In the specialist world of financing real estate projects, particularly in the commercial real estate (CRE) sector, a strategic interplay of financing strategies is essential. The capital stack, representing the funding structure for acquiring existing properties or initiating development projects, is of particular significance.

Debt is arguably one of the most foundational parts of this process, forming an important structure, and often, significant portion, of the total funding. This article delves into the critical role of debt in CRE financing and explores the various types and layers. Additionally, it addresses the associated risks for investors and demonstrates how debt shapes the overall funding structure within the capital stack.

Debt is dynamic

Debt plays a pivotal role in the capital stack, often forming the fundamental layer for financing real estate development projects. Developing a commercial real estate property requires substantial investment to cover elements such as land acquisition, demolition, construction, and ongoing maintenance until the property reaches stability. The duration and risk associated with this process vary based on factors like property size, development complexity, and speculative nature. Given these challenges, developers often seek financing from sources that can tolerate such risks, combining both debt and equity funding to support the project.

Simultaneously, investors often favour debt investments for the security they can offer, preferring the stability and predictability of returns that are often secured by mortgages over property, over the volatility of equity investments. Debt can provide investors with a reliable avenue to diversify their portfolios while enjoying predictable returns.

Debt is a critical tool for both property developers and investors. Developers rely on debt to access the necessary funds for acquiring land, construction, and completing projects. It helps them manage upfront costs and project risks more effectively. Similarly, investors prefer debt investments for their stability and fixed returns, offering a secure alternative to equity investments. In this way, debt plays a vital role in facilitating the goals of both developers and investors in real estate projects.

Understanding the different layers of debt in the capital stack

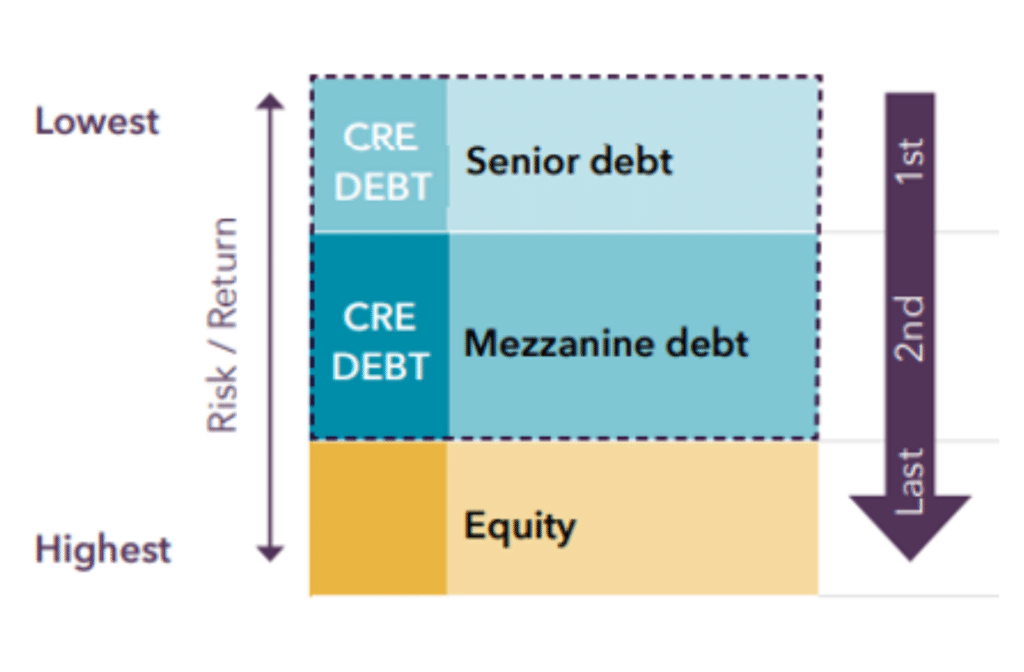

The capital stack incorporates various layers of debt, each with its own risk-return profile. Here’s a breakdown of two key categories:

Senior debt is a form of financing that holds the lowest risk, and highest priority for repayment, in the capital stack. In essence, it’s the first in line to be repaid in the event of asset liquidation or cash flow distributions. For investors, senior debt represents a lower risk investment option within the capital stack compared to other forms of financing and layers within the capital stack. This is because senior debt investors are prioritised in repayment over other creditors, including subordinated debt investors. This type of debt typically carries lower interest rates compared to other forms of financing, reflecting its lower risk profile.

Following senior debt in the capital stack hierarchy lies subordinated debt which includes mezzanine debt as well as junior debt. Subordinated debt occupies the middle ground between debt financing and equity investment.

Junior debt is simply a percentage of the loan that sits below the senior debt in the capital stack. Not all commercial real estate projects will have junior debt. The key difference between senior and junior debt is that the junior debt ranks after senior debt in repayment priority, although still ahead of equity, and charges a slightly higher interest rate on the capital provided to reflect its higher risk profile.

For real estate projects that do not have a junior debt layer, the capital after the senior debt will often come in the form of mezzanine debt, or preferred equity, instead of junior debt but often serve the same purpose of bridging the gap between the amount of common equity needed and the amount of debt provided by the senior lender.

Similar to senior debt, mezzanine debt offers investors regular interest payments at a predetermined rate. However, it ranks behind senior debt in repayment priority in the event of default or asset liquidation. As such, mezzanine debt carries a higher interest rate compared to senior debt reflecting its higher level of risk.

Despite this lower repayment priority risk, mezzanine debt is still debt and in the real estate capital stack, all forms of debt are of higher seniority and higher repayment than equity. This hierarchy means that the lenders must be repaid in full before equity holders can start to recover any proceeds. As such, equity holders could receive a marginal recovery on their investment, or nothing at all in the event of default.

Debt is not dirty

It’s important to note that a higher proportion of debt in financing commercial real estate projects doesn’t necessarily equate to higher risk. This is because lenders typically extend financing to properties they deem capable of managing the associated credit risk, with income levels sufficient to support the debt.

In the past, investors often took comfort from the scale and sophistication of tier 1 builders / projects, and for good reason. These projects perform well for investors when all goes to plan.

However, if cracks start to appear, unexpected risks may start to present through. For these reasons, and as part of our risk-mitigation discipline, we strategically work with projects in the $3 million to $50 million range which often have better margins, typically 7-10%.

Given Zagga’s deep experience in development projects and construction funding, we look beyond what independent quantity surveyors present, to identify conservative contingencies to help manage a project seamlessly and successfully through to Practical Completion, and ultimately, loan repayment.

Most real estate lenders, particularly those offering senior debt prioritise capital preservation above all else. At Zagga, we operate with an investor-first approach. Our focus and objective is on presenting risk-mitigated commercial real estate debt opportunities, which, when compounded over many years, constitute highly attractive returns.

Debt is a powerful tool

Debt financing plays a vital role in unlocking opportunities in the commercial real estate market for developers and investors. By leveraging debt strategically within the capital stack, investors can amplify returns. However, debt investments, as with all investments, carry risks. Understanding the nuances of the capital stack, the different layers of debt – such as senior debt, junior debt and mezzanine debt, along with the key risk factors, are all crucial elements for making informed investment decisions. When wielded with care and a thorough understanding of the commercial real estate debt market, debt can be a powerful tool to help investors achieve risk-adjusted returns and regular, predictable income.