Inflation is falling, the unemployment rate is continuing to edge higher while the economy remains weak.

These dynamics have seen markets move to expect a series of interest rate cuts from the Reserve Bank, starting around the middle of 2024. The RBA, conversely, is arguing against any near term interest rate reductions, saying that it needs to be convinced that inflation is entrenched at the mid-point of the 2 to 3 per cent target band before it will consider a cut.

As is always the case, the economic news will decide which way it goes.

In terms of the hard data, retail trade slumped 2.7 per cent in December, after a 1.6 per cent rise, boosted by Black Friday sales, in November. Consumer spending remains weak, having fallen by approximately 6 per cent in real per capita terms since the peak in late 2022. Consumers continue to be impacted by cost of living pressures, rising interest rates and the start of the weakening in labour market conditions.

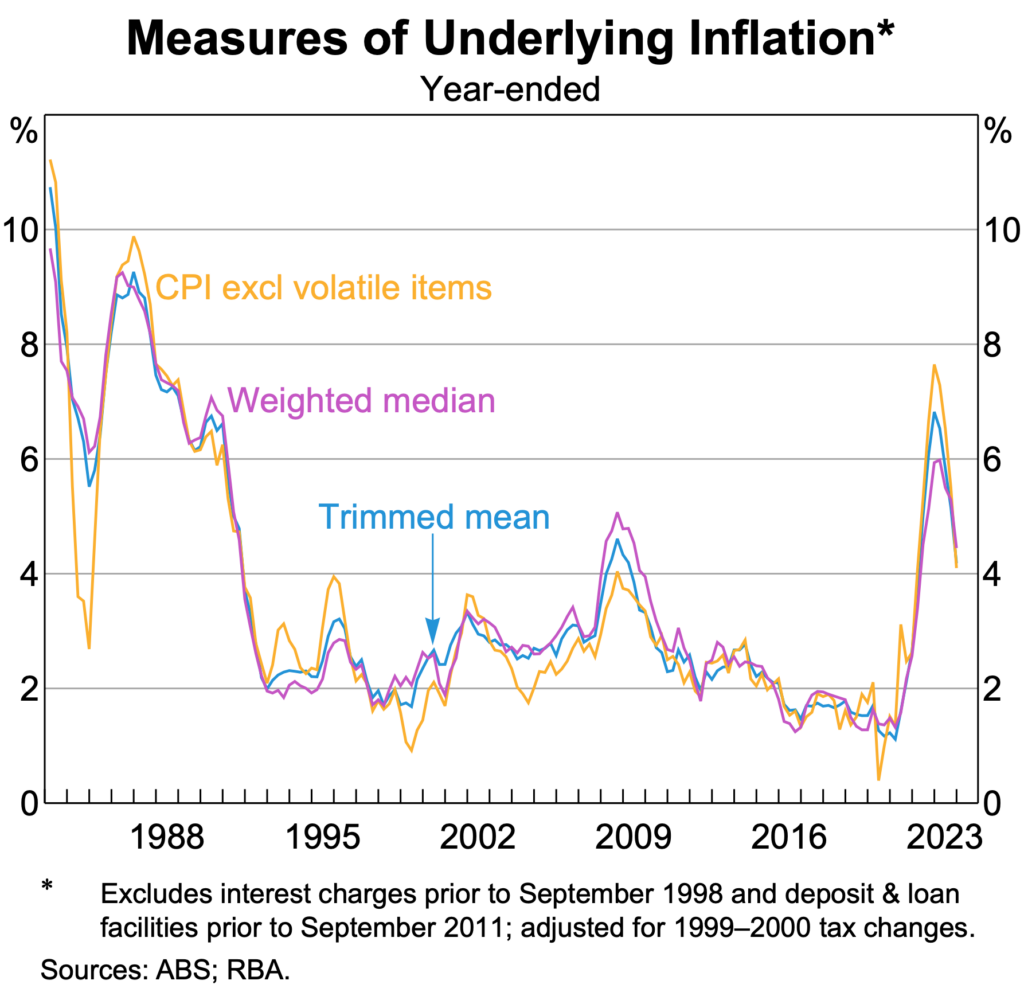

Inflation rose by 0.6 per cent in the December quarter 2023, the smallest quarterly increase in almost three years. The annual inflation rate eased to 4.1 per cent, a sharp deceleration from the peak of 7.8 per cent at the end of 2023. The latest data was around 0.5 percentage points below the RBA’s forecast, which helped to lock in market expectations for lower interest rates in the not too distant future.

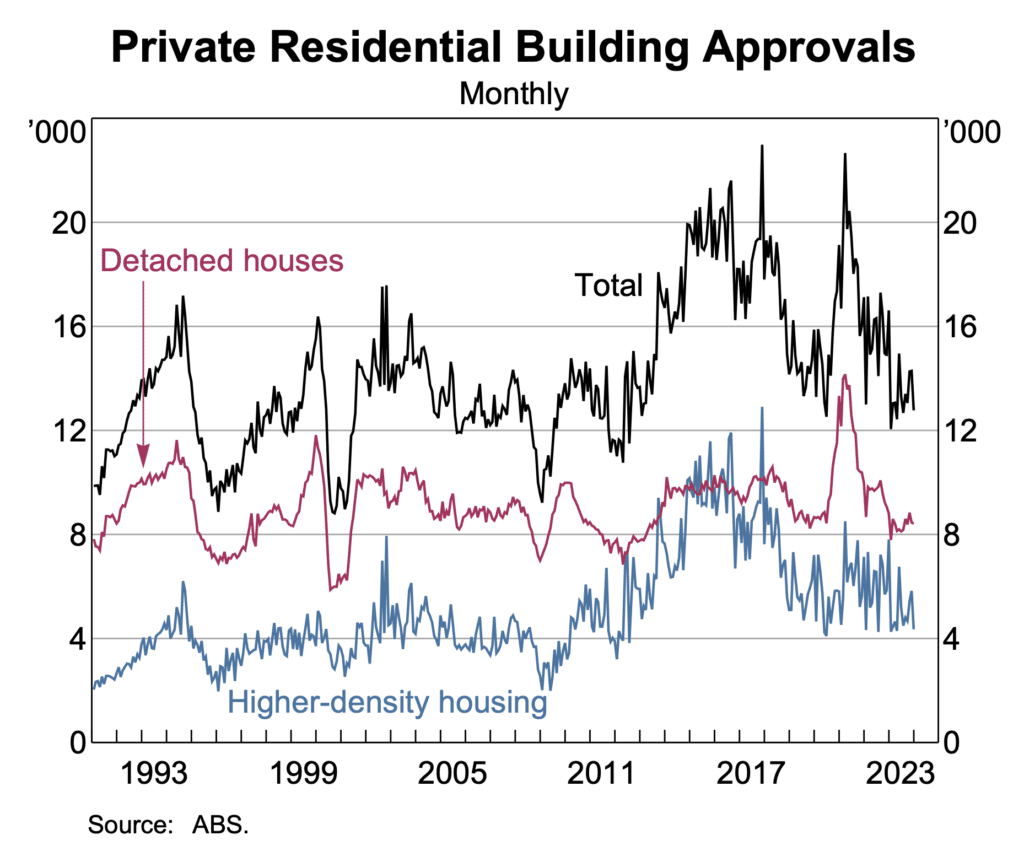

The number of new building approvals fell 9.5 per cent in December, partly reversing the gentle uptrend evident since the first half of 2023.

The current monthly level of building approvals remains around 13,000 to 14,000. For the government’s target of 1.2 million new dwellings to be built in the next five years, monthly approvals need to average 20,000 for five consecutive years.

This level has rarely been reached even temporarily, in the past.

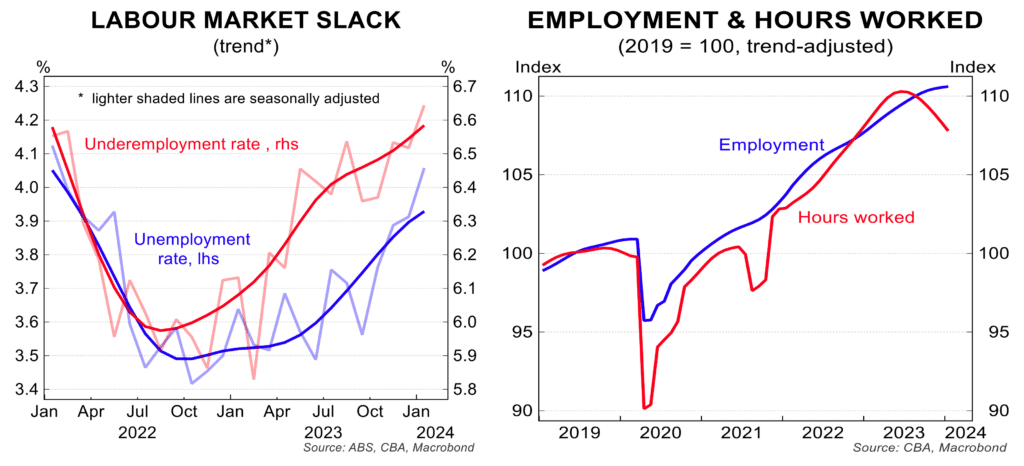

The labour market continues to weaken.

Employment was flat in January after falling a sharp 62,000 in December as employers reacted to weaker economic conditions by scaling back demand for labour. Of some concern was the fall in hours worked in the economy and the ongoing decline in job vacancies. At the same time, the unemployment rate jumped to 4.1 per cent to be on a clear upward trend and well above the 3.4 per cent cyclical low registered in 2022. The bottom line is that the labour market is weakening as the economy slows.

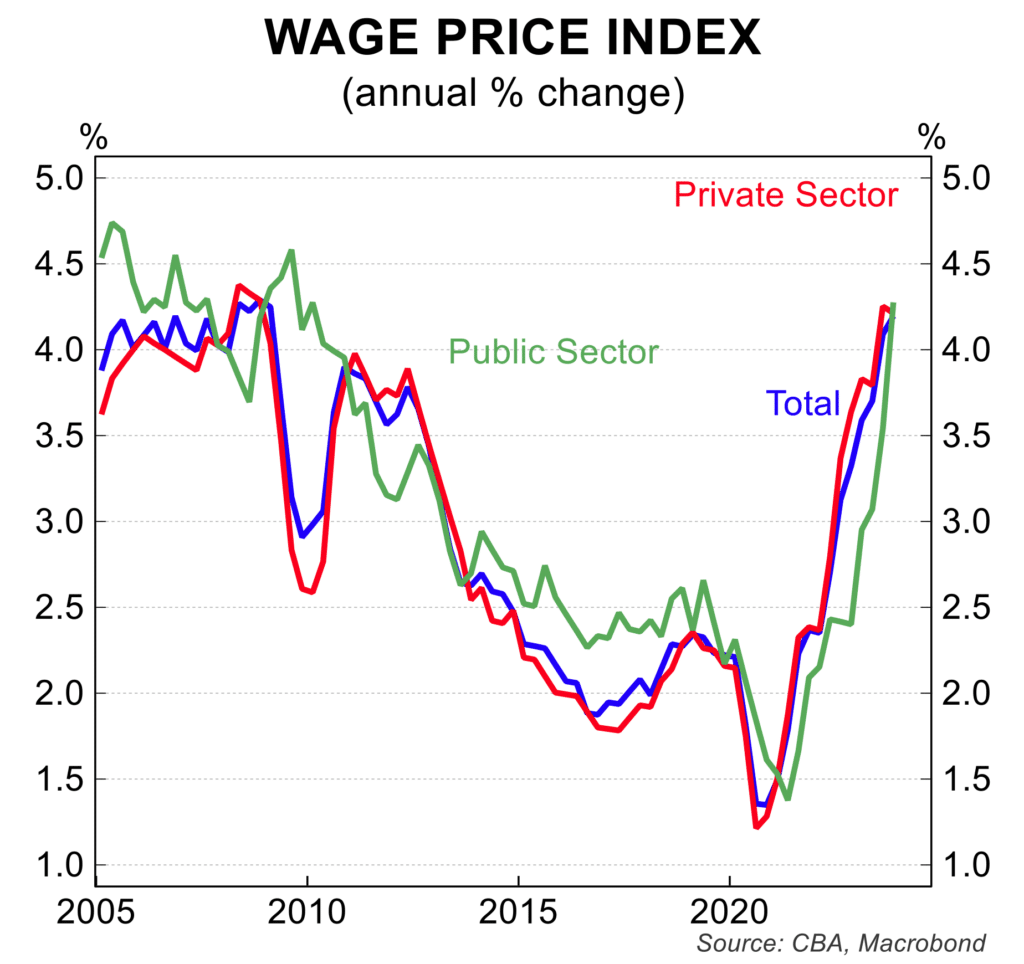

Wages growth remains solid, up 0.9 per cent in the December quarter and 4.2 per cent in annual terms.

The annual figure includes the one-off 5.75 per cent increase in the minimum wage and select awards from 1 July 2023. Given this sort of increase is unlikely to be repeated in 2024 and the labour market is slowing, wages growth is likely to hover around 3.75 to 4 per cent over the remainder of 2024 before easing in 2025.

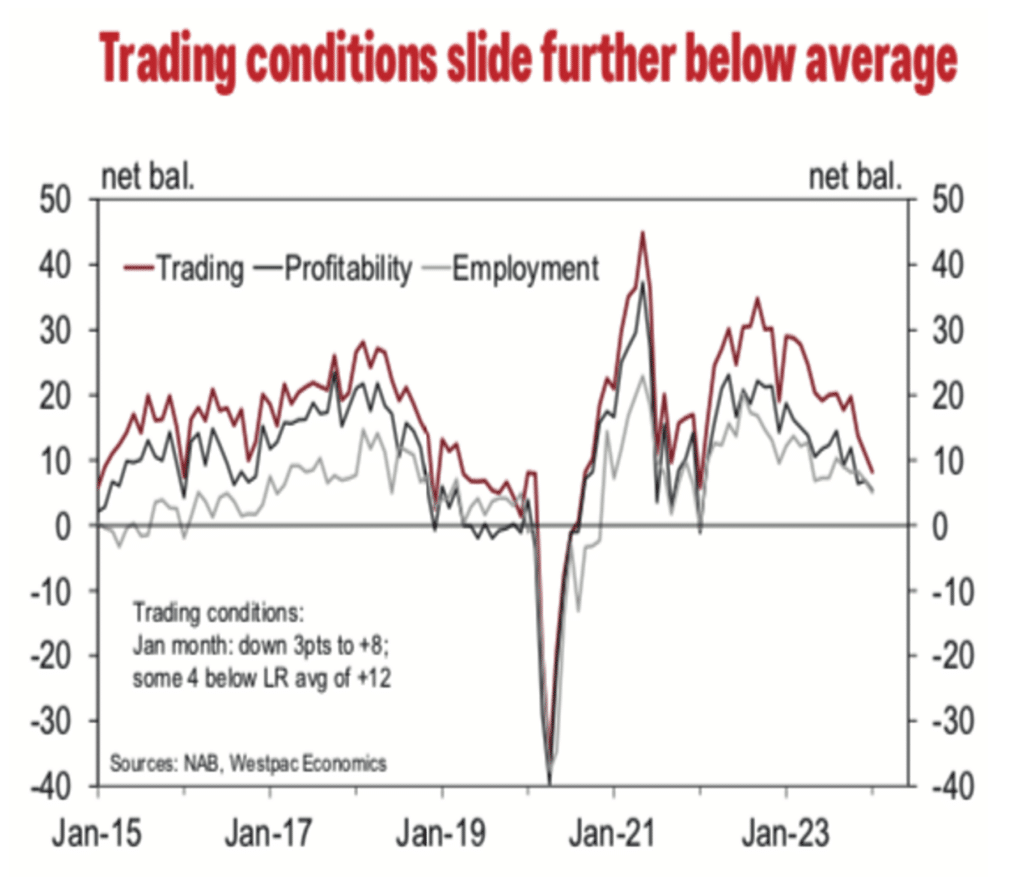

Business confidence and conditions and the sub-components in the survey are trending lower, reflecting the broader slowing in the economy. Business expectations for trading, profitability and employment has all weakened over the past year to be at or below the level prevailing prior to the pandemic.

If these trends continue, the weaker economy, rising unemployment and falling inflation will continue in coming months.

Interest rate cuts continue to be expected by market participants with little change in the past month. A total of 50 basis point cuts are expected for the second half of 2024 with further easing priced in for 2025.

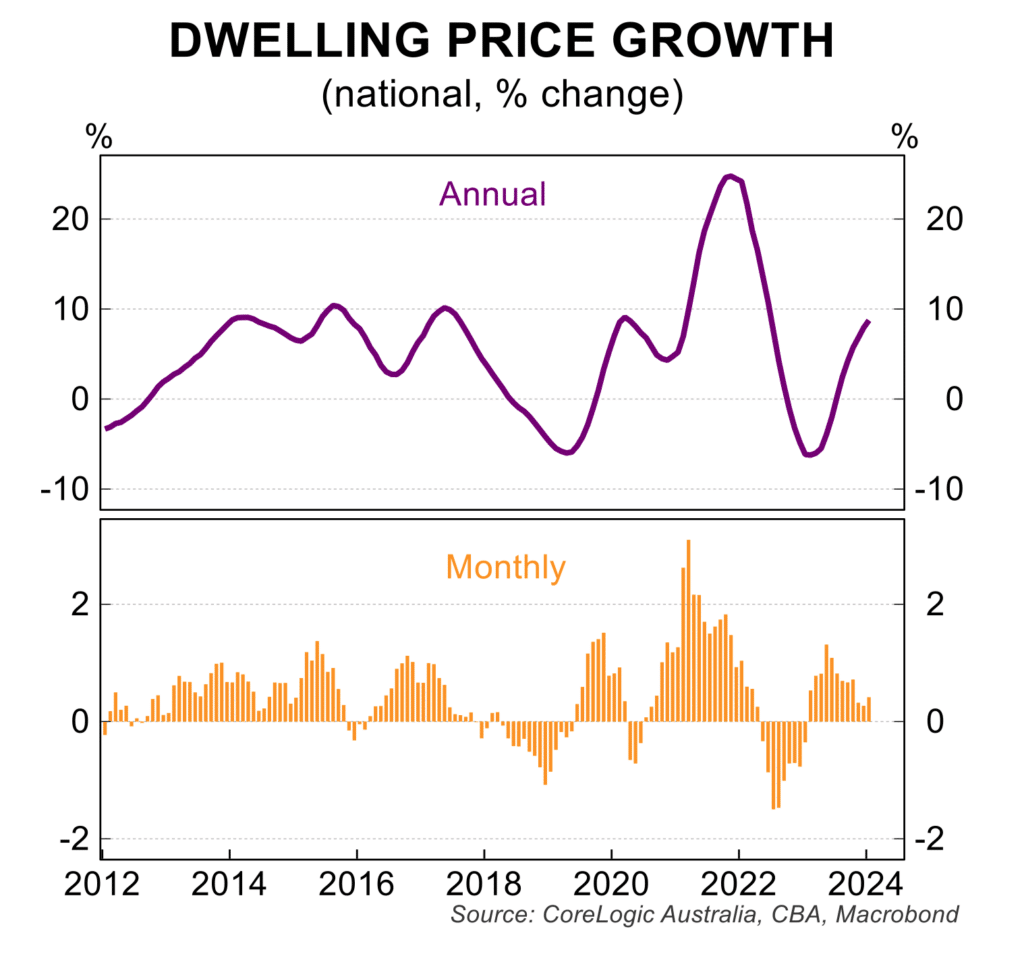

House price growth remains very varied from city-to-city although it is clear nationwide price pressures are slowing.

At a national level, house prices have risen 0.3 per cent, 0.3 per cent and 0.4 per cent over the past three months, which is below the average monthly increases of around 1 per cent in the middle of 2023.

Over the past three months, house prices fell 1.5 per cent in Hobart and 0.9 per cent in Melbourne while prices were broadly flat in Sydney and Canberra. The other major cities registered on-going strength with Perth prices up 4.9 per cent, Brisbane 3.7 per cent and Adelaide 3.2 per cent.

The overall slowing in house price growth is linked to key fundamentals:

- 425 basis points of interest rate hikes between May 2022 and November 2023;

- headwinds from the weaker labour market;

- the sugar-hit of the record immigration intake in 2022-23 is slowing and

- an uptick in new listings is adding to new supply.

There are reasons to expect a better second half of 2024 for the economy: Income tax cuts will take effect from 1 July 2024, the prospect for interest rate cuts, rising real wages and a positive wealth effect for households from housing and the strength in the stock market.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.