2025 brought real estate private credit into focus for a wider investor audience. Will growth and sophistication continue in 2026?

2025 has undoubtedly seen real estate private credit hit the investment mainstream, recognised for its diversification benefits, defensive characteristics, and reliable income.

As we look to 2026, real estate private credit is set to cement its position as a strategic allocation for sophisticated investors, attracting capital looking for alternatives from more mature, saturated markets, like the US and Europe, with several tailwinds furthering our market’s untapped potential.

Today, Australia’s private credit market is valued at $224 billion, growing nine percent year-on-year*. It is no longer a niche investment, becoming an established asset class on track to be larger than Australia’s domestic public bond market.

Real estate private credit, in particular, is forecast to hit $90 billion by 2029*.

At Zagga, we believe this trajectory will see private credit account for approximately 30 per cent of the commercial real estate debt market in the coming years.

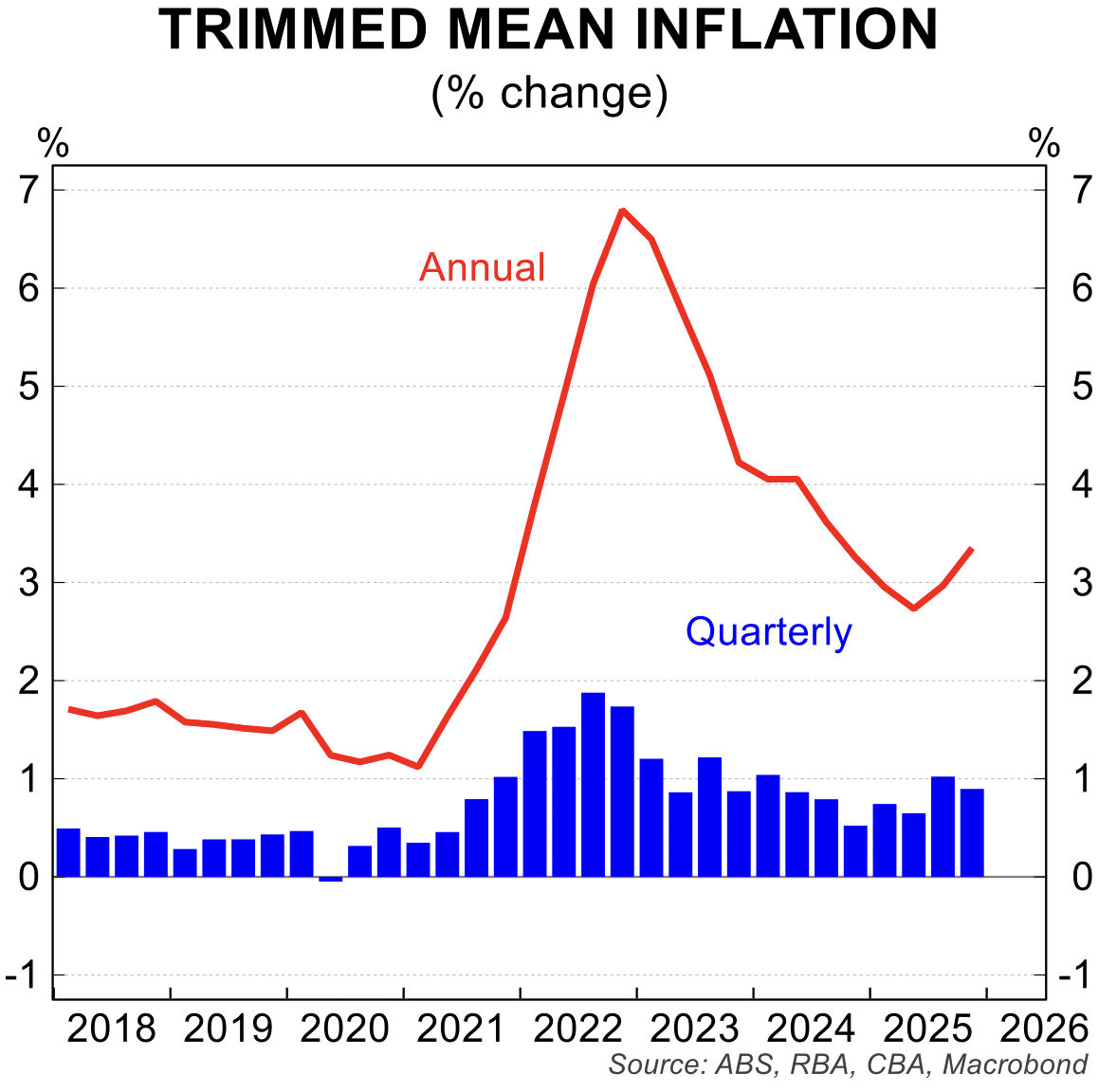

This growth is buoyed by significant market tailwinds. Globally, persistent market volatility and economic uncertainty have driven demand for income generation and enhanced portfolio diversification away from equity markets.

Locally, our housing market is suffering from a chronic supply shortage, with a projected shortfall of 262,000 dwellings by 2029**, as banks and other traditional lenders are limited in their ability to fulfil the rising demands for construction and development financing.

Despite increased attention, real estate private credit currently accounts for less than 20 percent of Australia’s commercial real estate lending market*, compared to more established markets like the US, where it represents 50 per cent of funding.

Yet this story is changing, with Australia now attracting the attention of sophisticated global and domestic capital. Zagga has been a beneficiary of this conviction.

In FY25, we saw SMSF allocations grow by almost 25 per cent year-on-year, while IFA-advised SMSFs grew by 130 per cent over this period. Global capital now accounts for ~30 per cent of our funds under management (FUM) with our largest institutional investors based in the ASEAN region.

As momentum continues to build, it’s imperative that there is a focus on quality – of managers, projects, and counterparties – to protect investors capital and ensure the sustainability of Australia’s real estate private credit sector.

As we step into 2026, here’s five trends we believe are set to shape real estate private credit.

Trend 1: Housing shortages will continue to drive demand

Structural under-supply and the government’s ambitious housing build requirements mean that non-bank capital will remain essential.

Banking constraints (specifically higher APRA/Basel III capital charges and the incoming Debt to Income (DTI) cap in 2026) are tightening traditional lending capacity.

This widens the funding gap for residential development, positioning private credit as a necessary, scalable solution for new housing delivery.

Trend 2: Real estate private credit will continue to reshape the capital stack

Private credit is no longer confined to mezzanine, opportunistic, or complex solutions – increasingly competing head-to-head with banks on senior positions.

Developers are turning to blended capital stacks that integrate bank debt, private senior credit, and subordinated private credit to optimise execution and flexibility.

As scale grows, institutional investors are demanding greater transparency, reporting, and standardisation, accelerating the sector’s maturity.

Trend 3: Sophistication, competitiveness, and opportunity accelerates

International investors are actively deploying into Australian real estate private credit, attracted by the country’s world-class legal framework, supply-demand imbalance, relative economic and political stability, and floating-rate income profile.

This inflow of global capital brings enhanced sophistication and competition, supporting deeper, higher-quality deal flow and pushing local managers to lift governance, reporting, and operational standards in line with global best-practice.

Trend 4: Heightened regulation drives industry consolidation

The regulatory lens on private credit is intensifying. Managers with transparent structures, disciplined oversight frameworks, and robust, conservative risk management are set to benefit, while weaker operators face increasing scrutiny and potential exit.

At Zagga, we welcome this scrutiny and a fit-for-purpose framework that bolsters investor confidence and trust without applying a “one-size-fits-all” lens to a highly diverse, multi-faceted sector.

In this environment, we expect manager consolidation through 2026 with disciplined, experienced, and quality managers coming to the fore.

Trend 5: Discipline and experience key performance differentiators

As capital availability increases, not all managers will outperform. The best results will skew heavily toward managers with deep origination channels, strong borrower relationships, and a consistent track record of conservative underwriting.

These managers will be best positioned to “cherry-pick” higher-quality transactions, particularly those banks cannot fund, delivering stronger risk-adjusted returns through tighter covenant structures and superior collateral controls.

For experienced, specialist real estate private credit investment managers, the current environment presents ample opportunities to access well-structured, investment-grade transactions with strong sponsors and counterparties.

For sophisticated investors seeking predictability, resilience, and attractive risk-adjusted returns, real estate private credit is becoming an increasingly relevant portfolio allocation.

As we enter 2026, I am of the view that this will be the year Australian real estate private credit proves itself as a true portfolio differentiator not just a niche alternative.

This article was developed in collaboration with Zagga, a Stockhead advertiser at the time of publishing and additionally published in Adelaide Now, Cairns Post, The Courier Mail, The Daily Telegraph, Geelong Advertiser, Gold Coast Bulletin, Herald Sun, NT News, The Chronicle, The Mercury and Townsville Bulletin.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

* Alvarez & Marsal, Australian Private Debt Market Review, November 2025

**National Housing Supply & Affordability Council (NHSAC)