Insights from industry experts on navigating a shifting economic landscape

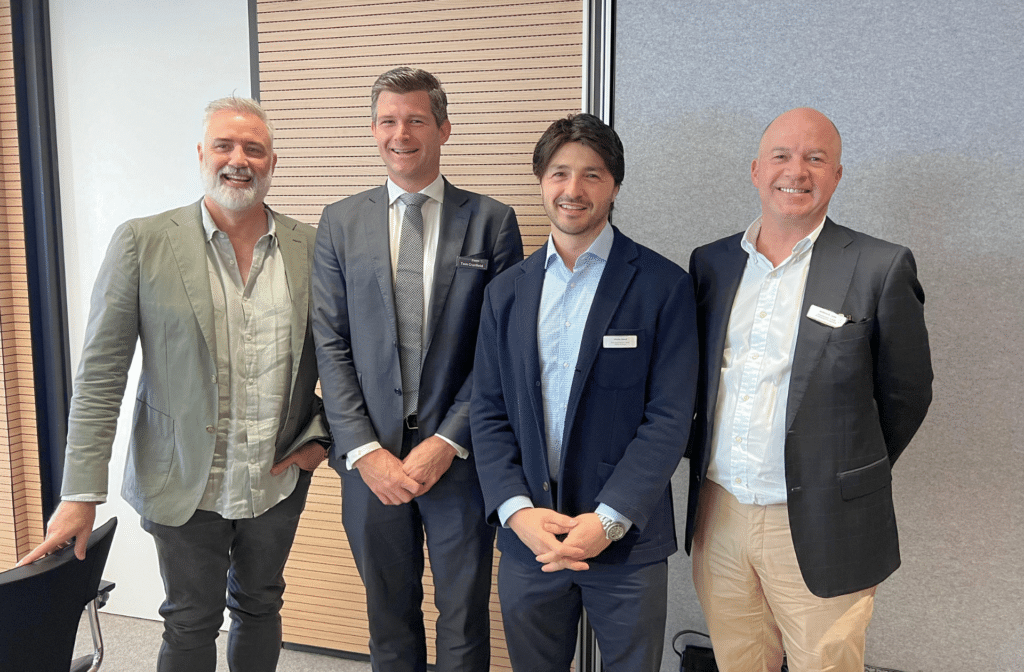

We recently hosted a Zagga Fireside Chat with the panel discussion centered on the topic “Adapting to change: The opportunities and challenges for developers and investors in a shifting economic landscape“. The panel, moderated by Zagga’s Director of Investment and Risk, Tom Cranfield, featured prominent voices in the property sector – Charles Daoud from Traders in Purple, Luke Berry from Third.i, and Matt Burrows from ST Real Estate Management. Together, they unpacked the key challenges facing developers and real estate investors and shared their insights on adapting to the ever-shifting economic climate.

The supply vacuum and rising costs

Charles Daoud opened the discussion by addressing a critical issue plaguing the property sector – the supply vacuum. Despite growing demand, the market is witnessing a significant shortfall in new developments and an escalation in construction and delivery costs.

Charles noted that developers are experiencing a “knock on effect… [of] the increased cost of construction and delivery… from a combination of… material costs, labour costs, planning, delays and timing”. He highlighted that building a two-bedroom apartment in Sydney now requires a budget closer to $700,000, up from an estimated $500,000 just a few years ago.

This escalation has created a challenging environment where costs outpace the feasibility of new projects. Charles commented on the impact of prolonged planning and approval processes, which he believes only exacerbate the supply constraints. “As soon as those interest rates come back a little bit and people feel like they have a bit more borrowing power, I think the market’s going to hit a ceiling and it might have to be subdued.”

Strategic thinking in a tough market

Luke Berry shared his perspective on navigating the complexities of property development in this current climate. Emphasising the importance of data-driven decisions, he noted how Third.i has shifted focus to regions outside Sydney, where land prices are significantly lower and offer better lifestyle options for the property purchasers.

“The reality is, I think we’re all coming out of the toughest periods,” he said, reflecting on the industry’s struggles and referencing mentors who have emphasised that “it’s the hardest in 40 years”. The silver lining is that the industry has had to push hard to become even more strategic and resilient and now “has got itself into… a really good position from a consumer confidence point of view”.

Challenges in the commercial real estate sector

Matt Burrows shifted the conversation to office buildings, where, particularly in Melbourne, vacancy rates have reached around 20%. Additionally, he voiced concerns about the current trend of speculative suites being built and quickly discarded, raising environmental and sustainability issues. “[It’s] socially concerning for me from a landfill perspective,” Matt remarked. “There needs to be a better drive for reusing where you can… getting longevity out of an [existing] workstation… we’re not seeing… any kind of credits, from a carbon perspective, on an adaptive reuse of a building”.

Matt’s commentary highlighted a broader issue within the industry—a need for regulatory support to encourage more sustainable development practices, which could help alleviate some of the costs and inefficiencies currently plaguing the sector. “It’s cheaper… to refurbish a B-grade building than it is to tear it down and build an A-grade building.”

The shift to private credit and non-bank lending

One key theme that emerged was the increasing preference for private credit and non-bank lending as traditional banks retreat from the commercial property sector. Tom Cranfield steered the discussion towards capital sourcing and asked how the panellists are navigating this change. Matt Burrows noted, “traditional banks have shied away from commercial real estate for the last few years”, which has historically been a major asset class for them.

This shift has made private credit providers, like Zagga, more crucial than ever. Matt explained that his “experience recently with Zagga has been [that] the non-bank lenders understand commercial deals, they understand the risks and they understand the potential rewards. They have good credit committees, good structures and can cut through a lot of noise”.

The panellists agreed that private credit offers faster decision-making processes and a deeper understanding of complex commercial transactions, providing a valuable alternative in a tight lending environment. As developers and investors seek more flexibility and agility, non-bank and private credit lenders have become increasingly important players in the market.

Looking ahead: cautious optimism and strategic acquisitions

Despite the headwinds, the panel expressed a sense of cautious optimism about the future. They identified strategic acquisitions in well-connected areas with potential for rezoning as promising opportunities and are seeing a shift towards projects that offer long-term value, particularly in regions with good transport links.

The importance of community engagement and maintaining strong stakeholder relationships was cited as essential elements for successful development. Additionally, Luke Berry affirmed that “for… property investors, it’s never been a better time to invest in real estate because everyone’s aligned in solving the housing crisis”.

Key takeaways: navigating a shifting landscape with resilience and strategy

The panel discussion underscored the importance of adaptability in today’s volatile market. From rising construction costs, increasing geopolitical tension and regulatory challenges to the shift towards non-bank and private lending, developers and investors are needing to pivot quickly in a constantly changing market.

What became clear from the discussion was the need for a strategic, data-driven approach and a focus on sustainable practices. The panellists highlighted the value of flexibility in financing options and the importance of fostering strong relationships with stakeholders to weather the current market conditions.

As we move forward, embracing these insights will be key for developers and investors looking to make informed decisions in a shifting economic landscape. The opportunities are there, but they require a careful balancing act between strategic planning, market adaptability, and a commitment to sustainability.

Why Zagga?

PARTNERSHIP

We treat our borrowers, investors and service providers as partners in our business.

TRUST

We operate with an ‘investor first’ approach and will not compromise credit quality over increased return.

RELATIONSHIP

We intrinsically understand that sustainable business requires long-term relationships.