There remains clear evidence of slower economic growth as the impact of past interest rate hikes from the RBA impact on activity.

Retail sales are falling in real terms, the number of new building approvals continue to plumb to their lowest level in over a decade, consumer sentiment is weak, business confidence is turning lower and the global economy is faltering. All of this feeds into weaker GDP growth and the early stages of a turnaround in unemployment and inflation.

There are some brighter parts of the economy – private sector capital expenditure is increasing as firms ramp up investment in IT, machinery and equipment and some areas of buildings and structures. These trends are likely to be sustained for the year ahead as many businesses ‘catch up’ to many investment plans that were postponed during the Covid lockdowns.

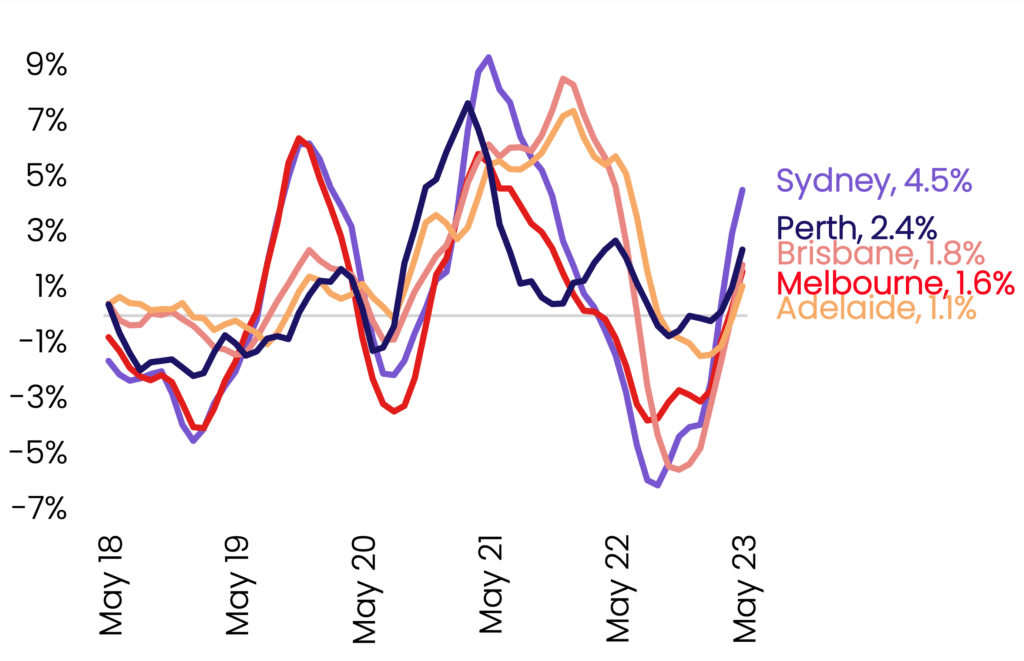

House prices are also stronger, being in the early stages of a cyclical upturn with a surge in demand for housing coming from sharply higher immigration and supply being constrained by low levels of new dwelling construction. House prices bottomed in February 2023 and the cumulative increase since that time is 3 per cent. Recall nation-wide house prices registered a peak to trough fall of 9 per cent between February 2022 and February 2023 (see Figure 1).

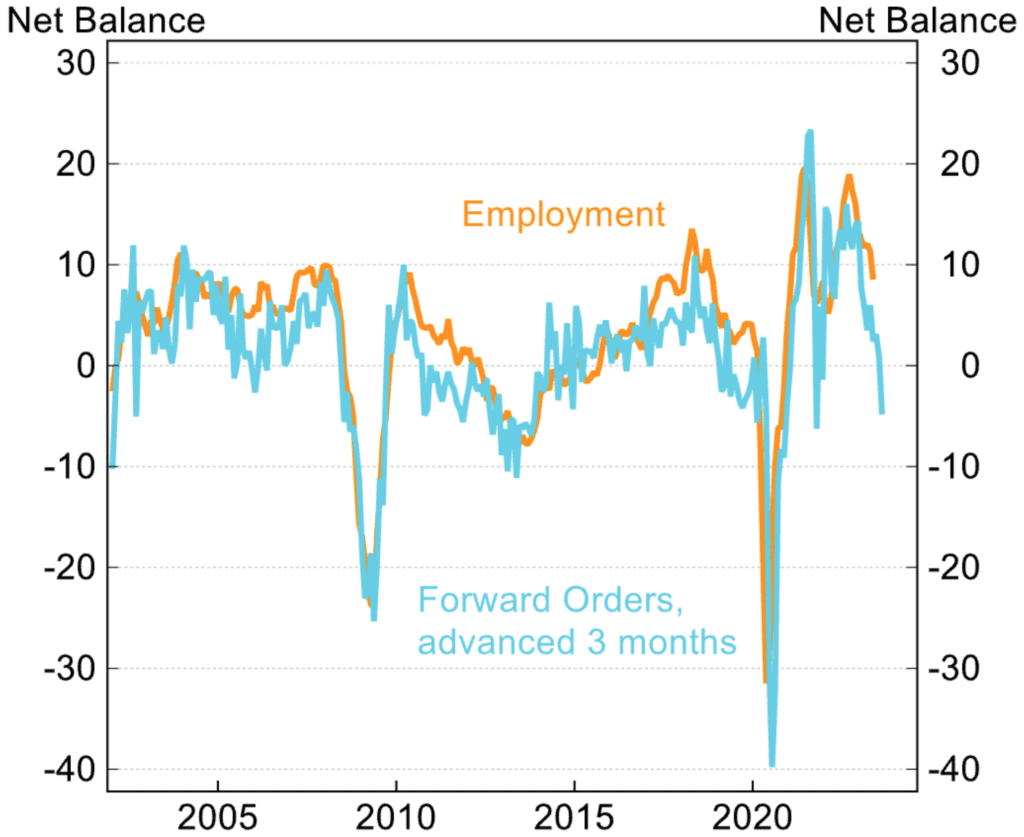

Labour market conditions remain firm, but the rate of jobs growth is slowing. Employment is increasing at a moderate pace and the unemployment rate remains low, even though there has been a clear turning point lower in job advertisements and vacancies. The unemployment was 3.6 per cent in May, continuing the broad range of 3.4 and 3.7 per cent since the middle of 2022.

RBA Deputy Governor stated that one of the objectives of the RBA in slowing the economy is to see the unemployment rate rise to around 4.5 per cent. This looks assured given the solid correlation between business forward orders and changes in employment which shows employment gains being eroded over the second half of 2023 (see Figure 2).

Figure 1: Rolling three-month change in dwelling values – State Capitals (Source: Corelogic)

Figure 2: Business Conditions (Source: CBA, Macrobond)

House prices are... stronger, being in the early stages of a cyclical upturn.

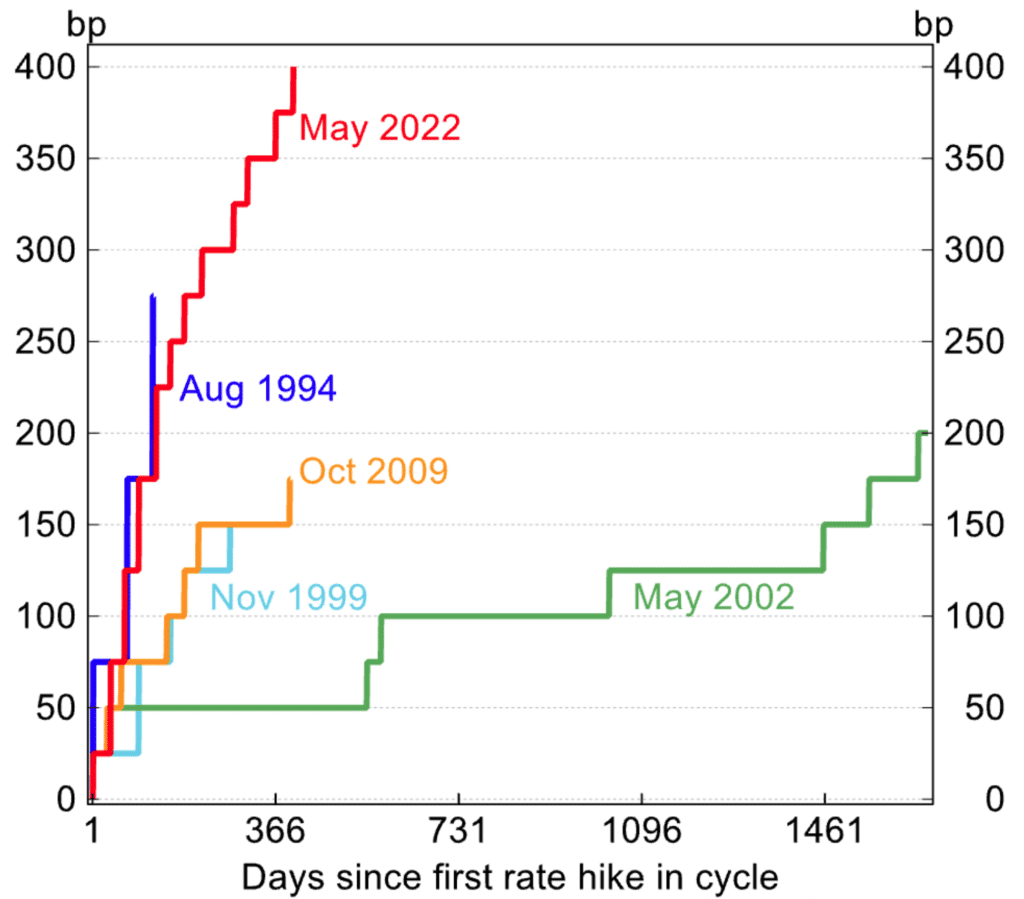

The RBA continues to surprise most economists and market participants with its aggressive interest rate hiking cycle. It lifted the official cash rate by 25 basis points to 4.1 per cent at its June meeting.

Key factors impact the RBA actions include its assessment that inflation will remain higher for longer, the rebound in house prices which it expects to support household wealth and spending and its on-going assessment that the tight labour market will, at some stage in the future, feed into an acceleration in inflation even though there is currently no evidence of this. Indeed, as the labour market softens over the second half of 2023 and into 2024, any such risks will moderate.

The current interest rate hiking cycle, which totals 400 basis points, is the largest in more than 30 years (See Figure 3). The aggressive move from the RBA reflects two main elements: The starting point for the cash rate in this cycle was a low of 0.1 per cent which may exaggerate the extent of the policy action; and the fact that the RBA is dealing with and trying to tackle the sharpest rise in inflation in more than 30 years – inflation peaked at 7.8 per cent which is materially above the target band of 2 to 3 per cent.

Figure 3: RBA Rate Hike Cycle (Source: CBA, Macrobond)

For the second half of 2023, the critical issues will be the extent of the slowing in economic growth, the rise in the unemployment rate and the deceleration in inflation. The current consensus is for economic growth to stall, for the unemployment rate to edge up towards 4 per cent and inflation to track lower in line with trends globally.

If the economy weakens further than the consensus, as is a high and growing risk, money markets will start to anticipate interest rate cuts in 2024.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.