Slower growth confirmed as the housing shortage intensifies

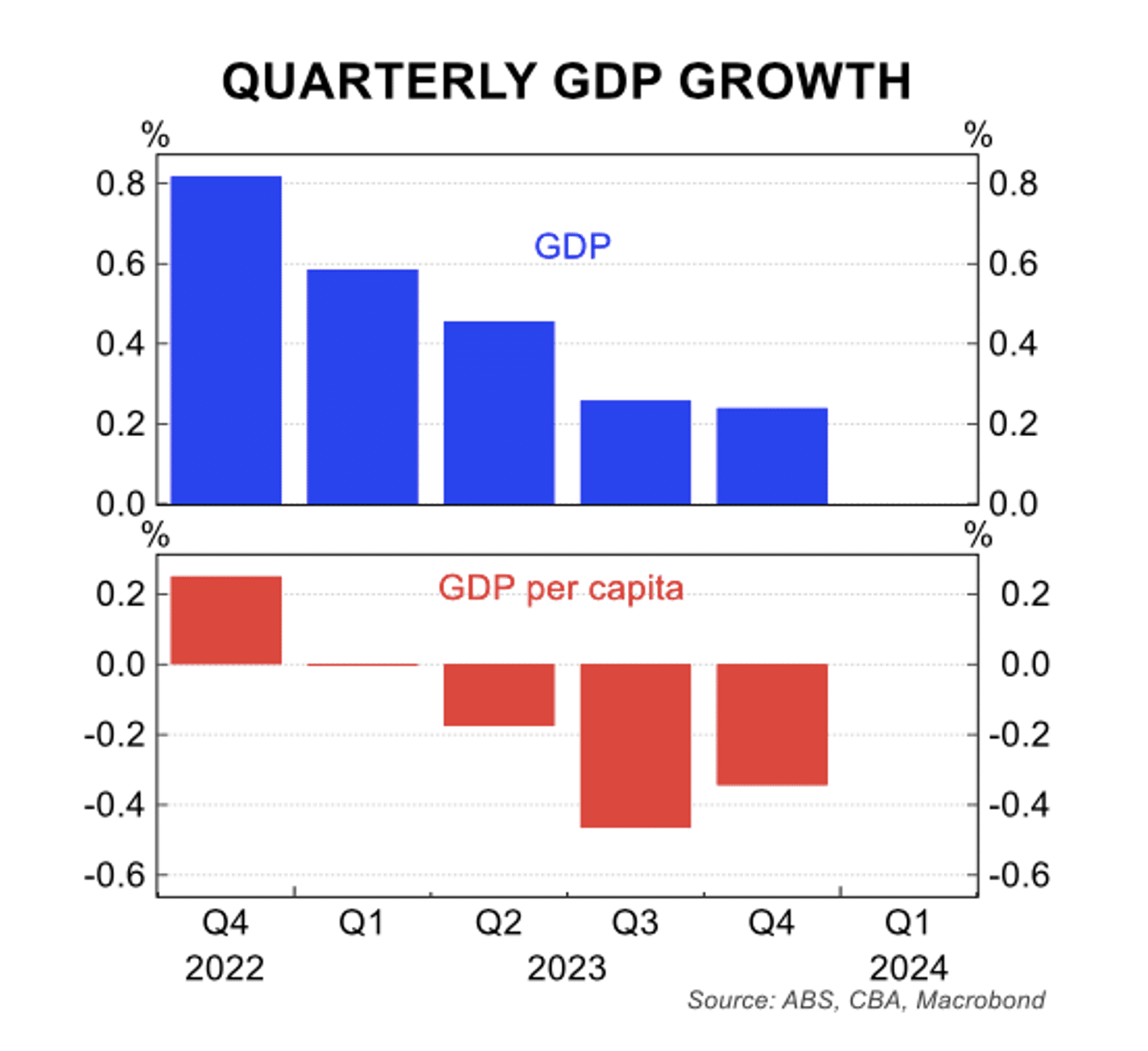

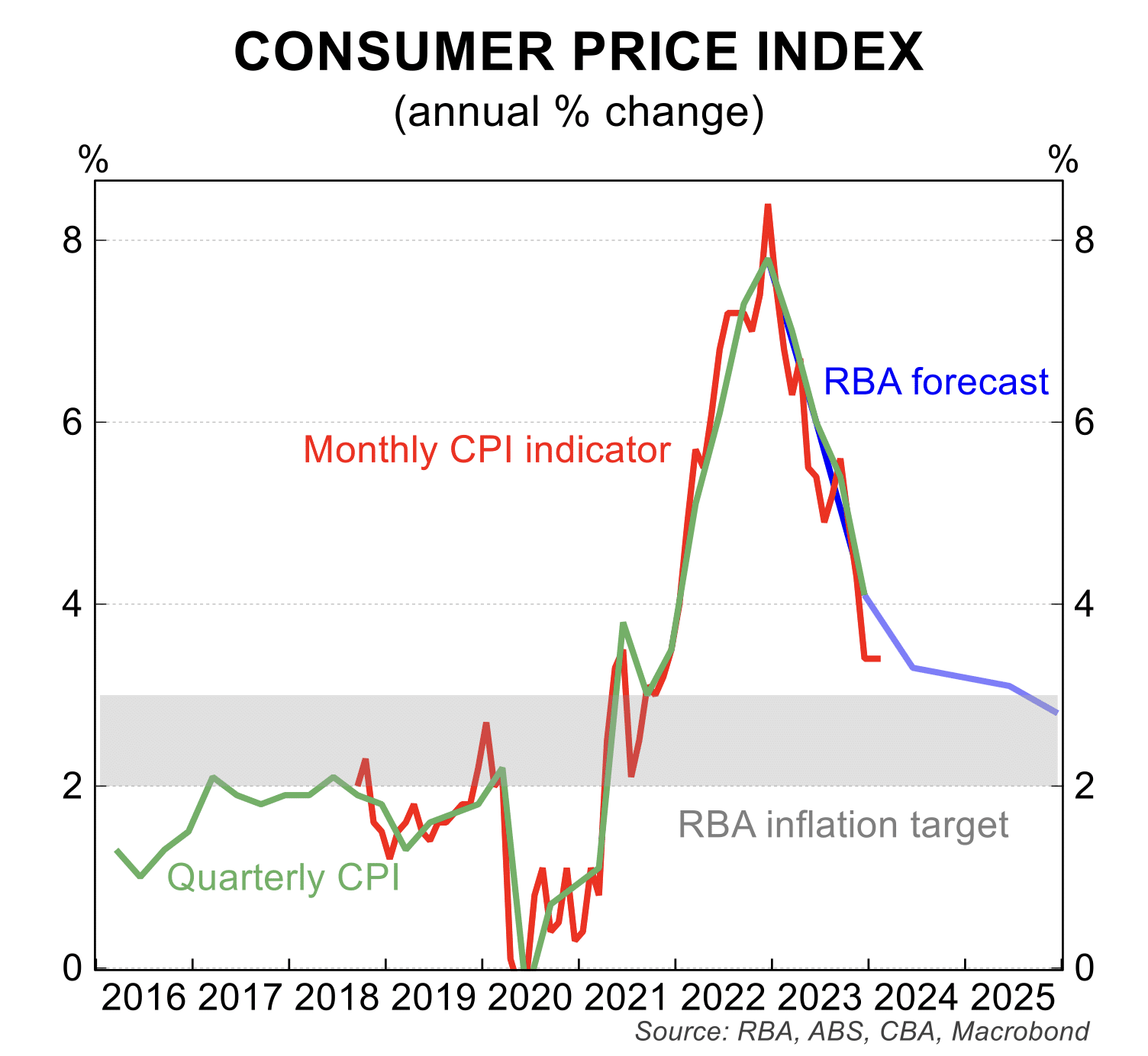

The Australian economy has continued to track at a low growth rate with inflation continuing to ease. As a result of these trends, the RBA has moved to a clear neutral bias dropping the ‘next move is likely to be up’ comments at its March meeting.