The answer is YES.

There are more ways to gain exposure to property than simply buying into it. Debt-based real estate investments have grown in popularity and availability in recent years due to a number of factors, outlined below.

However, approximately 70% of those owners own just one property, meaning they have significant concentration risk: with a large amount of wealth tied up in one asset, it is heavily dependent on asset selection – in other words, putting all their eggs in one basket. In addition, there can be significant and often unpredictable maintenance costs, plus sensitivity to rising interest rate costs.

Another way to ‘own’ real estate is through Real Estate Investment Trusts (REITs), but these are particularly sensitive to valuation fluctuations. For example, the S&P/ASX 300 A-REIT, which tracks Australian REIT performance, is yet to recover from the significant drop it experienced at the start of the pandemic2.

Against this background, debt-based real estate investments have grown in popularity and availability in recent years. Just as corporate bonds provide an alternative to buying shares in companies, CRED provides exposure to the property market without needing to own the assets.

In a period of rising inflation and interest rates, CRED has a number of attributes that may make it attractive to investors.

Secured

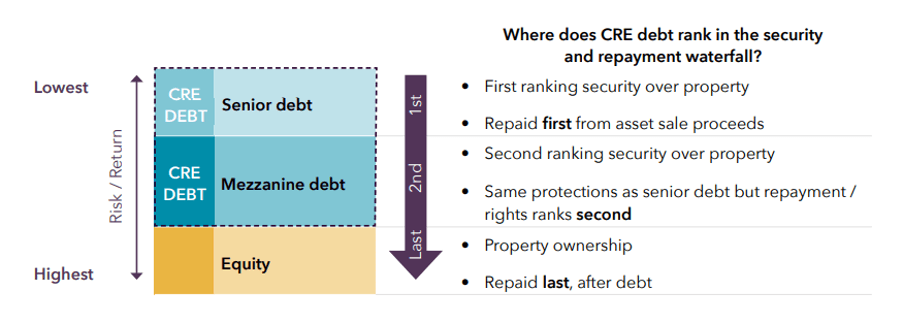

Loans are secured by real assets (e.g. development site), with investors taking precedence among creditors in the event of the loan defaulting (see Figure 1). This helps to manage risk.

Predictable Income

Borrowers agree to pay interest over the life of the loan, and this is the basis of ongoing ‘coupon’ payments to investors. This is unlike dividends for equities, which are discretionary and dependent on the company’s cashflows.

Pricing Power

Loans are negotiated on a deal-by-deal basis. This means loans can be priced according to market conditions, even if interest rates rise. Most new loans to do incorporate some form of variable rate pricing mechanism.

Zagga’s latest white paper outlines the market dynamics driving the popularity of such investments.