The Zagga CRED Fund

Another CREDible alternative for advisors

The Zagga CRED Fund is our flagship unitised fund that aims to deliver investors with risk-adjusted returns and regular defensive interest income through investment exposure to a diversified portfolio of creditworthy commercial loan transactions secured by quality Australian real estate.

Fund Overview

For investors looking for an alternative to shares and traditional fixed income and property investments, the Zagga CRED Fund (ZCF) provides a CREDible avenue for portfolio diversification and regular, risk-adjusted income by investing in a specifically curated portfolio of credit-vetted, mortgage-secured loans.

The Fund invests predominantly in senior debt, diversified across a mix of geographic locations, sectors, and borrower profiles. By investing in the Fund, investors can access opportunities not readily available to private investors on a direct basis, while accessing the specialist knowledge and skills of the Investment Manager.

Fund Facts

Minimum investment1

$50,000 for the initial investment

Multiples of $10,000 for any additional investments

Investing

Units will be issued on a monthly basis

(unless the Trustee decides to value the Fund more frequently)

Target return

RBA Official Cash Rate + 4% p.a.

Issue price

$1.00

(for the first investment)

Income distribution

Monthly

Access to funds

Subject to the minimum lock-up period and maintaining a minimum remaining balance of $50,000, an investor may redeem part or all of their units only with the consent of the Trustee

Redemption price

Redemption Requests accepted by the Trustee will receive the Redemption Price calculated on the most recent Valuation Date occurring prior to the redemption of units

Valuation

The Fund will be valued on the last business day of each month

(or more frequently as the Trustee determines)

Management fee2

0.50% p.a. of the Gross Asset Value

(calculated and accrued monthly on the last business day of the month and paid to the Trustee monthly in arrears)

Suggested minimum investment time frame

Minimum lock-up period of 12 months from the date of investment

(which may be waived at the discretion of the Trustee)

Research rating

VERY STRONG investment rating by Foresight Analytics for the Fund

Four-star, SUPERIOR investment grade rating by SQM Research for the underlying Lending Trust

1. The Trustee may alter the minimum amounts specified at any time without prior notice to unitholders.

2. All numbers exclude GST unless otherwise noted and all dollar amounts are in AUD.

Access the key Zagga CRED Fund documents

Ratings and reports

VERY STRONG | Foresight Analytics

Foresight Analytics & Ratings has recently completed an initial rating assessment of the Zagga CRED Fund.

The fund has been assigned a VERY STRONG rating, indicating a very strong level of confidence that the manager can deliver a risk-adjusted return in line with its investment objectives.

The material contained in this document has been prepared solely by Foresight Analytics and Ratings Pty Ltd under Australian Financial Services Licence No. 494552. The material contained in this document is for general information purposes only, and individual financial positions, objectives and circumstances have not been taken into consideration. The information contained in this material should not be acted upon without obtaining advice from a licensed investment professional. It is neither an offer to sell nor a solicitation of any offer to purchase and /or sale of any securities in an investment product or managed investment scheme, derivative, index, or financial instrument, nor is it an advice or a recommendation to enter into any transaction. No allowance has been made for transaction costs or management fees, which would reduce investment performance. Any investment in a financial product or fund involves a degree of risk. Actual results may differ from the reported performance. It is important to note that past performance is not an indication of future performance.

4-star 'SUPERIOR' | SQM Research

Zagga, a fully licensed boutique, non-bank lender and investment manager, has confirmed that independent research house, SQM Research (SQM) has awarded a 4-star ‘Superior’ (Investment Grade) rating for the Zagga Investments Lending Trust (ZILT), for the fifth year running.

The rating contained in this document is issued by SQM Research Pty Ltd ABN 93 122 592 036 AFSL 421913. SQM Research is an investment research firm that undertakes research on investment products exclusively for its wholesale clients, utilising a proprietary review and star rating system. The SQM Research star rating system is of a general nature and does not take into account the particular circumstances or needs of any specific person. The rating may be subject to change at any time. Only licensed financial advisers may use the SQM Research star rating system in determining whether an investment is appropriate to a person’s particular circumstances or needs. You should read the product disclosure statement and consult a licensed financial adviser before making an investment decision in relation to this investment product. SQM Research receives a fee from the Fund Manager for the research and rating of the managed investment scheme.

How to invest?

For advisers

- Find us on the following platforms:

BT Panorama | HUB24 | Mason Stevens | Netwealth | Praemium

For investors

- Speak to your financial adviser or broker

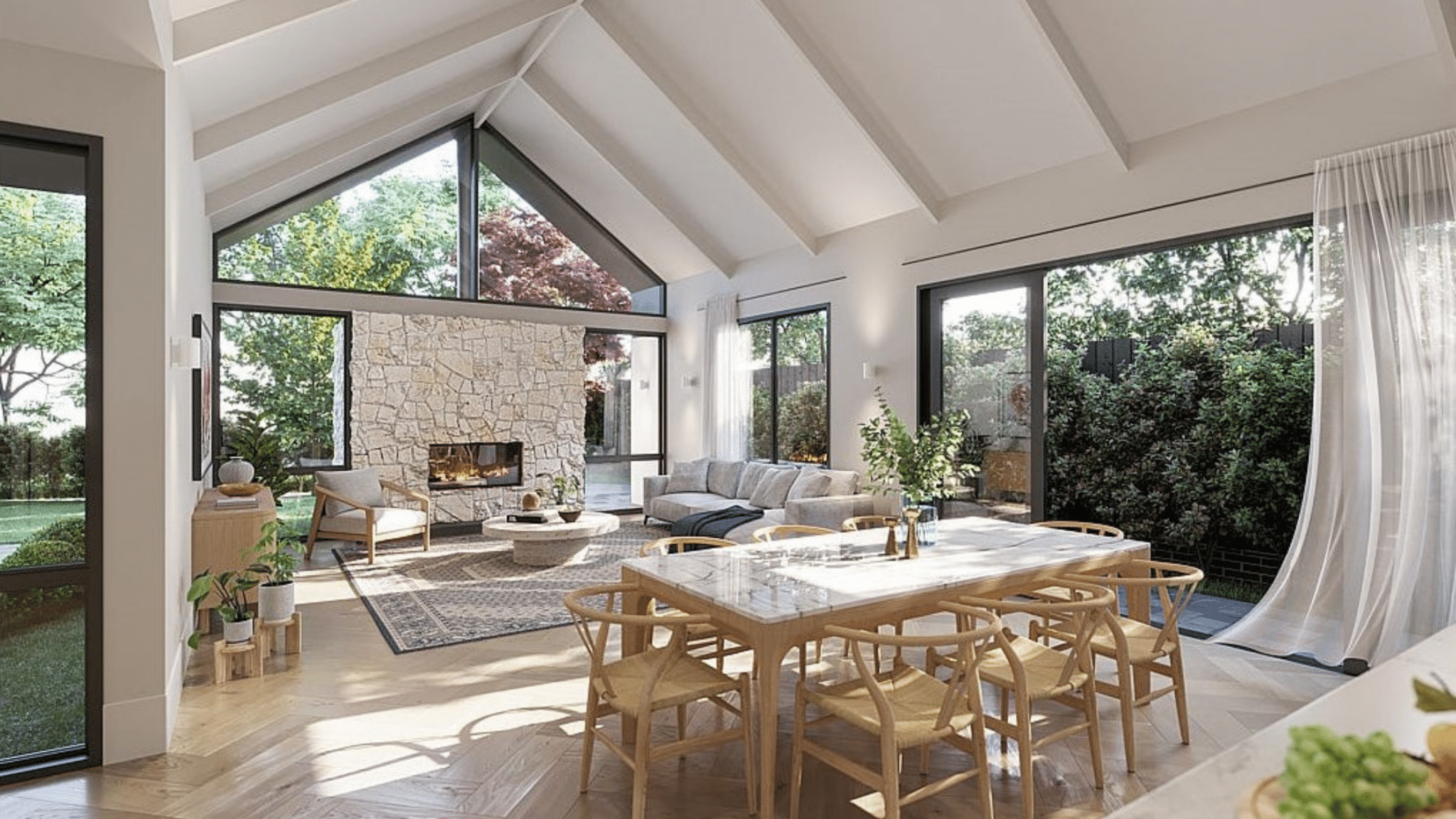

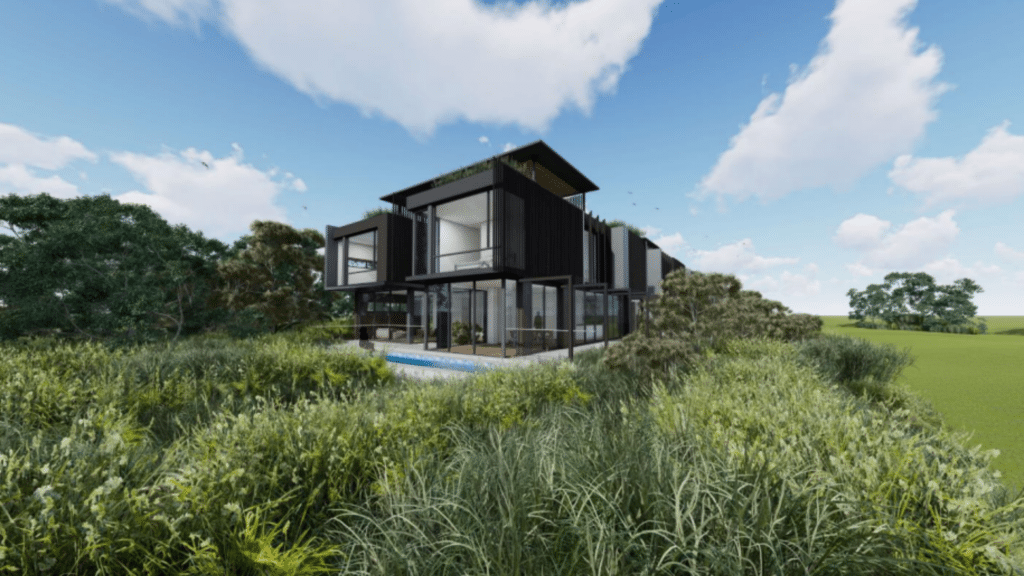

ZCF will invest in property assets across residential, commercial and industrial sectors

Below is a high-level summary of the type of loan transactions in which ZCF may invest.

Bondi Beach, NSW

Real Estate Sector

Land Banking

Loan Purpose

Acquisition of an existing mixed-use site overlooking Bondi Beach (retail and residential) for highly-experienced counterparties as they run DA approval process for an improved mixed-use site

Facility Size

$11,200,000

LVR

70%

Term

6 to 12 months

Bowral, NSW

Real Estate Sector

Residential Development

Loan Purpose

Construction of seven over-60’s luxury standalone dwellings each consisting of three-bedrooms + study, 2.5 bathrooms and double garage

Facility Size

$9,800,000

LVR

59.92%

Term

13 months

Castle Hill, NSW

Real Estate Sector

Residential Development

Loan Purpose

Construction of 14 residential townhouses comprising of 2 and 3-bedrooms. Facility commenced with 6 sales representing 52% of net presale cover

Facility Size

$16,860,000

LVR

66.32%

Term

12 to 18 months

Collingwood, VIC

Real Estate Sector

Residual Stock – Commerical

Loan Purpose

To provide time for Borrower to finalise remaining lease agreements on favourable terms to facilitate a refinance to a long-term investment facility with their existing major Bank lender

Facility Size

$14,200,000

LVR

57.20%

Term

12 months

Little Bay, NSW

Real Estate Sector

Land Banking

Loan Purpose

Land acquisition while the Sponsors run DA process for development of site into 16 dwellings (8 detached villas and 8 duplexes). The site has direct frontage to the first hole of St Michael’s golf course and sweeping views of the Pacific Ocean

Facility Size

$11,050,000

LVR

65%

Term

12 months

Silverdale, NSW

Real Estate Sector

Commercial Development

Loan Purpose

Provision of funds for redevelopment of Silverdale shopping centre which contains Woolworths as an anchor tenant on a 10-year head lease with five x 8-year options. There are also a number of leases and Heads of Agreements (HOA) in place

Facility Size

$36,245,037

LVR

52.65%

Term

10 to 12 months

Note: These current loan transactions meet the Investment Criteria for ZCF, as detailed in the Information Memorandum. They may not represent the actual Underlying Loans.

With investors facing a storm of volatile pricing, and residential property yields compressed by high purchase prices, what alternatives are there?

Our newest white paper delves into the dynamics of the fast-growing private lending market, and what’s driving it.

Why Zagga?

We are an established Australian boutique CRED specialist and investment manager.

We have a proven track record and maintained strong momentum

and above-system growth since inception in 2017.

AFSL

ACL

licenses

SUPERIOR

Investment rating

Over

combined experience

Investor capital

returned

Subscribe to our newsletter to learn more about Zagga

News & Insights

Zagga Fund Update – For the Quarter and Financial Year ended 30 June 2025

In this update, we share an overview of the current market environment and highlight how we are adapting to changing conditions while remaining focused conservative and prudent risk management.

Zagga has been shortlisted for the Australian Wealth Management Awards 2025

The Australian Wealth Management Awards is an unparalleled awards program that identifies the top businesses and professionals in the wealth management profession across the nation.

“We’re honoured to be

Eight years of Zagga: reflecting on a remarkable journey

Our CEO, Alan Greenstein, takes a moment to reflect on how far Zagga has come since its inception – “None of this would have been possible without the ongoing support

Do you have questions about the Zagga CRED Fund?

Fill in your details to schedule a call back at a time that suits you.