Why do private lending and non-bank lending exist?

Why is there a market for private lending and non-bank lending in Australia? Who is it for and what are the risks of private and non-bank lending?

Why is there a market for private lending and non-bank lending in Australia? Who is it for and what are the risks of private and non-bank lending?

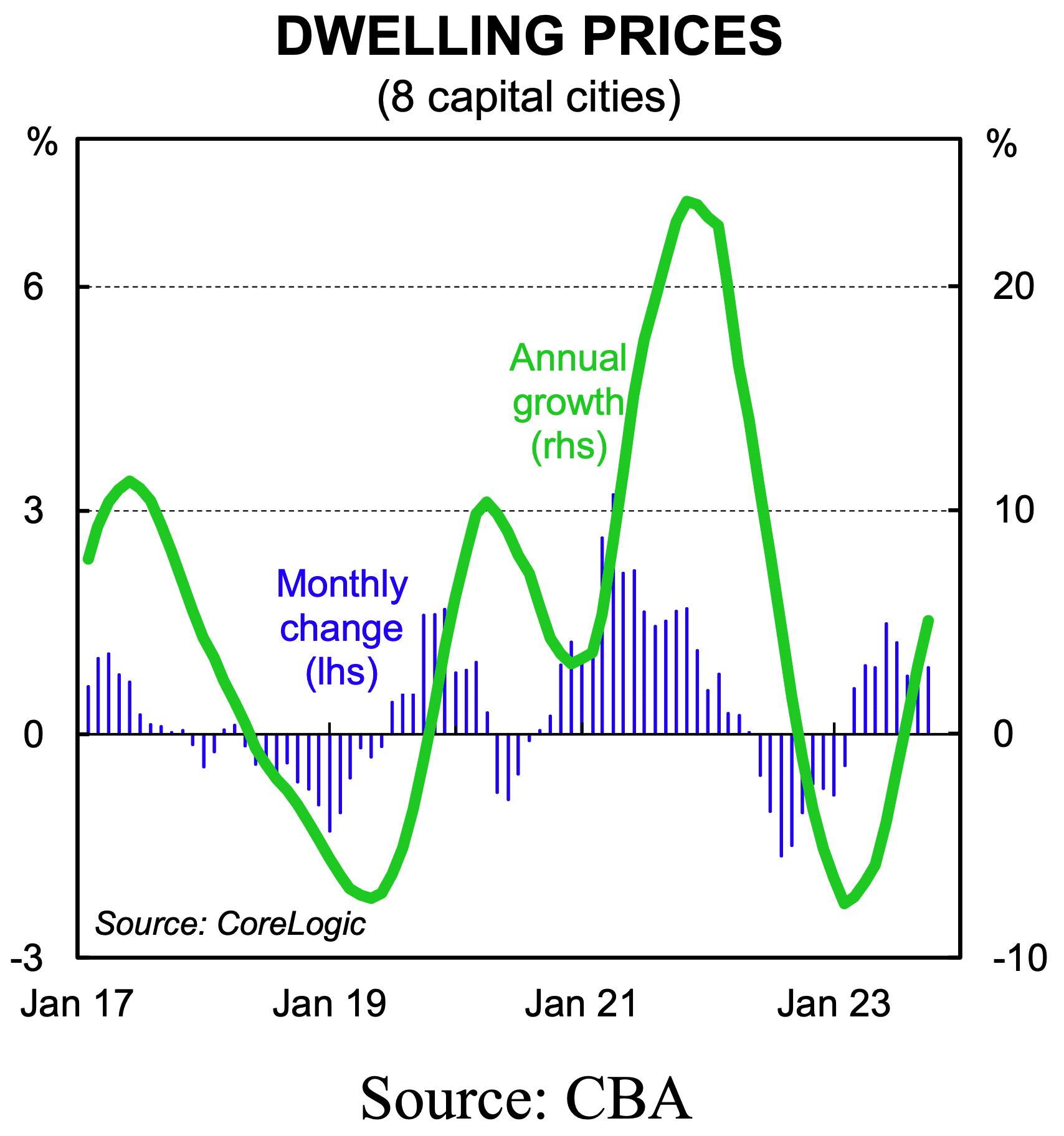

House prices continue to rise at a solid pace with the strong demand / weak supply dynamics still at play… but the largest cities continue to register large price increases. Since the low point early in 2023, house prices have risen 8 per cent to be at a new record high. Importantly, auction clearance rates have turned down from the mid 2023 peak, while at the same time new listings of properties for sale are rising as sellers take advantage of what are positive issues for them to list their property.

In the second part of this series ‘Demystifying Private Debt: Separating Fact from Fiction”, we aim to debunk common myths and provide clarity, drawing from our team’s combined experience in credit, property, private debt and investment management.

Following a spate of builders collapsing, it’s crucial for investors to seek experienced CRED investment managers to protect and grow their capital.

A guide to income investing: Understanding different investment options that generate passive income.

One of the key issues for the Australian economy in 2023 has been the strength in house prices… The end point… is that house prices are set to rise by 10 per cent in 2023, not fall 20 per cent, as the demand and supply dynamics underpin prices across all capital cities and in many regional areas. From an economic perspective, this is good news.

These events have had a significant impact on global financial markets which have reaction by pricing in a higher probability – but not a certainty – that official interest rates will need to rise further to squash any re-emerging inflation pressures while at the same time, expectations for interest rate cuts have been dramatically scaled back.

In this series ‘Demystifying Private Debt: Separating Fact from Fiction”, we aim to debunk common myths and provide clarity, drawing from our team’s combined experience in credit, property, private debt and investment management.

The Capital Stack: A comprehensive guide for all Real Estate Investors. The importance of understanding both sides of the real estate coin.

As we look to build on the foundations established since 2017 and to grow our business, we remain committed, not only to sourcing top quality alternative investment options from our accredited borrower clients and trusted introducers, but also to innovate and diversify the manner in which these can be structured and delivered to best effect and to meet the expanding requirements of our broad investor base.

We would like to acknowledge the Traditional Custodians of the lands, seas, and communities in which we provide our services. We would also like to pay our respects to the Elders past, present and emerging, and the continuing cultural influence they have on Australia.

Zagga Market Pty Limited (Australian Credit Licence 490904) ACN 611 662 401 acts as the Servicer of loans acting on behalf of the credit provider, Zagga Investments Pty Limited (AFSL 492354) ACN 615 154 786, trustee of the Zagga Investments Lending Trust

All portfolio numbers quoted correct as at 31 December 2025.

*Average investor return across the active portfolio as at 31 December 2025.

**Target return is after expenses and any applicable management fees for the year ended 30 June 2026. OCR = Australian Reserve Bank Official Cash Rate.

Past performance is not a reliable indicator of future performance, and should not be taken as an indication or guarantee of future results. Investments involve risk, fees and costs, and returns are not guaranteed. No representation or warranty is made regarding future performance, and economic conditions may change.

Prospective investors wishing to invest in a Zagga direct investment or a Zagga Fund should fully consider the Information Memorandum, ZFF Fact Sheet and/or ZWF Brochure, available from Zagga, before applying to invest. Investments are subject to risks.

Articles (including white papers and audio or video content) and FAQs on this website have been prepared by Zagga Investments Pty Limited (AFSL 492354) ACN 615 154 786 (Zagga) for general information only. They do not take into account your objectives, financial situation or needs, and are not a substitute for accounting, tax or other professional advice. Nothing in these articles or FAQs is an offer or solicitation to buy or sell a financial product, nor a recommendation to enter into or refrain from any transaction.

Any analysis provided in the articles (including white papers and audio or video content) or FAQs on this website is based on information believed to be reliable, however Zagga does not represent or warrant that it is accurate, complete or up to date. Zagga is not obliged to update the information or opinions contained in any article it. Opinions are those of the author and may change without notice. Readers should exercise their own judgment when relying on information contained in the articles or FAQs. To the maximum extent permitted by law, no member of Zagga accepts liability for any loss arising from the use of such information.

Media coverage featured reflects the independent opinions of the authors and does not necessarily represent the official views of Zagga.