Pooled Funds

Earn attractive, risk-adjusted returns through investing via one of our discretionary, pooled funds.

Invest in property without buying the bricks and mortar

Investors in a Zagga Fund invest in quality loans to creditworthy borrowers, all mortgage-secured by high-quality, Australian property, without the need to personally scrutinise each and every individual loan.

Zagga's pooled funds

Depending on an investor’s situation and objective, investors can select from one of two income generating funds:

Zagga Feeder Fund

The Zagga Feeder Fund (ZFF) is our flagship discretionary pooled fund that provides investors with the opportunity for regular, defensive interest income without a disproportionate increase in risk.

Launched in December 2018, ZFF focuses on lending to a specifically curated portfolio of high-quality, mortgage-secured loans in the commercial real estate sector.

Target return**

OCR + 5.00%

p.a. on capital deployed (target return from 9.35%)

Minimum term

12 months

Minimum lock-up period from date of investment

Notice Period

90 days

Following minimum lock-up period of 12 months

Zagga Wealth Fund

For investors focussed on liquidity, the Zagga Wealth Fund (ZWF) provides investors with an attractive rate of return with the added flexibility of access to funds on 30 days’ notice (after minimum term).

ZWF provides investors with defensive interest income via a specifically curated portfolio of high-quality, mortgage-secured loans in the commercial real estate sector.

Target return**

OCR + 3.00%

p.a. on capital deployed (target return from 7.35%)

minimum term

3 months

Minimum lock-up period from date of investment

Notice Period

30 days

Following minimum lock-up period of 3 months

Subscribe to our newsletter to learn more about Zagga

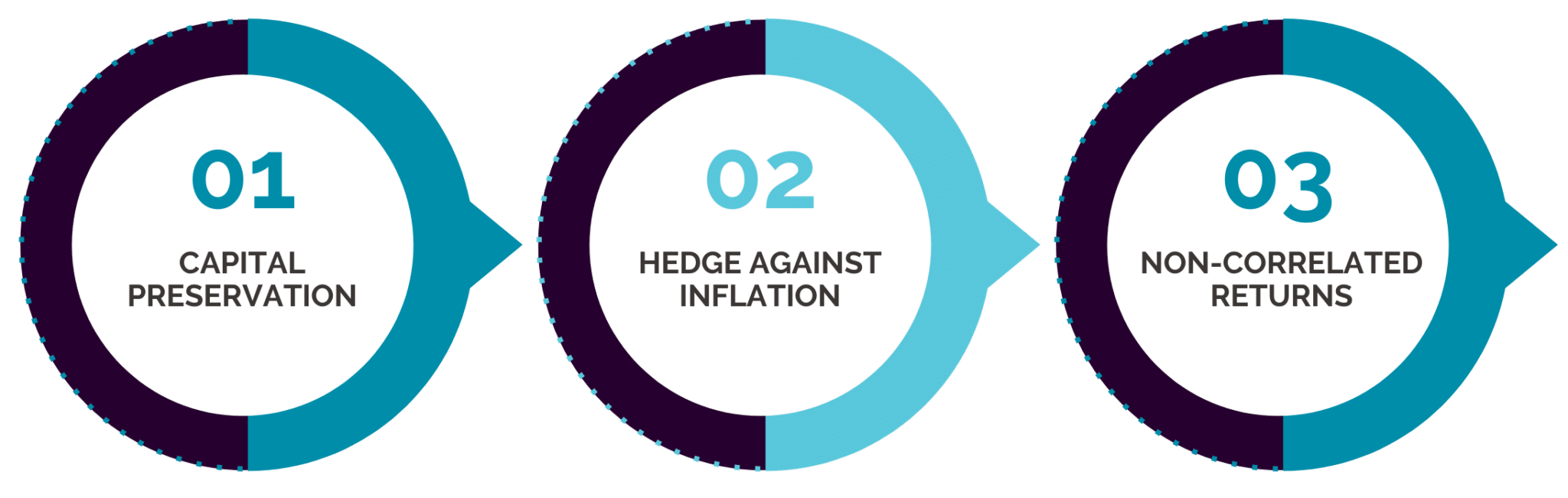

Benefits of investing in the commercial real estate sector