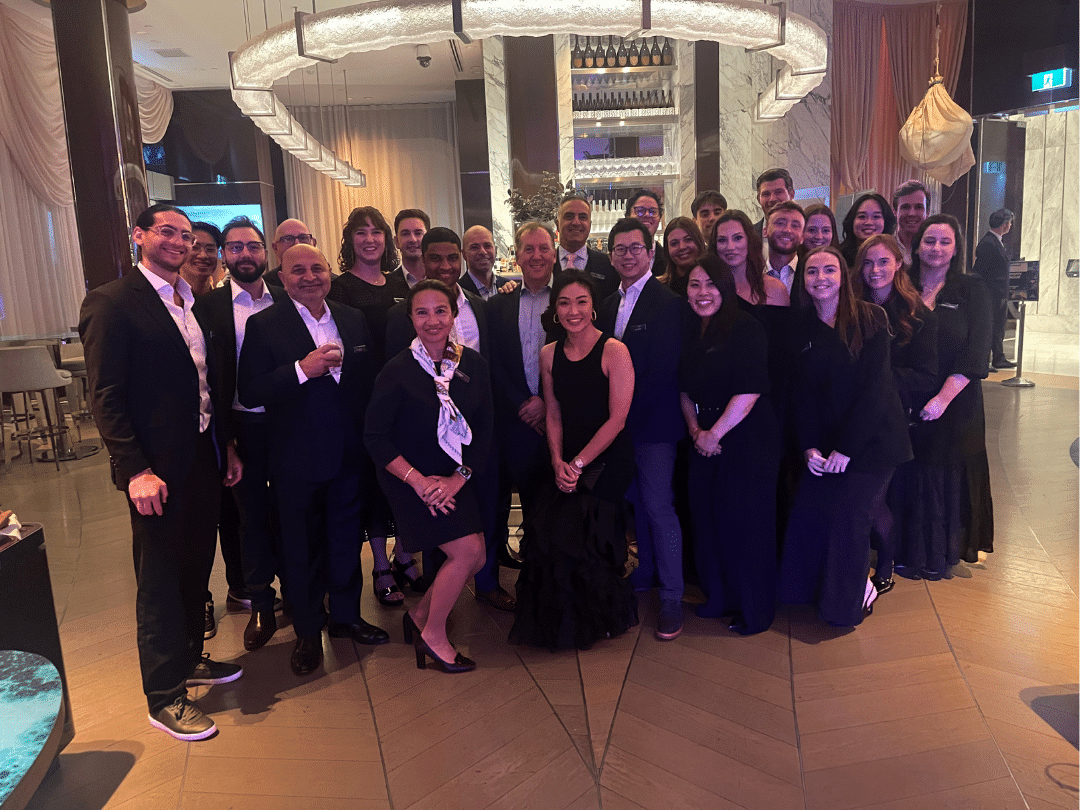

Eight years of Zagga: reflecting on a remarkable journey

Our CEO, Alan Greenstein, takes a moment to reflect on how far Zagga has come since its inception – “None of this would have been possible without the ongoing support of our investors, the loyalty of our borrowers and introducers, the excellence of our service providers, and the deep capability and character of the Zagga team — from our Day One originals to our newest recruits.”