The past month saw important economic policy decisions with the RBA meeting and the Federal Budget. Both were broadly neutral for the economy, acknowledging slower growth, progress to lower inflation and problems that may emerge with higher unemployment.

The RBA left interest rates steady

The RBA left interest rates steady at its May meeting, with the cash rate at 4.35 per cent. While expressing frustration about the time it is taking for inflation to return to the 2 to 3 per cent target, RBA Governor Bullock maintained a ‘neutral bias’ in terms of the direction in the next move in interest rates – no particular scenario was ‘ruled in or out’.

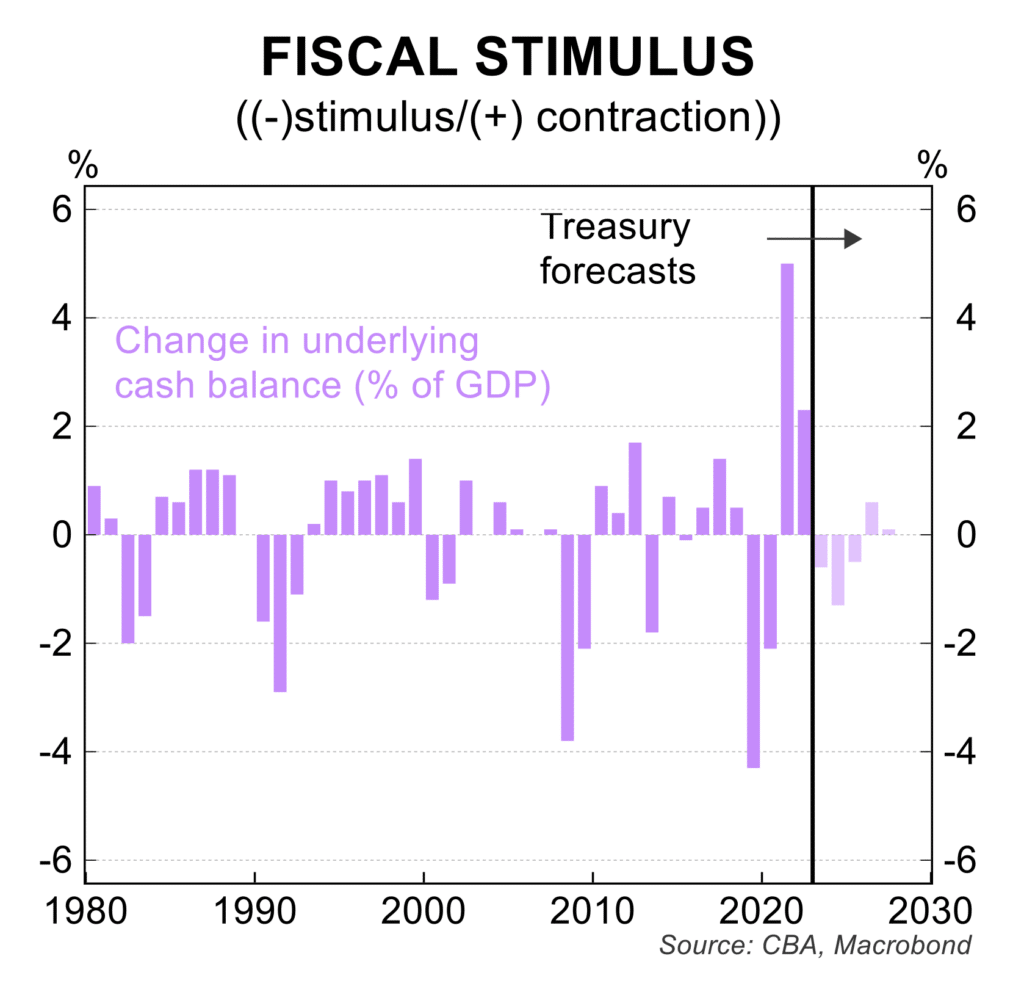

Treasurer Chalmers delivered the government’s budget, forecasting a return to a deficit in FY2024-25 after recording two budget surpluses in the prior two years. There were a range of policy changes, including income tax cuts, subsidies for electricity and dwelling rent. The overall effect will add marginally to the rate of economic growth which is occurring when the outlook for economic growth and unemployment are problematic.

Inflation continues to fall

Inflation continues to fall, easing to 3.6 per cent in the year to the March quarter 2024, which is down from the peak of 7.8 per cent in the December quarter 2022 and 4.1 per cent in December 2023. The quarterly 1.0 per cent increase was a little above market expectations. The policy measures in the Budget on electricity and rent subsidies are estimated to cut headline inflation by 0.75 percentage points in the next year. This saw Treasury produce a forecast for inflation to return to the 2 to 3 per cent target by the end of 2024.

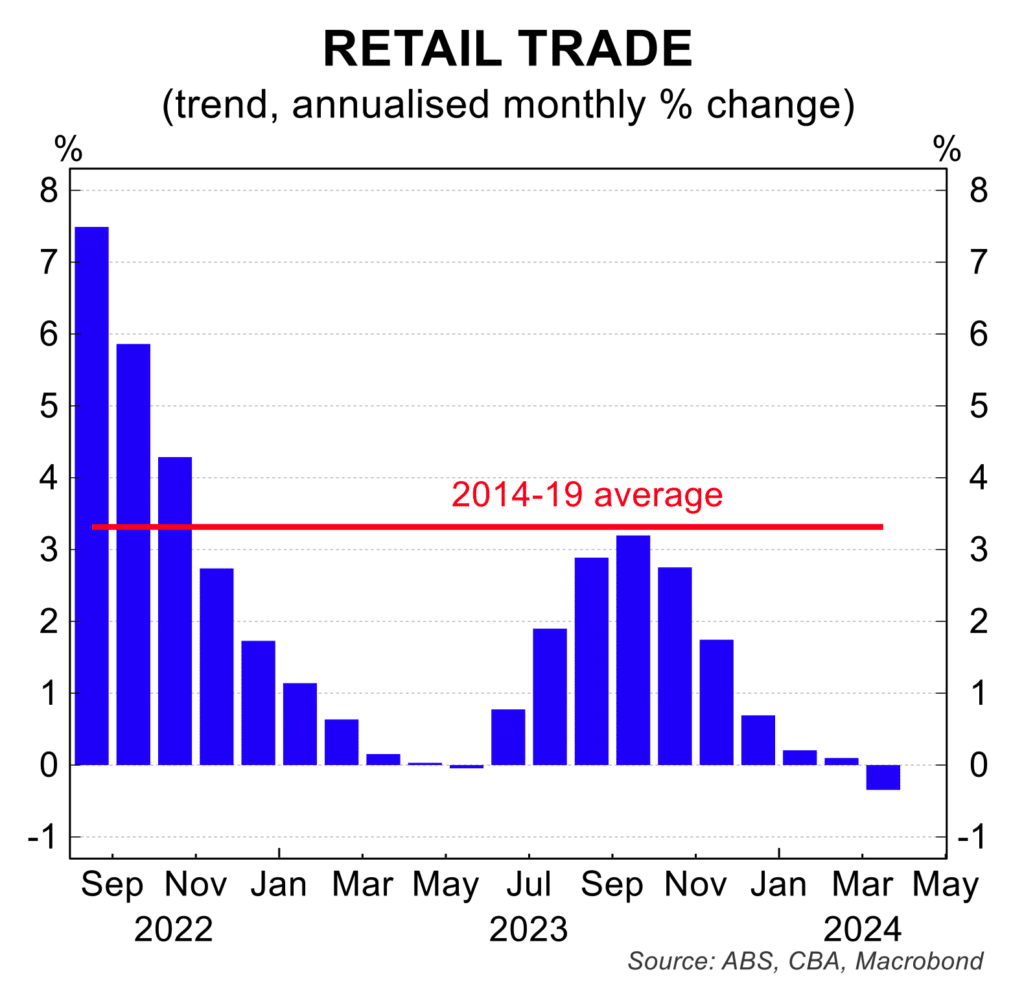

The poor news on the household sector continued

Retail sales fell 0.4 per cent in March to register annual growth of just 0.8 per cent. In real terms, retail sales also fell 0.4 per cent in the March quarter to register 5 falls in the last 6 quarters. Consumer sentiment remains very weak.

The unemployment rate jumped

The unemployment rate jumped to 4.1 per cent in April, having risen from what was a cyclical low of 3.5 per cent a year ago. With job ads and vacancies continuing to fall, further increases in the unemployment rate are expected by both Treasury and the RBA over the next year. Trends in unemployment will be an important issue for the RBA when it comes to the outlook for official interest rates.

There was further problematic news regarding the much needed lift in housing supply with only a tepid rise in number of building approvals in March, albeit from a low base. In annual terms, dwelling building approvals remain near an 11 year low and on current trends, are well below the Government target for the construction of 1.2 million new dwellings over the next five years.

Business confidence and conditions were broadly stable in April at a level well below their mid-2023 peak. The slower domestic economy is impacting business trading, profitability and hiring plans.

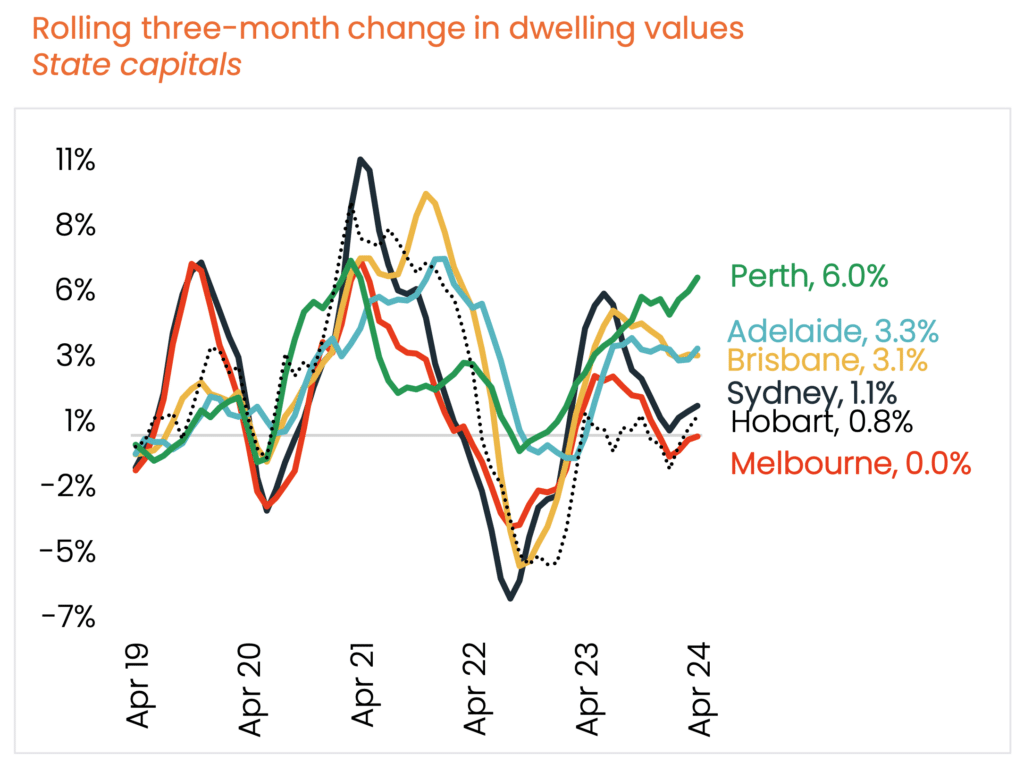

House price growth remains moderate

Nationwide prices rose 0.6 per cent in April to be 8.7 per cent higher than a year earlier. While the rate of house price growth has moderated at a nationwide level since the middle of 2023, it masks a wide divergence in price trends from city to city and in regional areas.

In the last three months, house prices rose a very strong 6.0 per cent in Perth, 3.3 per cent in Adelaide and 3.1 per cent in Brisbane. Over the same time, dwelling prices rose just 1.1 per cent in Sydney, 1.0 per cent in Canberra and Darwin, 0.8 per cent in Hobart and were unchanged in Melbourne.

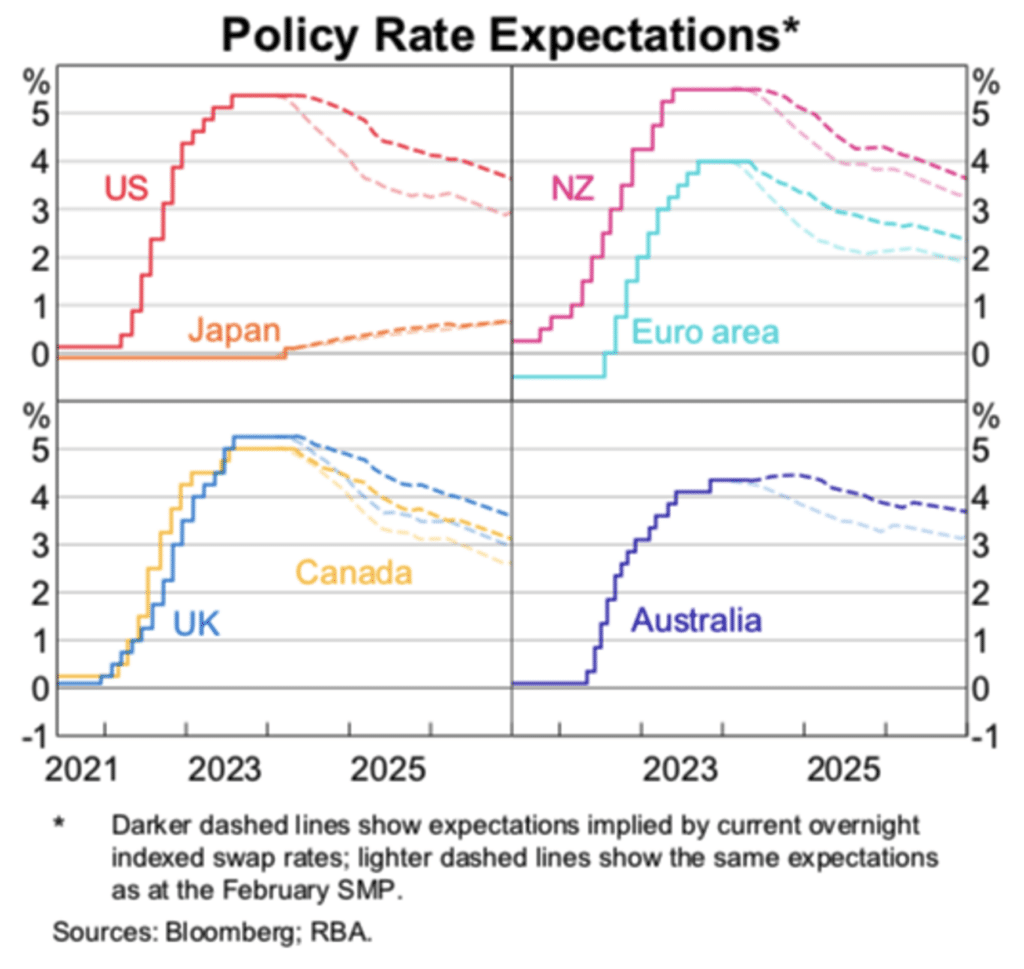

Market pricing for interest rates has returned to cuts after a brief run which priced in a chance of higher rates.

Markets are volatile

Weak economic conditions and falling inflation has rekindled expectations of interest rates cuts in Australia and much of the industrialised world in coming months. It is noteworthy that rates cuts have recently been delivered in Sweden, Switzerland and Brazil.

In Australia, one 25 basis point cut is priced in by the end of 2024 or early 2025 with a further 25 basis point cut priced in for later in 2025. The next readings on inflation and unemployment will be critical in the timing of those cuts.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.