With official interest rates nearing their peak, having been hiked 375 basis points since May 2022, the Australian economy is slowing.

A slower economy is the direct objective of the Reserve Bank and its interest rate hiking cycle. It is aiming to bring inflation down from a peak of 7.8 per cent in the December quarter 2022 to eventually hit the 2 to 3 per cent target based largely on a pull-back in consumer spending and softer growth more generally.

While inflation remains high, there is clear evidence that inflation is falling with annual inflation easing to 7.0 per cent in the March quarter 2023. The monthly data showed inflation falling even more – to 6.3 per cent in the year to March.

Within the broader economic slowdown, the construction sector has been under pressure, but the softness evident in the sector now is – perversely – setting the property market up for a strong rebound over the medium term into late 2023 and in 2024.

In the near term, the slowing in construction has been driven by rising materials costs and labour shortages which both hit at the time demand for housing eased due to higher interest rates. These factors have combined to see the number of new dwelling approvals falling from the 2021 peak and to now be hovering at a decade low.

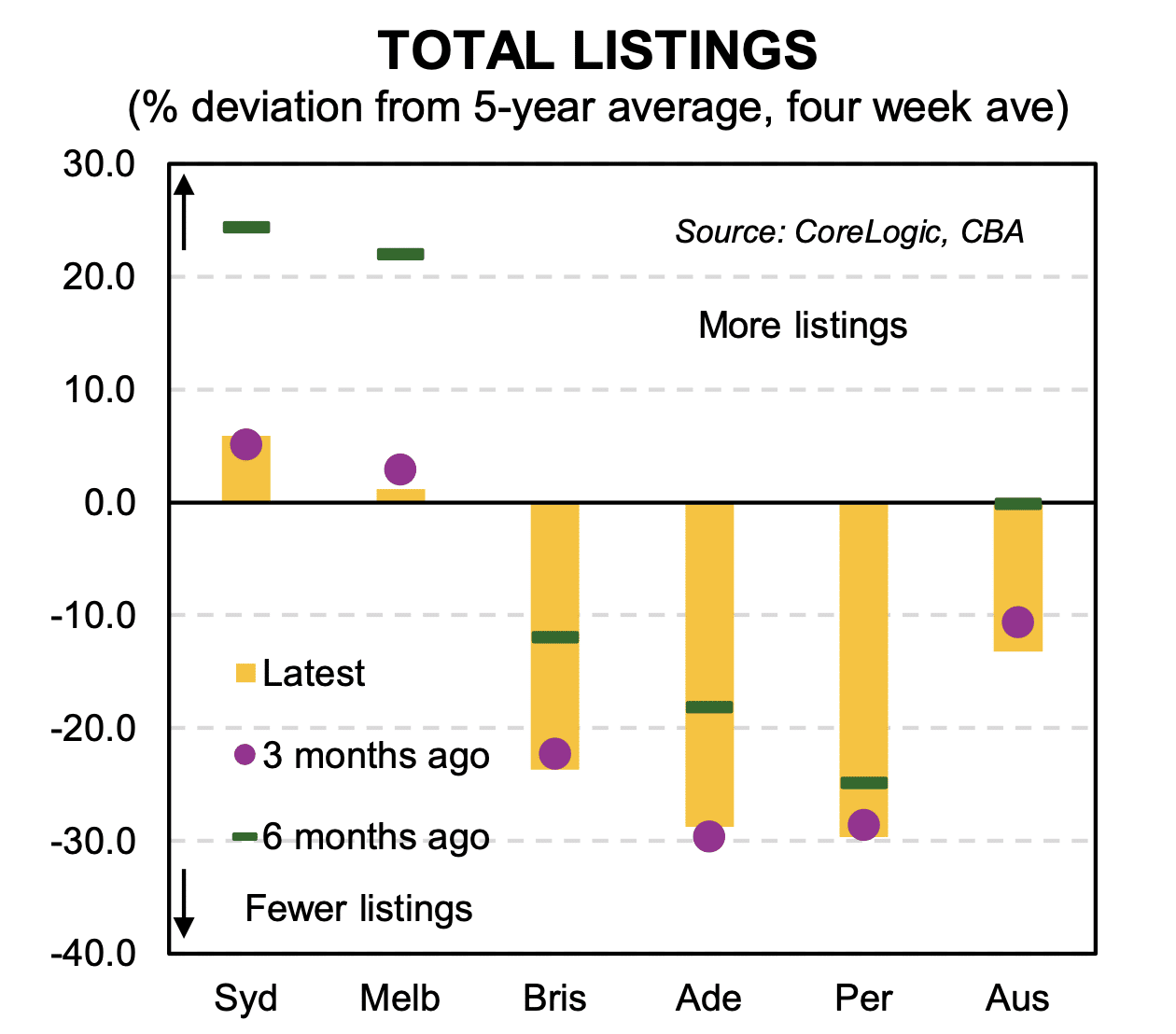

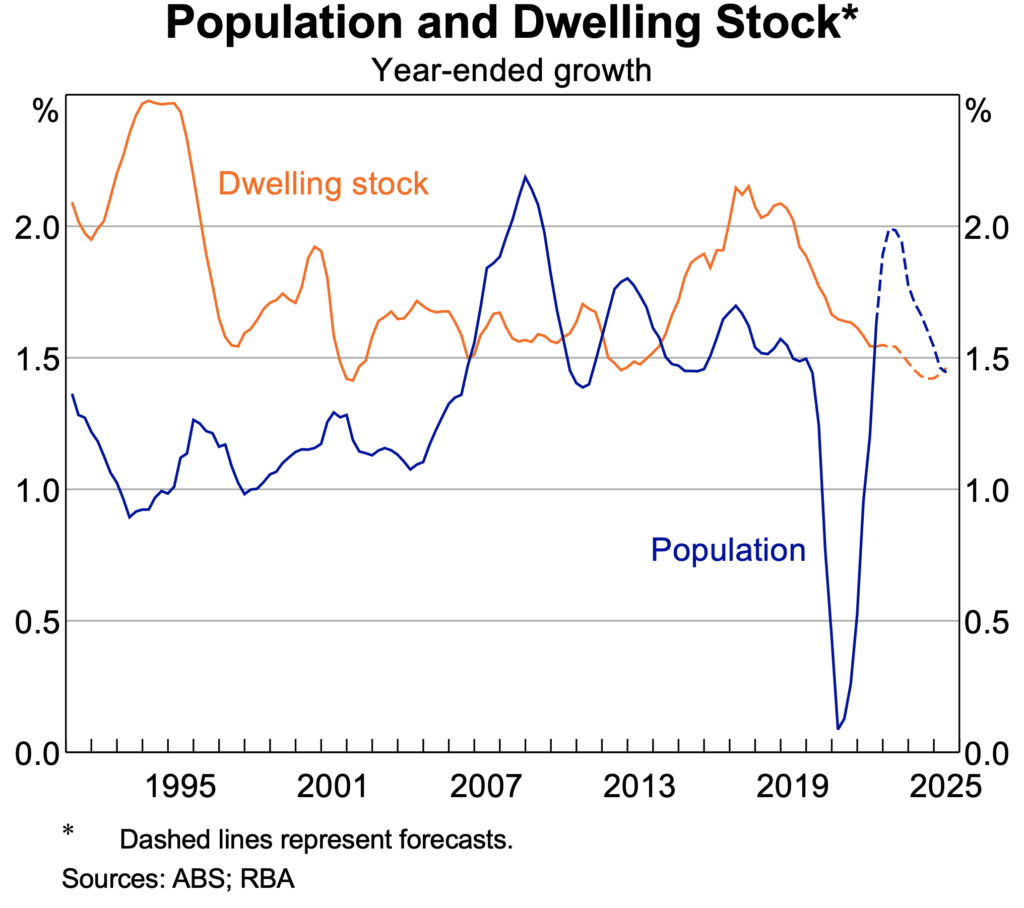

While this is hurting construction activity and the economy more broadly in the near term, further out it will mean Australia will have a shortage of dwellings, given that population growth is booming with immigration levels surging in the post-pandemic era of open borders. A return of foreign students is pressuring the rental market which has seen rental vacancy rates hover near record lows.

There are early signs that these factors are signalling a bottoming in the housing cycle. According to Corelogic, house prices have risen nearly 2 per cent from the low point in early February. The negative effect of higher interest rates is being overwhelmed by the surge in demand from strong population growth which is a key factor boosting underlying demand for housing.

"The economy is slowing, inflation is falling and the unemployment rate is poised to edge higher as a result."

Over the more medium term, which is the next 3 to 5 years, the need for housing will be very strong, simply to keep up with population growth. Approximately 200,000 new dwellings will need to be constructed each year to simply meet demand. Recall that around 20 per cent of new dwellings replace ‘knock downs’ and do not add to overall supply.

The Government has signalled that it will work with the States to build 1 million new dwellings over the next 5 years as it works to tackle the problems of housing affordability.

In the period from the opening of Australia’s international borders following the COVID pandemic, the net immigration inflow will total more than 1 million people in less than 3 years. Over the same time, there will be a further 200,000 people or so from natural increase.

As they say, they have to live somewhere.

This surge in population will trigger a strong increase in demand for dwellings and indeed, other infrastructure, including for transport, tourism and other service industries.

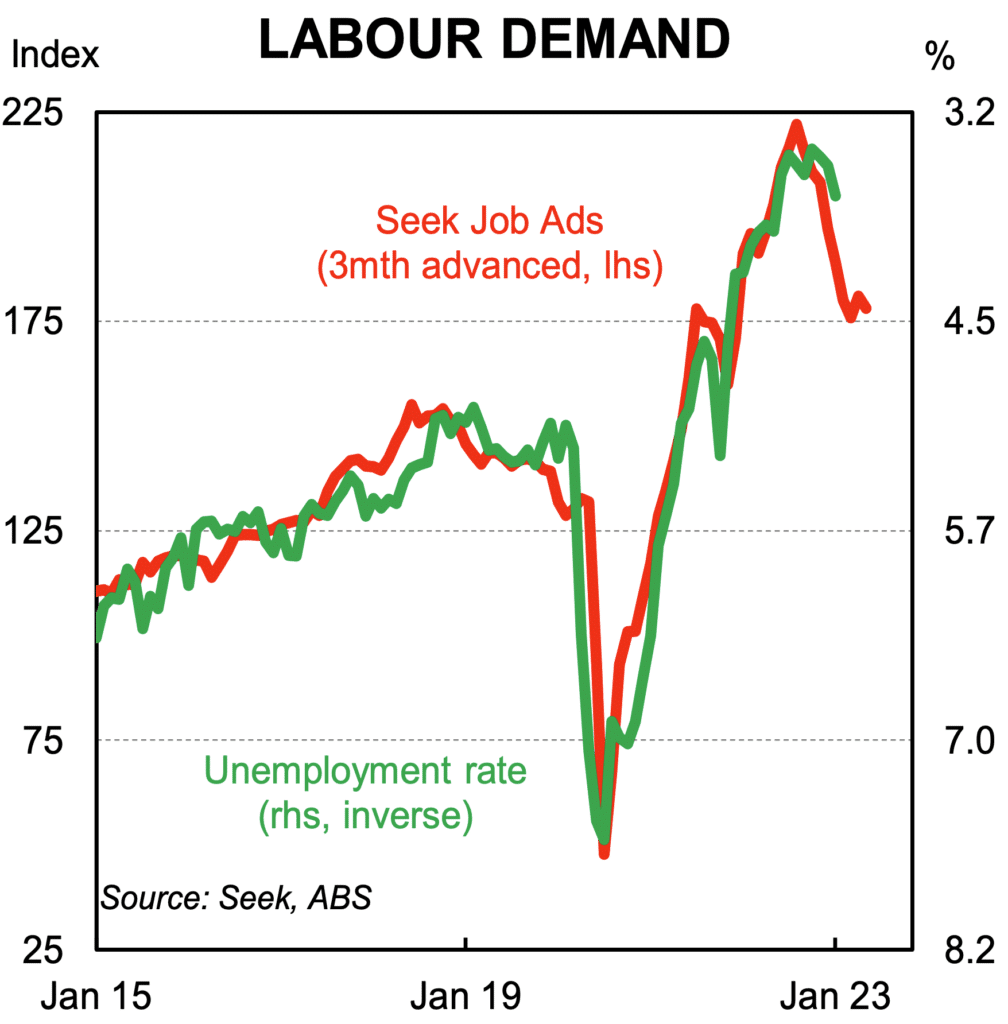

Another critical issue for the economy is the shortage of workers, both skilled and unskilled. With the unemployment rate hovering around a 50 year low of 3.5 per cent, there have been labour shortages which have added to business costs and hampered business expansion.

There are clear signs that labour market conditions are easing, with slower economic growth reducing demand for workers and the jump in skilled immigration adding to labour supply. The number of job advertisement and vacancies are still elevated but have turned lower in recent months.

According to analysis from CBA, the turn lower in the number of Seek job advertisements from the late 2022 peak will lead a change in the unemployment rate over the next 6 months – see the chart beside. On current trends for job ads, the unemployment rate is likely to rise to around 4.25 to 4.5 per cent by the end of 2023, a trend that would ease the current labour shortages and ease some of the pressure that has been building on labour costs.

The end point remains – the economy is slowing, inflation is falling and the unemployment rate is poised to edge higher as a result.

While bottom-line GDP growth will slow further in the first half of 2023, a positive outlook for business investment, the turn in housing and an economic recovery in China will offset the inevitable weakness in consumer spending to ensure an economic soft landing.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.