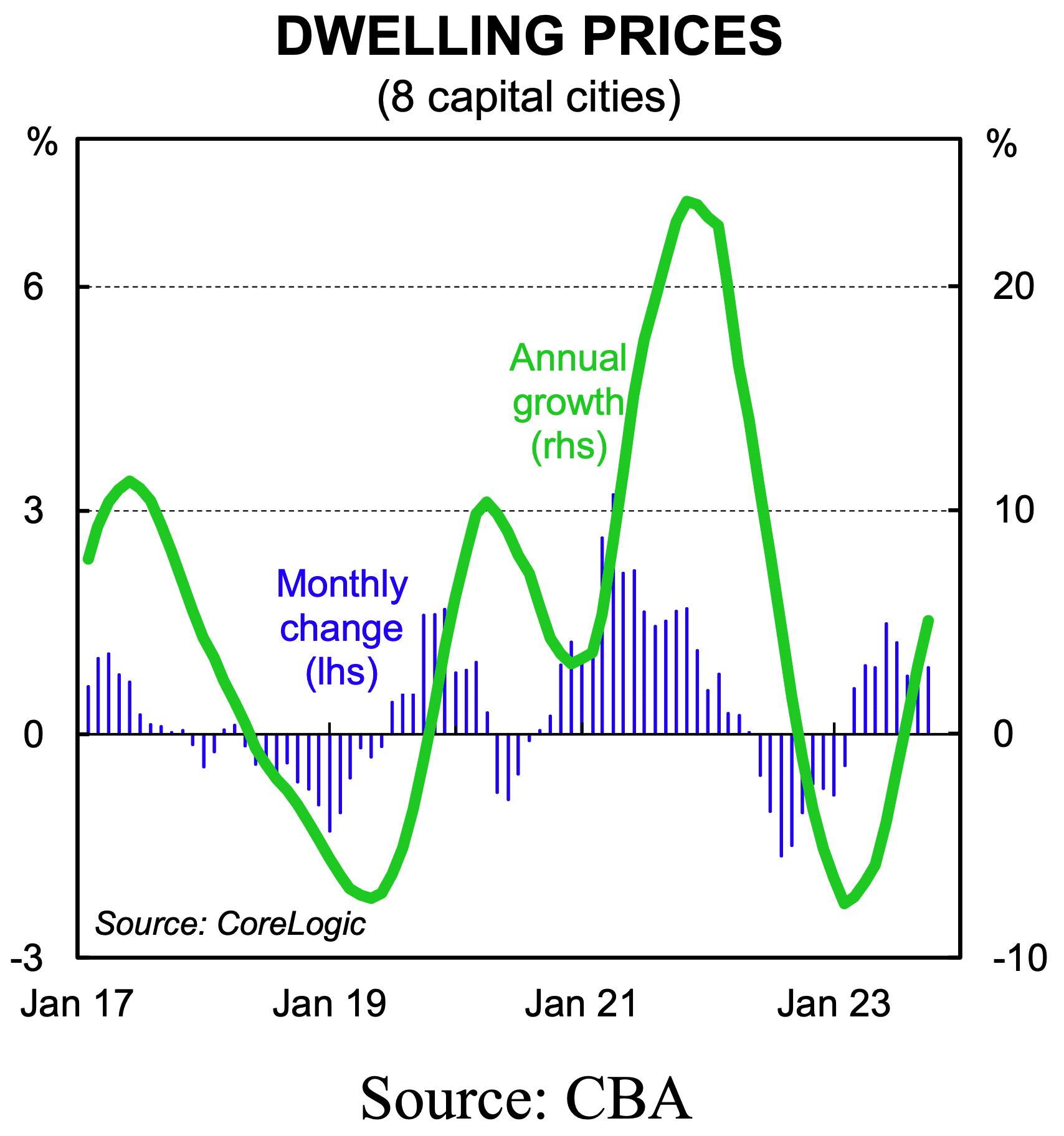

If 2025 was the year real estate private credit stepped into the mainstream, 2026 could be shaping up as the year it becomes a permanent pillar of the financial system.

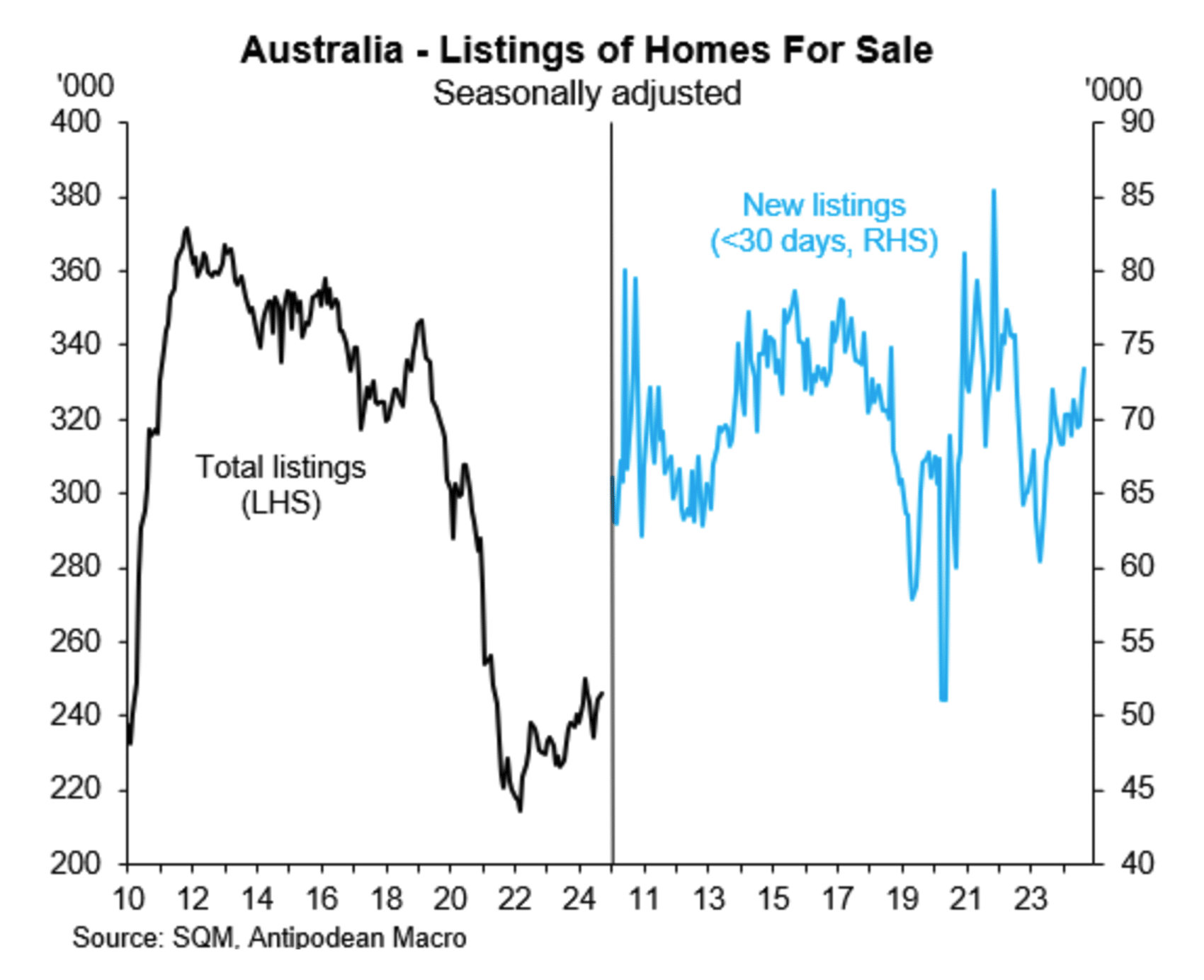

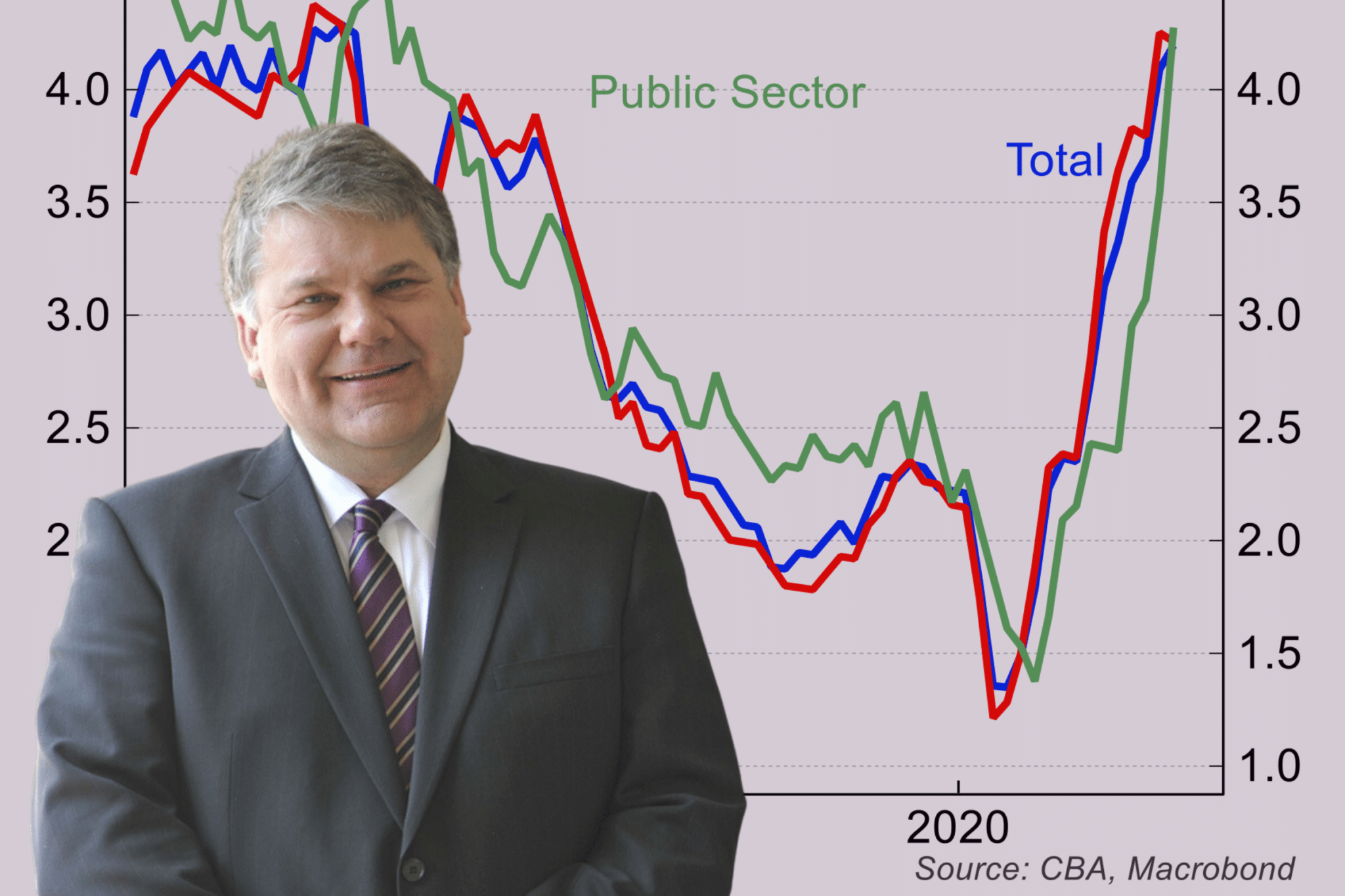

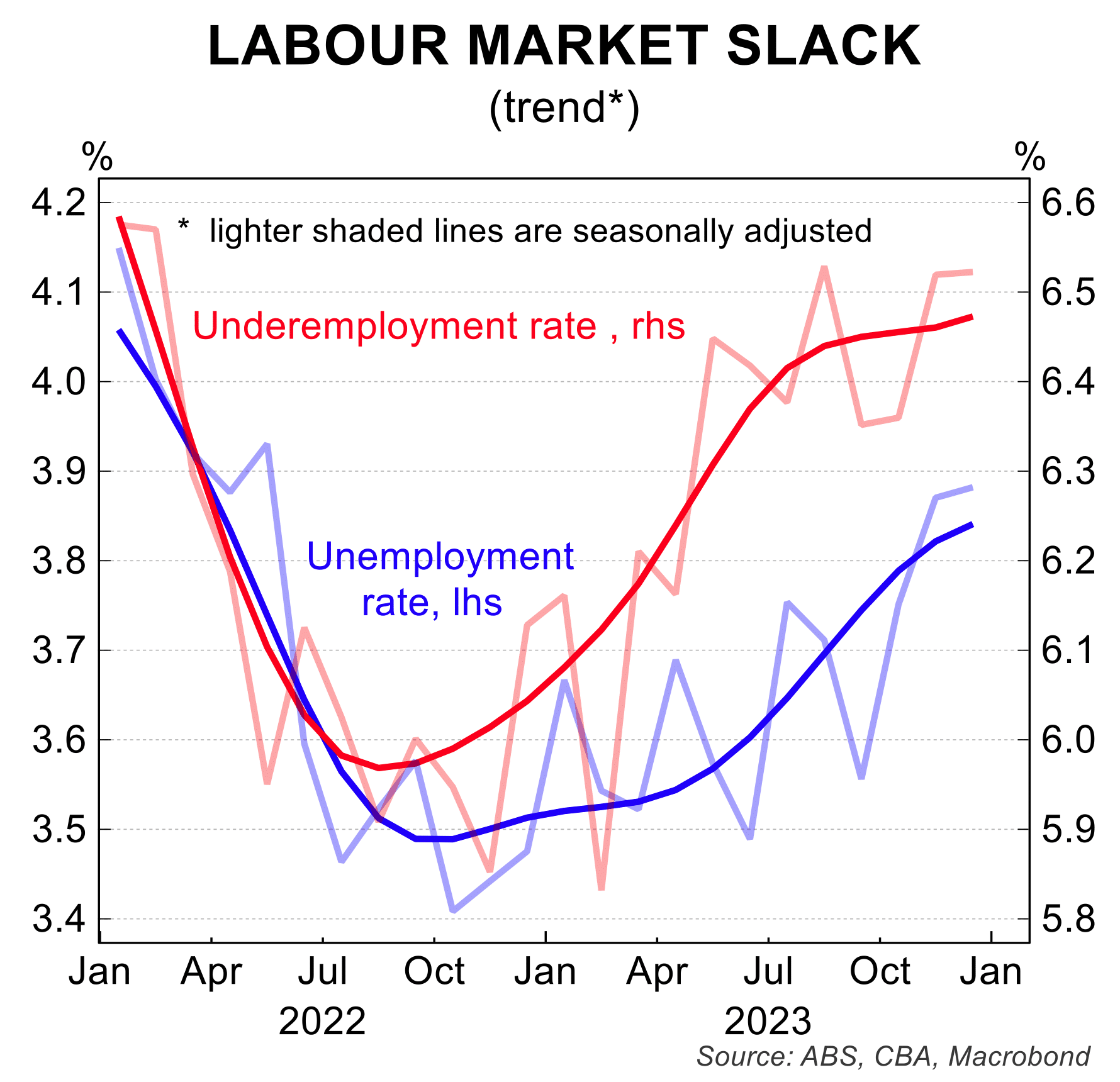

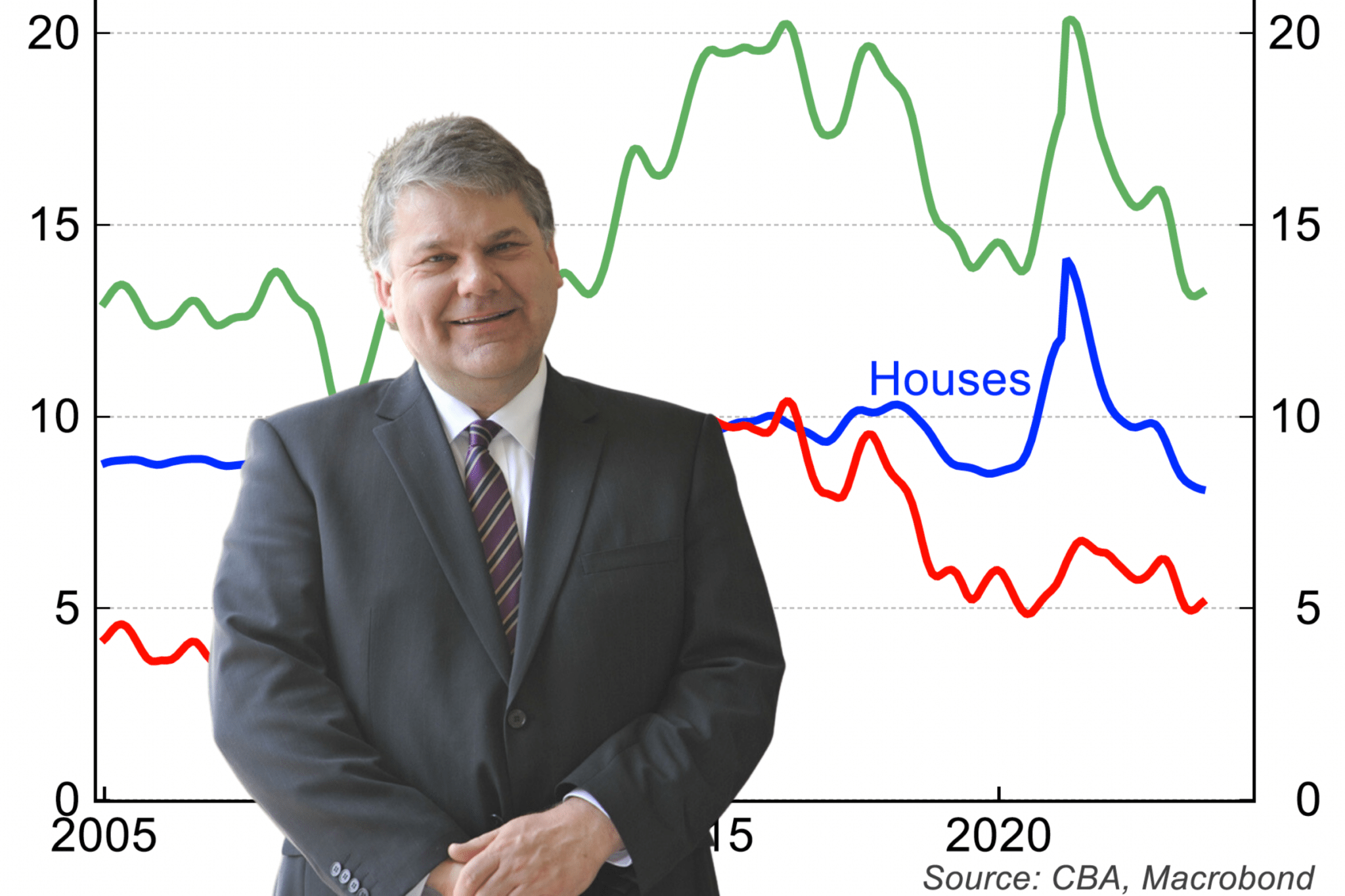

Australia’s private credit market now exceeds $220 billion and continues to enjoy close to double digit growth. Real estate private credit alone is forecast to approach $90 billion by the end of the decade.

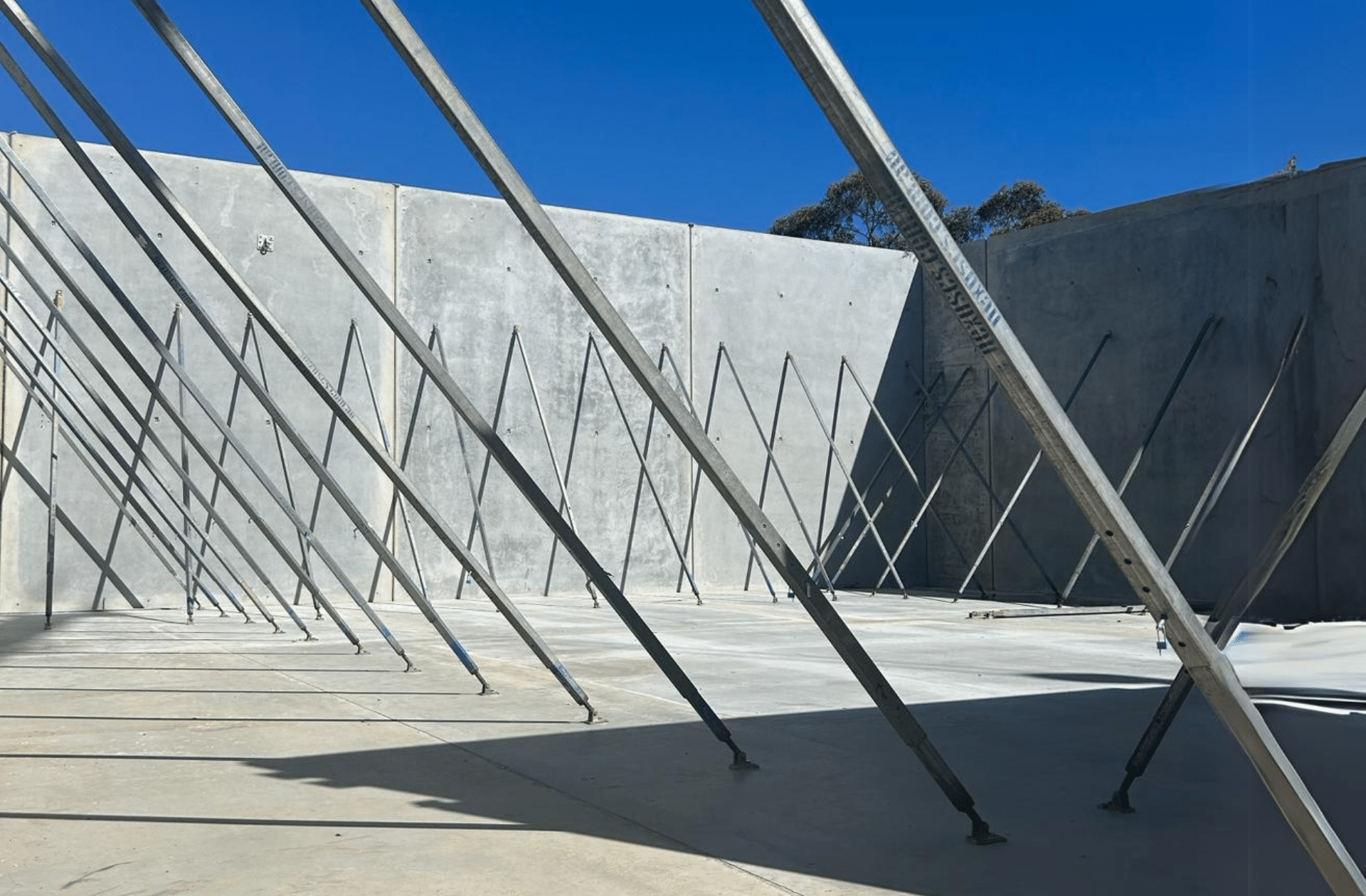

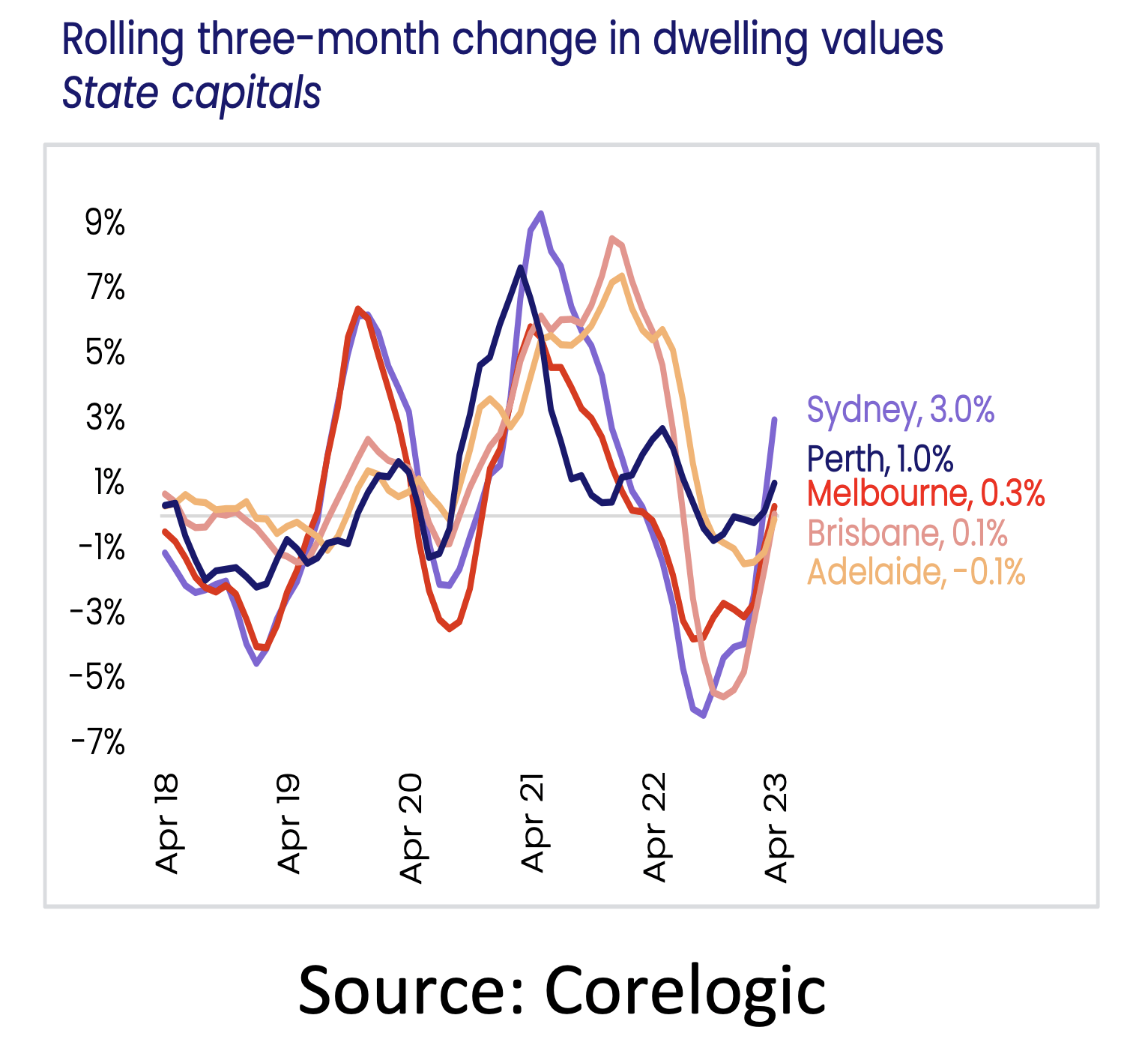

What’s driving that momentum is not just investor appetite, but a structural reshaping of how property is funded.