Source: Financial Review

Author: Larry Schlesinger

Date: 25 June 2024

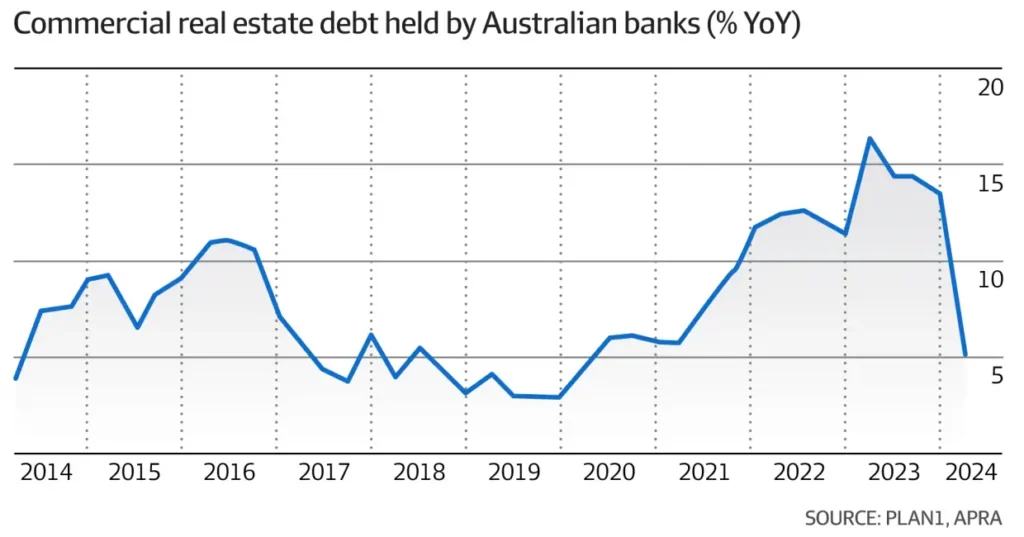

Australian banks grew their commercial real estate loan books over the past 12 months at the slowest rate in four years, as they took a more cautious approach to lending against assets like office towers, hotels and residential land projects, analysis by consultancy Plan1 has found.

This slowdown has paved the way for the high-flying non-bank lending sector – or private credit providers, as they are also called – to secure a larger slice of the lending pie.

Over the 12 months to March, total Australian bank commercial real estate (CRE) debt reached an all-time high of $374.1 billion, but grew by just 5.1 per cent – the slowest pace of growth since 2020, according to Plan1.

It was also well below the average 10-year annual growth rate of 7.9 per cent, said the research firm’s co-founder, Richard Jenkins.

Mr Jenkins said the relatively slow growth rate indicated that traditional lenders had responded to the changing risk profile across the commercial property market by becoming increasingly selective with new loans.

“They continue to re-weight their exposure by sectors, especially in the office sector, offering an opportunity to the non-bank sector to further increase their participation in the asset class,” he said.

Non-bank lender Zagga is providing a $28m loan to fund the upgrade of Invicta House, an office building in Melbourne.

He added that Australian banks had also reduced their exposure to the residential land subdivision and tourism sectors over the past year, whilst lending to high-density development was also expected to trend down due to fewer suitable projects.

Highlighting how much of the CRE debt market the big four banks have given up in the past decade, the combined market share of ANZ, NAB, the Commonwealth Bank and Westpac had shrunk to 70.9 per cent as of March this year, down from 84.7 per cent in 2013.

In its half-year financial update in May, Westpac revealed its lending for office property had reduced to 1.4 per cent of its total committed exposure, down from 2.1 per cent in September 2020.

In February, the Commonwealth Bank noted in its half-year update that “tighter origination loan-to-value ratios are in place for office properties in high vacancy precincts”.

While banks are stepping back from the office sector, non-bank lenders like Zagga are stepping into the breach.

The Sydney-based group, which has originated $1.8 billion of loans since launching in 2017, is providing a… loan to ST Real Estate Management (previously called Fidinam Group)… to fund the upgrade and refurbishment of Invicta House, a 5,000 square metre heritage-listed office building on Flinders Lane in the Melbourne CBD, which Fidinam purchased for $40 million from Swinburne University in 2021.

Zagga, whose investors include family offices, high net worth individuals and smaller institutional groups, expects to generate a return of 9.25 per cent from this deal…

With developers knocking on their door for finance, Zagga CEO and co-founder Alan Greenstein said the group’s aspirations were to “slowly and carefully” double its funds under management to about $1.5 billion and attract a deep pool of funders.

“Non-bank lenders have carved out a space for themselves in the market by offering a highly credible solution,” Mr Greenstein told The Australian Financial Review.

“The market is deep and there is space for a lot of players.”

He added that he expected further consolidation moving forward, following the likes of ASX-listed alternative asset managers Regal Partners and HMC Capital respectively acquiring non-banks Merricks and Payton Capital this year.

With office and retail property expected to account for the largest share of maturing debt held by banks by 2026, the refinancing of this sector would also present opportunities for non-banks to grow their lending, Mr Jenkins said.

He added future population growth would lead to increased demand for all property asset classes and push up the level of Australian debt for commercial construction to $300 billion in 2026.

“However, the increased regulatory capital requirements for commercial property exposures on the four major Australian banks will create further opportunity for non-banks.”