Confirmation of on-target inflation and further evidence of a sluggish pace of economic growth was not enough for the RBA to lower interest rates at its 8 July meeting.

It surprised economists and the market, leaving official interest rates at 3.85 per cent, just 50 basis points down from the peak. A 25 basis point cut was expected and priced into markets.

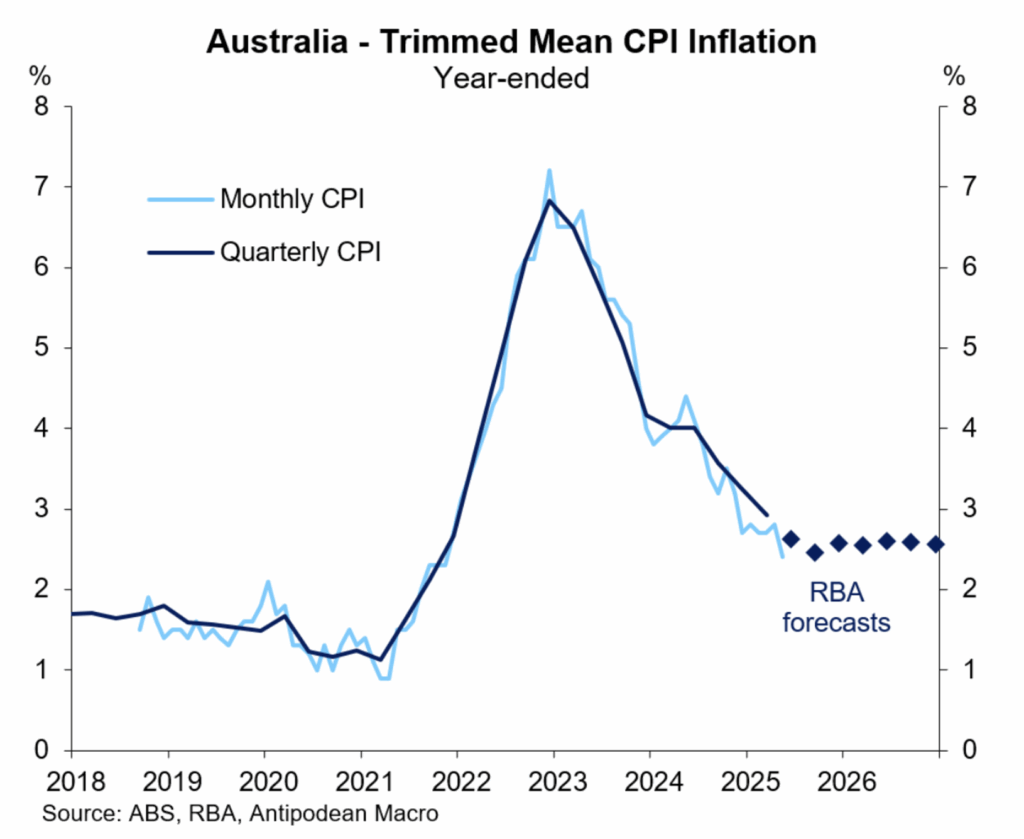

The RBA Governor noted uncertainty around the inflation outlook as a critical reason behind the decision not to deliver a 25 basis point cut even though on both a headline and underlying basis, annual inflation was below the mid-point of the 2 to 3 per cent target band.

Global factors, the escalating trade and tariff stoush and geopolitical ructions in particular, continue to present downside risks to the global growth outlook. Weaker international trade is a negative factor for the global economy in the medium term.

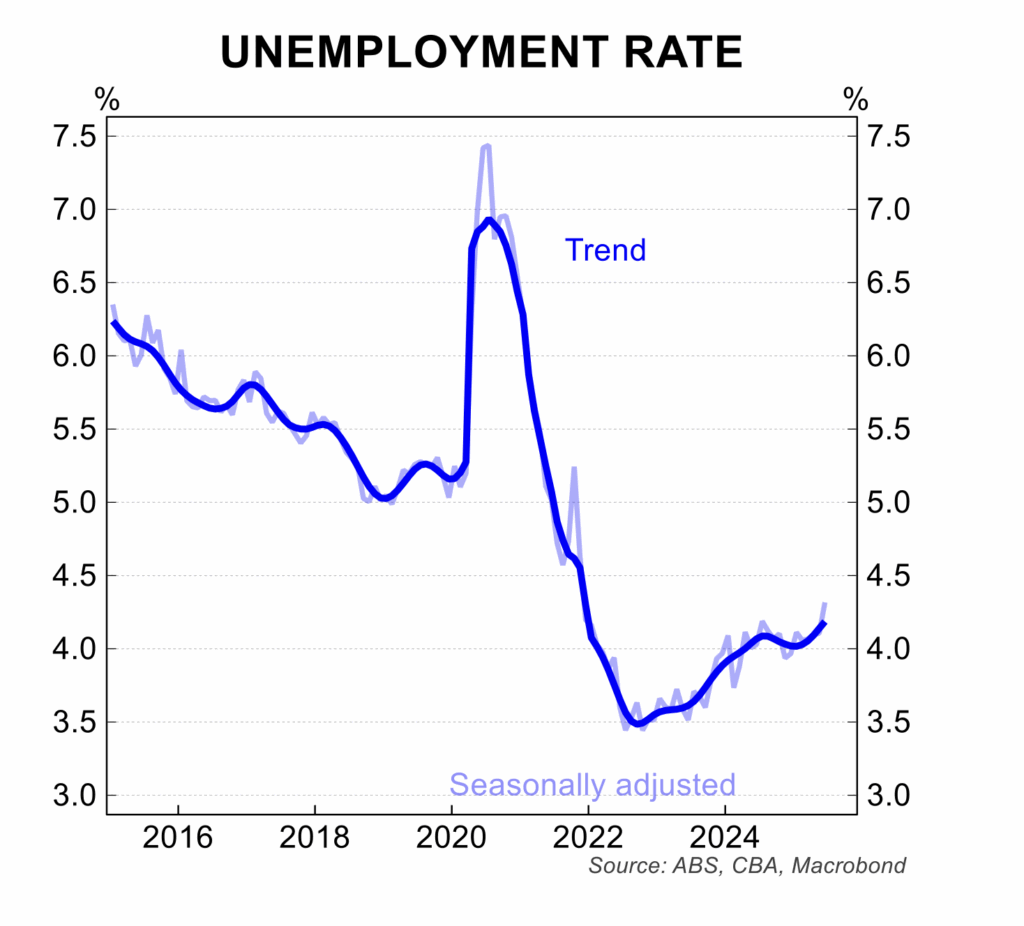

In the period since the “no rate cut decision” from the RBA, markets continue to price in further policy easings. An official interest rate around 3 per cent remains priced in for the first half of 2026. The rise in the unemployment rate to a three and a half year high after the RBA decision underpinned the market pricing and had some economists criticising the RBA decision not to cut rates earlier in the month.

Key data

Below is an update of key trends in the economy:

- To reiterate: Based on the monthly data, annual inflation fell to 2.1 per cent in May, making it 10 months in a row where inflation has been in the target band. The trimmed mean annual inflation rate eased to 2.4 per cent, which is a three year low and the sixth month where this inflation measure has been below 3 per cent.

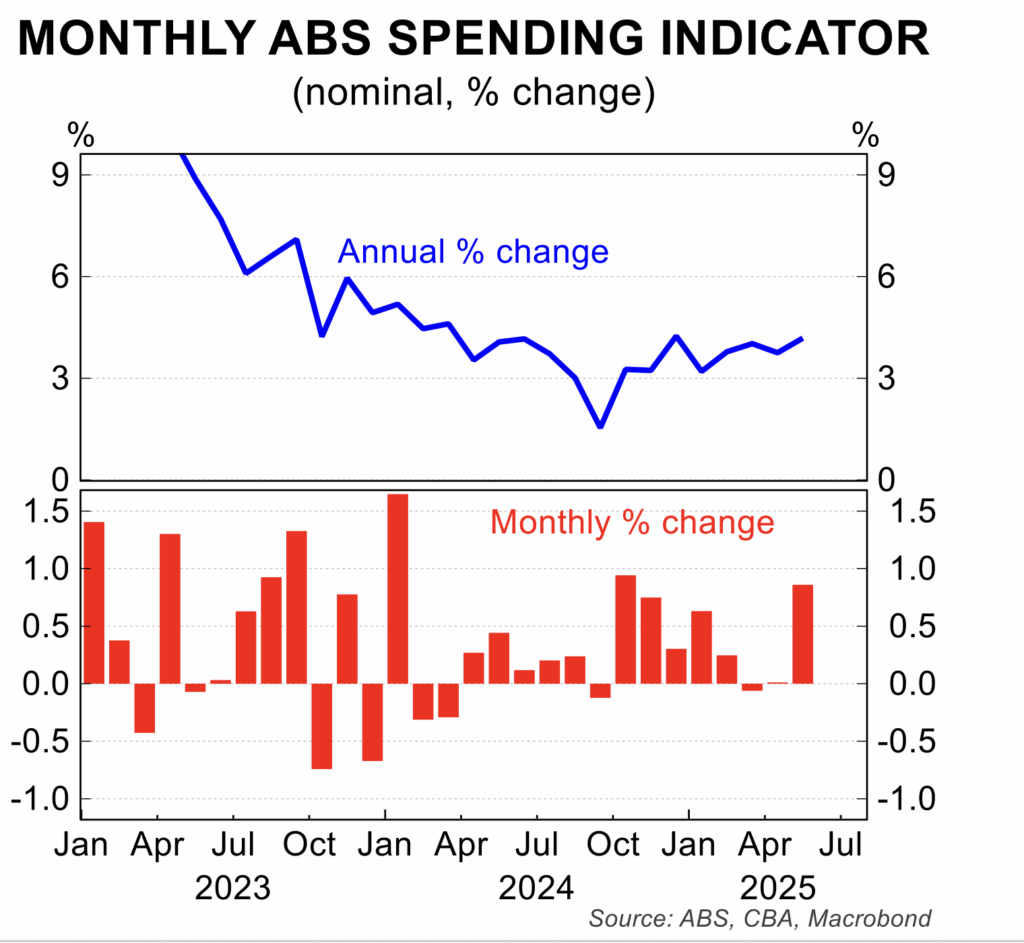

- Household spending rose 0.9 per cent in June, which was a solid increase but it followed a flat result in May and a fall of 0.1 per cent in April. Suffice to say, household spending growth remains subdued. Key issues for households in the months ahead will be future interest rate cuts, real wages and the level of unemployment.

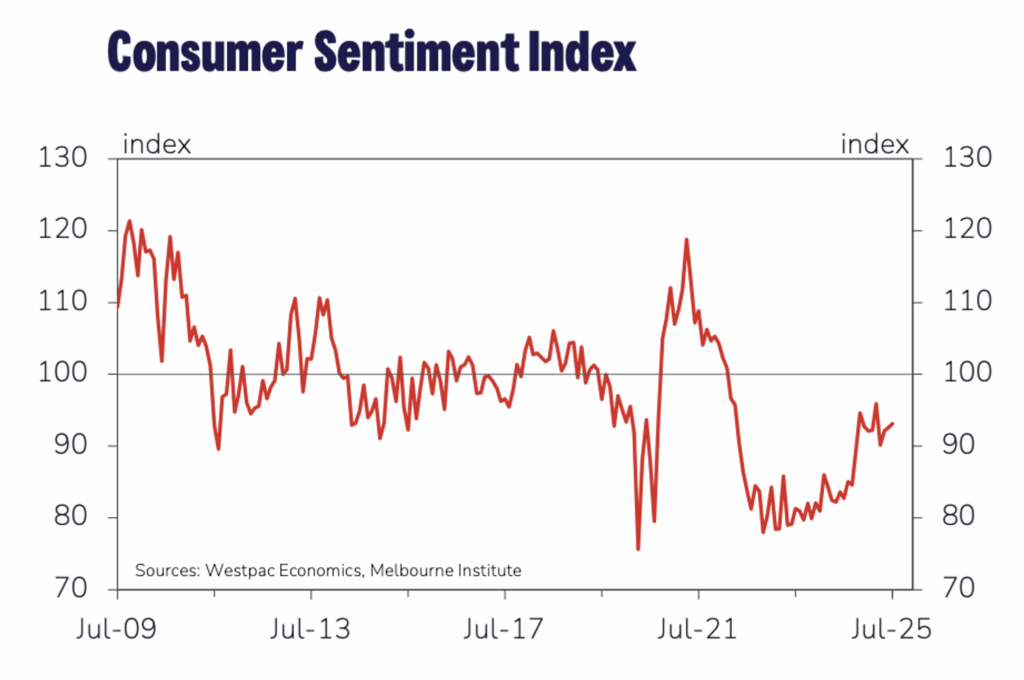

- While the level of consumer sentiment has increased from the 2023 lows, it has stalled or even pulled back in recent months. It remains at a level where there are more pessimists than optimists. While cost of living pressures have eased and two interest rate cuts have been delivered, further gains in real wages and further interest rate cuts will be needed to see consumer sentiment move to an optimistic level on a sustained basis. There is a solid correlation between the level of sentiment and household spending. This makes a return to ‘optimism’ a critical part of the expected economic pick up.

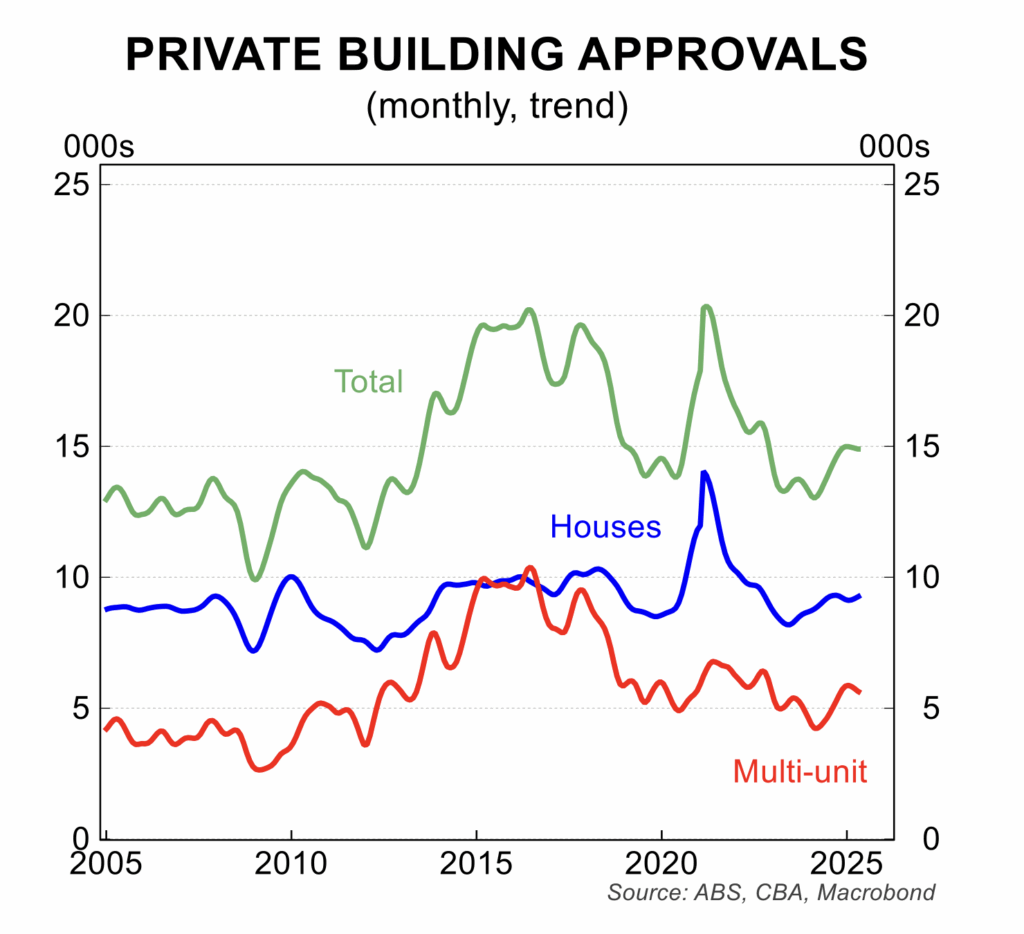

- Having fallen in March and April, the number of new dwelling approvals rose 3.2 per cent in May. The level of new approvals remains at an annualised rate around 185,000, well below the 240,000 new dwellings needed per annum to meet the government’s target of 1.2 million dwellings in the five years to June 2029.

- In a major data surprise, the June labour force data showed a rise in employment of just 1,000 which followed a fall of 2,000 in May. This softness in job creation saw the unemployment rate rise to a three and a half year high of 4.3 per cent. This is now almost a full percentage point above the cyclical low of 3.4 per cent in 2023. Job vacancies point to on-going softness in demand for labour.

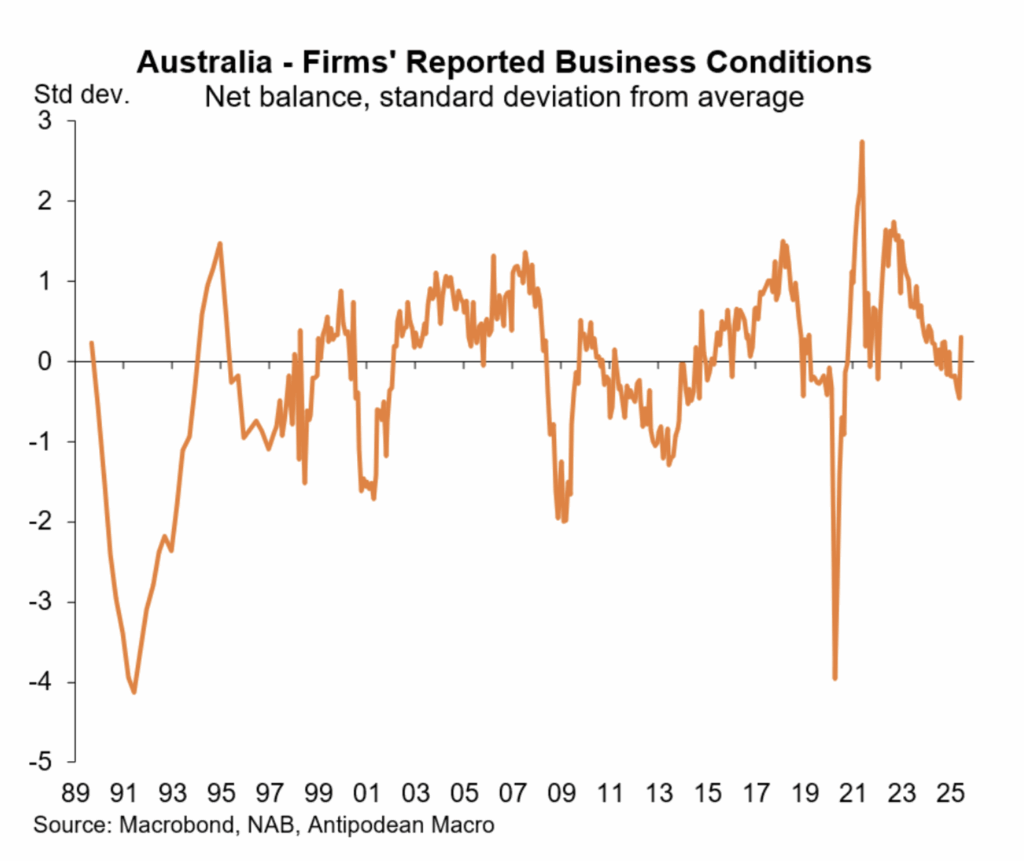

- There was a welcome lift in business confidence and conditions in June, although this was from a low base. The recovery in business sentiment was broadly based, with a lift in expected profits, trading conditions and business investment. The survey also confirmed well contained cost pressures which is consistent with ongoing low inflation.

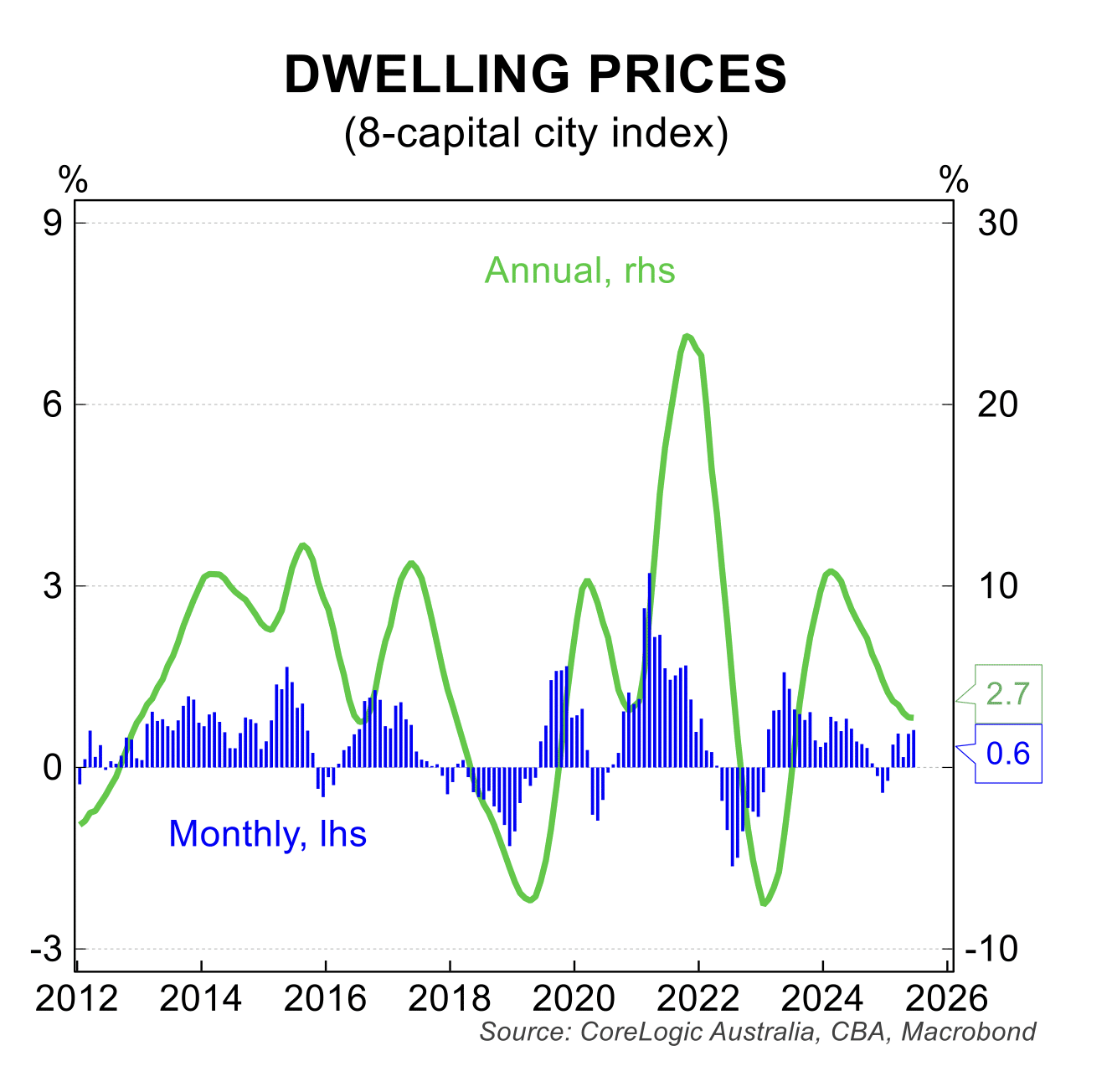

House prices

House prices continue to recover following the slight falls of late 2024/early 2025. Nationwide prices rose 0.6 per cent in June to register the fifth consecutive monthly rise. For the June quarter, prices rose 1.5 per cent following a rise of 0.9 per cent in the March quarter. Prices are 3.4 per cent higher than a year ago.

The rebound in prices has been broadly based with the previously weaker cities – Melbourne, Sydney, Darwin and Canberra – showing signs of improvement. The rise in supply evident towards the end of 2024 has recently reversed with new listings of properties for sale edging lower in recent months.

The start of the interest rate cutting cycle in February improved sentiment towards housing and is cited by Cotality as one of the reasons for the more favourable climate in housing. The preliminary data for July show solid auction clearance rates in the main cities and a further modest uptick in house prices.

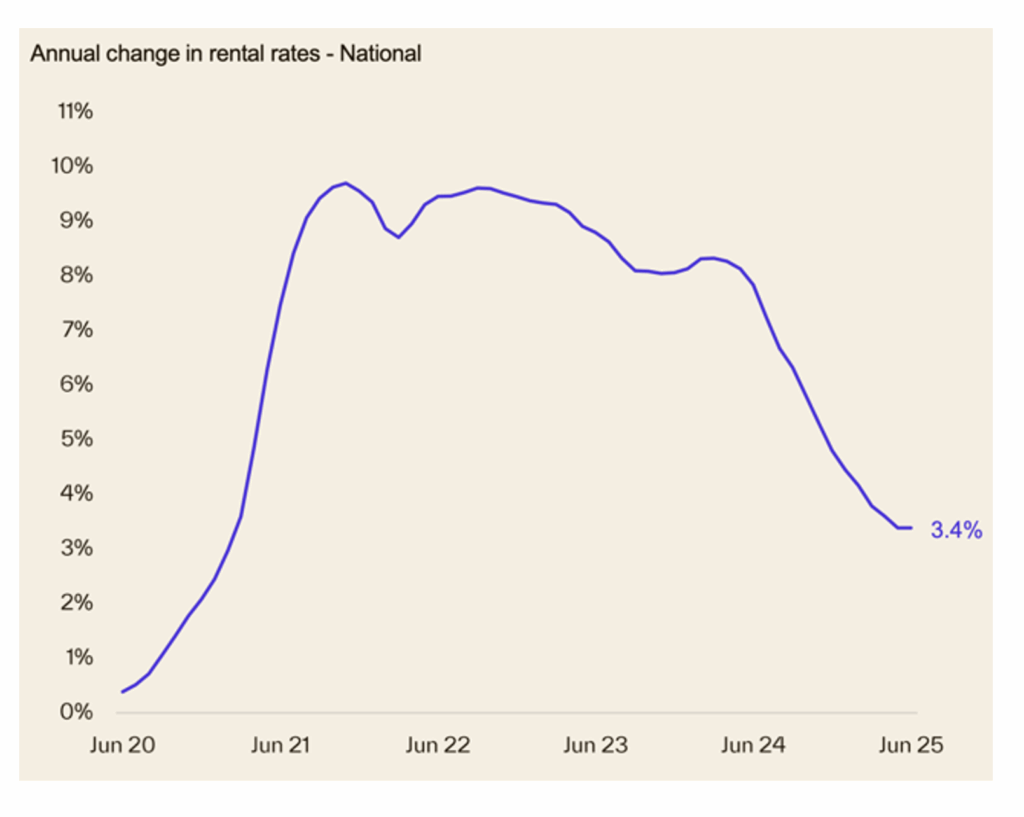

The rental market remains mixed – vacancy rates remain relatively low while the pace of advertised rent increases continues to slow. The investor lending data remains solid which suggests a steady supply of new rental properties are on the market, although this may be at the expense of dwellings available for owner occupation.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.