A sharp rise in global commodity prices and signs that the global deceleration in inflation was moderating has fed into a further repricing of the interest rate outlook in the past month. This has been mainly in the US although the sentiment spread to other markets including Australia where interest rate cut expectations were pushed back and moderated. The US economy, while slowing, is more resilient than other markets. The Eurozone, the UK, Canada and New Zealand are weak and on current market expectations are likely to cut interest rates before the US.

The Australian economy has continued to track at a low growth rate with inflation continuing to ease.

As a result of these trends, the RBA has moved to a clear neutral bias dropping the ‘next move is likely to be up’ comments at its March meeting.

At this stage, the RBA has NOT flagged the possibility of interest rate cuts – it needs inflation to be on track to be sustainably within the 2 to 3 per cent target band and a higher unemployment rate for it to deliver lower rates.

The weakest link in the Australian economy remains the household sector.

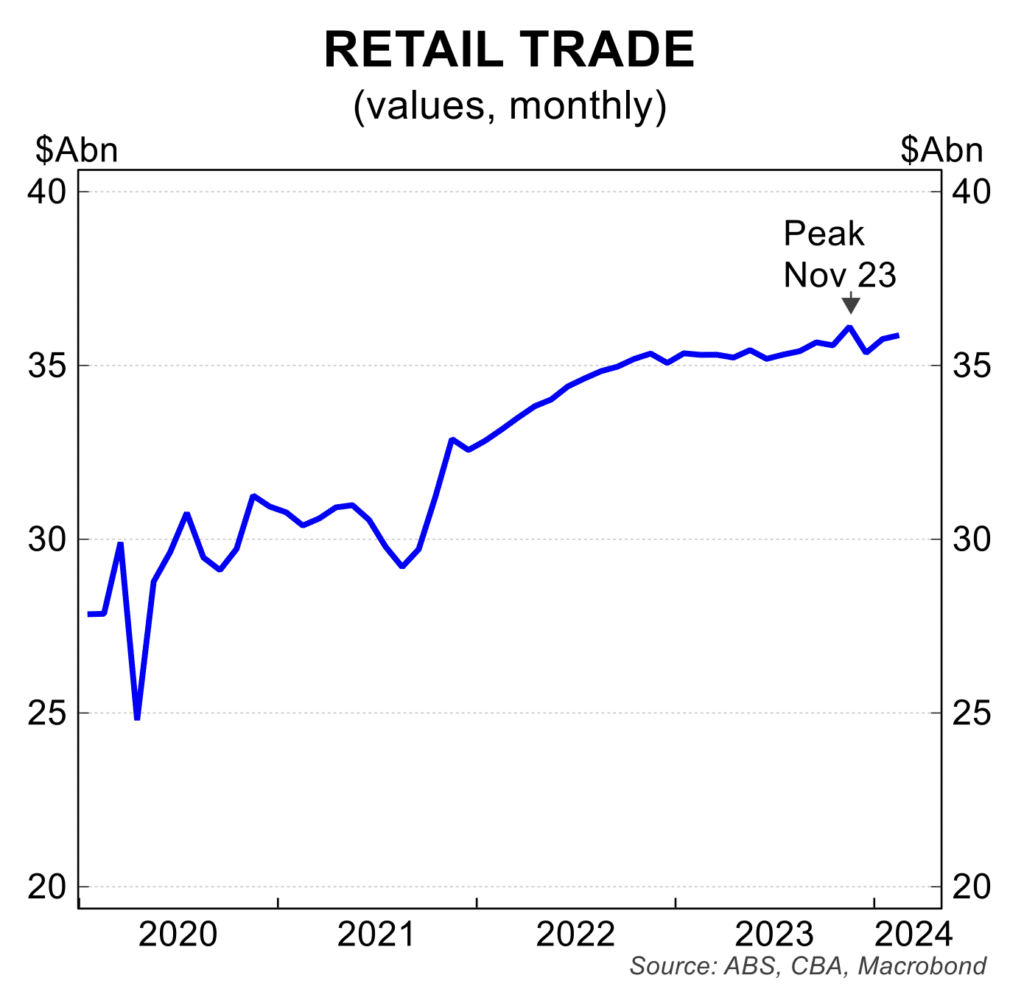

Growth in household spending is flat in real terms and has been falling in per capita terms for over a year. Consumers are continuing to confront cash flow constraints from higher mortgage interest rates and other cost of living pressures, even though wages are now increasing at a pace above inflation.

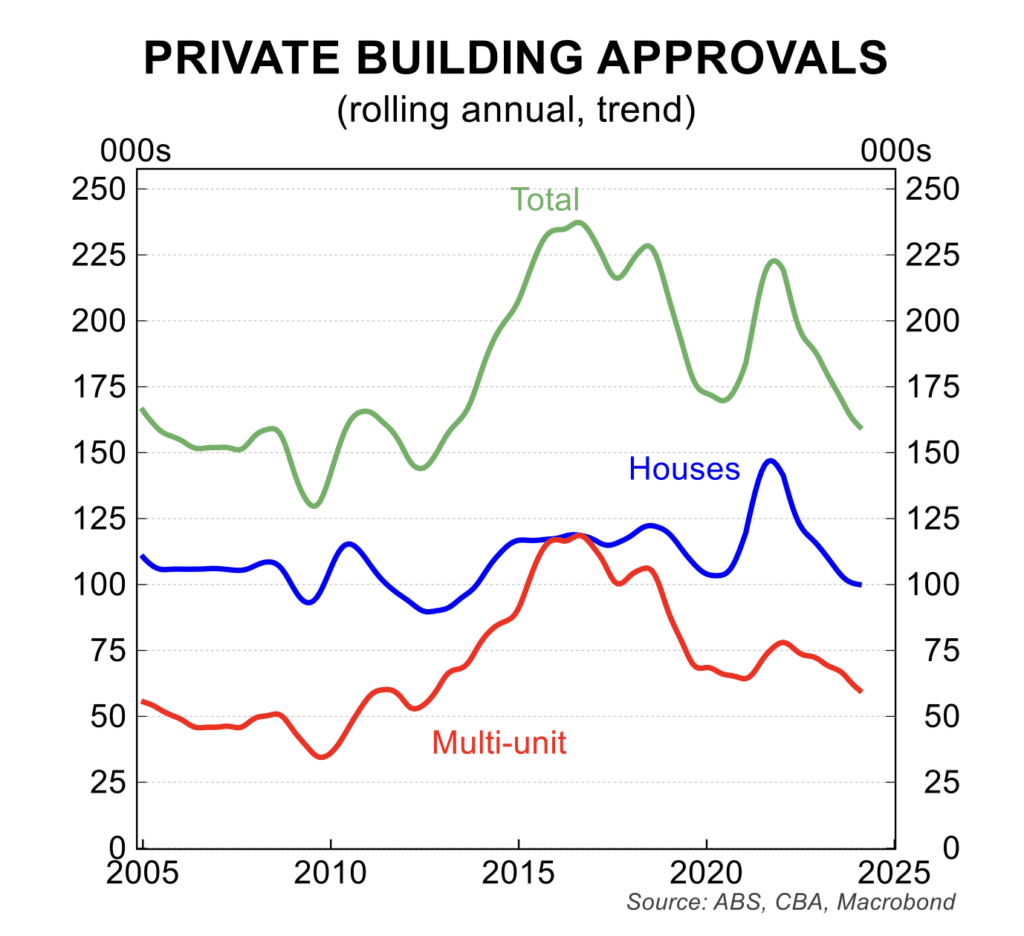

The number of building approvals remains weak, which is negative for near term GDP growth and is a longer run structural problem exacerbating the housing shortage. Building approvals fell 1.9 per cent in February and were down 5.8 per cent over the past year, to be at a level not seen since 2009. In annualised terms, the number of new dwelling approvals is 150,000, which is approximately 70,000 below the number needed to achieve the government’s objective of 1.2 million new dwellings over the next 5 years.

There remains some reasonably positive momentum in private sector business investment and exports, critical factors that are likely to work against a hard landing or recession if they are sustained.

Business conditions remain positive even if off their highs from early in 2023.

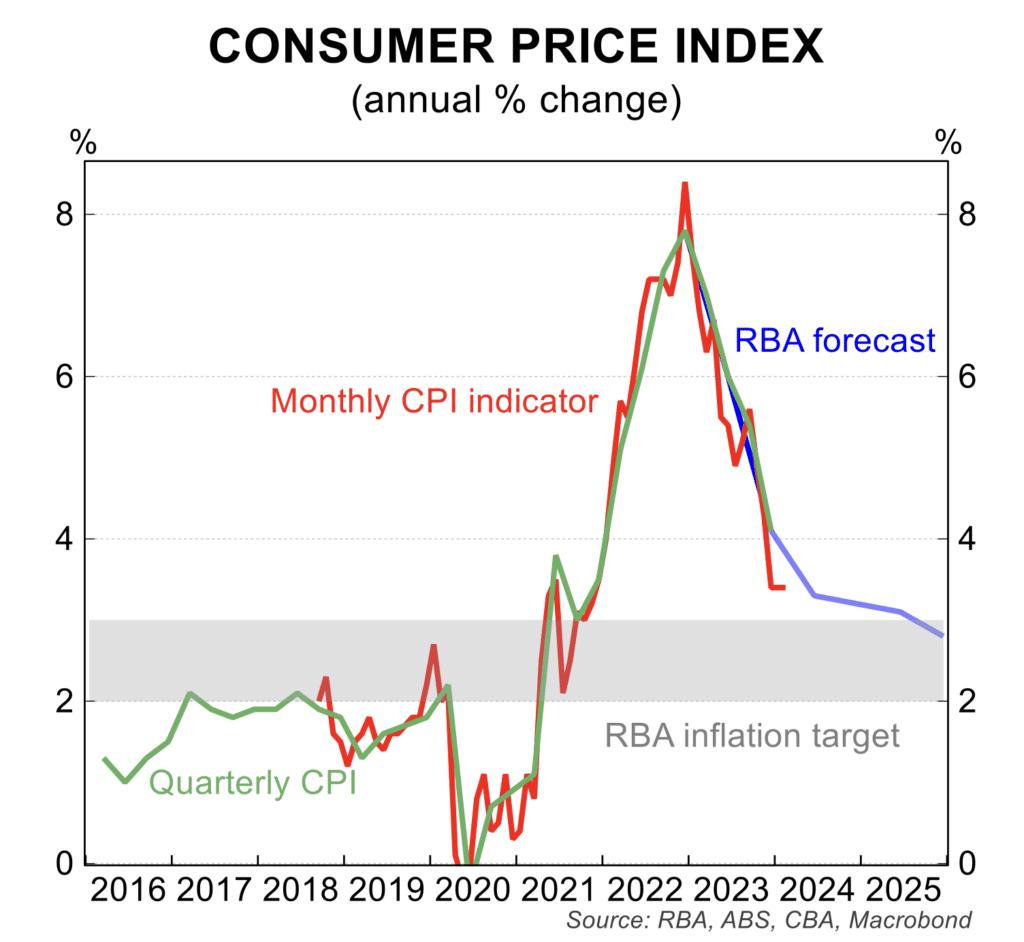

Inflation continues to surprise on the down side with the annual increase holding 3.4 per cent in February, which is down from the peak of 8.4 per cent in December 2022. Inflation is on track to settle within the 2 to 3 per cent target band during 2024, a key reason for the market pricing for interest rate cuts. The inflation momentum appears to be undershooting the latest RBA forecasts. The March quarter CPI – due for release on 24 April – is critical for assessments on the monetary policy outlook.

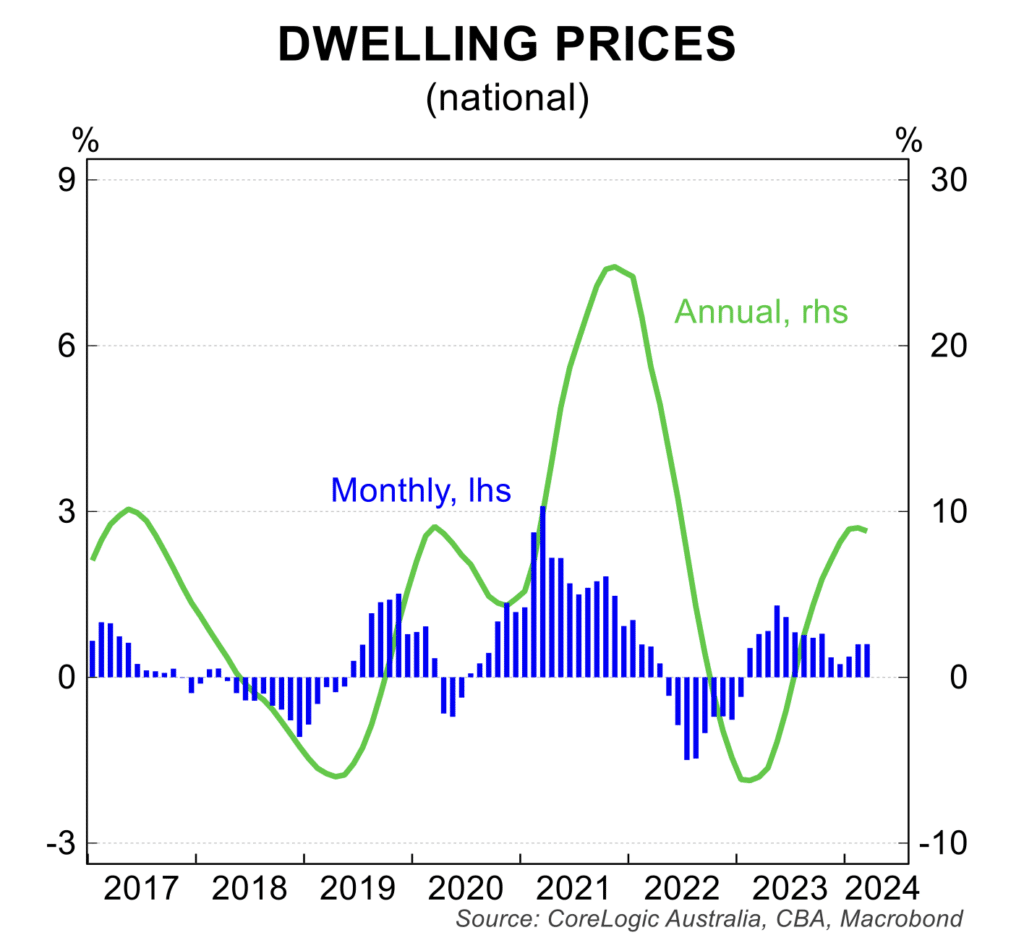

House price growth remains moderate

Nationwide prices rose 0.6 per cent in March and by1.6 per cent in the March quarter to be 8.8 per cent higher than a year earlier. As has been the case since the end of 2023, the rate of house price growth has slowed at a nationwide level but that there is a substantial divergence from the strongest to the weakest city.

The extreme divergence in price changes from city to city remains extreme. In the March quarter, dwelling price rose 5.6 per cent in Perth, 3.3 per cent in Adelaide and 3.0 per cent in Brisbane. Over the same time, dwelling prices rose just 0.9 per cent in Sydney, 0.8 per cent in Canberra and 0.1 per cent in Hobart but fell 0.2 per cent in Melbourne.

In annual terms, prices in Perth are up 19.8 per cent, 15.9 per cent in Brisbane, 13.3 per cent in Adelaide and 9.6 in Sydney. In contrast, prices in annual terms are up just 3.2 per cent in Melbourne, 1.9 per cent in Canberra, and 0.3 per cent in Hobart.

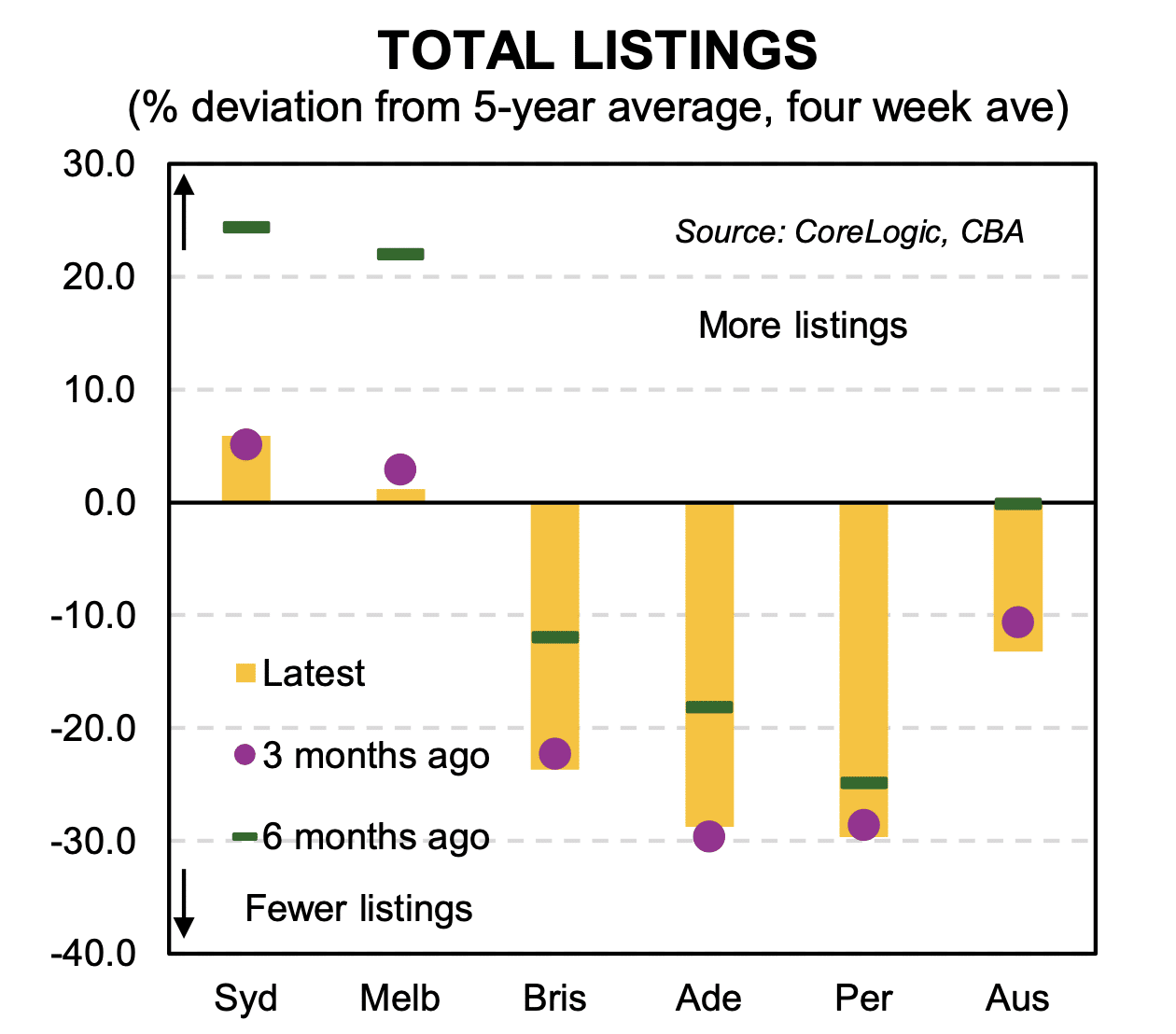

There remains an acute demand / supply imbalance, which is underpinning house prices and dwelling rents and even in the medium term, this imbalance will not correct. Immigration inflows remain strong, even though they are off their peak levels, while new supply remains problematic with low levels of new construction. Having said that, there is tentative evidence from SQM Research that there has been jump in new listings as sellers take advantage of higher prices or, perhaps, are forced to sell because of financial difficulties.

Amid the recent bout of market volatility, Australian financial markets continue to price in interest rate cuts from the RBA. The timing of the first cut has been pushed back to late 2024 and there is only one more 25 basis point cut in 2025 fully priced in this easing cycle.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.