Zagga concluded the December quarter with $410 million in originations, bringing the FY26 year-to-date total to $663 million. The Zagga Feeder Fund (ZFF) grew by 155% in CY25, now comprising over 85 active investments.

Portfolio Disciplines and Deployment

Zagga maintains a disciplined approach to credit risk, originating only 8% of reviewed opportunities for FY26 to date. Recent settlements align with our strategy of partnering with high-quality sponsors in blue-chip locations, including Manly, Marrickville, Neutral Bay, and Rose Bay.

Notably, Zagga originated its largest loan to date in October 2025 – a c.$120 million facility for a mixed-use aged care project on Sydney’s Lower North Shore. With works now complete, a full takeout by a major Australian retail bank is on track for late Q126. ZFF has allocated 4.79% of its funds to this specific loan.

Market Dynamics and Pipeline

Buoyancy in the NSW market, supported by government housing supply initiatives, has allowed Zagga to fund several land-bank acquisitions while progressing development approvals. This strategy has built a robust forward pipeline of approximately $500 million for 2026.

We have seen an increase in loan repayments as market headwinds from the 2020 to 2022 cycle continue to abate. $180 million of the Zagga book matured in FY26 to date, with further maturities expected in Q1 2026, supporting continued redeployment of capital into new opportunities.

Risk Management and Outlook

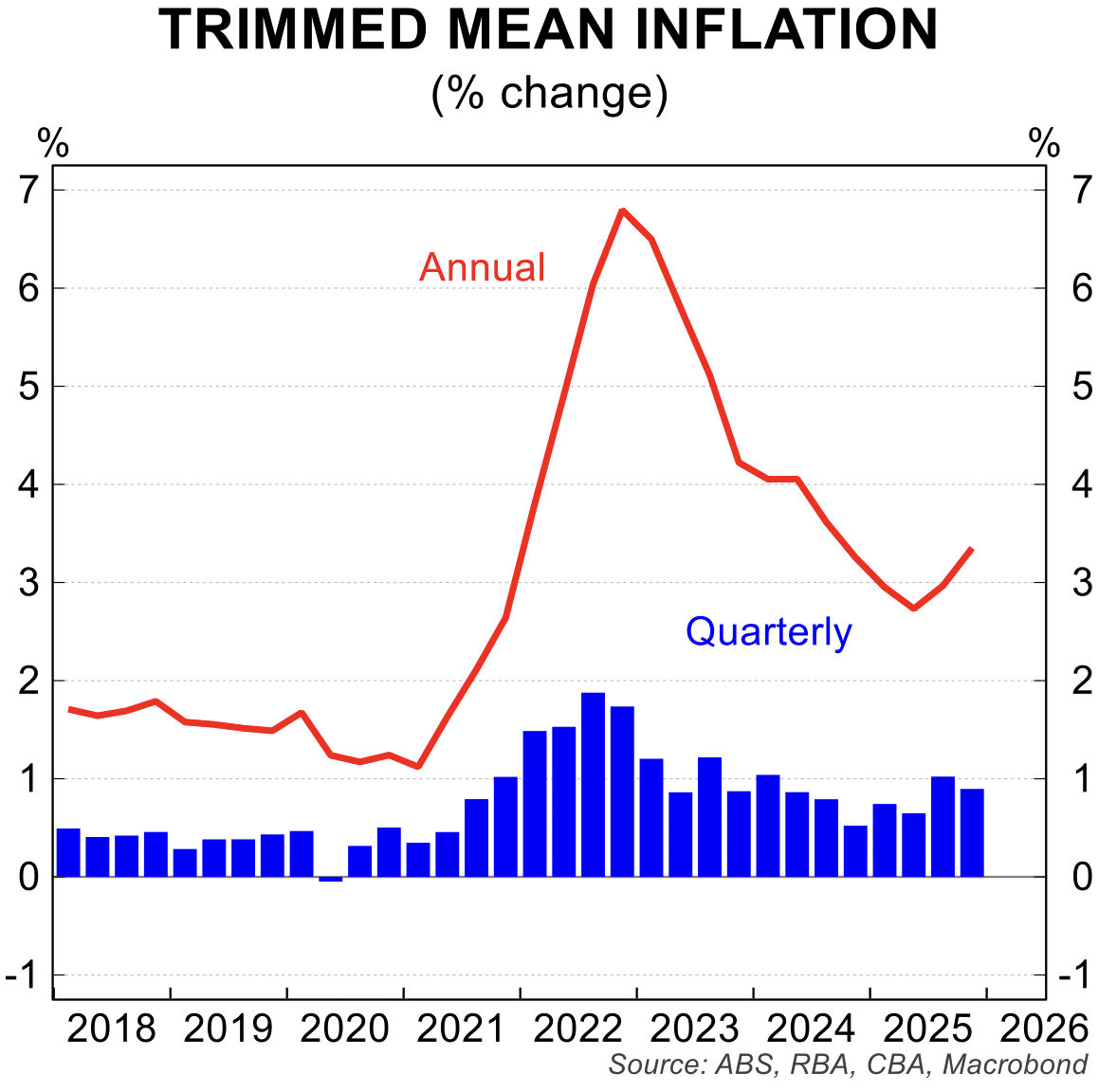

Heightened market liquidity and borrower choice resulted in a 2.25% increase in ZFF’s weighted average LVR to approximately 67% over CY25. To mitigate potential interest rate increases in H1 2026, all loans remain on variable rates, ensuring sustained target investor returns.

Looking forward, Zagga remains committed to a conservative, risk-focused strategy. Investors can expect continued evolution in fund structures and enhanced reporting as we capitalise on the expanding private credit asset class.