Source: The Korea Times

Author: Lee Yeon-woo

Date: 12 December 2025

Australia may not have been on the radar for Korean investors — until now. As institutional appetite for alternative assets grows, Australian fund manager Zagga is positioning itself as a first mover to connect Korean capital with real estate opportunities down under.

“Australia is considered part of the Asia-Pacific region and is seen a friendly jurisdiction. Investors are looking at Australia as an alternative to Europe or America,” Alan Greenstein, CEO and co-founder of Zagga, told The Korea Times in a recent video interview. “Australia is not yet a well-known market for Korean investors. So we’re going to be one of the first funds into the market from that point of view.”

Zagga is an Australian alternative real estate investment manager that specializes in private credit. Private credit refers to lending structures involving privately negotiated loans between borrowers and non-bank lenders. It offers faster execution and more flexible terms than traditional bank financing.

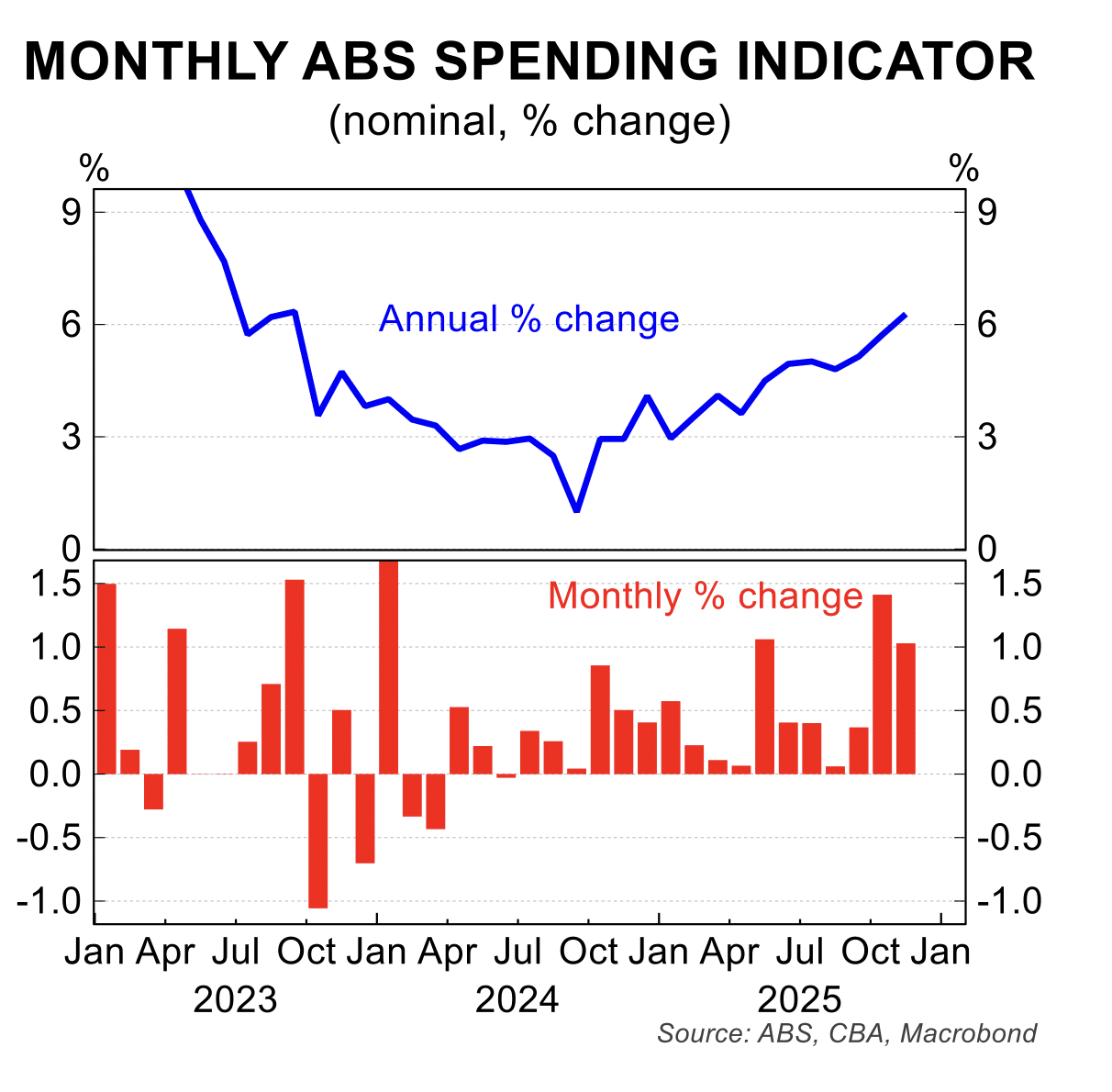

Behind the growing interest from global institutional investors is the resilience of the Australian real estate market, which is the country’s second-largest industry.

The sector accounts for 13 percent of Australia’s GDP, with significant room to grow due to a constantly increasing population. Australia’s population grew from 21 million in 2013 to 27 million in 2023, and it is expected to reach up to 35 million by 2050.

Yet, residential supply remains limited. According to Zagga, housing supply is running at only 74 percent of target levels, and the ongoing trend of net positive migration is expected to further exacerbate the housing shortage.

At the same time, traditional sources of funding are retreating. Banks — long the dominant players in construction lending — are pulling back as regulations tighten. Basel III and Basel IV, global regulatory frameworks for banks, have made real estate loans more capital‑intensive and less profitable. As a result, banks are shifting focus away from property development toward safer, simpler assets.

Greenstein said that private credit managers like Zagga serve a crucial role in providing commercially viable funding to developers in this environment when demand keeps increasing and banks remain restricted in servicing that growth.

“The real estate market is driven by a shortage of residential accommodation, and about 50 percent of the people coming into the country want to live in Greater Sydney or greater Melbourne," Greenstein said. "Banks still hold about 83 percent of the market, while only 17 percent is currently private credit. We estimate that private credit will grow to around 25 percent (which is still lower compared to other major economies)."

Greenstein and other Zagga executives plan to visit Korea early next year for meetings with relevant institutions and to assess the local market environment. The firm holds a registered Singaporean entity and local distribution groups in Hong Kong, Japan and other ASEAN markets. Greenstein added that he hopes to establish a presence in Seoul by next year.

Interest toward private credit is indeed growing in Korea.

Large domestic institutions such as the National Pension Service, Korea Investment Corporation and major insurers are increasing their allocations into real estate private credit, with nearly half of Korean limited partners planning to expand exposure, according to real estate consultancy Knight Frank. While overall returns may be lower than equity investments, asset-backed private credit is likely to offer greater stability — if executed carefully.

“More and more Korean investors at the institutional level are moving money out of the U.S. and out of Europe, and they’re looking a new at a new home for their money (for diversification),” Greenstein said. “We wouldn’t be doing this unless we were confident that there was interest.”