The RBA held official interest rates steady at a 12 year high of 4.35 per cent following its March Board meeting.

While there was no change in policy, there was a change in its assessment for the outlook for interest rates, dropping the bias that interest rates could still rise, to “we are not ruling anything in or anything out” when looking at the monetary policy outlook.

Money markets are still pricing in a series of interest rate cuts, starting in the September quarter 2024 and amounting to a total of approximately 75 basis points by the second half of 2025. This outlook is a rapidly moving feast and in addition to the importance of upcoming local inflation and labour market data, trends in the global economy and from other central banks will have a major influence on the path of Australian interest rates.

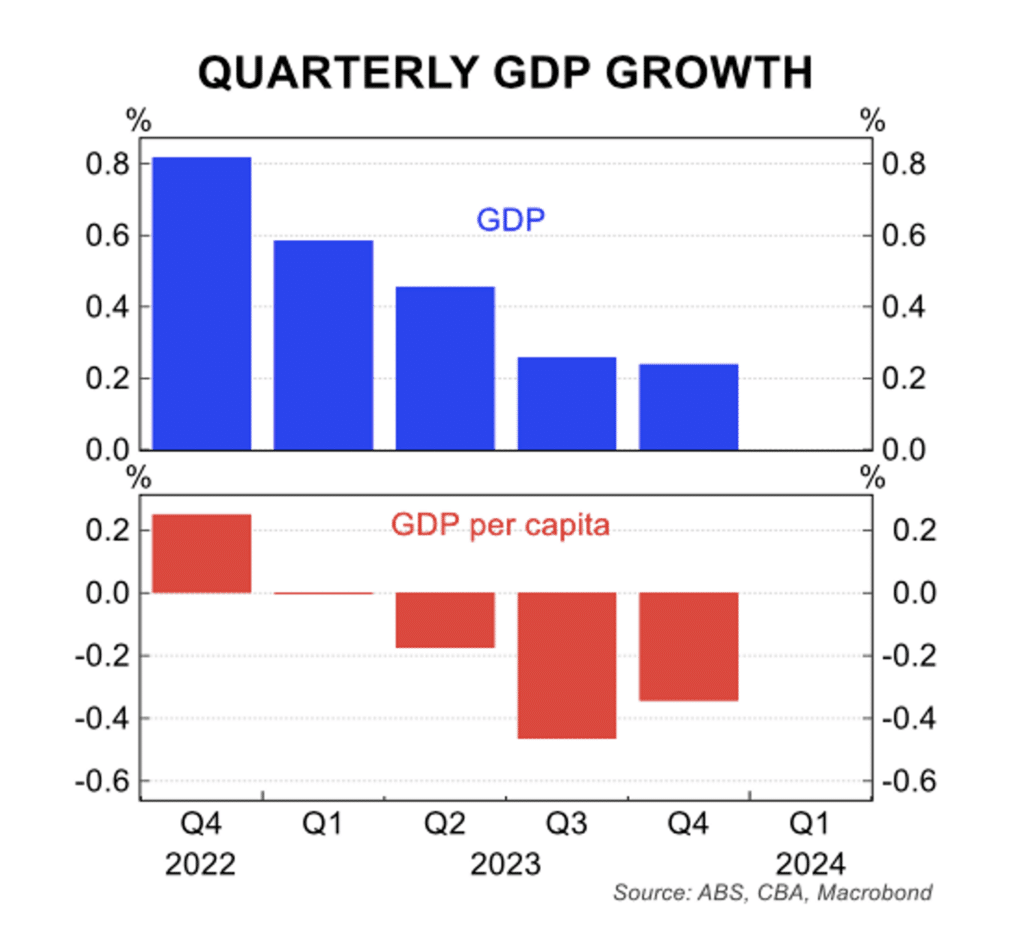

Key data confirmed the economy to have slowed to one of its weakest positions, outside the COVID pandemic, for two decades with annual GDP growth easing to 1.5 per cent in the year to the December quarter 2023 and just 1.0 per cent – annualised – in the second half of 2023. In the quarter, household spending was basically flat, dwelling investment fell, while private sector capital expenditure was the bright spot recording solid 7 per cent growth.

The economic indicators for the March quarter 2024 remain generally weak.

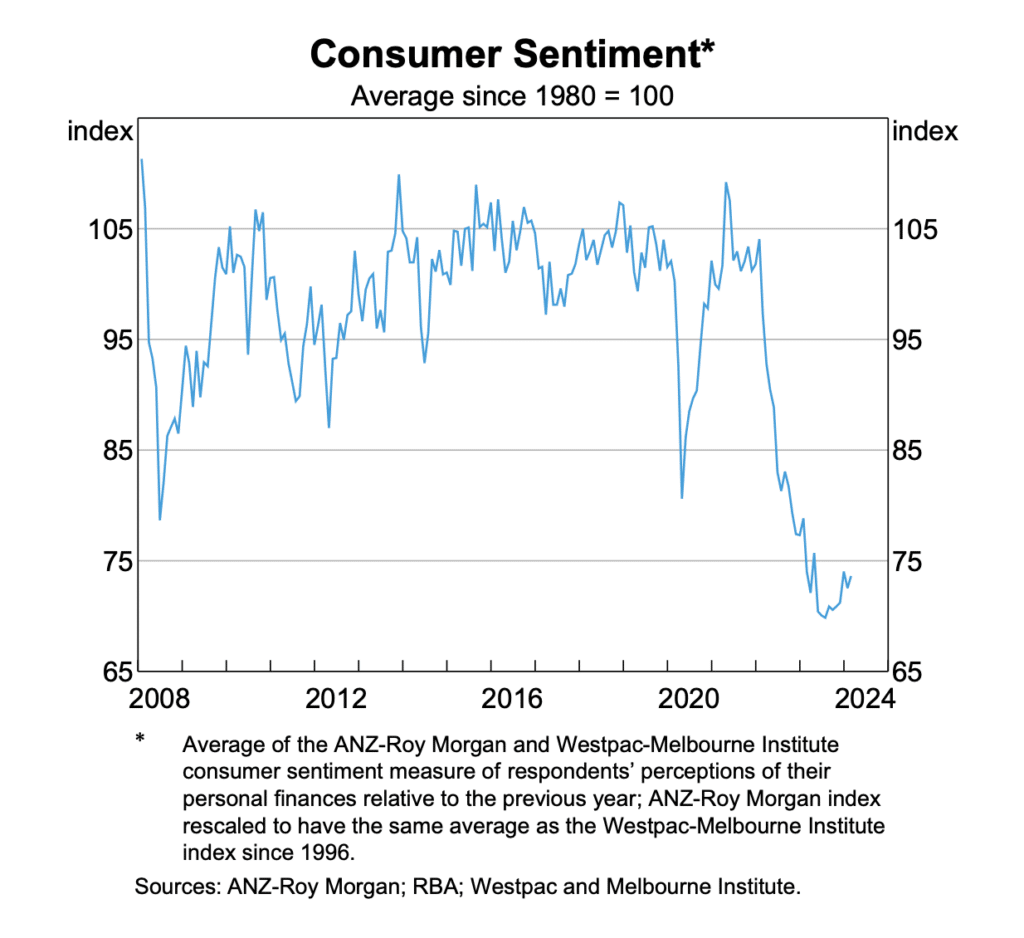

Retail spending is flat, under pressure from residual cost of living pressures and the impact of the sharp increase in rents and mortgage costs. This weakness in the economy is also being reflected in an on-going weak level of consumer sentiment, even though it has edged up from the lows in the past month. The payment of income tax cuts on 1 July 2024, a strong stock market and media speculation of interest rate cuts may have fed into the less pessimistic level of sentiment.

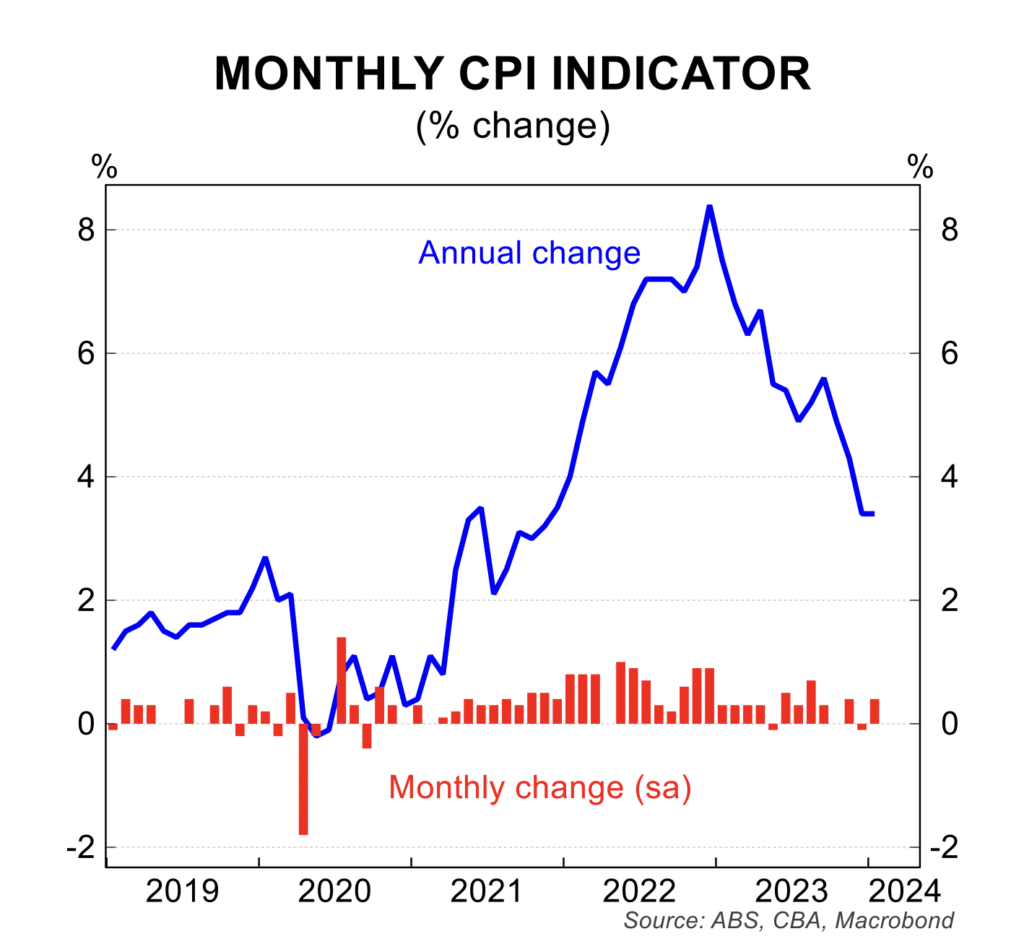

The monthly inflation rate was steady at a two year low of 3.4 per cent in the year to January 2024. This is well below the end-2022 peak of 8.4 per cent and confirmed a clear downward trend in inflation over the past year. The broad economic slowing and impact of the restrictive stance of monetary policy are driving inflation lower and this trend is expected to continue into late 2024.

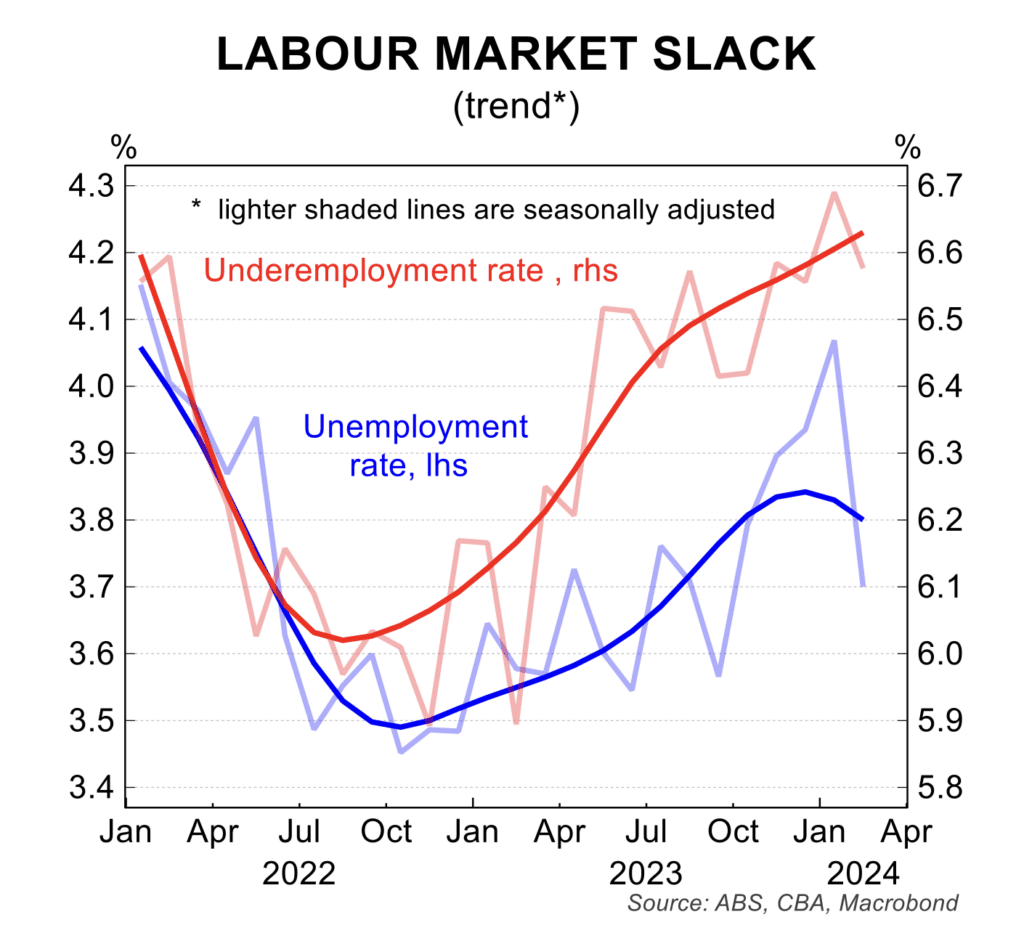

After several months of weakness, the labour market rebounded in February surprising forecasters with employment rising an unusually large 116,500 which saw the unemployment rate drop from 4.1 per cent to a six month low of 3.7 per cent. This was in the context of the prior two months showing weakness in employment and a higher unemployment rate. The ABS noted that the greater volatility in the data meant the trend data was a better guide to the strength of the labour market. Using that methodology, employment growth and hours worked are slowing and the unemployment rate is rising.

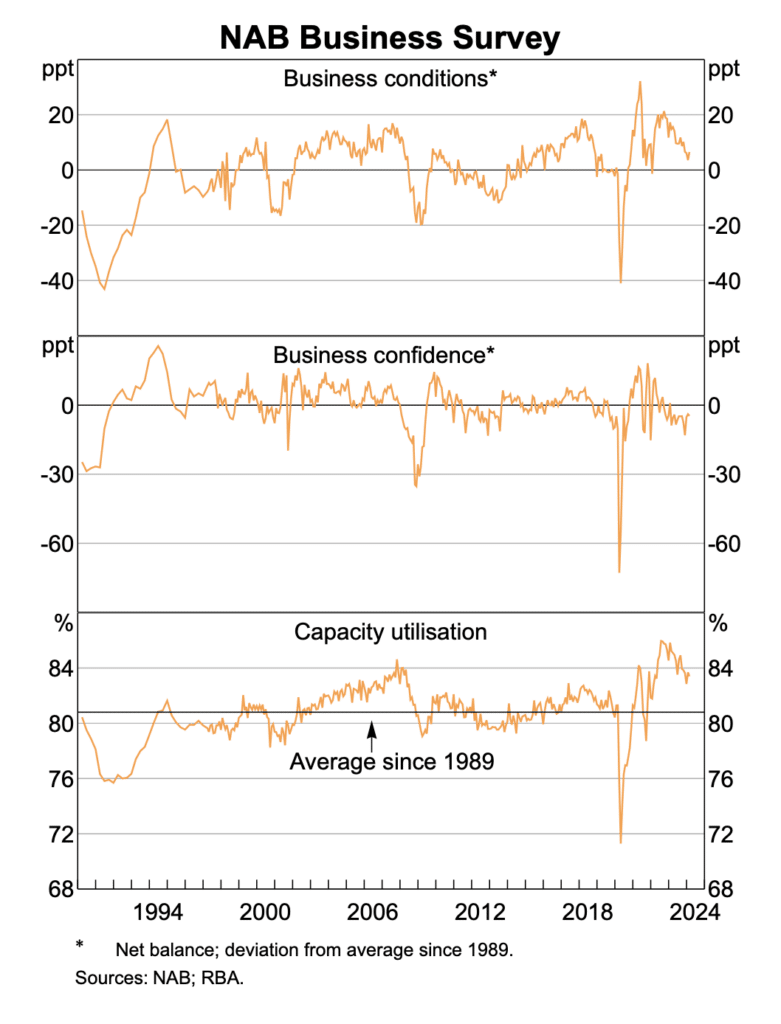

Business confidence and conditions and the sub-components in the NAB Business Survey were consistent with steady, albeit, below trend economic growth in the broad economy.

The index of business conditions remains mildly positive while business confidence has been below zero for six months. The sub-components of the survey point to a further deceleration in inflation over the second half of 2024.

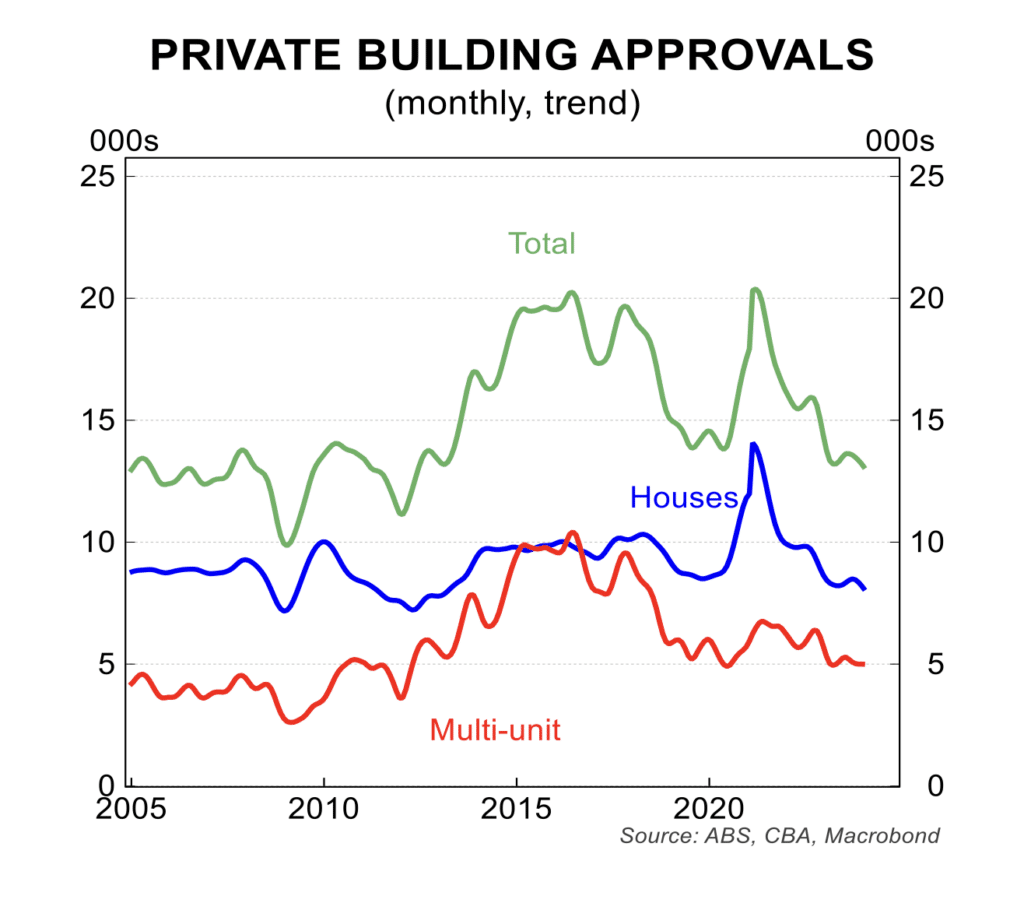

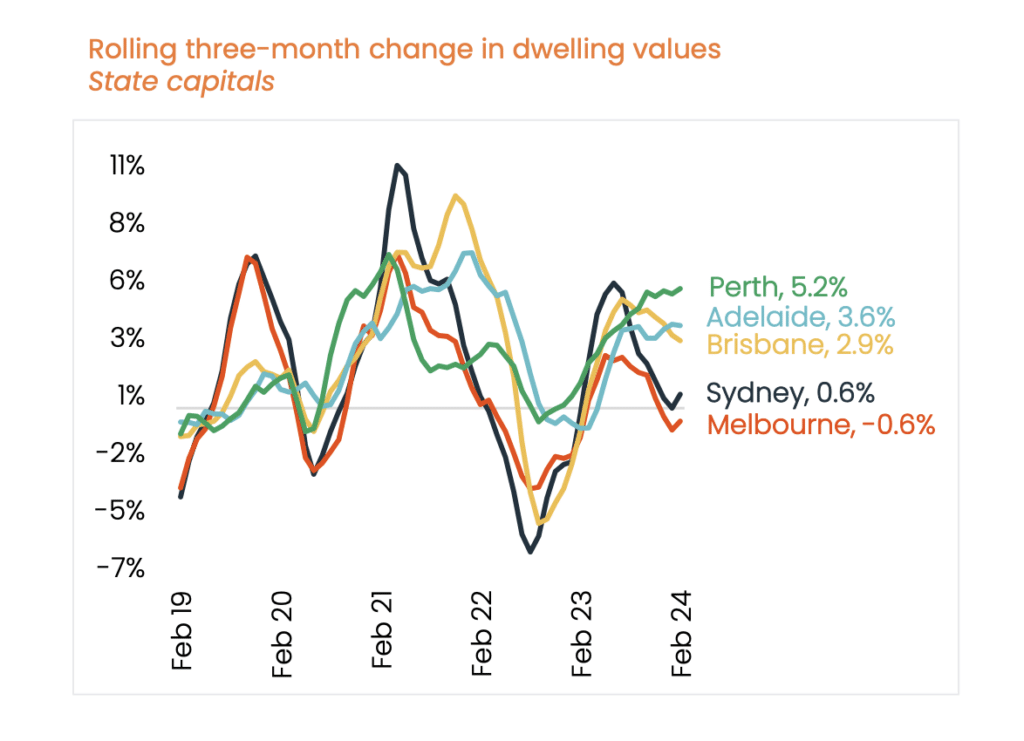

National house prices are still rising but at a slower pace than around the middle of 2023. In February, house prices rose 0.6 per cent after rising 0.4 per cent in January. Over the past 4 months, the average monthly increase has been around 0.5 per cent, well down on the monthly increases of around 1 per cent in the middle of 2023.

That said, there is an even more extreme move in prices from the strongest to the weakest capital city prices. In the three months to February, dwelling price rose 5.2 per cent in Perth, 3.6 per cent in Adelaide and 2.9 per cent in Brisbane. Over the same time, dwelling prices rose just 0.6 per cent in Sydney, 0.3 per cent in Canberra and fell 0.6 per cent in Melbourne and fell 1.4 per cent in Hobart.

In annual terms, the divergence is even more extreme:

- prices in Perth are up 18.3 per cent,

- 15.6 per cent in Brisbane,

- 11.8 per cent in Adelaide and

- 10.6 in Sydney.

In contrast, prices in annual terms are down 0.6 per cent in Hobart, 0.1 per cent in Darwin and are up just 1.6 per cent in Canberra and 4.0 per cent in Melbourne.

While there remain reason to be cautiously optimistic about the outlook for the economy later in 2024, the RBA needs confirmation that inflation is tracking towards the mid-point of its 2 to 3 per cent before moving to cut rates. This is likely to come the next quarter or two as the current sluggish growth dampens the pricing power of business and with that inflation is driven lower.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.