Real estate investment has long been synonymous with property ownership, a path that many property investors are eager to tread. The attractiveness of owning tangible assets, benefiting from property appreciation, and enjoying a steady stream of rental income is certainly appealing. However, amid this prevailing enthusiasm for property ownership, the realm of real estate debt investments, specifically, commercial real estate investments, often remains in the shadows.

In this comprehensive guide, we aim to illuminate the importance of understanding both sides of the real estate coin, focusing specifically on the dynamics of the capital stack. Via this guide, we will delve into the financial framework that underpins commercial real estate transactions, and shed light on how equity, while appealing for its potential rewards, shoulders the most significant risk in the risk/repayment hierarchy.

What is the capital stack?

In the context of commercial real estate, the capital stack refers to the various tiers of financing sources used to fund the acquisition and/or enhancement of a commercial real estate project.

A capital stack in a commercial real estate investment refers to three concepts and rights:

- Tiers of financing sources in a real estate investment, such as equity and debt

- Order in which investors are paid back

- Repayment rights and order in the event of a default

Ideally, a commercial real estate investment project will successfully align with its business plan and feasibility projections, ensuring that all stakeholders receive their expected payments and repayments. However, similar to any investment, real estate carries inherent downside risks. The capital stack serves as an informative framework for investors, offering insights into their position within the hierarchy of cash flow distributions, the implications of this order on the risk of repayment, and ultimately, whether the projected return on investment justifies the assumed level of risk.

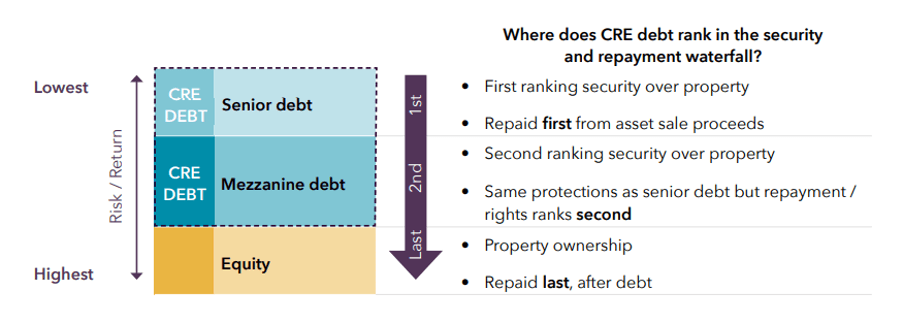

The capital stack is often depicted as a vertical stack, with each layer representing a different type of capital or financing. These layers are typically arranged in order of seniority – otherwise referred to as ‘ranking’ – with regard to repayment, and risk. Some diagrams are shown with the most senior positions at the bottom and the riskiest positions at the top. Here, in our diagram, we have shown the riskiest positions at the bottom and the most senior, or secured, positions at the top.

The typical components of the Capital Stack:

1. Senior debt

Senior debt for commercial real estate investment is the very foundation of the capital stack. It is typically the largest, least risky, and least expensive portion of the capital stack. Investors who may be conservative and want the least amount of risk may consider a senior debt investment.

In our diagram, senior debt sits as the highest, or most secured, layer. Senior debt is also commonly referred to as first mortgage secured loans, historically provided by traditional lending institutions such as banks and credit unions, but now also provided by non-bank lenders, like Zagga. Senior debt investors are given the highest priority in terms of repayment as the investment is secured by a mortgage over the property. This gives the senior debt lender recourse over the property in the event the borrower defaults on the loan. Because of its lower relative risk, returns for senior debt investments are generally lower than investors in the other layers of the capital stack.

2. Mezzanine debt

Ranking behind senior debt is mezzanine debt, a type of financing that falls between senior debt and equity and sometimes referred to as junior debt. Mezzanine debt is similar to senior debt in that mezzanine debt investors will typically have a right to receive regular interest payments at a stated investor return and that rate will typically be higher than the senior debt rate because of the increased risk of being repaid after senior debt.

For example, if a property drastically underperforms expectations or in the case of enforcement due to the borrower defaulting on the loan, the senior debt is repaid first. The mezzanine debt lender is only repaid to the extent that there is the cash remaining after the repayment of the senior loan.

Mezzanine debt comes immediately after any senior debt investors, but before the equity layers and as such, is often considered less risky than equity in that it ranks ahead of equity investors in the repayment order.

3. Preferred equity

Preferred equity holders occupy a unique position in the capital stack in that this layer comprises characteristics of both equity and debt investments. Preferred equity is in many ways similar to mezzanine debt but with two key distinctions:

- preferred equity is never secured by the asset

- preferred equity is usually structured as an equity investment into the entity that owns the real estate rather than as a loan to the ownership entity which is how mezzanine debt is structured

Mezzanine debt and preferred equity comes into a commercial real estate debt transaction when the borrower wishes to borrow an amount beyond what the senior debt lender is willing to provide. The borrower will therefore select either mezzanine debt or preferred equity to fund the difference.

4. Ordinary equity

Finally, ordinary equity, sometimes referred to as common equity, represents the last-ranking layer of the capital stack. Ordinary equity investors are the ‘owners’ of the asset and is usually the borrower and/or project sponsor in a commercial real estate debt transaction.

Ordinary equity investors have the potential for the highest returns but also carry the highest level of risk. If an asset underperforms, the common equity investors have the most to lose. They stand the greatest risk of losing their entire investment in a worst-case scenario. Ordinary equity is the last to be repaid, after senior debt, mezzanine debt and preferred equity investors.

Common equity investors often include private equity real estate investors, real estate income trusts (REITs), pension funds, sovereign wealth funds and individuals.

Speak to one of our team today

Why it's important for all investors to understand the capital stack

Investors need to understand the capital stack so that they can adequately assess risk against reward. Knowing where their investment sits in the hierarchical order of repayment, security, and returns will help investors make more informed decisions on whether or not that investment is worth the assumed risk.

The capital stack structure outlined in this guide is primarily associated with commercial real estate transactions. However, the concept of the capital stack, characterised by its varying levels of financial protection, extends beyond real estate and applies to a diverse range of investment and asset classes.

Let’s look in the context of publicly listed companies. A typical capital stack consists of a blend of debt and equity financing. Equity is provided by shareholders, while debt funding is typically procured from banks or bondholders. Within this capital stack, there exist multiple tiers of funding, encompassing bank loans, unsecured bonds, hybrid instruments, and, at the top, equities.

In the event of a company’s liquidation, the security for senior secured loans is provided by the company’s assets, and these lenders rank highest and enjoy priority in repayment. Unfortunately, shareholders of publicly listed companies rank lowest in the repayment hierarchy in the case of business failure, with their capital being the last to be recovered. If there are no remaining assets, equity holders lose all their capital.

It’s also worth noting that dividend payments to equity holders are discretionary and contingent entirely upon the company meeting all other financial obligations. The company however, has an obligation to make predetermined payments to its lenders, which is why such arrangements are termed ‘fixed income’ investments.

Conclusion

In the world of real estate investing, understanding the capital stack is imperative as it empowers investors to evaluate risks, make informed decisions, negotiate effectively, and align their strategies with their financial goals. Those pursuing capital growth often incorporate equities into their investment portfolio. On the other hand, investors primarily seeking income and capital preservation frequently explore debt-based investments, such as those offered through investment managers like Zagga, as a means to align with their investment objectives.

For commercial real estate investors, understanding the layers of funding that constitute a real estate project is an important step as it can assist investors making well-informed and considered decisions. This can help them be better prepared to navigate the complexities of the market and position themselves for success in an ever-evolving landscape. Whether you’re a seasoned investor or just entering the realm of commercial real estate, understanding the fundamentals of the capital stack is undoubtedly an essential step towards building a well-considered and diversified investment portfolio.

Speak with one of our team today to discuss the ways in which Zagga can offer you an opportunity for capital preservation and portfolio diversification, through commercial real estate debt.

FAQs

What is the difference between capital stack and capital structure?

“Capital stack” and “capital structure” are terms commonly used in finance and real estate to describe different aspects of how a company or a real estate project is financed.

The capital stack refers to the various types of financing that are used to fund a real estate project. It represents the different layers or “stack” of capital sources, each with its own position in terms of repayment priority and risk.

Capital structure of a company refers to the composition of its total capital, which includes both equity and debt. It represents how a company finances its overall operations and projects.

The main difference lies in their application and context. The “capital stack” specifically refers to the layers of financing used in real estate projects, while “capital structure” is a broader term that applies to the overall financing of a company, encompassing various forms of capital.