There is increasing confidence that the Reserve Bank of Australia has ended its interest rate hiking cycle. Falling inflation, the domestic economic slowdown and growing signs of economic concerns in China are feeding into this broad economic assessment.

The background to the economic moderation is a step down in global economic activity and 400 basis points of interest rate increases in Australia from May 2022 through to June 2023 which are still feeding into the economy.

Clear signs of slower growth is showing up in a rise in the unemployment rate which hit a yearly high of 3.7 per cent in July. With job vacancies edging lower, the consensus forecast is for the unemployment rate to reach 4.5 per cent in 2024.

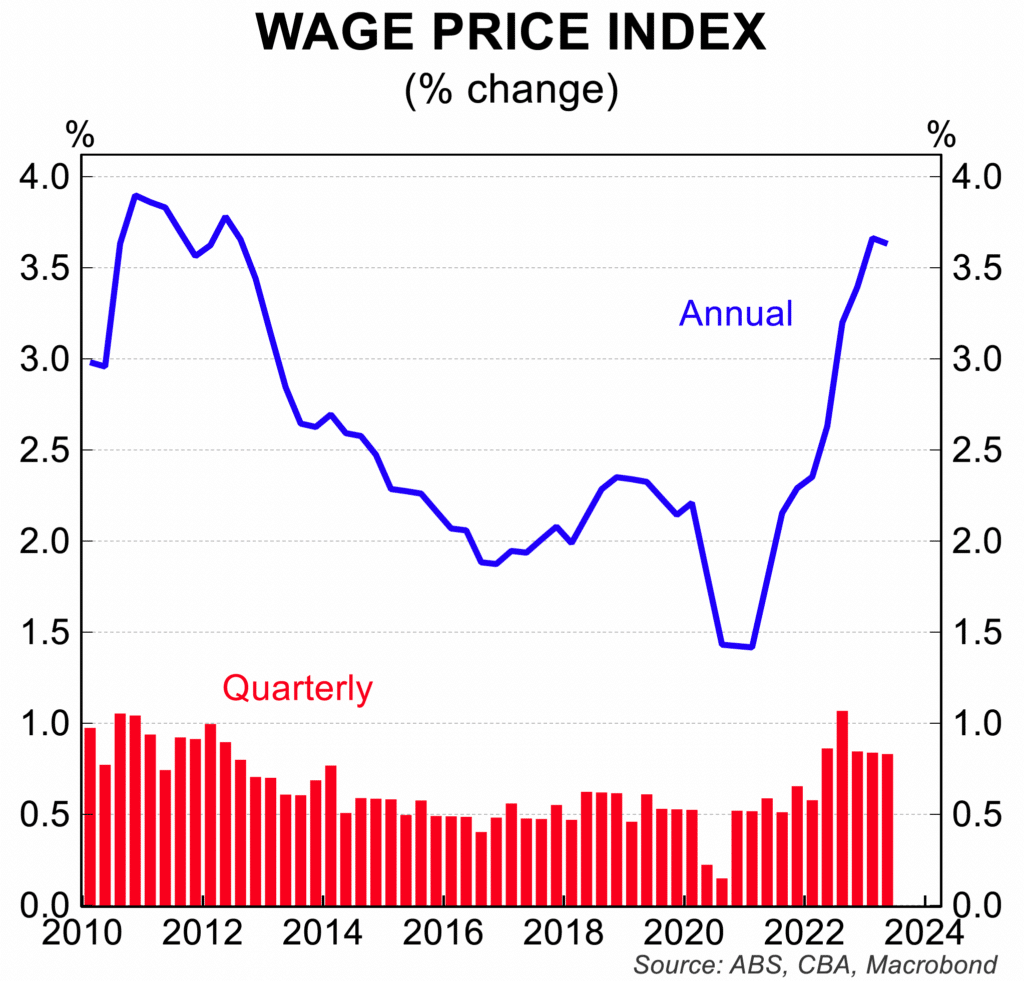

At the same time, wages growth has stalled at a level below the central forecast of the RBA. In the June quarter, the wage cost index rose by 0.8 per cent for an annual increase of 3.6 per cent. Some wages ‘catch-up’ was inevitable after the weakness in the last 5 years, including during the pandemic and it must be noted that annual wages increases around 3.5 to 4 per cent are entirely consistent with the RBA inflation target.

The RBA had been concerned that wages growth would be excessive, mentioning a ‘wage-price spiral’ on many occasions when referencing factors behind its decisions to increase interest rates. The absence of such a problem on wages and therefore inflation and the emergence now of an upturn in the unemployment rate points to wages growth and inflation undershooting its forecasts.

This is another important factor feeding into the ‘no more rate hike’ market pricing.

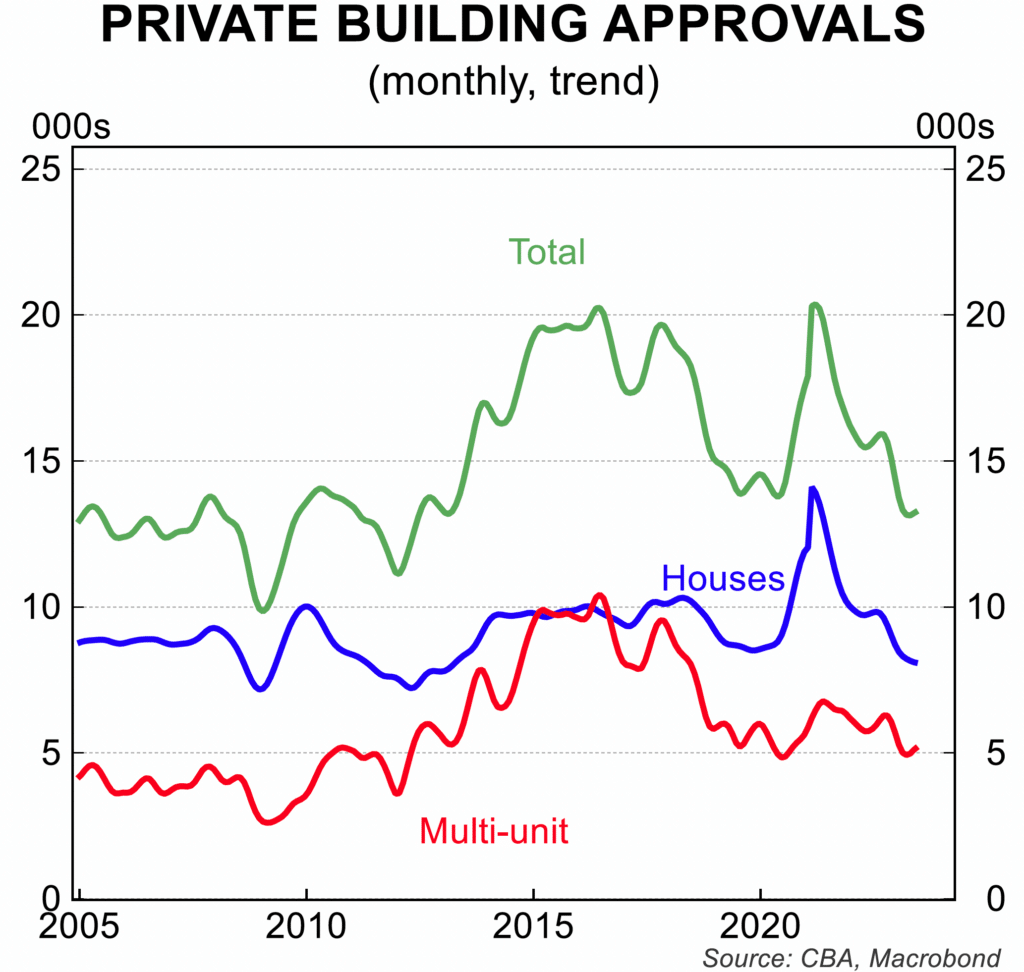

The government has recently announced a policy aimed at building more dwellings with incentives for State and local governments to exceed the construction of 1 million new dwellings in the five years from July 2024. The new target of 1.2 million dwellings in that time frame is to address the on-going housing shortage which it expects to dampen growth in rents and prices by adding to housing supply.

It is a worthy objective although there is some concern about the on-going difficulty of land zoning and the supply of labour needed for such an ambitious target. The 1.2 million dwelling target would mean a sustained record high level of building – just under 20,000 private sector dwellings per month every month for five years on average, which may be difficult to sustain.

If the plan works, it will be a major positive for the construction sector with an extended upswing in prospect.

The current shortage of housing being built and listed for sale relative to buoyant underlying demand from a surge in immigration continues to underpin rising house prices and strong increases in rents.

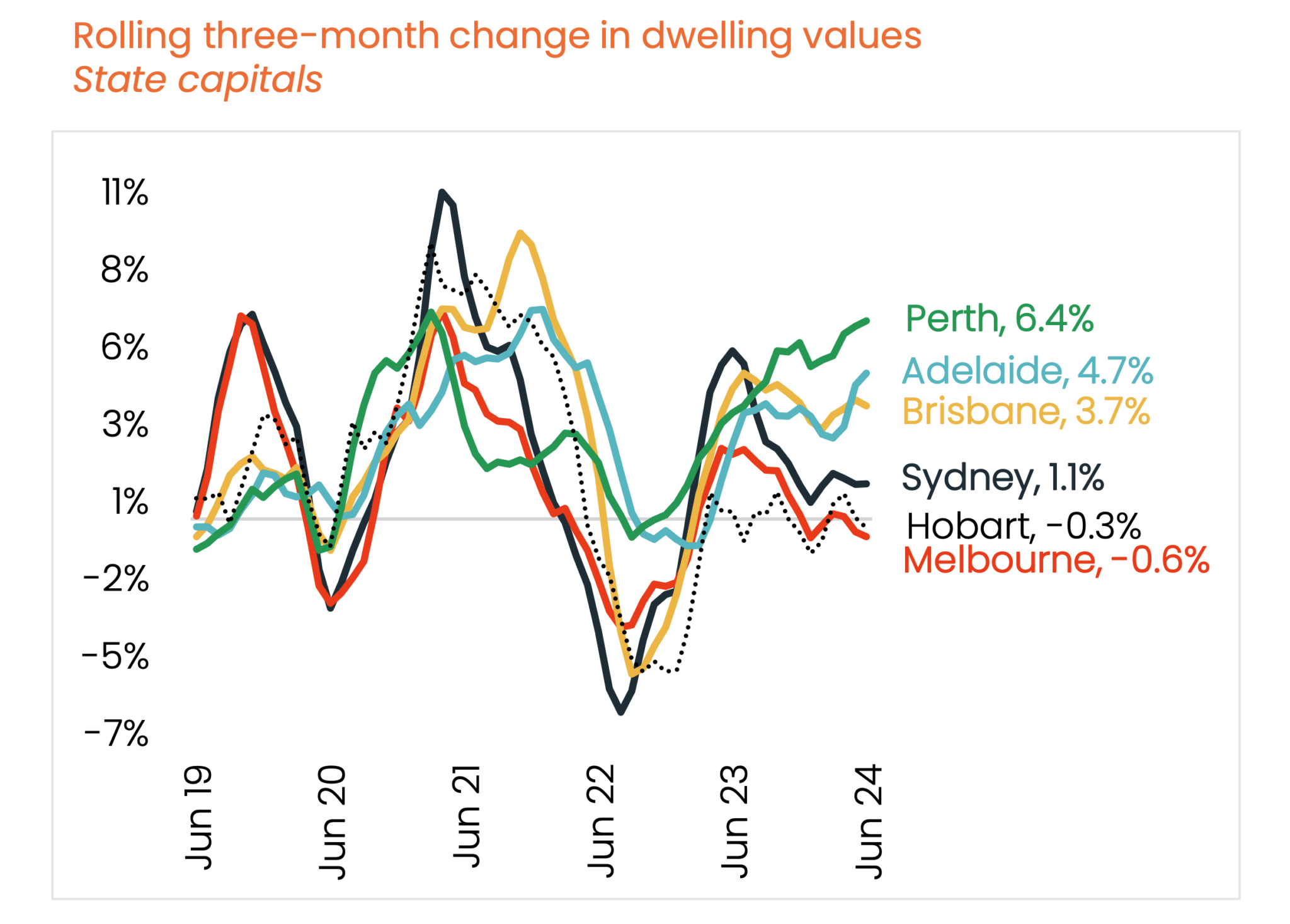

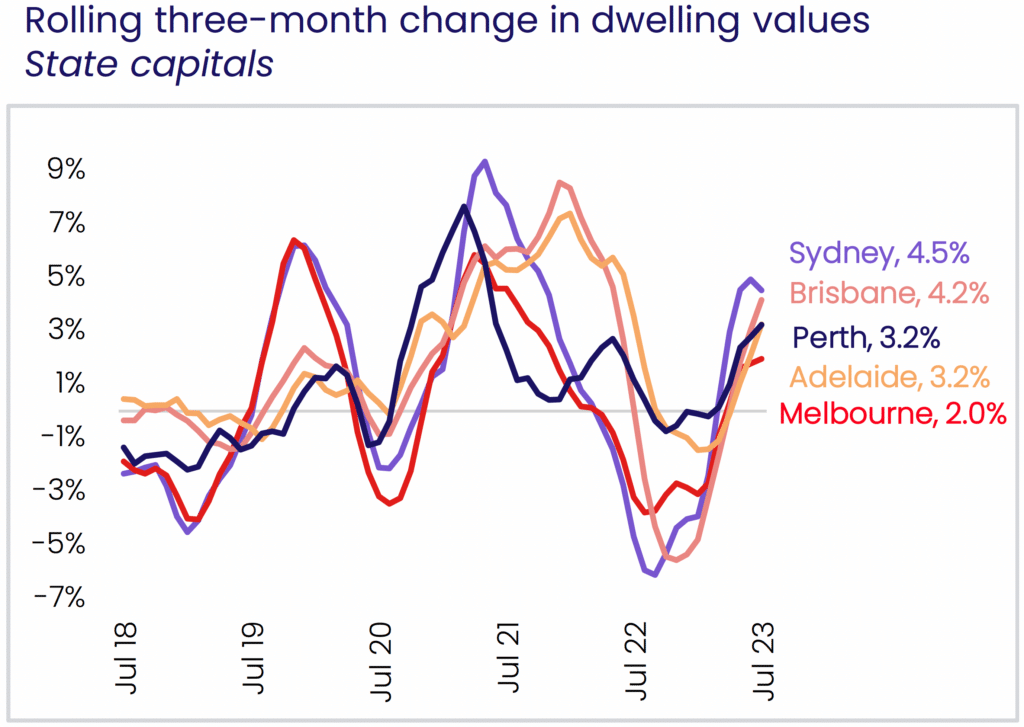

Nationwide house prices rose 0.7 per cent in July, after increases of 1.1 per cent in June and 1.2 per cent rise in May. High frequency data from Corelogic is pointing to a further rise of around 1 per cent in August.

After falling 9.1 per cent from peak to trough in the recent 2022 downturn, house prices are now 5.0 per cent higher than the February 2023 low. The largest price gains continue to be in Sydney, Brisbane and Perth with Hobart and Canberra registering only small gains.

Other data show weaker economic growth. Retail sales continue to weaken, with consumer sentiment remaining near historical lows. The outlook for business investment has softened as firms react to the weaker local economy and concerns about global economic growth, especially from China. Growth in exports is also slowing, which will be another factor putting downward pressure on Australian economic growth in the short to medium term.

Looking forward, the key issues remain the trajectory for inflation, the extent of the slowing in economic activity and the rise in the unemployment rate.

The most recent forecasts from the RBA have inflation falling to its 2 to 3 per cent target in 2025 with GDP growth remaining weak for the next 12 to 24 months. This looks a realistic scenario given the recent data.

The risks are that, in the near term, growth will be weaker than forecast and that inflation falls more rapidly. If this comes to pass, the current market pricing for lower interest rates in 2024 would gain credibility.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.