There was good news in the economy with confirmation that inflation is falling at a steady rate while the unemployment rate remains near a 50 year low. After the falls in 2022, house prices continue to trend higher which is an important issue for home buyers, property developers and banks who would be adversely impacted if house prices fell sharply for an extended period.

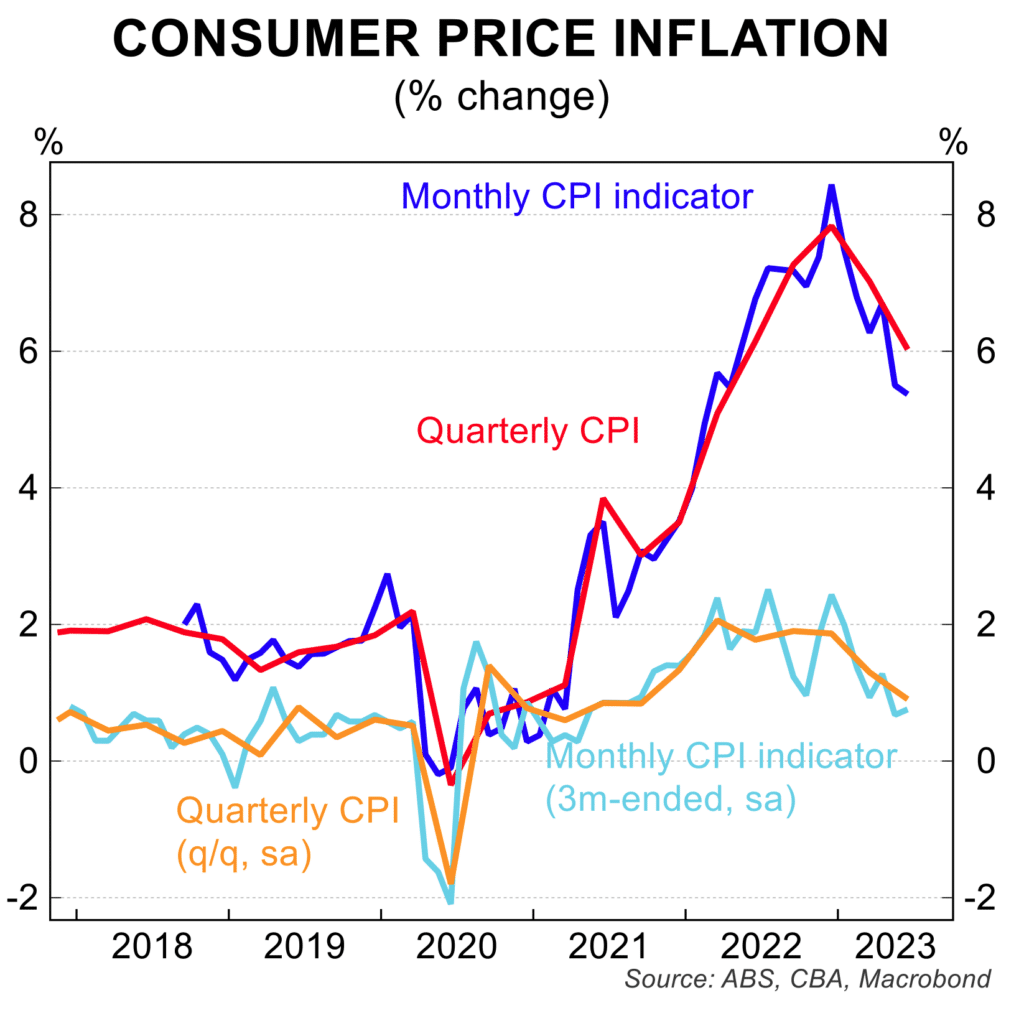

The decline in inflation means that the RBA is at, or at least very near, the end of the interest rate hiking cycle with inflation on a path to return to the target band of 2 to 3 per cent in the next 12 to 18 months.

According to the monthly inflation data, inflation has fallen from a peak of 8.4 per cent in the year to December 2022 to 5.4 per cent in June 2023. For the quarterly, slightly more comprehensive inflation data, annual inflation has fallen from a 32 year peak of 7.8 per cent in the December quarter 2022 to 6.0 per cent in the June quarter.

Importantly this is below the RBA forecast profile which means it is starting to ‘over achieve’ on its inflation fight.

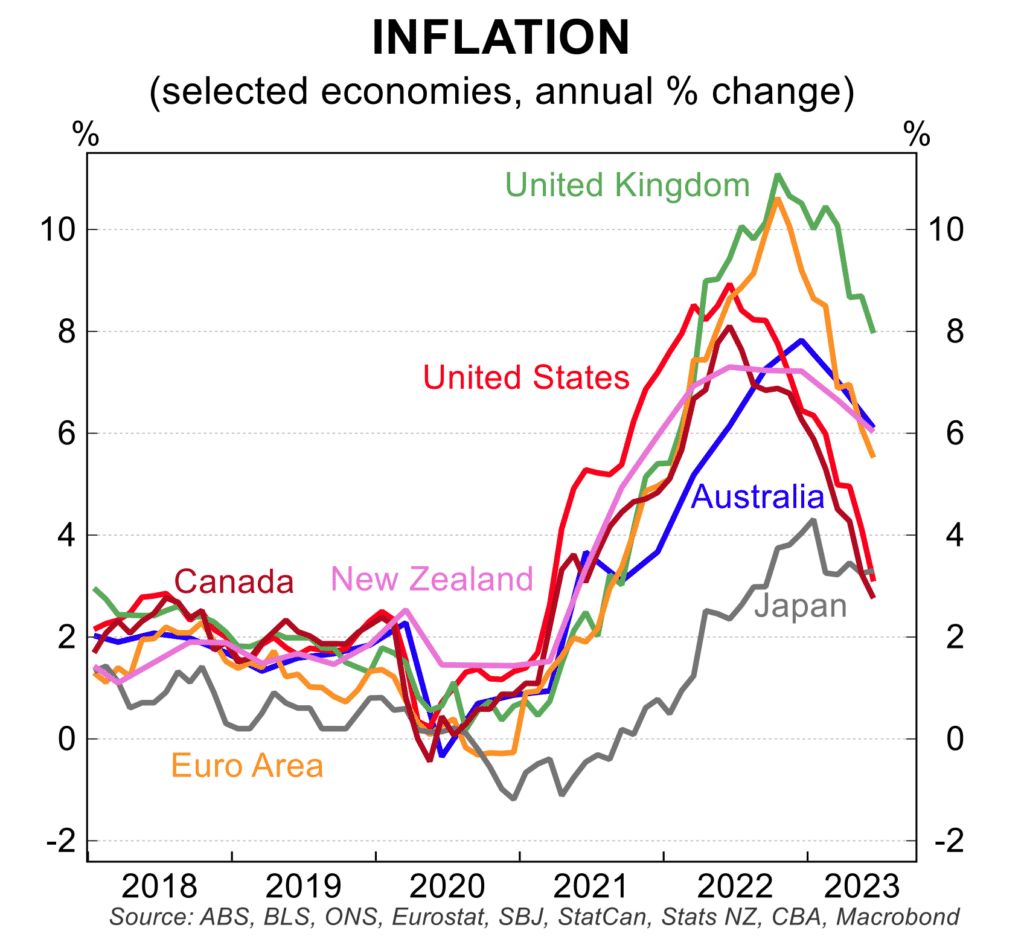

The important issue from a more medium term perspective on inflation is that the turn lower in price pressures is a global phenomenon. While each country has different issues impacting their inflation rate, the direction of inflation is clear in all major economies.

The key data for the economy confirm slower growth.

Retail sales are weak as consumers continue to adjust to cash flow pressures from higher interest rates and cost of living imbalances. Retail sales will have fallen for three straight quarters when the June quarter data are released. Consumer sentiment, which is a good leading indicator for future consumer spending, remains extremely low.

The softer outlook for the economy is starting to impact business confidence even though it remains more positive than consumer about the outlook. Businesses are reporting a broad moderation in trading conditions, forward orders and profits while their labour hiring intention plans are also being scaled back.

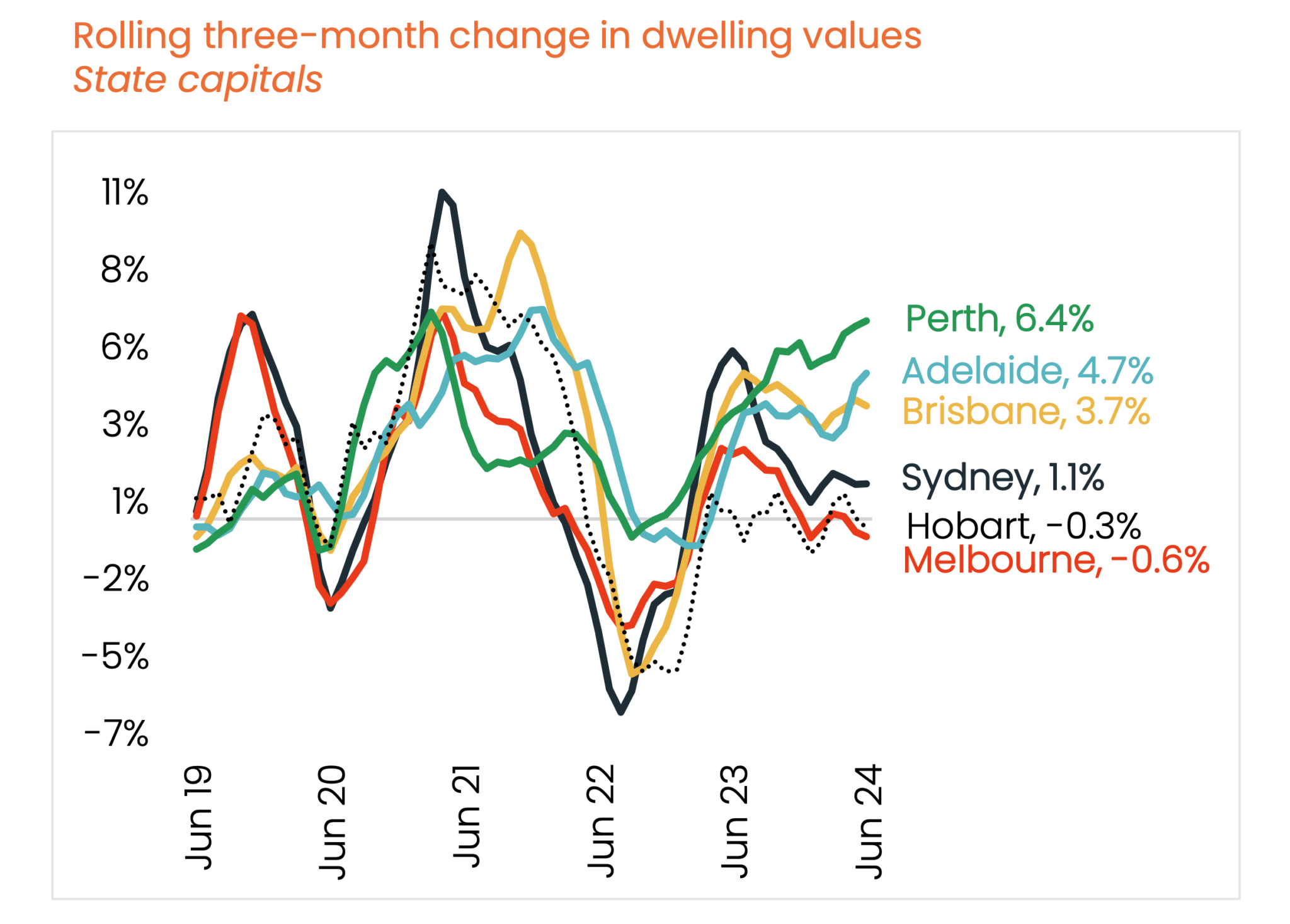

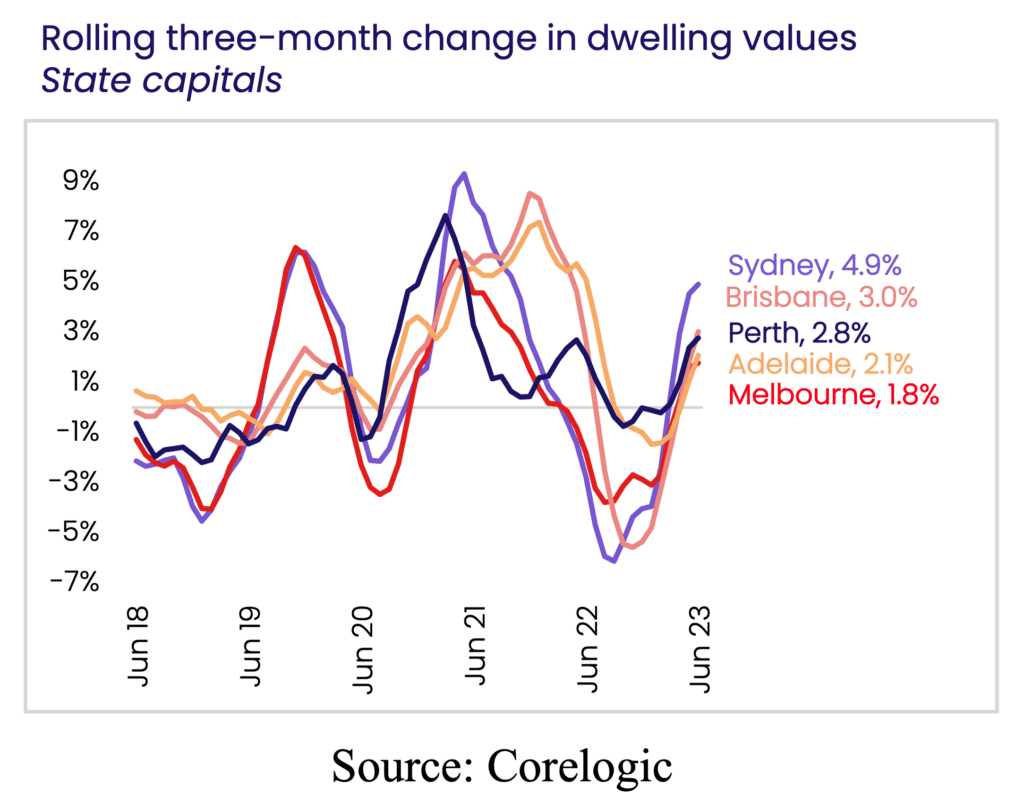

Strong demand from rapid population growth in concert with limited supply because of relatively soft rates on new dwelling construction are seeing house prices continuing to rise. The price increases are across all capital cities and are extending to most regional centres. From the low point in February 2023, nationwide house prices have risen by around 4.5 per cent, with strong gains in Sydney.

Even with interest rates being hiked 400 basis points in the past 15 months, the supply and demand imbalance is likely to continue to support house prices in the near term, albeit with some moderation in price gains over the remainder of 2023 and into 2024.

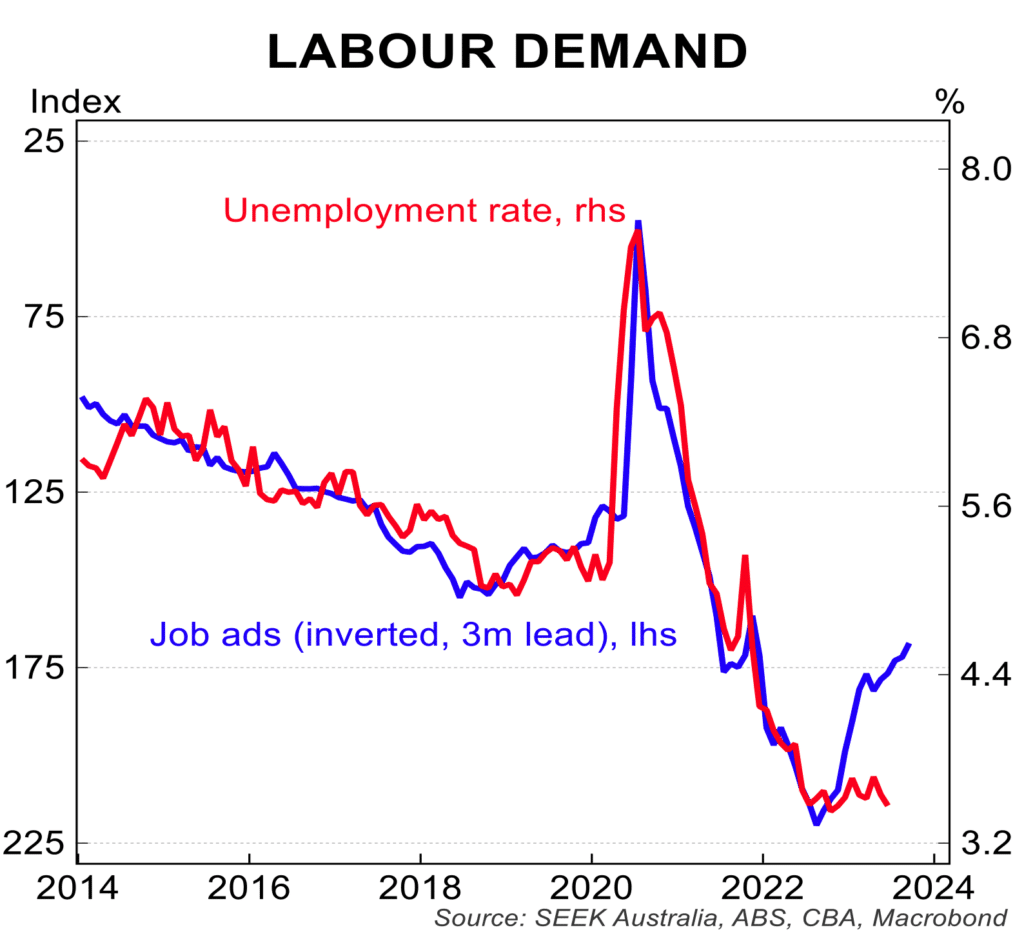

Labour market conditions remain firm, with job creation broadly matching the population growth and the unemployment rate holding steady at around 3.5 per cent. That said, the slower economy and a clear turn in forward indicators for the labour market – job vacancies and job advertisements – are trending lower. Indeed, if recent trends remain in place the unemployment rate is likely to rise toward 4.5 to 5 per cent over the next to 18 months.

"Inflation is falling at a steady and welcome pace and the labour market... remains solid."

The RBA is getting close to the end of its interest rate hiking cycle – in recent monthly Board meetings it has mulled over keeping them steady or hiking 25 basis points. For the last four meetings, it’s two of each. The cash rate is currently 4.1 per cent.

As inflation continues to fall, the RBA will be comforted to see its plan of getting inflation back to target is working and as such, it is soon to enter a period of many months when interest rates are likely to be on hold. It is noteworthy that the yield on the 3 year government bond, a solid proxy for medium term expectations has been yielding 3.80 to 4.00 per cent in recent weeks.

In a nutshell, the economy remains weak, inflation is falling at a steady and welcome pace and the labour market, for now, remains solid.

It is a set of economic fundamentals that the RBA and government, for that matter, would like to see continue for the remainder of 2023 and into 2024.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.