Dwelling construction lifts as interest rates remain on hold

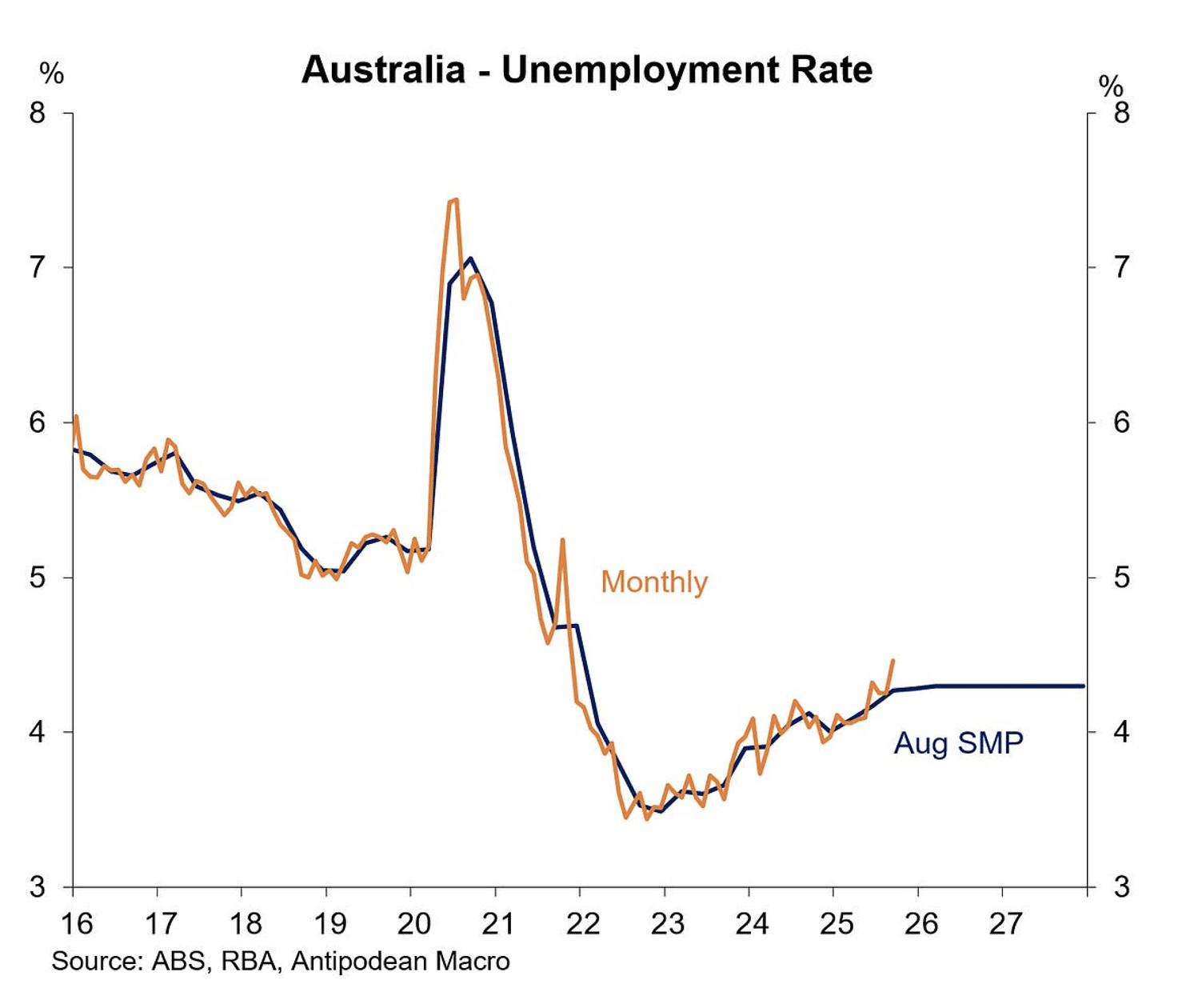

Mixed news on the economy and an uptick in inflation has seen the RBA move to a neutral bias for interest rates. This means that the medium turn outlook has switched from expectations for lower interest rates to one now steady interest rate settings are expected into 2026.

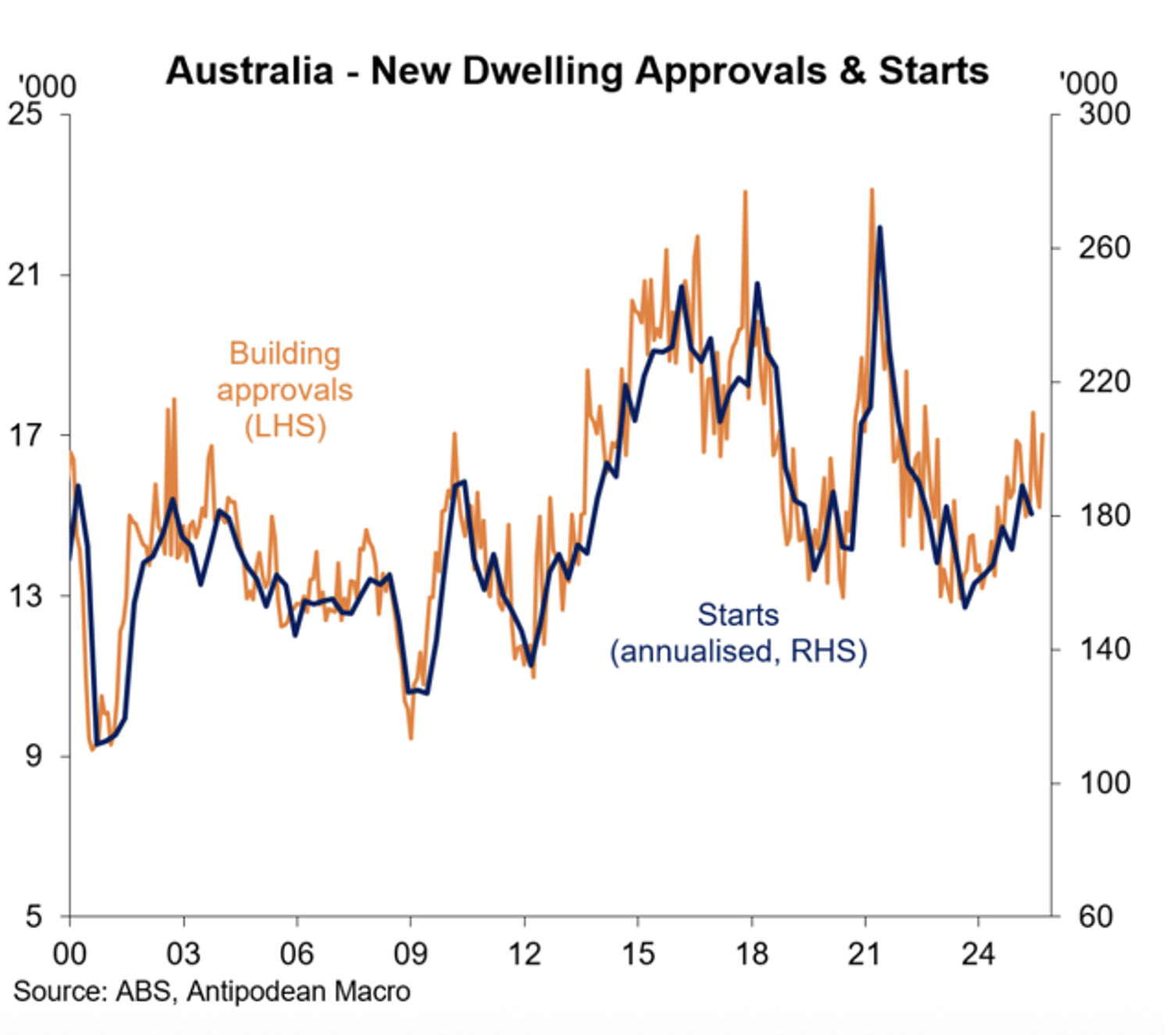

At the same time, the housing market is recovering. New dwelling building approvals have rebounded strongly although the level of activity remains below the rate needed to address the housing shortage.