2024 Forecast by Stephen Koukoulas, Zagga's Economist 'in residence'

“Happy New Year! Stephen Koukoulas here, Economist ‘in residence’ at Zagga, and we’re kicking off 2024 with the economy in a really interesting position.

The good news is that inflation is coming down, that it’s going to be within the RBA target during the course of this year, and that means the interest rate hikes of the prior 18 months to 2 years have worked – inflation is under control. And as the money markets are pricing it (and I fully endorse this), the next move in interest rates is going to be down.

There’s a debate going on about when that might occur? When’s the first rate cut?

Probably around mid-year. It’s very hard to pinpoint the exact month, but around mid-year, we should start to see a gentle interest rate easing cycle coming through.

And then how many rate cuts will there be in this cycle?

I think it’s important to emphasise right now, we are not going back to where interest rates were during the pandemic; we’re not going to get 400 basis points of rate cuts. More likely we’re going to see the Reserve Bank being cautious – nudging rates down every few months as the inflation rate remains in control and the economy slows down.

At this juncture, it looks like we might get 1 to 1.5 percentage points of rate cuts over the course of the next 12 to 24 months, so it will be a welcome relief to the economy that we’re going to be getting the inflation under control and interest rates cuts coming through and that’s good news for the economy.

The other thing which has just crept up on us (very relevant to the Zagga crowd here in addition to the interest rate question) is that dwelling construction is just starting to inch up. Now, by inching up, of course it doesn’t sound all that exciting. But remember the headwinds that the residential and even non-residential construction sector of the economy was facing over the last couple of years: higher interest rates, really strong building cost growth, labour shortages, and of course just this general feeling that the economy was sort of sluggish.

Now, in those circumstances, we’ve had monthly dwelling building approvals edging up from around 12,500 a month at the beginning of 2023. Most recent number is about 14,500 so that’s a nice 10 to 15% increase; admittedly from a really low base, and we’ve still got a lot more to do.

But when you look at population dynamics – a big increase in population growth – you look at the other key issues. The dwelling cost construction side has eased, but those input costs are moderating, which is good news. Skill shortages are easing – that’s good news. And as I mentioned, if interest rates are cut during the course of this year, then that threshold for new construction activity starts to dissipate.

My factor X for the next year or two is that we get a surprising upswing in dwelling construction, partly because we need them and the government, again, is trying to encourage the LGAs to have a more progressive approach to approving properties.

And things like the Rosehill Racecourse Development, I know that’s many years down the track, but don’t forget the government does want there to be 1.2 million new dwellings built over the next 5 years. Ambitious, to be sure, but even if they get close to it, it’s a positive outlook for the construction sector.

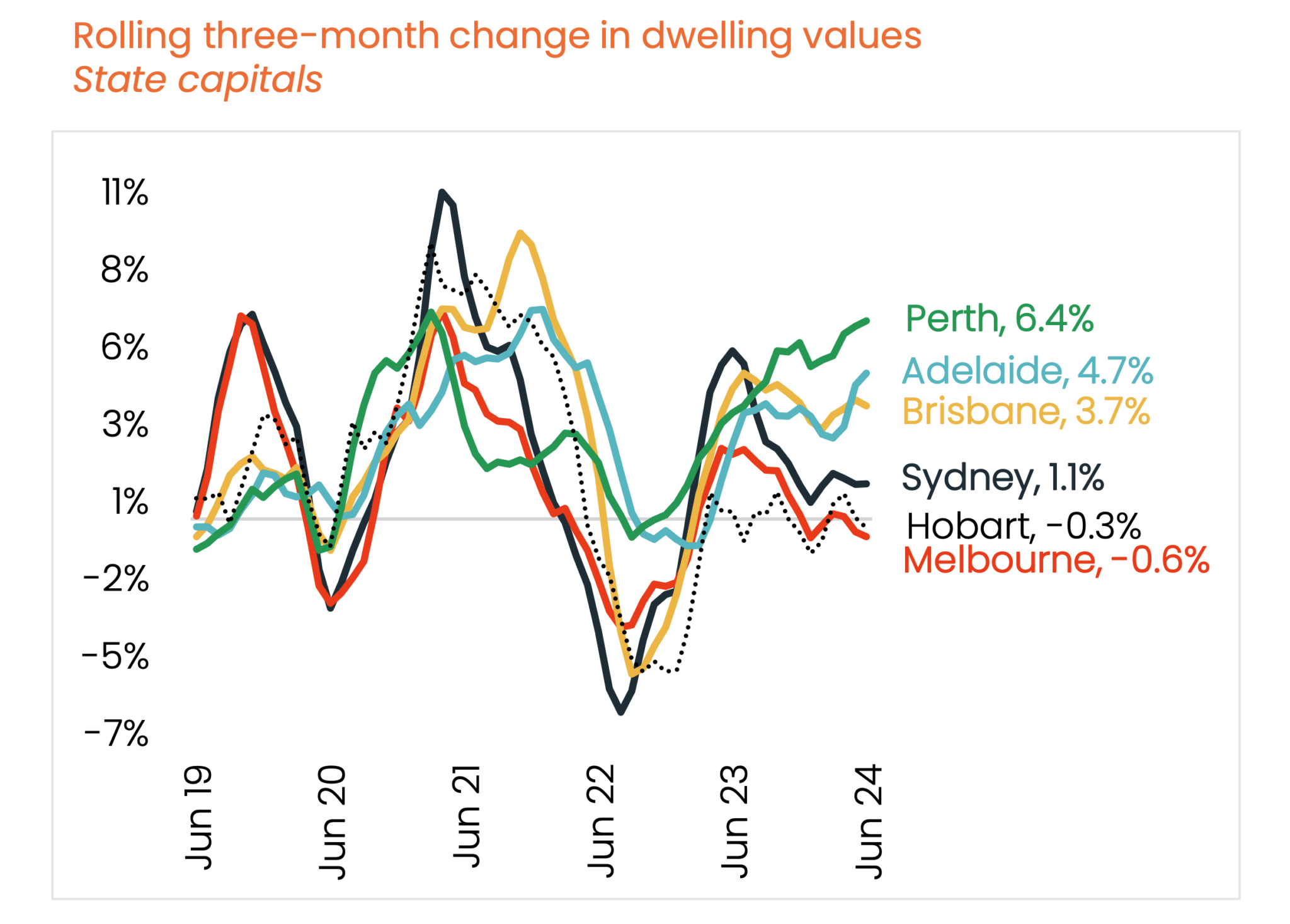

Other things that are concerning me is that we’ve got the labour market weakening, the unemployment rate will creep up, and that will have implications for house prices. I’m a little bit negative on house prices, and it might sound odd, even with interest rate cuts coming through, but my negativity on house prices is more to do with the labour market. If we get a bit of a jump in the unemployment rate, remembering that we’ve already had unemployment going from 3.40 percent to 3.90 percent, I think we will get to 4.50 percent during this year, maybe even a little higher, then that just puts a damper on housing. People can’t borrow if you’re unemployed, and it has implications for the bank’s willingness to lend.

It’s going to be a tough first half of 2024, I think, for the economy. But when we get to the second half, the tax cuts that we’re hearing so much about, will come through. If we get interest rate cuts and inflations under control, then the second half of 2024 will be a better year for the economy. And we could even have a pretty strong outlook for 2025.

I look forward to chatting to everybody over the course of 2024 on these and a whole bunch of other really important issues. And thanks to Zagga, I hope it’s a good year for everybody.”

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.