One of the key issues for the economy through 2023 is the extent of the broader economic slowdown and the impact this will have on inflation and the unemployment rate.

In other words, how quickly will inflation return to the RBA’s 2 to 3 per cent target, and how high the unemployment rate will rise as a result.

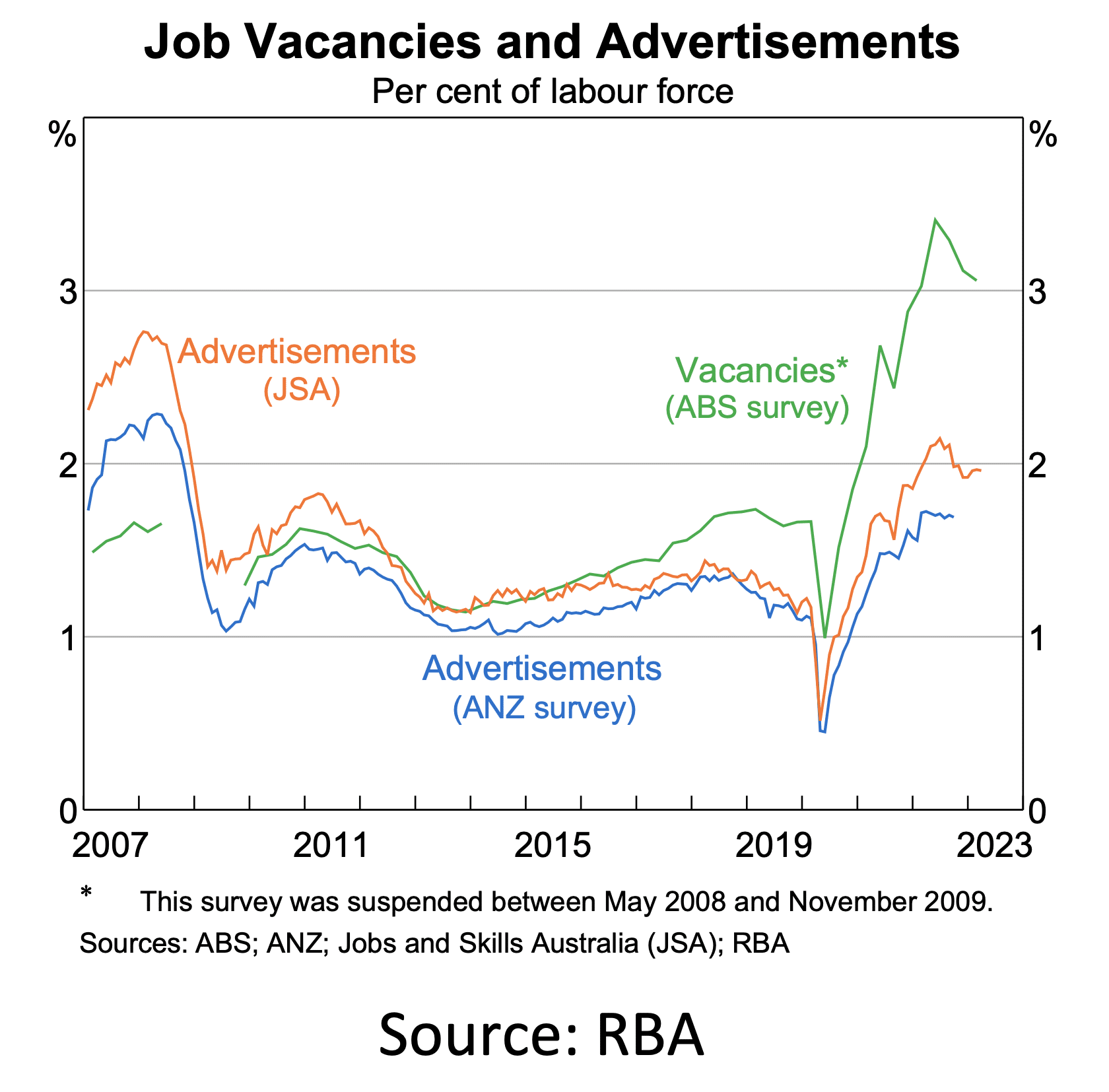

The data flow in the past month has confirmed a situation of slower growth – retail spending is weak, business confidence continues to ease, the recent budget announced a surplus as the government ‘banked’ the windfall gains from the commodity price boom. Demand for labour continued to ease.

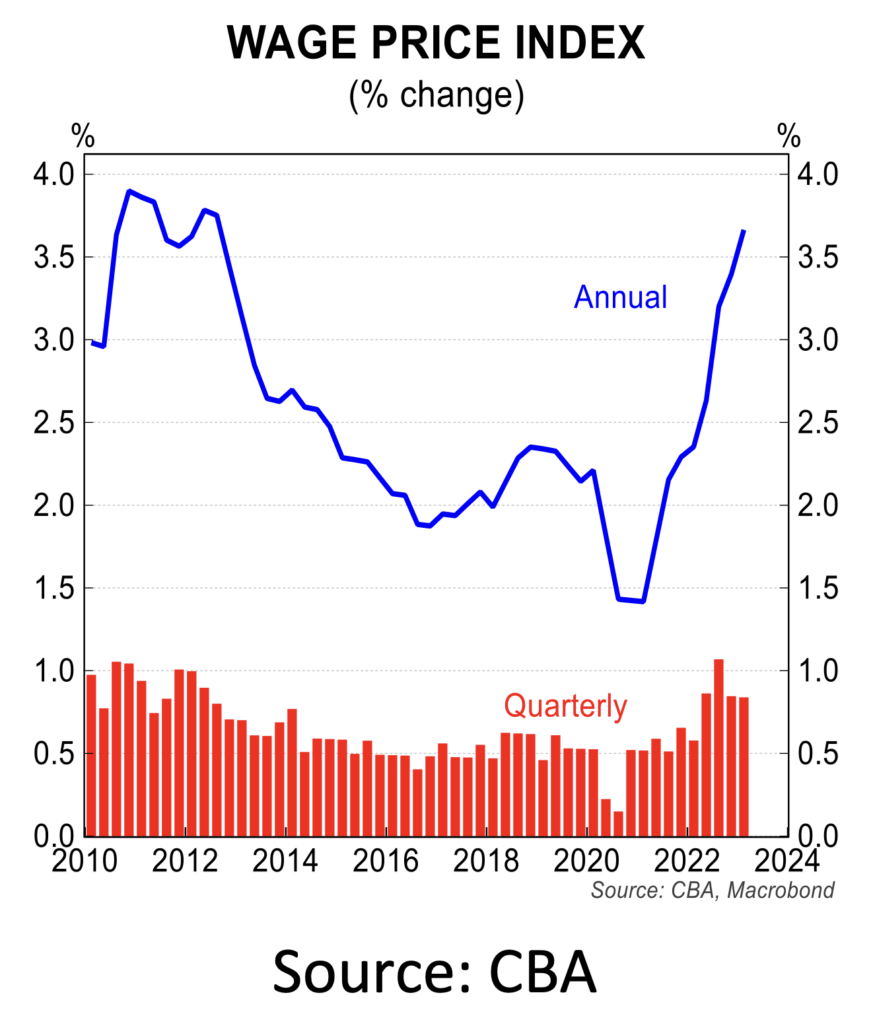

Two of the most important data release in the past month were for the labour force and the wage price index.

Both come in materially weaker than the consensus of economists was expecting. Employment fell by 4,000 people in April, reflecting the broader economic cooling that has been evident since the middle of 2022.

At the same time, the unemployment rate lifted to 3.7 per cent which is up from the cyclical low of 3.4 per cent in October 2022.

While caution needs to be exercised when looking at one month of labour market data, the weaker than expected labour force results fit with the broader indicators of job advertisements and vacancies, both of which are trending down.

As the recent Budget forecasts and those from the RBA noted, the unemployment rate is projected to rise to around 4.5 per cent by late 2024 and into 2025.

"If what we are seeing on house prices is the early stages of a price uplift, the incentives for builders moves in favour of new construction."

The wage price index for the March quarter was at face value a strong result.

The annual increase in the WPI was 3.7 per cent, the fastest rate of increase in more than a decade. That annual result masked what might be termed a ‘topping out’ of wages growth in the quarterly data. The last two quarterly results showed the WPI increasing by 0.8 per cent, which when annualised, points to growth around 3.25 to 3.5 per cent.

Indeed, when the strong 1.1 per cent rise for the September quarter drops out of the run-rate, the annual increase in the WPI is likely to ease back towards 3.5 per cent, or a little lower.

With the economy slowing and the demand for labour easing, wages growth is likely to hover in a 3.25 to 3.75 per cent range. This is an important issue as it suggest the complete absence of a feared wage-price spiral.

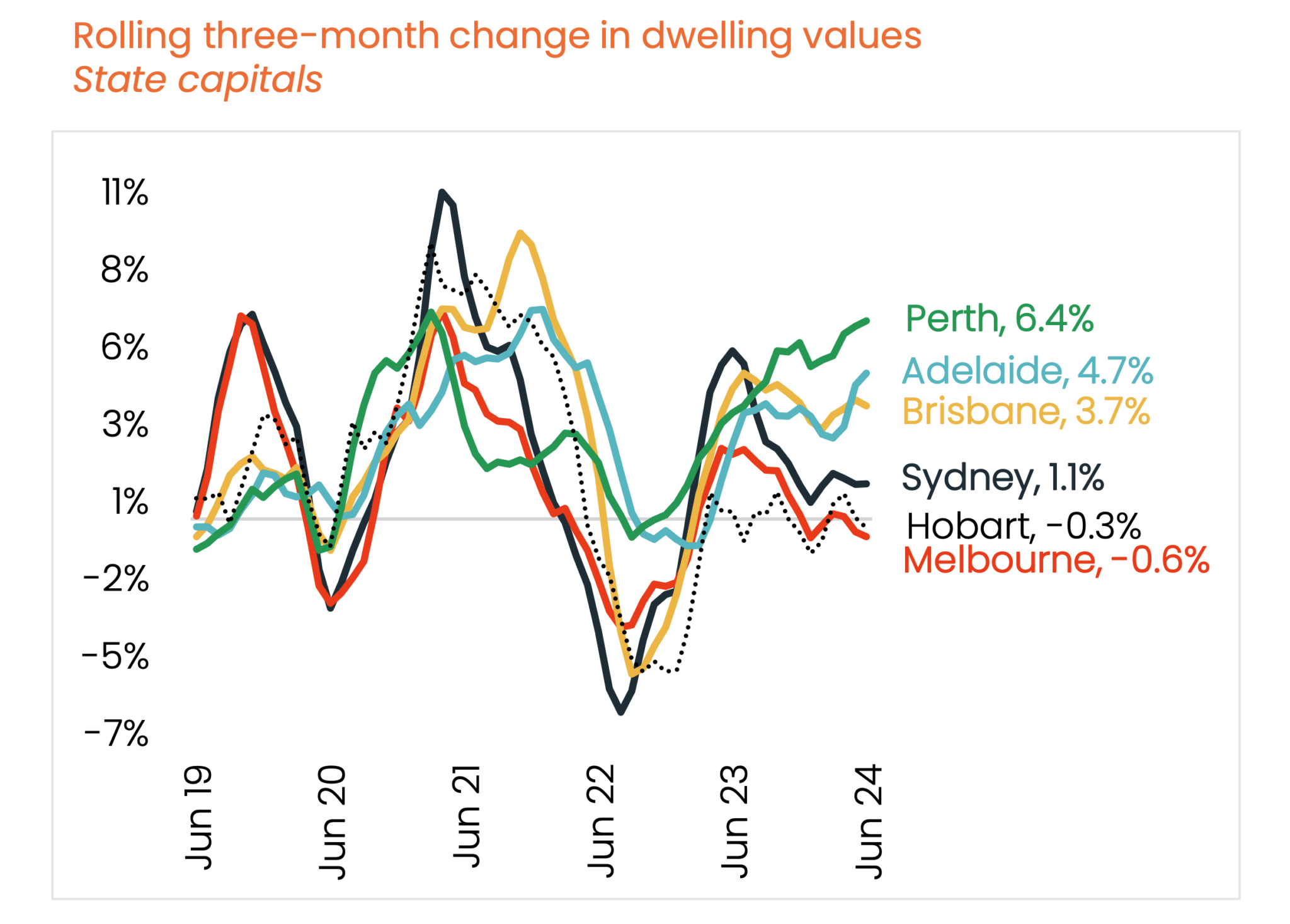

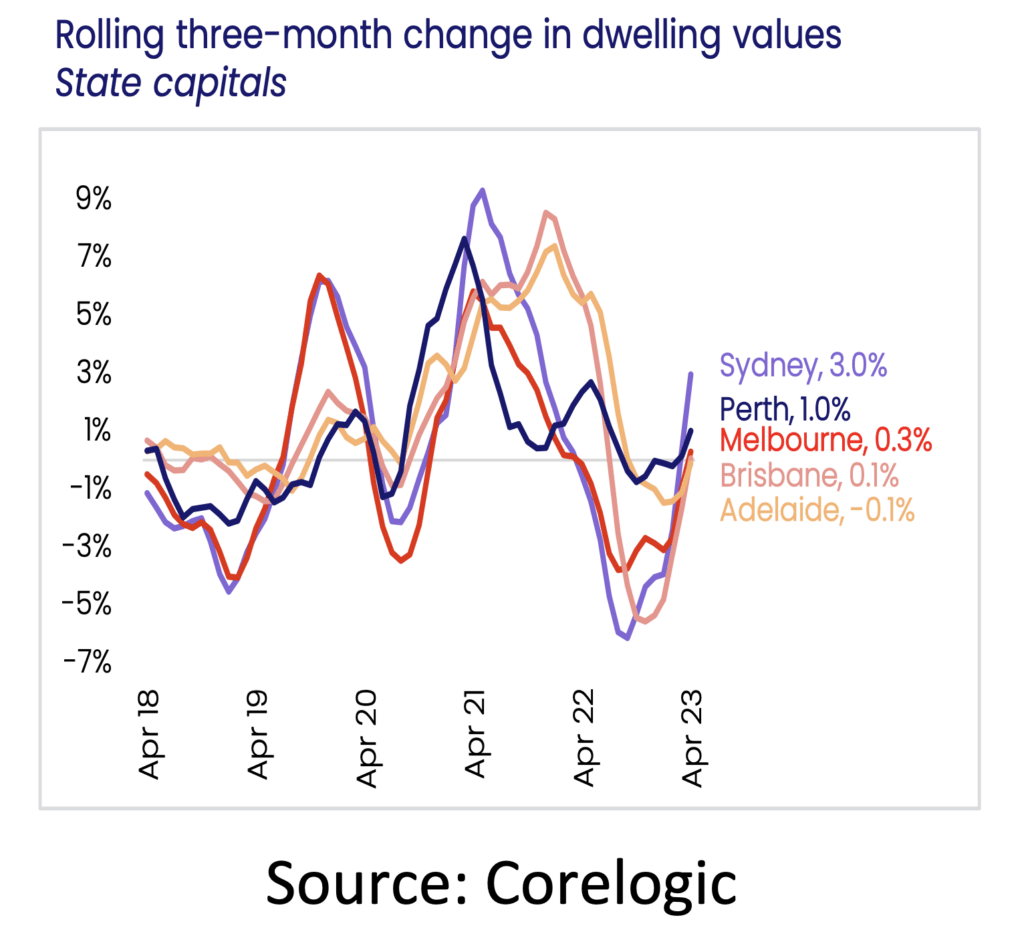

House prices are rising.

The upswing in house prices in the Corelogic data is now meaningful. This has a range of important implications particularly when it comes to the cost effectiveness of new construction and the medium term outlook for the dwelling sector.

One factor behind the sharp drop in new dwelling approvals has been a significant cost blow out which coincided with weakness and outright falls in house prices. The financial maths for many builders and property developers deterred new construction. If what we are seeing on house prices is the early stages of a price uplift, even of moderate proportions, the incentives for builders moves in favour of new construction.

It is important to note that the current cycle is in its infancy. House prices have risen by around 2.5 per cent from the February 2023 low and there remains some uncertainty about the sustainability of the price recovery and this increase follows a peak-to-trough fall of 9 per cent from early 2022 to February 2023.

But with a surge in demand being driven by high levels on net immigration, which the recent budget confirmed is projected to stay strong for at least the next three years, there is a growing probability that house prices will rise by 15 to 20 per cent by the end of 2024. Such a move would be supportive for the medium term outlook for construction.

The key issues for the economy remain the extent of the economic slowdown, the speed at which inflation continues to fall and the projected rise in the unemployment rate.

Current policy settings point to a soft landing which means annual GDP growth eases to around 1 per cent in 2023 and 2024, inflation drops back to 3 per cent by the end of 2024 and the unemployment rate rises to 4.5 per cent.

This would be a solid result given how severe the inflation problem was and how difficult it has been to repair policy settings in the aftermath of the COVID pandemic.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.