Zagga's Q&A as part of InvestorDaily X IFA's Whitepaper, 'The Road Ahead – Preparing Clients for Tomorrow's Investment Landscape'

Private debt has solidified its place as a vital asset class, offering attractive returns and stability in increasingly uncertain market conditions. This article explores the drivers of its growth, including the demand for tailored funding solutions and defensive investments, and emerging trends shaping its future in Australia and globally.

In your opinion, has private debt established itself as a significant asset class for a diverse range of investors, particularly in recent years and into 2024? Do you anticipate this growth trend to continue?

Private (or non-bank) debt has certainly solidified as a critical asset class for a broad range of investors, particularly in the post-2020 economic landscape. The search for higher yields amid a prolonged low-interest-rate environment initially spurred interest in private debt. Today, its appeal lies in its risk-return profile, its ability to provide steady and defensive income, and portfolio diversification benefits. According to Morgan Stanley1, the size of the private debt market at the start of 2024 was approximately $1.5 trillion, compared with approximately $1 trillion in 2020, and is estimated to grow to $2.8 trillion by 2028.

These numbers reflect its rising popularity, not just among institutional investors like pension and sovereign wealth funds, but also among family offices and high-net-worth individuals looking to capitalise on the predictability of the returns this asset class can offer, often with less volatility than public markets.

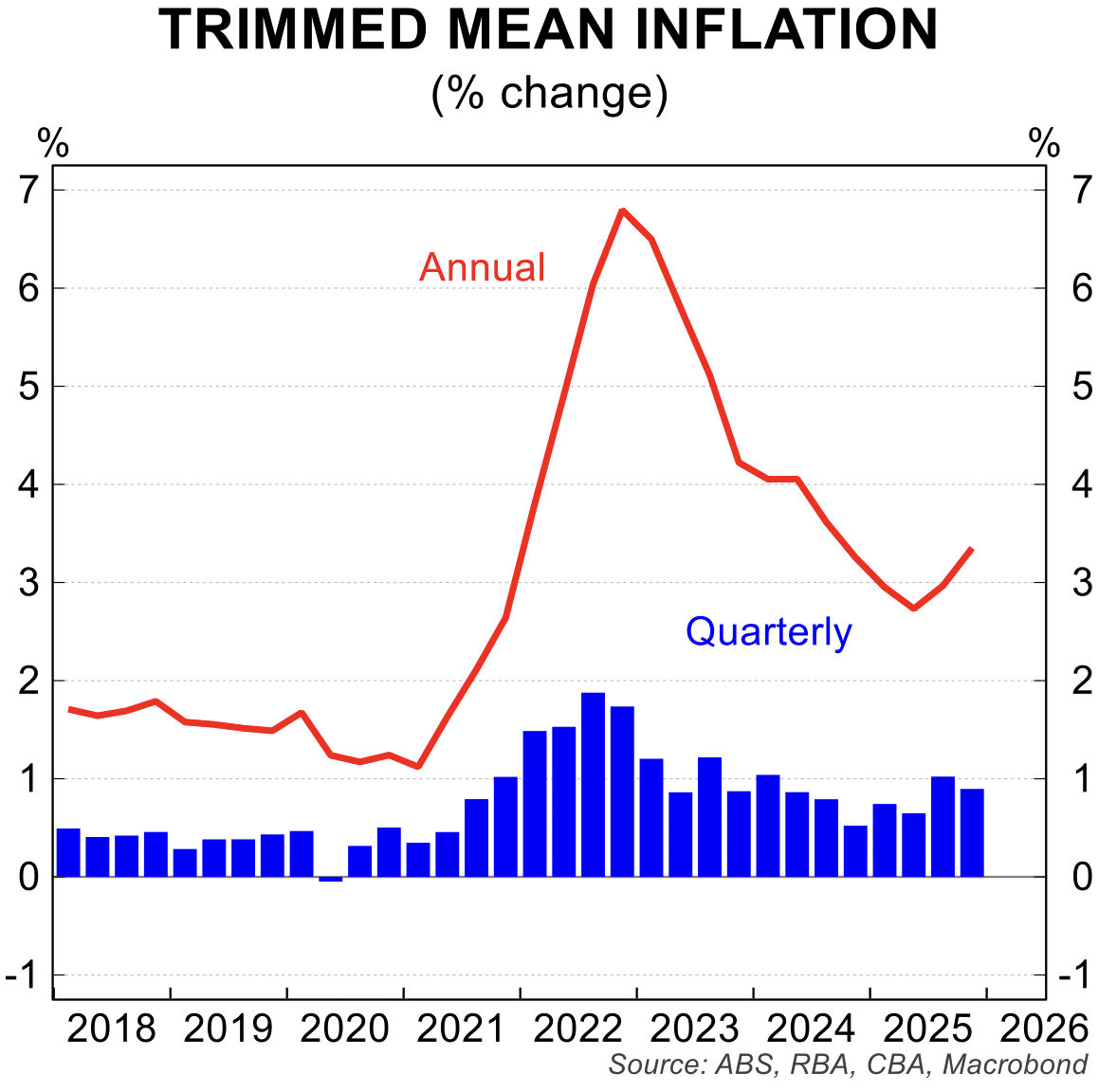

Moving forward, the appetite for private debt is expected to remain robust. Market movements globally have resulted in private debt, especially that which is underpinned by real estate, becoming very popular as an alternative asset class and popularity is steadily growing. High interest rates may dampen demand for traditional fixed-income products, while private debt offers an attractive alternative with higher yields and more tailored risk management opportunities. The continuing pressure for financing, owing to tightening bank lending criteria and capital constraints, will further solidify private debt as an essential source of capital.

Looking ahead to 2025, how do you expect market volatility to impact investment opportunities within the private debt landscape?

Looking ahead to 2025, market volatility is expected to be a double-edged sword for private debt investments. On the one hand, heightened volatility in public equity and bond markets caused by ongoing geopolitical risks could increase the appeal of private debt, which historically offers more stability and predictable cash flows. On the other hand, if economic conditions worsen or a global recession occurs, default rates among private debt borrowers – particularly those in riskier segments – could rise. Now, more than ever, the selection of a highly competent investment manager with a proven track record is paramount, particularly in the fastgrowing commercial real estate sector where loans are idiosyncratic in nature and require thorough due diligence and structuring of risk management prior to investment. This specialist asset class requires intensive asset management and risk management. Fund manager selection is therefore critical when investors do their product due diligence.

Given the rising geopolitical tensions, what proactive strategies are you implementing to protect your investments in the private debt sector?

Geopolitical risks have underscored the need for proactive risk management in private debt portfolios. As an investor-first, conservative investment manager, one key strategy we continue to implement is diversification across sectors and borrower profiles within Australia, with a primary focus on the eastern seaboard. By spreading exposure across different markets and segments domestically, we aim to mitigate concentration risks, enhance portfolio resilience, and create stable, risk-adjusted returns for our investors, regardless of macroeconomic uncertainties.

"THE APPETITE FOR PRIVATE DEBT IS EXPECTED TO REMAIN ROBUST. MARKET MOVEMENTS GLOBALLY HAVE RESULTED IN PRIVATE DEBT, ESPECIALLY THAT WHICH IS UNDERPINNED BY REAL ESTATE, BECOMING VERY POPULAR AS AN ALTERNATIVE ASSET CLASS."

Alan Greenstein, CEO & Co-Founder

Current geopolitical issues have made globally focused investors consider safer havens for their capital. Australia, with its strong, resilient economy and stable government with effective governance, is often viewed as a safe and attractive investment environment in times of global instability.

In addition to diversification, we maintain a stringent due diligence process, particularly assessing borrowers’ ability to withstand macroeconomic shocks. Strong covenants and collateral structures remain essential for protecting downside risk.

Our investments are designed to form part of a balanced portfolio, optimising returns on the cash allocation without disproportionate increases in risk. Our investment strategy is tailored to align with this objective.

Senior private debt investments are not intended to outperform investors’ other strategies or expose them to excess risk in the pursuit of higher returns. We believe that conservative returns, delivered consistently over many years with manageable risk, represent strong, attractive outcomes when viewed over time. Our business is structured to deliver this effectively, efficiently and consistently to our investors.

How do you anticipate changes in the regulatory environment will affect private debt, and what implications might this have for fund managers and investors going forward?

The regulatory environment is poised to evolve as private debt continues its growth trajectory, particularly as governments and regulatory bodies catch up with the rising popularity and global growth of alternative lending.

In the US and Europe, greater regulatory scrutiny around private debt funds is already occurring, with an emphasis on transparency, systemic risk, and investor protection. New regulations in Europe under the Alternative Investment Fund Managers Directive may impose stricter reporting and compliance obligations on fund managers. Similarly in the US, the US Securities and Exchange Commission has proposed rules that would increase reporting requirements for private funds, aiming for more disclosure around fees, expenses and fund performance.

It is likely that Australia will follow suit in the future, especially given the plethora of new entrants into the non-bank lending space, albeit over a longer period as our private debt market is significantly smaller, less sophisticated, and in several respects, different from our northern hemisphere peers. The key is to promulgate regulation, which is relevant, implementable and efficient. A one-size-fits-all approach could do more harm than good.

While increased regulation may initially present challenges for fund managers in terms of compliance costs, it could lead to enhanced market confidence and potentially attract more investors who previously shied away owing to perceived risks. Additionally, regulations around environmental, social, and governance (ESG) investments may push private debt funds to integrate sustainability criteria into their investment strategies, which could reshape the market landscape moving forward.

What emerging trends in private debt do you foresee shaping the market in 2025?

Looking ahead, several key trends are likely to shape the private debt market – particularly in Australia. These include increased offshore and institutional investor participation, greater adoption of technology and data analytics for risk assessment, and a continued focus on ESG factors.

In response to the volatile macroeconomic landscape, family offices worldwide are re-evaluating their investment approaches, particularly considering higher capital costs and evolving returns from non- traditional asset classes. Many are diversifying beyond public markets and turning to private debt.

In Australia, this comes at a time when the demand for housing is significant – as the population grows, housing supply remains insufficient, and prices continue to climb – and is fuelling demand on both the borrower and investor side.

Despite the challenges posed by market dynamics, quality housing and commercial assets in prime locations across key cities remain attractive for family offices and institutional investors. Lending via private debt provides a compelling opportunity for investors seeking attractive, determinable income uncorrelated to market volatility. Add to that robust governance, a sophisticated investment sector and solid market dynamics.

Australian real estate private debt becomes an attractive option for foreign and local investors alike, providing a positive platform for sustainable growth in the coming year, and as such, the private debt sector will continue to evolve, responding to both opportunities and challenges from regulatory, market and geopolitical developments.

- Morgan Stanley | Private Credit Outlook