Committed To Excellence In Real Estate Private Credit

Principal & interest

repaid

Successful loan

exits

Value of

loans funded

Average

investor return p.a.*

*Average investor return across the active portfolio as at 31 December 2025. Past performance is not a reliable indicator of future performance.

PARTNERSHIP | TRUST | RELATIONSHIP

Since 2017, we remain steadfast in our commitment to always putting our investors first.

Why zig when you can Zagga?

Alternative real estate investment opportunities

As one of Australia’s leading alternative real estate investment managers, Zagga is committed to delivering attractive, risk-adjusted investor returns, and tailored private credit solutions, across the capital stack.

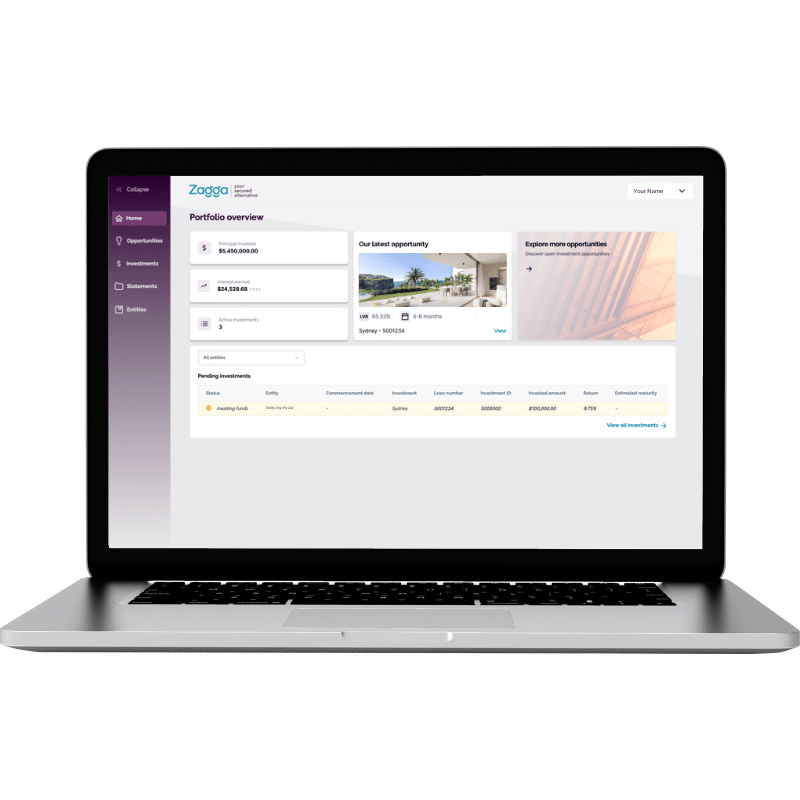

For Investors seeking alternative real estate investment opportunities

Zagga offers the alternative of accessing regular, predictable income and the option of adding a ‘middle ground’ to a well-diversified portfolio, all 100% first mortgage secured by Australian property.

For creditworthy borrowers exploring flexible, bespoke alternatives

Zagga means fast, simple and flexible borrowing for multiple loan purposes. Since 2017, Zagga has funded a range of lending transactions across a spectrum of loan purposes.

Our industry affiliation

Zagga is proud to be a member of the following respected industry and professional associations, covering credit, property, and investment management. These memberships complement our capabilities across our core business areas and align with the wider lending and investment sector.

Subscribe to our newsletter to learn more about Zagga

Typical investment opportunities

Build a diversified portfolio and add that ‘middle ground’ through investing in Commercial Real Estate Debt.

Here are some recent alternative investment opportunities we have facilitated for our investors.

Register to start exploring alternative real estate investment opportunities in Australia.

Camden, NSW

8.40%

Investor return p.a. (variable)

LVR 65,00%

Site acquisition

Estimated term 10-16 months

Double Bay, NSW

8.50%

Investor return p.a. (variable)

LVR 45.79%

Refurbishment – Commercial office

Estimated term 15-18 months

Haymarket, NSW

8.35%

Investor return p.a. (variable)

LVR 67.57%

Working capital facility

Estimated term 12-18 months

Spring Farm, NSW

8.90%

Investor return p.a. (variable)

LVR 65.59%

Residential subdivision

Estimated term 10-13 months

What we lend for

Zagga has worked with developers large and small. Projects which we have funded to date range from

simple residential projects to multi-million-dollar commercial and residential developments.

Explore our funding showcase.

LAND

BANKING

CONSTRUCTION

FINANCE

RESIDUAL

STOCK

BRIDGING

LOAN

WORKING

CAPITAL

INVESTMENT

PURPOSES

Meet the leadership team

Our team has over 200 years’ combined experience in credit, property and investment management.

Alan Greenstein

CEO & Co-Founder

Alan has more than 30 years’ experience in banking and finance, following a short stint as a legal practitioner, with work experience in the UK, South Africa and Australia.

He has consulted widely to owner-managed businesses across strategy, technology and operations. He co-founded Zagga in 2016.

Frank Hageali

Director, Investments

Frank has been involved in the finance and property industry for 25 years. Prior to his last bank role as Senior Associate Director/Acting State Director NSW for ANZ Bank’s Corporate Property Group, Frankheld senior and management positions in Corporate, Institutional and Property divisions in Australia’s major financial Institutions. Most recently he was Head of Credit at Secured Lending.

Steven Levy

Director, Investments

Steve has been a part of the core team since inception and comes with a high level of experience in portfolio management, investor relations and capital markets.

As a Chartered Accountant (CA ANZ), Steve is a key operator of the business and member of both the Investment and Credit Committees

Alan has more than 30 years’ experience in banking and finance, following a short stint as a legal practitioner, with work experience in the UK, South Africa and Australia.

Frank has been involved in the finance and property industry for 25 years.

Steve has been a part of the core team since inception and comes with a high level of experience in portfolio management, investor relations and capital markets.

Alan has more than 30 years’ experience in banking and finance, following a short stint as a legal practitioner, with work experience in the UK, South Africa and Australia.

Alan Greenstein

CEO & Co-Founder

Tom is an experienced company director, banker and property developer/investor.

Tom Cranfield

Director, Investment & Risk

Frank has been involved in the finance and property industry for 25 years.

Frank Hageali

Director, Property & Risk

Steve has been a part of the core team since inception and comes with a high level of experience in portfolio management, investor relations and capital markets.

Steven Levy

Director, Funding & Treasury

Simon is a qualified Chartered Accountant with 7 years’ experience in financial services prior to Zagga.

Simon Mutch

Director, Finance, Compliance & IT

Erica is a senior marketing professional with over 20 years’ experience in a diverse range of financial services’ roles.

Erica Tsang

Director, Marketing & Communications

Leanne brings over two decades of expertise to her role as a seasoned leader in customer service, operations, and technology within the financial services sector.

Leanne Hui

Director, Client Services & Administration

Marcus is the Co-Founder of Zagga NZ (formerly LendMe), which he started in 2014.

Mr Cranfield is an experienced company director, banker and property developer/investor.

Erica is a senior marketing professional with over 20 years' experience in a diverse range of financial services’ roles.

Erica Tsang

Director, Marketing & Communications

Leanne brings over two decades of expertise to her role as a seasoned leader in customer service, operations, and technology within the financial services sector.

Leanne Hui

Director, Client Services & Administration

Simon is a qualified Chartered Accountant with 7 years’ experience working at PwC in financial services prior to joining Zagga.

Simon Mutch

Director, Finance, Compliance & IT

Three steps to get started

Register to start exploring the alternative investment

opportunities we offer

Register

Confirm your investment entities and status as a wholesale investor

Investment Strategy

Choose between investing directly or via one of our Funds

Invest

Earn regular income and be kept informed on your investments

Questions?

Look here.

Some types of alternative investments include real estate, private equity or venture capital, hedge funds, commodities, managed funds, art and antiquities, wine, and cryptocurrencies.

The future of alternative investments looks promising as investors continue to seek diversification, potentially higher returns, and lower correlation with traditional assets. As global economic conditions and financial markets become more volatile, alternative investments offer a hedge against inflation and economic downturns.

The rate of return on alternative investments varies depending on the type of investment and the specific investment strategy used. Some alternative investments can offer higher returns than traditional investments but also have higher risks.

Alternative investments are popular because they offer diversification benefits and potentially higher returns and provide a hedge against inflation and economic downturns.

With investors facing a storm of volatile pricing, and residential property yields compressed by high purchase prices, what alternatives are there?

Our white paper delves into the dynamics of the fast-growing private lending market, and what’s driving it.

Client testimonials

The absolute best part for me is the 0% loss.

A massive congrats to the whole Zagga team.

I have confidence in Alan and the entire team. It’s important for me that it’s not just the online platform. At all times I have access to, and face-to-face contact with the individual team members. The team is trustworthy and reliable-essential criteria.

Your service, quality of investment and returns are excellent and I couldn’t be a more satisfied partner. Please continue to include me in all offers.

Seamless in every way.

A real professional investment company from the top down.

Never missing a payment and very transparent.