Summary: 'Two Minutes for Zagga' | December 2025

The past two months have brought a series of surprises for the Australian economy, shaping the Reserve Bank’s outlook for 2026.

Growth picks up

GDP growth has climbed above 2% for the first time in two years, up from just 0.8% annual growth a year ago. While not spectacular, this improvement marks a welcome shift after a prolonged period of weakness.

Driving the turnaround:

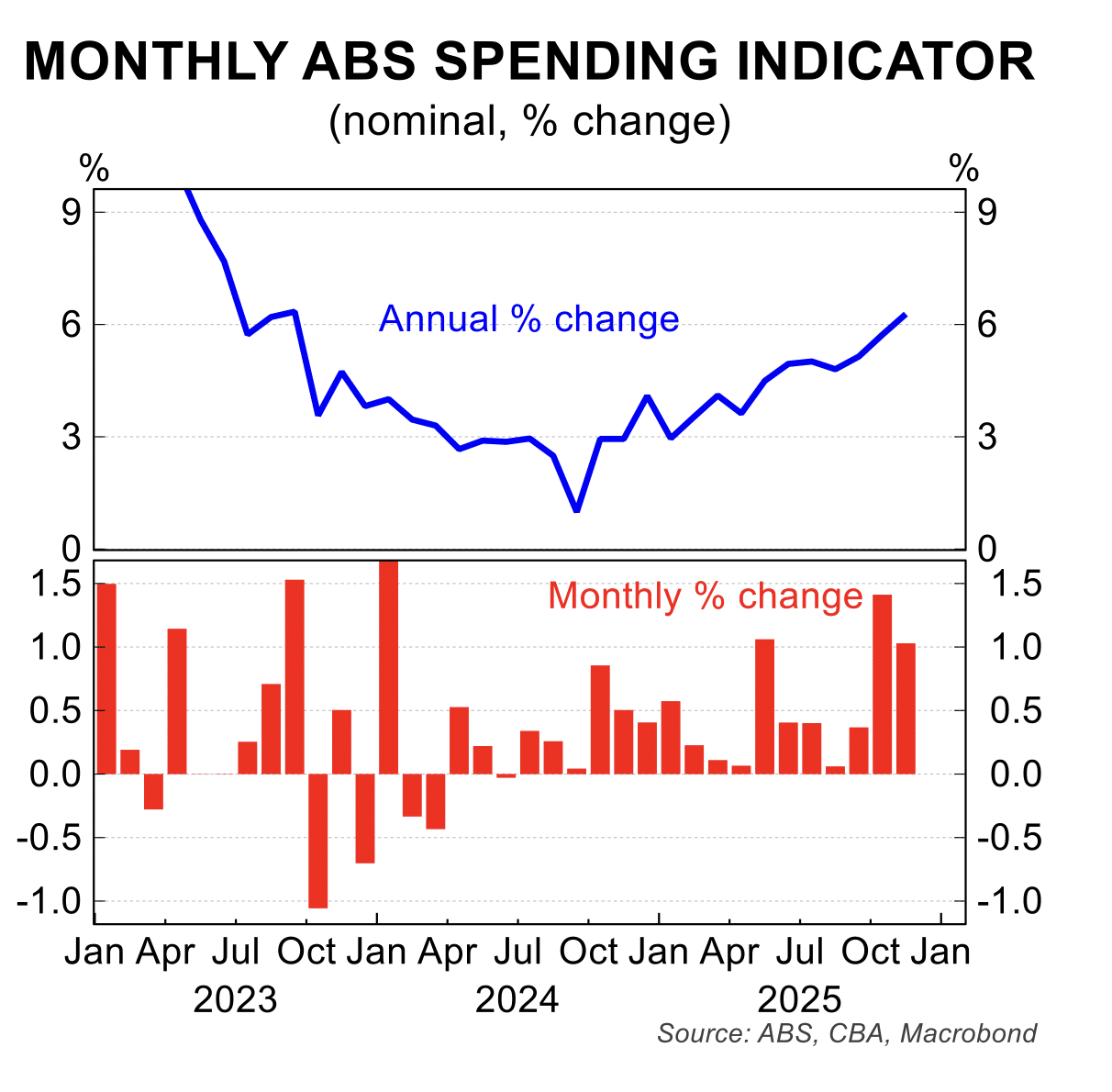

- Business investment — a critical boost for productivity.

- Household spending — continuing to strengthen through October.

- Dwelling investment — early signs of recovery, though the housing shortage remains unresolved.

Inflation shocks

Recent quarterly and monthly inflation readings were higher than expected. While some of the increase reflects one-off factors such as electricity subsidies, the Reserve Bank is watching closely to determine whether these pressures persist.

Housing market accelerates

House prices have surged over the past five to six months, reversing earlier cooling. Gains are broad-based, with Melbourne rebounding and boom cities like Adelaide, Perth, and Brisbane recording annualised double-digit growth. While the RBA does not target house prices, it monitors them for wealth effects — and the current momentum is a concern.

RBA outlook

At its December meeting, the RBA left rates unchanged and ruled out a cut. While not signalling an imminent hike, the Board acknowledged that if inflation proves persistent and the labour market remains strong, a rate increase could be considered in the first half of 2026. For now, rates are likely to stay on hold — provided inflation eases back into the target band as temporary factors wash out.

The bottom line

A stronger economy, elevated inflation, and rising house prices make for a complex policy landscape. As Stephen notes, it’s “way too early” to talk rate hikes, but the RBA is keeping its options open.

Watch the full video below:

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.