Why investors could turn to private credit when Division 296 tax bites

STOCKHEAD & THE AUSTRALIAN

While the government argues Division 296 will only affect a small portion of Australians, it’s clear that SMSFs – often used by high net worth individuals to manage their retirement wealth – will feel the brunt.

If the tax does go ahead, it could lead to some big shifts in how super is used, and investors are likely to look for other places to park their wealth, such as trusts or companies.

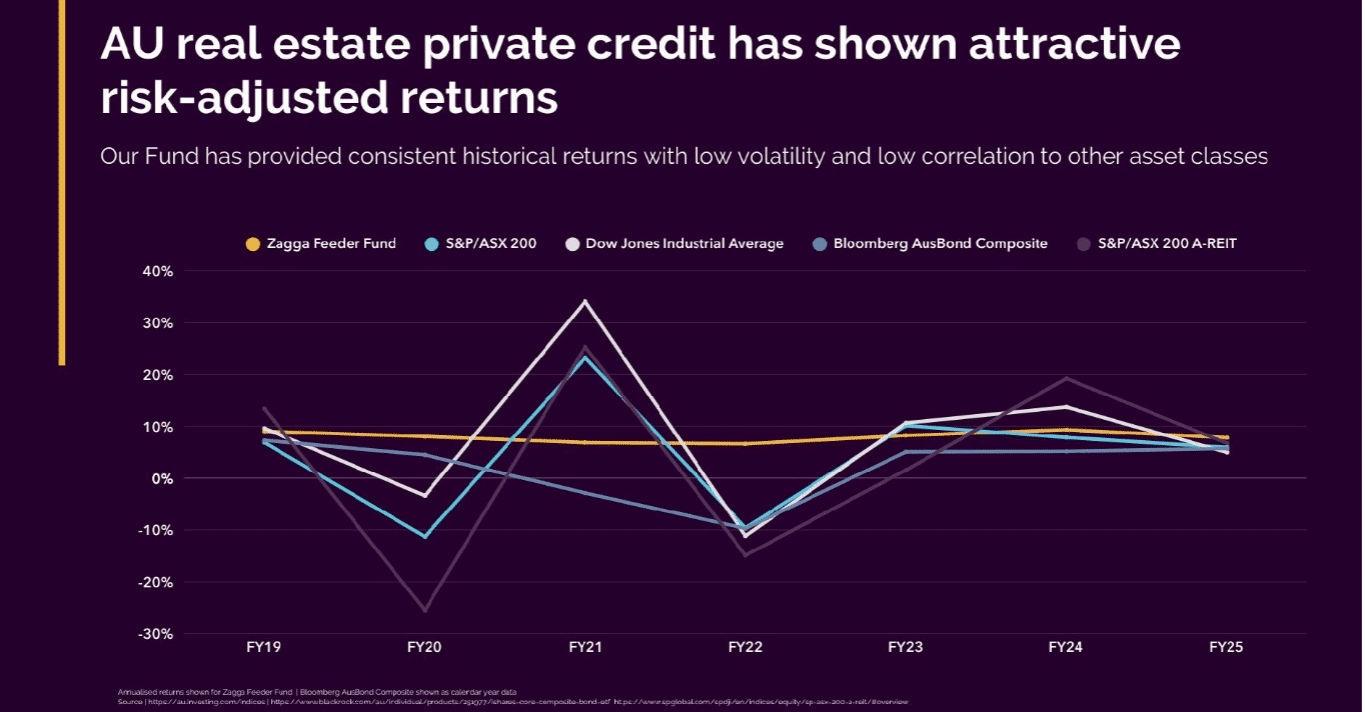

That’s where private credit, like Zagga’s core offering, could come in for these investors.