A cut in oil output from Saudi Arabia has sparked a surge in the oil price which has risen by around 35 per cent in the last two months. This surge in oil have filtered through to a lift in inflation in most countries, just at the time when weaker domestic economic growth and a turning point higher in the unemployment rate were driving inflation towards most central bank targets.

These events have had a significant impact on global financial markets which have reaction by pricing in a higher probability – but not a certainty – that official interest rates will need to rise further to squash any re-emerging inflation pressures while at the same time, expectations for interest rate cuts have been dramatically scaled back.

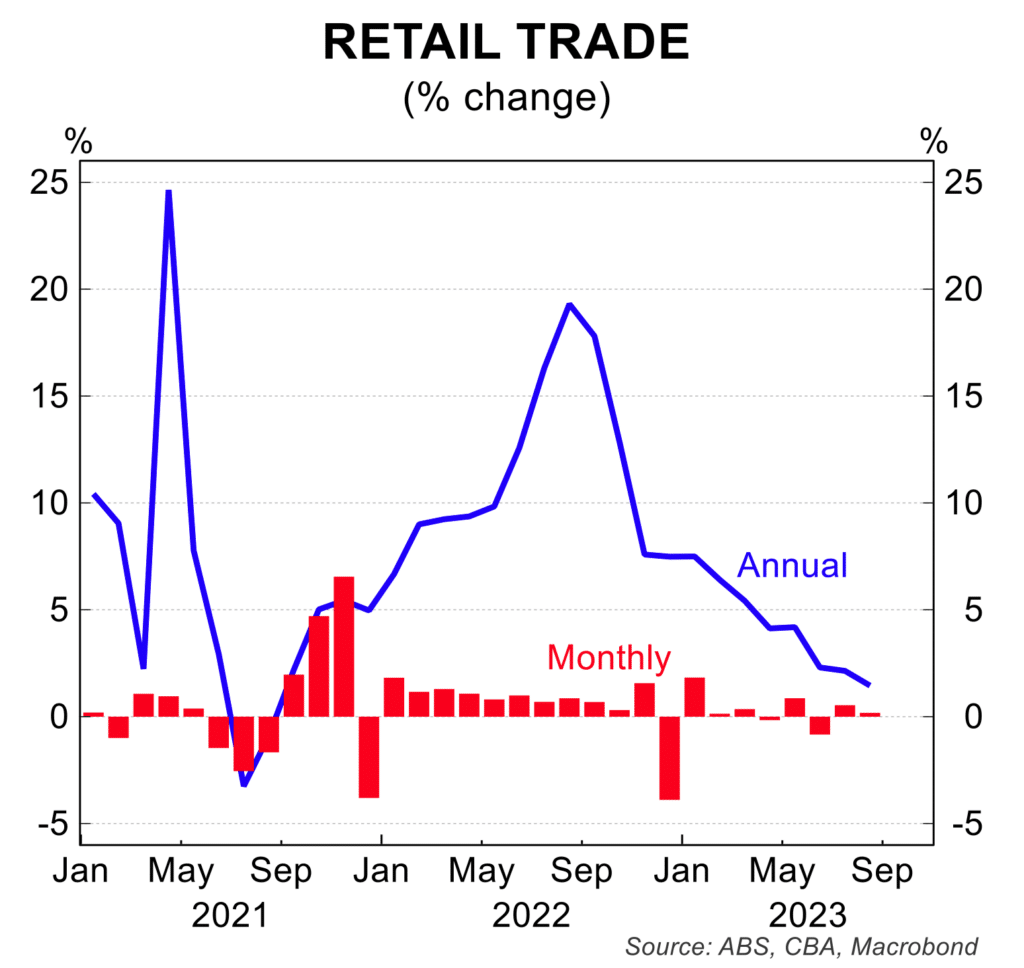

In the meantime, the hard data on the economy continues to confirm a broader slowdown, with the bulk of the weaker activity coming through household and consumer spending.

Retail sales rose by a tepid 0.2 per cent in August but remain below the level of November 2022. This despite inflation running near 5 per cent, and strong population growth adding to sales. In real per capita terms, retail sales are likely to register a fourth straight quarter of decline in retail terms in the September quarter.

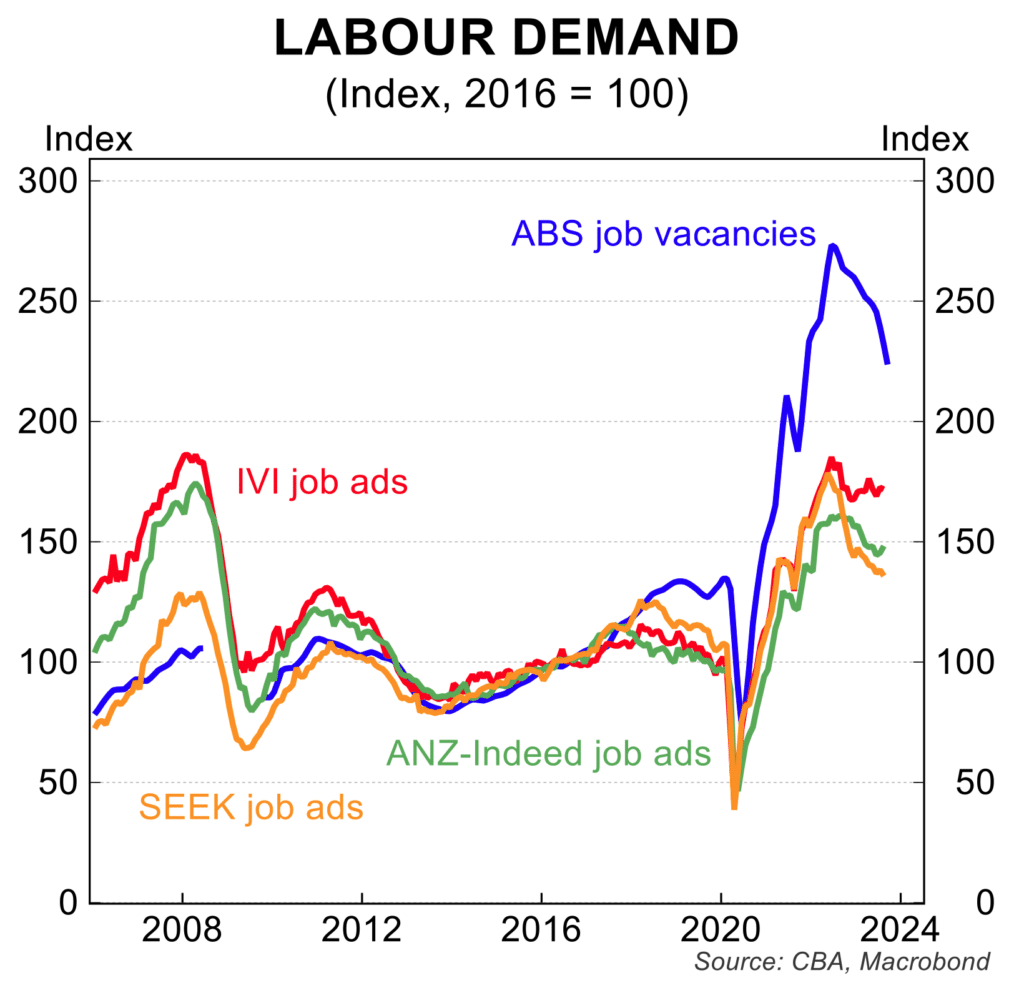

Reflecting the broader economic slowdown, the labour market is starting to weaken with the unemployment rate in August holding at 3.7 per cent, up from the cyclical low of 3.4 per cent late in 2022. The rate of job creation is only just keeping up with population growth which suggests that any further step-down in labour demand will feed into a more meaning lift in the unemployment rate.

As a sign of things to come, the number of job vacancies fell a hefty 9 per cent in the three months to August to be 18 per cent lower than the mid-2022 peak. The fall in job vacancies is consistent with RBA forecasts for the unemployment rate to rise to 4.5 per cent in 2024 and 2025.

Dwelling construction remains soft with the number of new approvals remains near a decade low. High interest rates, labour shortages and rising costs have worked to suppress new activity and the impact of the Federal Government’s plan for there to be 1.2 million new dwellings in the five year from the middle of 2024 is yet to impact. There is still uncertainty about whether this target can be met given so-called ‘red tape’ hurdles with zoning, council approvals and the financial squeeze being felt by builders and developers.

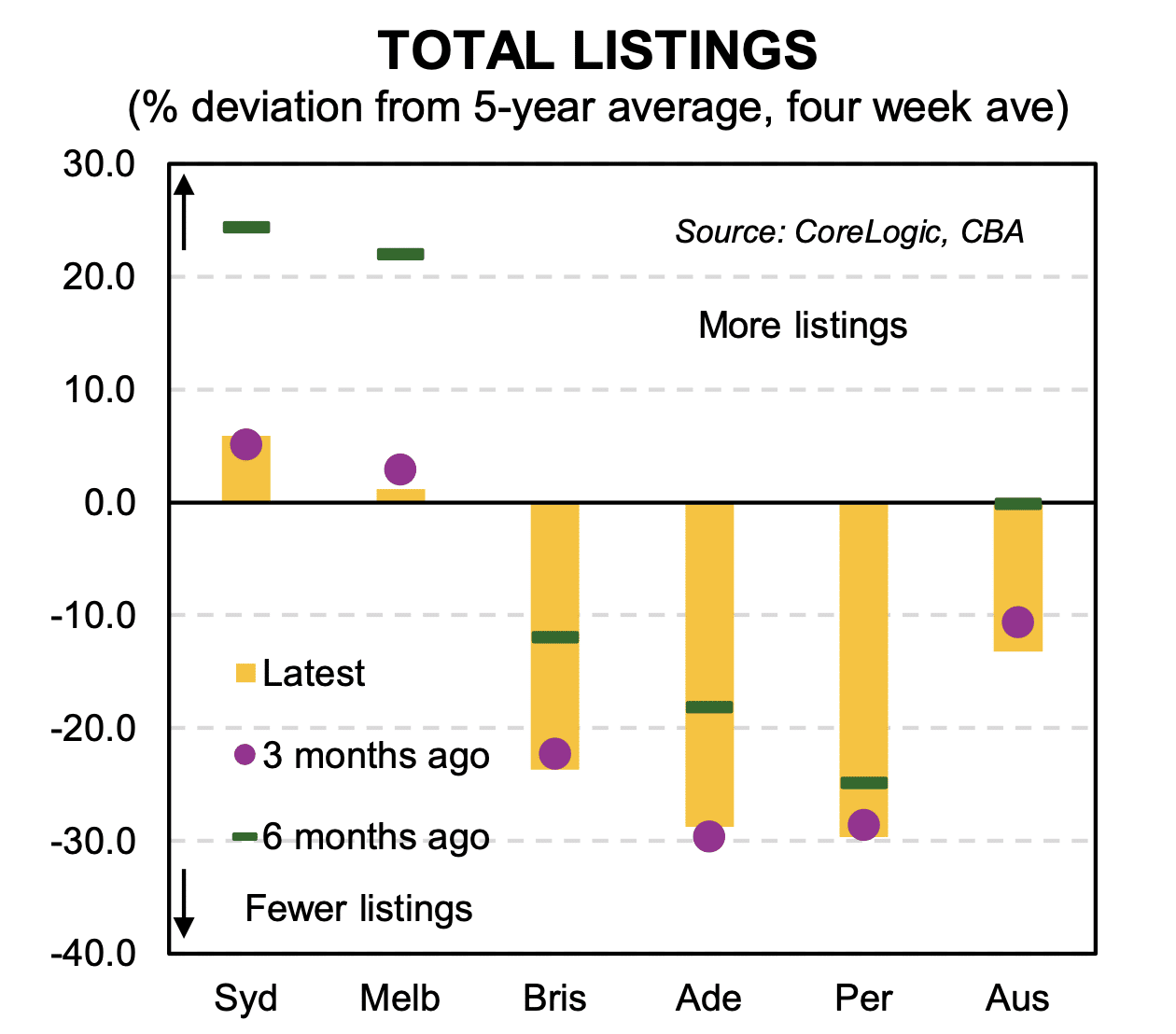

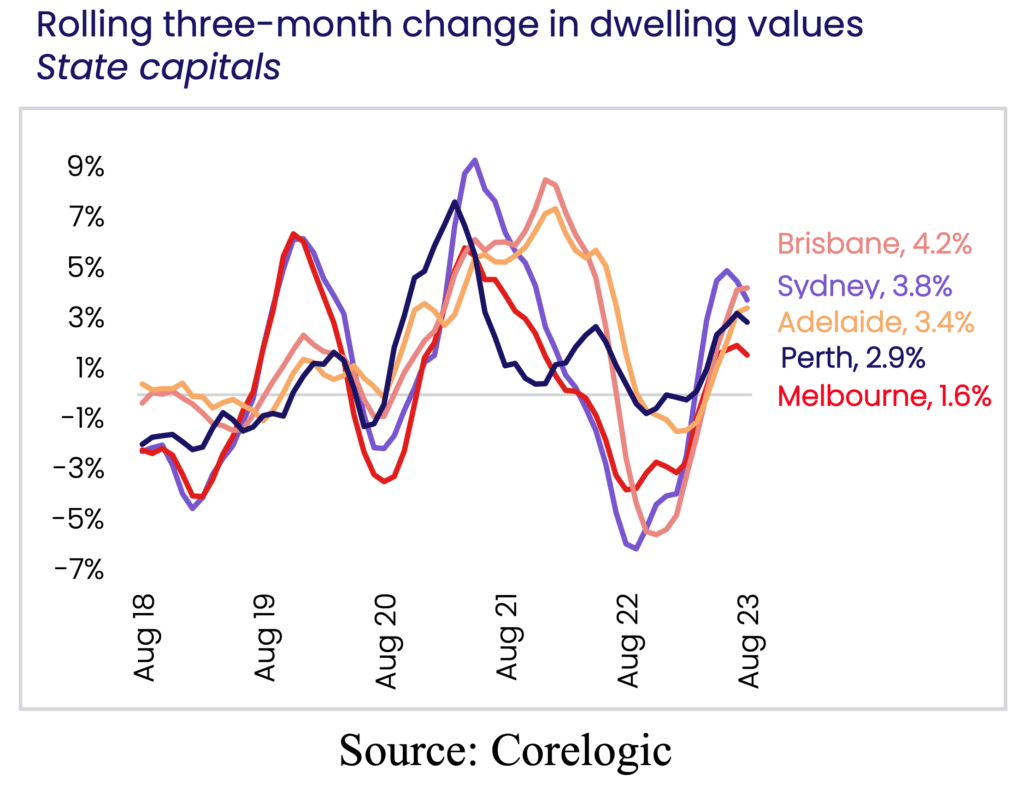

Amid the current housing shortage, house prices and dwelling rents continue to rise at a solid pace. The Corelogic data show house prices rose by 1 per cent in September, a seventh straight monthly rise. After falling 9.1 per cent from peak to trough, dwelling prices are 6 per cent higher with the largest price gains continuing to be in Sydney, Brisbane and Perth with Hobart and Canberra registering only small gains. There has been a substantial lift in new listings which may go some way to addressing the shortage of properties for sale.

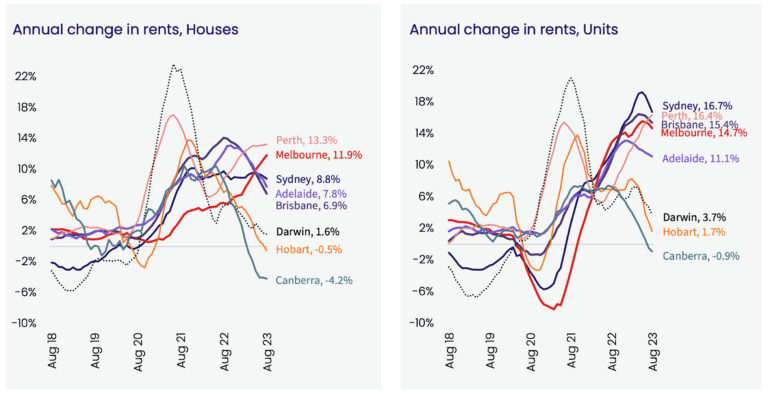

At the same time, rents are growing at a strong pace except in the three smaller capitals, Canberra, Hobart and Darwin when growth has slowed or is even negative. Like house prices, a shortage of dwellings relative to strong demand being driven by immigration inflows is the key factor pushing rents higher.

For the RBA and the interest rate outlook, the overwhelming consensus is for interest rates to remain on hold for the next few months, notwithstanding the rise in the oil price and some other commodities.

The RBA has held rates steady for three months in a row as it waits for the full effect of the rate hikes already in the system to fully impact and it remains careful not to seriously over-tighten policy at a time when the economy is clearly slowing and the outlook for the labour market is clearly weakening.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.