As the private credit asset class continues to expand, the role of environmental, social, and governance (ESG) considerations has become central to how investment managers assess risk, manage portfolios, and deliver long-term value.

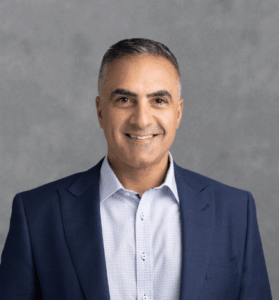

In a recent interview, Zagga Executive Director, Frank Hageali shared how the firm is integrating ESG into its credit risk process and what this means for investors, developers, and communities.

ESG: More than a box-ticking exercise

For Zagga, ESG is not a compliance exercise — it is embedded in how loans are originated and managed. Frank explained that real estate, which underpins all of Zagga’s lending, is traditionally a carbon-intensive sector. That makes it even more important to actively consider environmental impacts when financing projects.

“We look at lending to developers who incorporate energy-efficient design, water-saving technology, and sustainable materials. It’s about reducing the carbon footprint while still delivering projects that meet market needs.”

Managing long-term risk and supporting housing supply

Frank noted that ESG integration strengthens Zagga’s risk management framework. By screening for environmental and social factors, alongside financial metrics, Zagga ensures potential risks are identified early and addressed through loan structuring and monitoring.

But ESG is also about community outcomes. With Australia facing an ongoing housing shortage, Zagga sees an opportunity to finance developments that contribute meaningfully to supply. “If we can play a role in bringing more housing stock to the market, while also managing our investors’ capital responsibly, that’s a win-win.”

The role of the PRI

Zagga’s recent decision to become a signatory to the UN Principles for Responsible Investment (PRI) reflects this philosophy. For Frank, joining the PRI is about being part of a global community of like-minded investors committed to responsible finance.

“It gives us a platform to share knowledge and continuously improve how ESG is integrated into credit strategies and operations. Ultimately, it strengthens accountability and builds investor confidence.”

Frank Hageali, Executive Director, Risk & Investments

Investor outcomes: stability and resilience

Zagga’s investor base, spanning institutions, high-net-worth individuals, and family offices, is looking for income that is steady and not correlated with equities or listed markets. Frank emphasised that Zagga’s focus remains on safe, stable, risk-adjusted returns, achieved by lending into deep markets with enduring demand.

“With real estate-backed credit, particularly in a market facing structural undersupply, we see resilience. That underpins our ability to deliver consistent outcomes for investors, without chasing growth at the expense of prudence.”

Looking ahead

As Australia grapples with both housing challenges and heightened expectations around ESG, private credit is positioned to play an increasingly important role. For Zagga, the intersection of disciplined credit, responsible investing, and community contribution is where the greatest long-term opportunities lie.

Watch the interview below.