The economy remains subdued or even weak. Inflation is trending down, unemployment is trending up.

In terms of key data, retail sales in real terms rose just 0.2 per cent in the September quarter which followed three consecutive quarters of decline. Consumer spending is weak as households adjust to ongoing cost of living pressures and the impact of higher interest rates on cash flows.

The persistently low levels of consumer sentiment is a further indicator of a troublesome outlook for consumer demand over the near term.

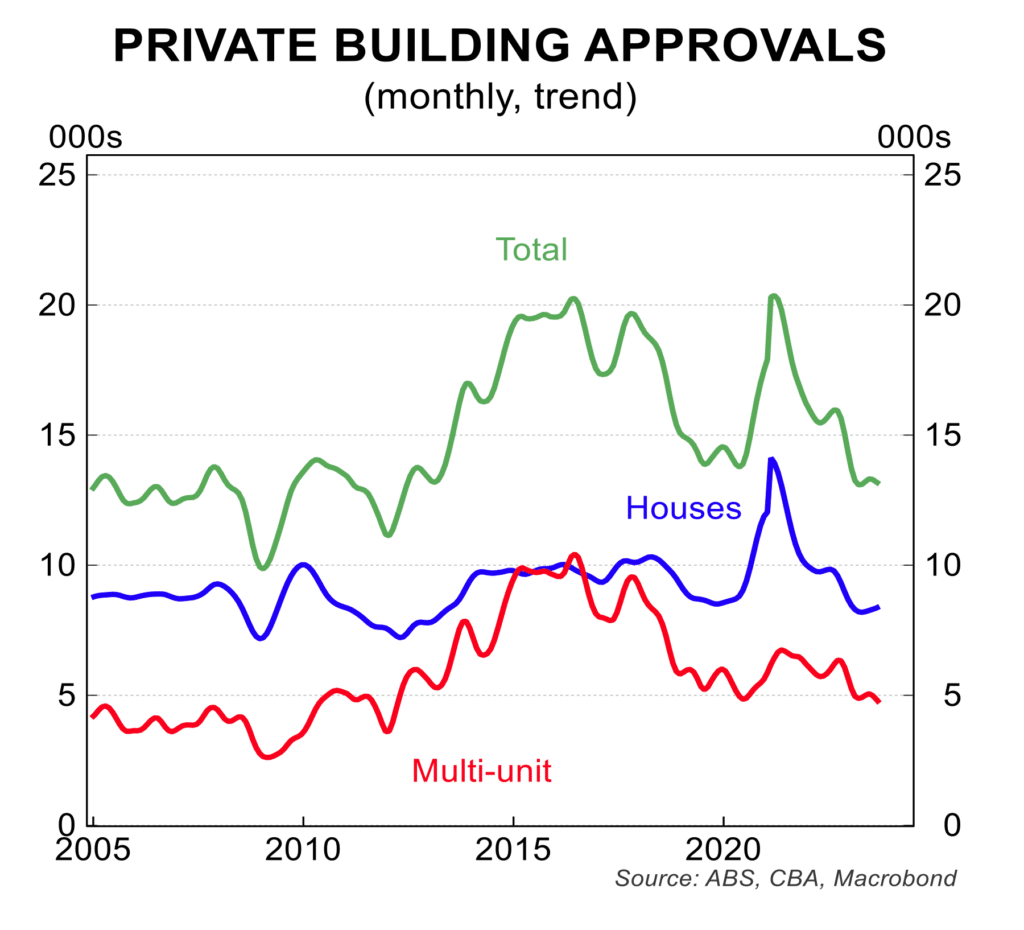

Building approvals continue to bounce along the bottom of the current cycle but there is some tentative evidence that the rise in house prices and easing in building input cost pressures, including for labour, are feeding into a slightly optimistic outlook that will see a mild construction recovery in 2024 and 2025.

The slowing in the labour market remains uneven

The pace of employment growth has slowed, but the unemployment rate is above the 48 year recorded late in 2022. In October, employment rose by 55,000 but the increase was in part time work which may be linked to the Australian Electoral hiring workers for The Voice referendum. The unemployment rate edged up to 3.7 per cent which is above the cyclical low of 3.4 per cent in late 2022.

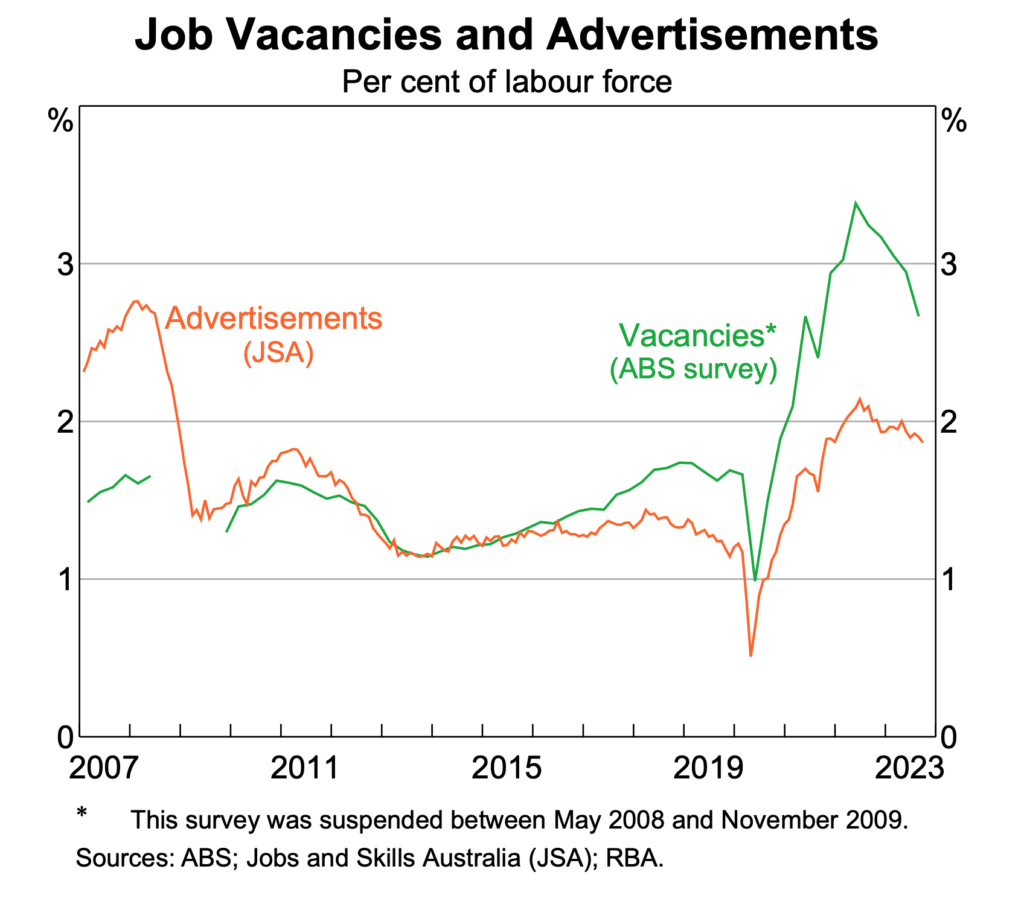

Demand for labour is softening in line with the slowing in economic growth. Job vacancies and advertisements are on a clear trend lower. This suggests the unemployment rate is on course to exceed 4 per cent in coming months and reach 4.25 to 4.5 per cent in late 2024 or early 2025.

There is some tentative evidence that the rise in house prices and easing in building input cost pressures... are feeding into a slightly optimistic outlook that will see a mild construction recovery in 2024 and 2025.

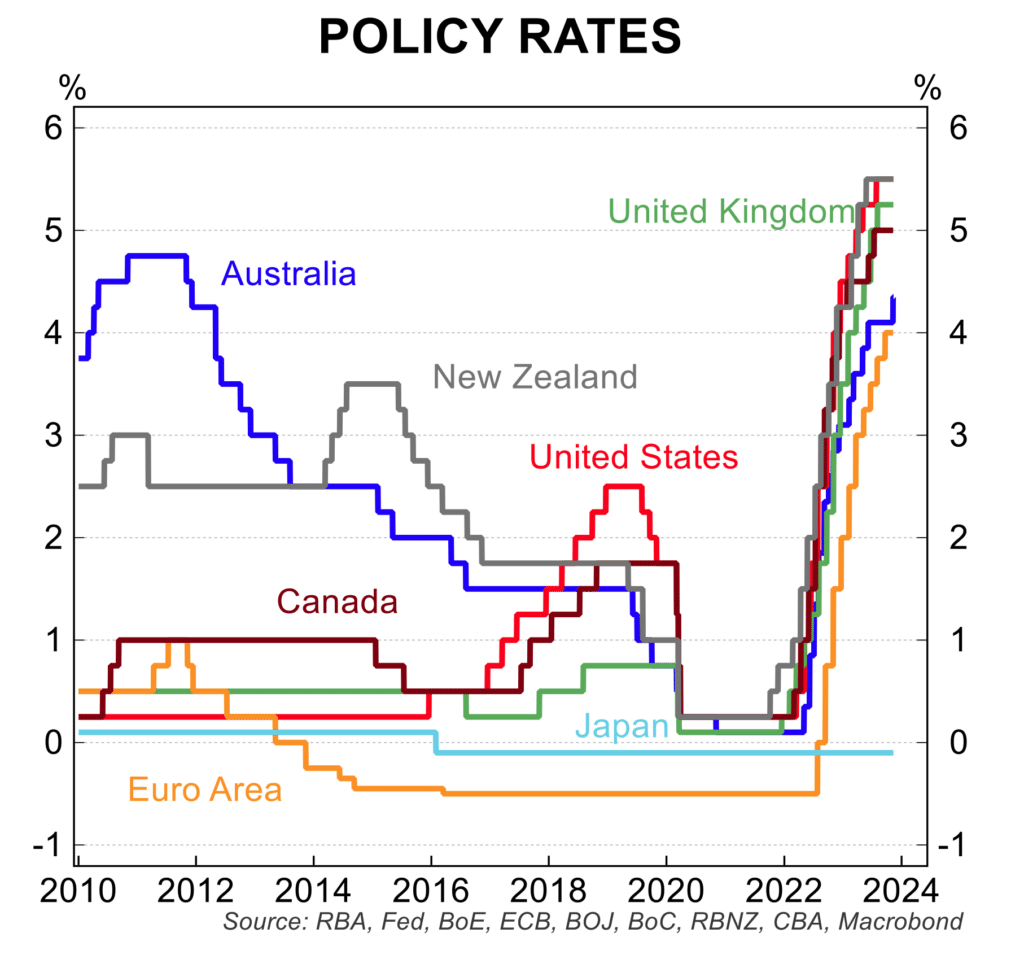

The RBA interest rate hike in November was based on its forecasts for higher inflation and its material upward revisions to the inflation outlook over the next 6 to 18 months. It was a surprising move relative to the sentiment of the market and the stance of the RBA itself just a month ago and in the wake of the slowing in global economic growth.

That said, the November Statement on Monetary Policy signalled some risk of a further interest rate increases if the outlook for a lower inflation rate is further pushed back in the months ahead. This makes the next raft of data on wages, unemployment and the monthly inflation rate critical to the RBA assessment of monetary policy.

Money markets have been volatile in the wake of the RBA policy changes and to global developments which confirm that inflation is on a broad downward trajectory. That said the yield on 3 year government bonds remains around or a little below the new cash rate – in a 4.10 to 4.40 per cent range. Many markets overseas are pricing in interest rate cuts in 2024, including for the US, Eurozone, Canada and New Zealand.

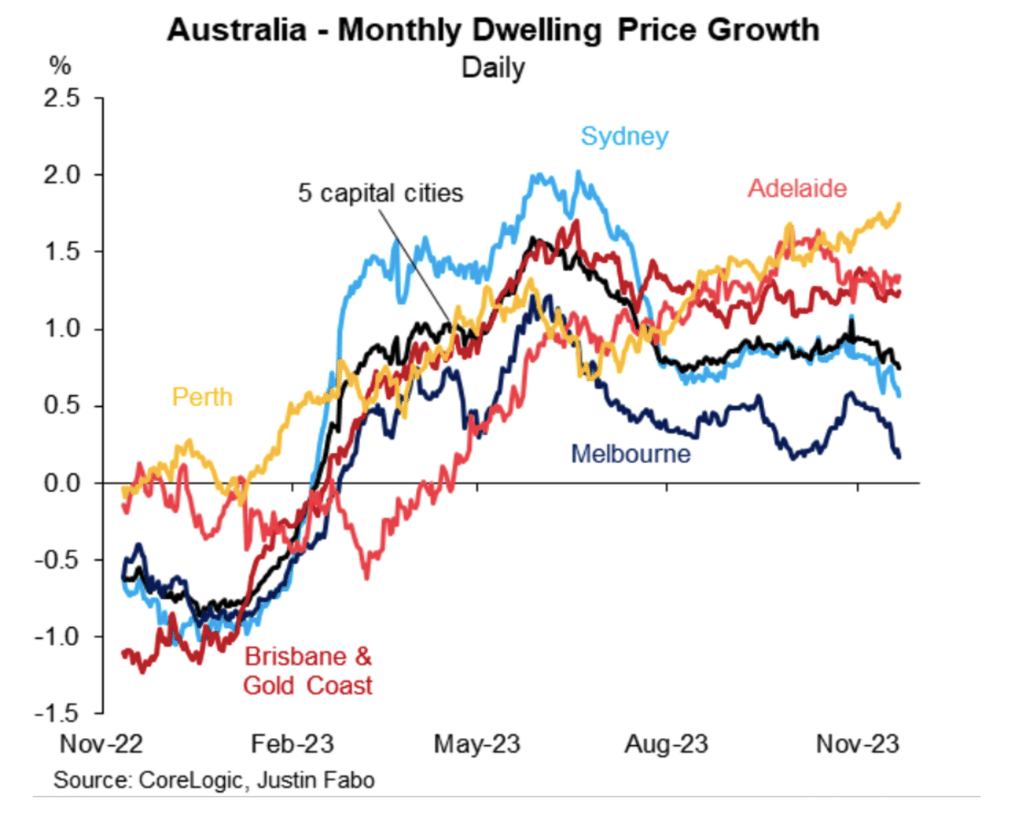

House prices continue to rise at a solid pace with the strong demand / weak supply dynamics still at play

Nation-wide house prices rose 0.9 per cent in October, to register the ninth straight increase. There are signs of price weakness in Canberra, Hobart and Darwin, but the largest cities continue to register large price increases. Since the low point early in 2023, house prices have risen 8 per cent to be at a new record high.

That said, there remains tentative evidence that the pace of price increase is softening. At this stage, this does not necessarily mean price falls, but rather monthly price increases around 0.25 to 0.5 per cent in the medium term a step down from the 0.75 to 1 per cent increases through most of 2023.

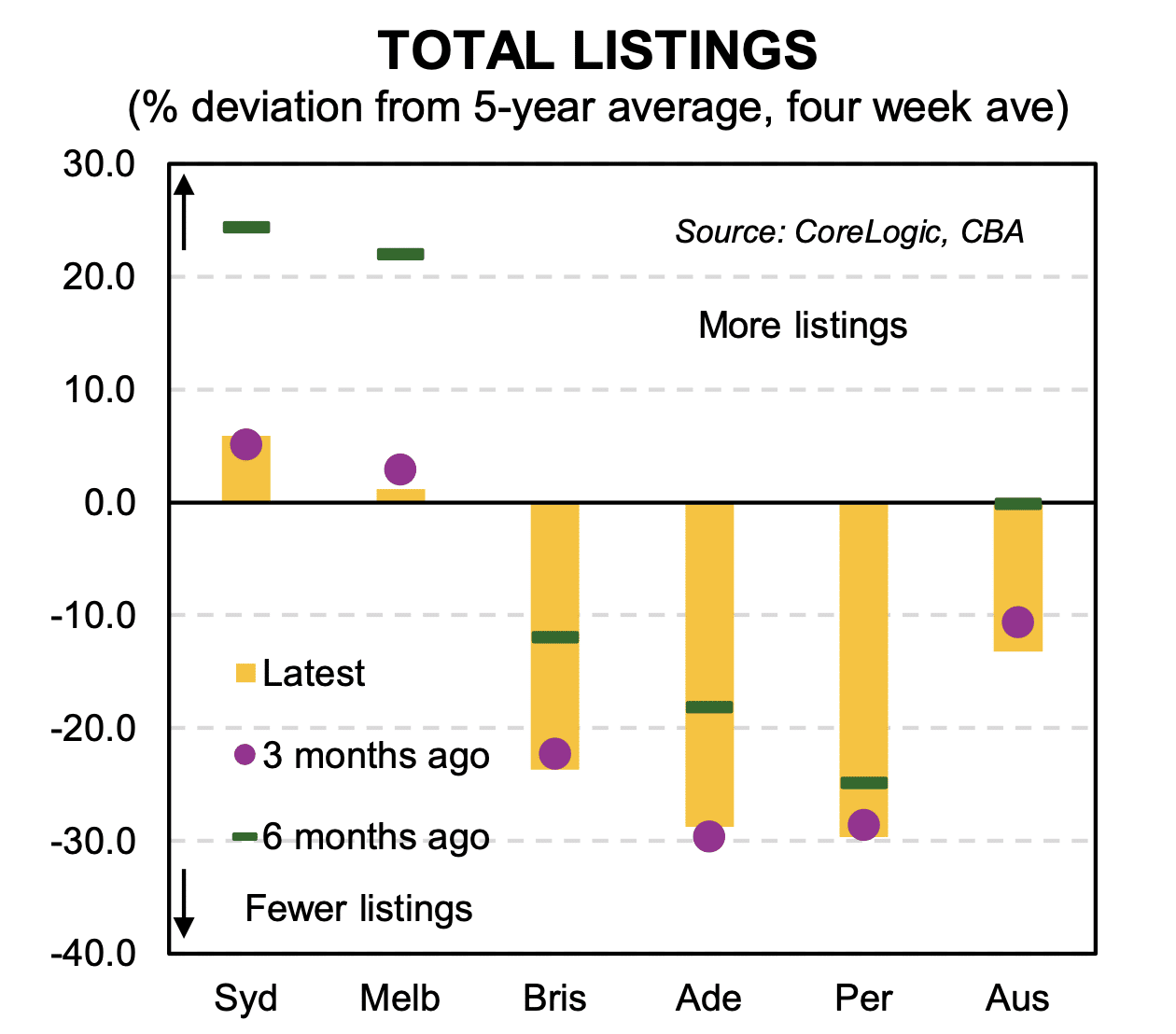

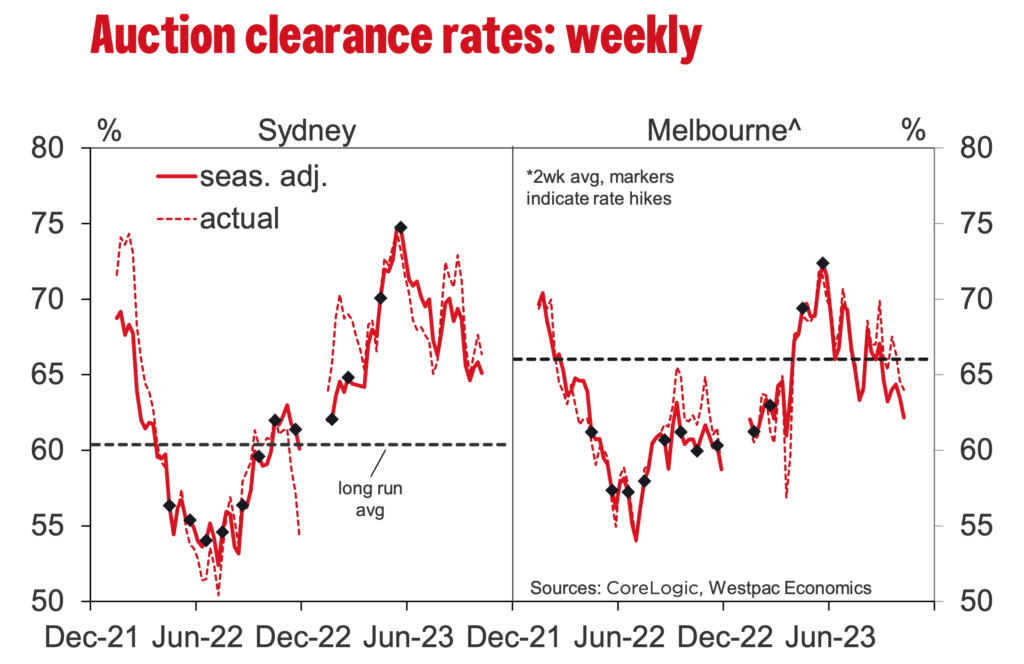

Importantly, auction clearance rates have turned down from the mid 2023 peak, while at the same time new listings of properties for sale are rising as sellers take advantage of what are positive issues for them to list their property.

Overall, the economy is slowing with some key issues in the outlook

Lower inflation, rising unemployment, softness in house prices with the more favourable news pointing to a turning point recovery in dwelling construction in 2024 and 2025.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.