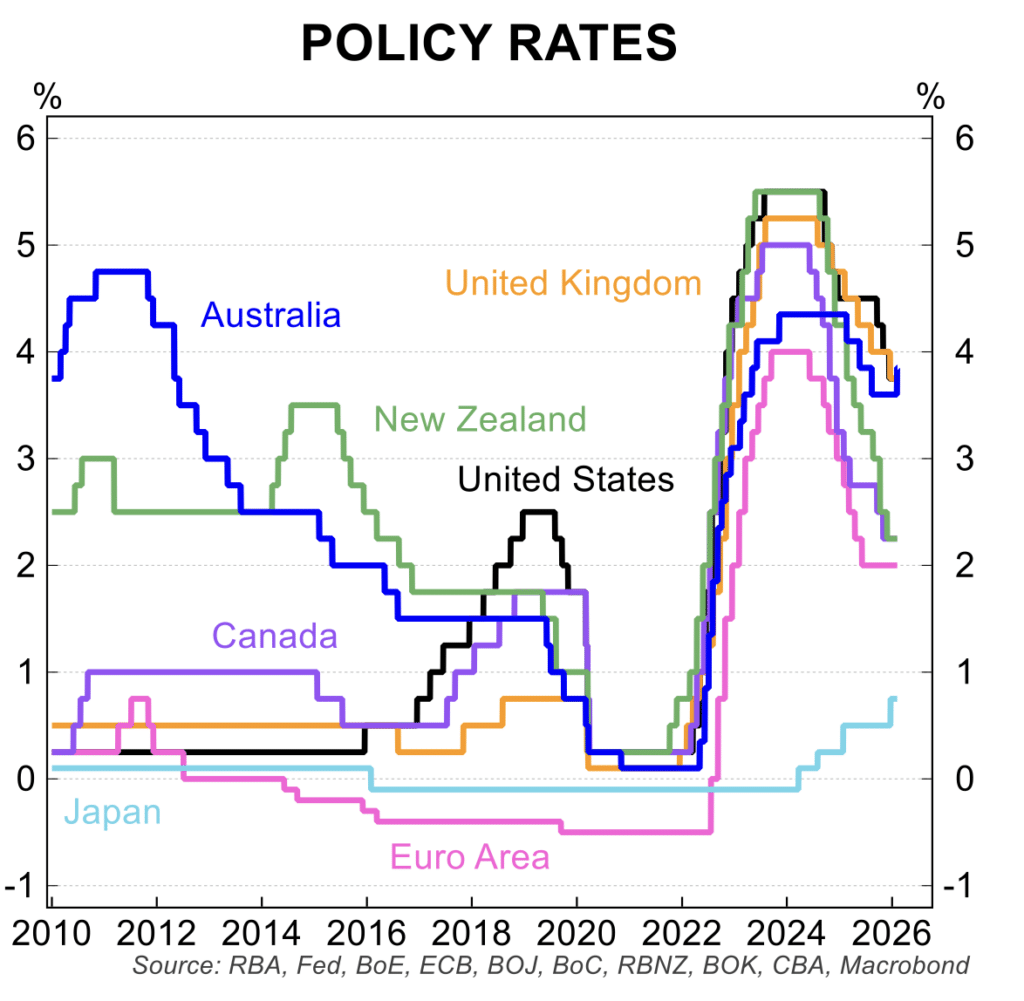

The sudden and unexpected about-face in economic conditions saw the RBA move from cutting interest rates with a bias for more cuts in August 2025, to hiking them with a bias for more hikes in February 2026.

In simple terms, the facts on the economy changed.

The defining changes in that six months were:

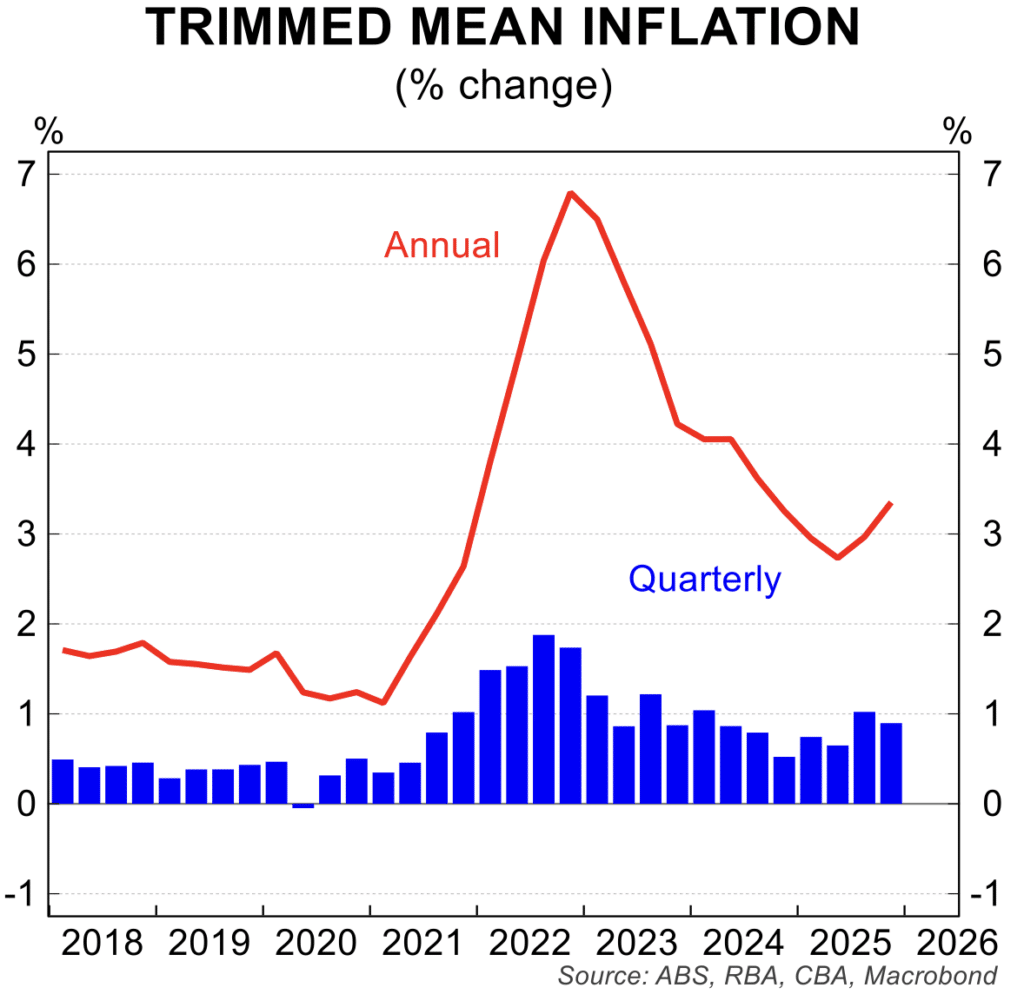

- Higher inflation in both the September and December quarters.

- A drop in the unemployment rate in December.

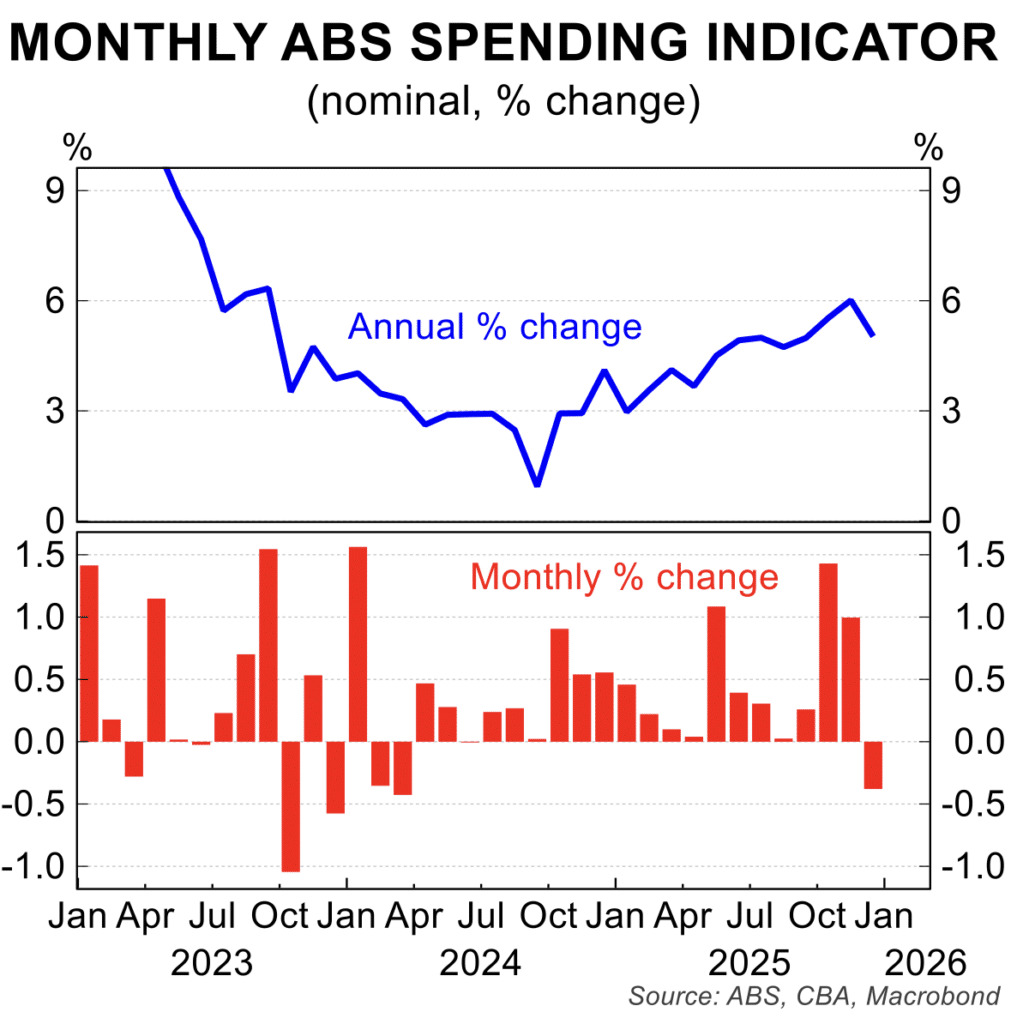

- A pick up in household spending in October and November.

- Unexpected resilience and stability in the global economy in the wake of geopolitical issues and policy ructions in the US.

After the February interest rate hike, RBA Governor Michele Bullock avoided giving substantive forward guidance on the future path for interest rates. Rather, she reiterated the RBA view that future policy moves will be dependent on the data flow, especially for inflation and the labour market.

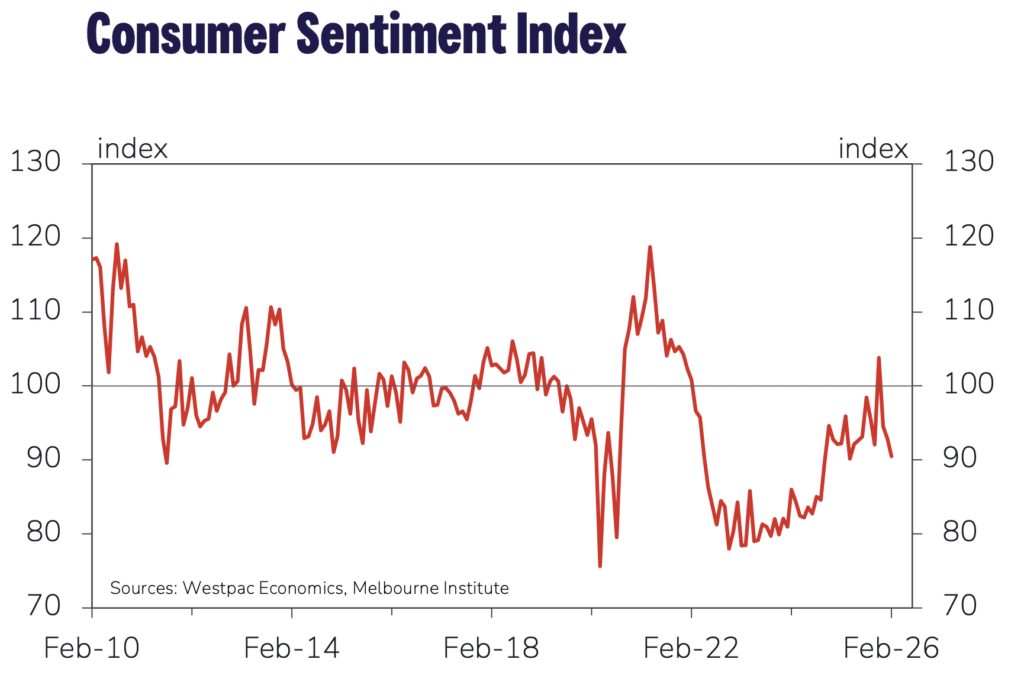

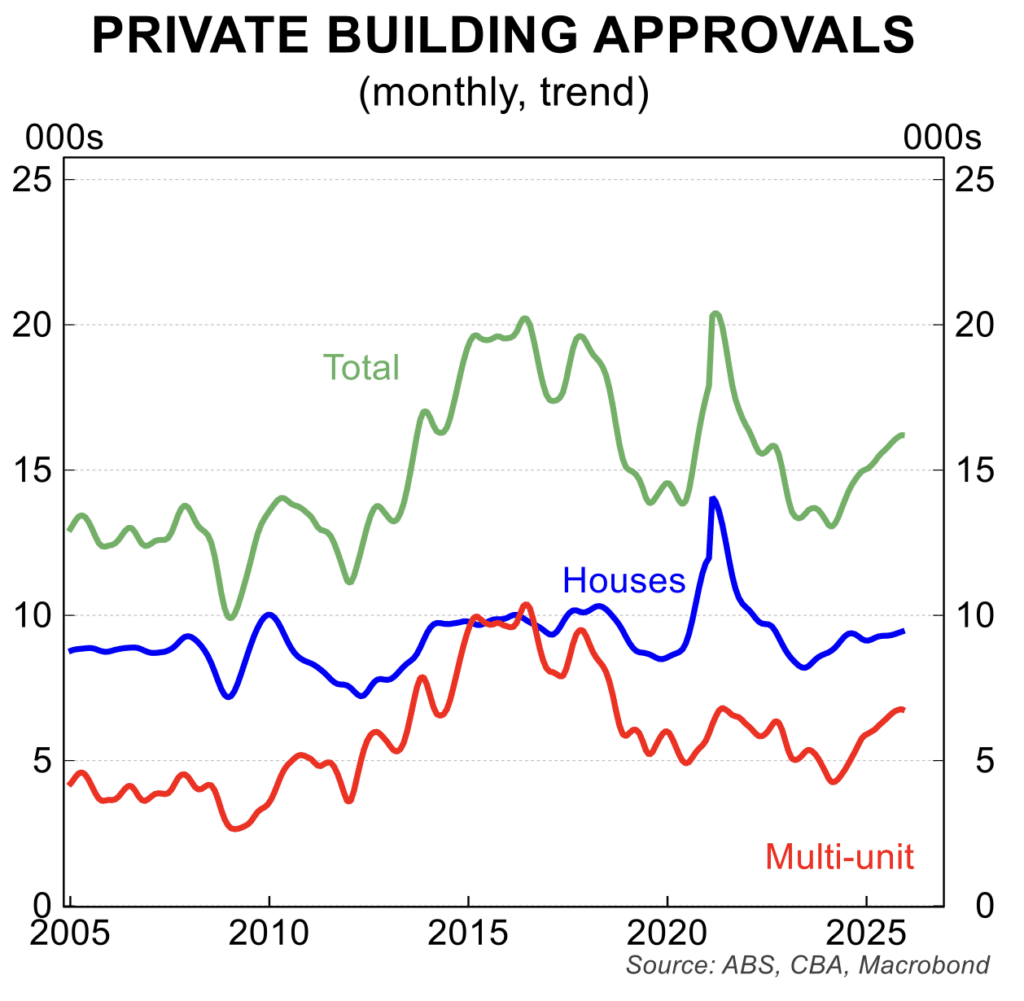

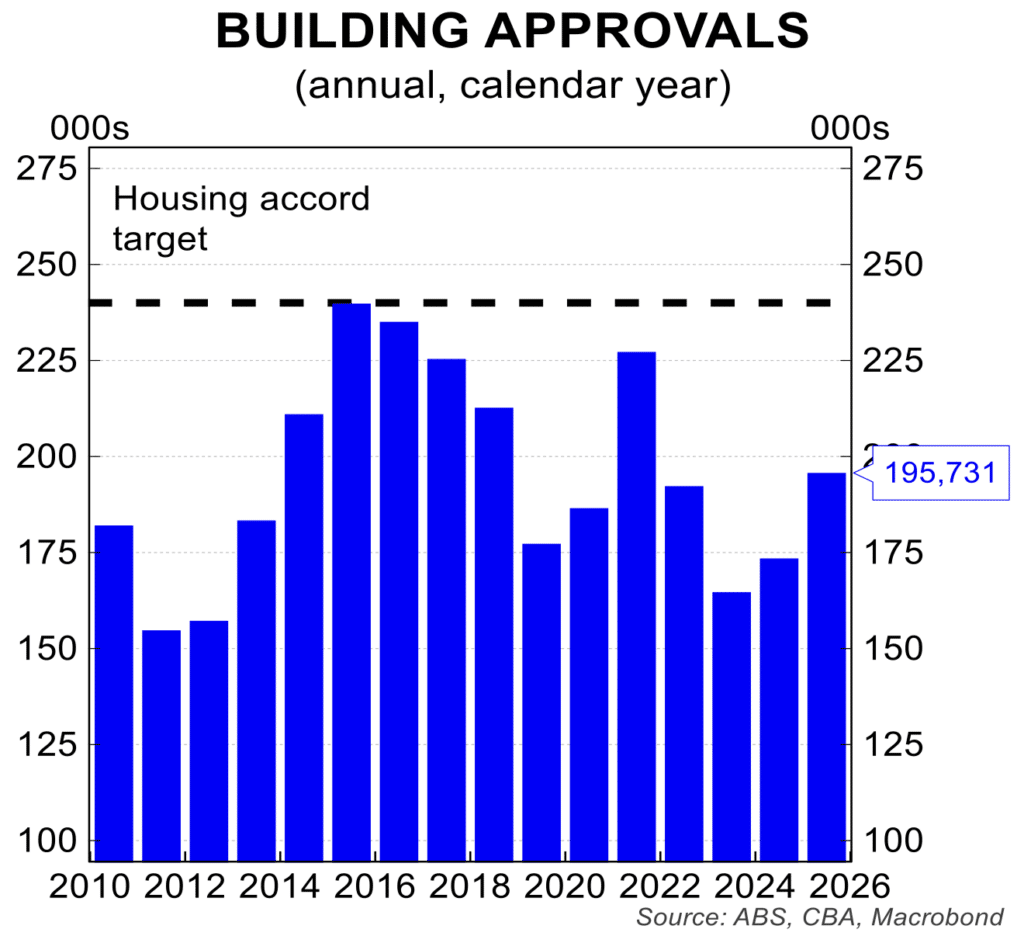

In data since the rate hike, there has been confirmation that household spending growth is registering moderate growth; business investment is lifting; unfortunately the recovery in the number of dwelling building approvals has stalled while consumer sentiment remains pessimistic.

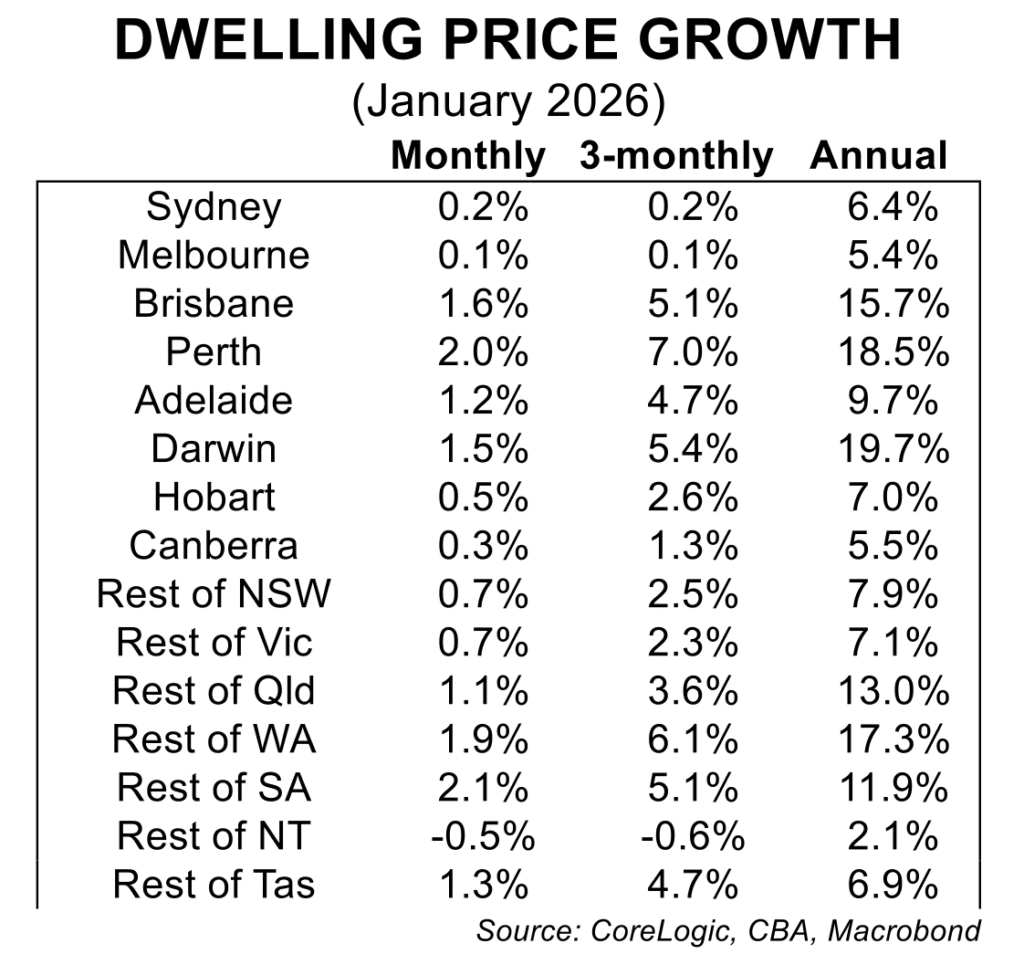

The recent volatility in the economic data is showing up in employment and the unemployment rate which, at this stage, appear to be improving after a period of weakness around the middle of 2025. House prices are rising but at a slower pace. Prices in Melbourne and Sydney are weak, but remain strong in Perth, Adelaide, Brisbane and Darwin.

Key data

Below is an update of key trends in the economy over the past month:

- The quarterly trimmed mean inflation rate rose 0.9 per cent in the December quarter for an annual increase of 3.4 per cent. In monthly terms, headline inflation rose 0.2 per cent in December to be 3.8 per cent higher annually. Headline inflation continues to be impacted by increases in public sector administered prices, including the unwind of householder electricity subsides, higher public transport fares and excise hikes. The annual increase in market prices remains well contained at 2.5 per cent.

- Household spending fell 0.4 per cent in December, the first monthly decline since 2024. The drop followed two solid months where spending rose 1.0 per cent and 1.4 per cent, respectively, results heavily influenced by Black Friday sales. That said, household spending growth is consolidating, at a steady pace, with the cash flow benefits of 2025 interest rate cuts, a positive wealth effect and the resilient labour market helping to support spending.

- Consumer sentiment fell 2.6 per cent in February with ‘current conditions’ and the ‘medium term outlook’ weakening. At 90.5 index points, sentiment remains at a level where there are more pessimists than optimists. This suggests downside risks to aggregate household spending in early 2026.

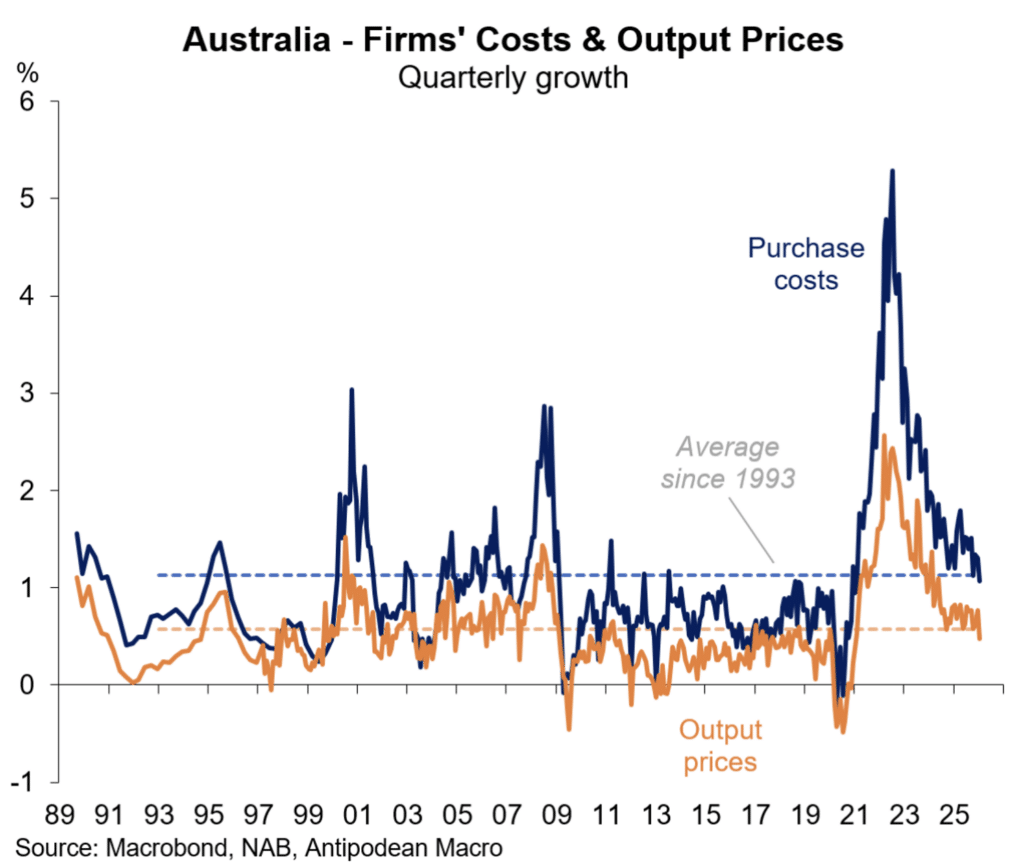

- The NAB business survey showed business conditions falling 3 index points to +7 while business confidence rose 1 point to +3 points. Both of these measures are consistent with only moderate economic growth. From an inflation perspective, there was critical news on business costs and output prices, both of which eased to fresh four year lows and are now below the 30 year average. This is consistent with the RBA 2 to 3 per cent inflation target.

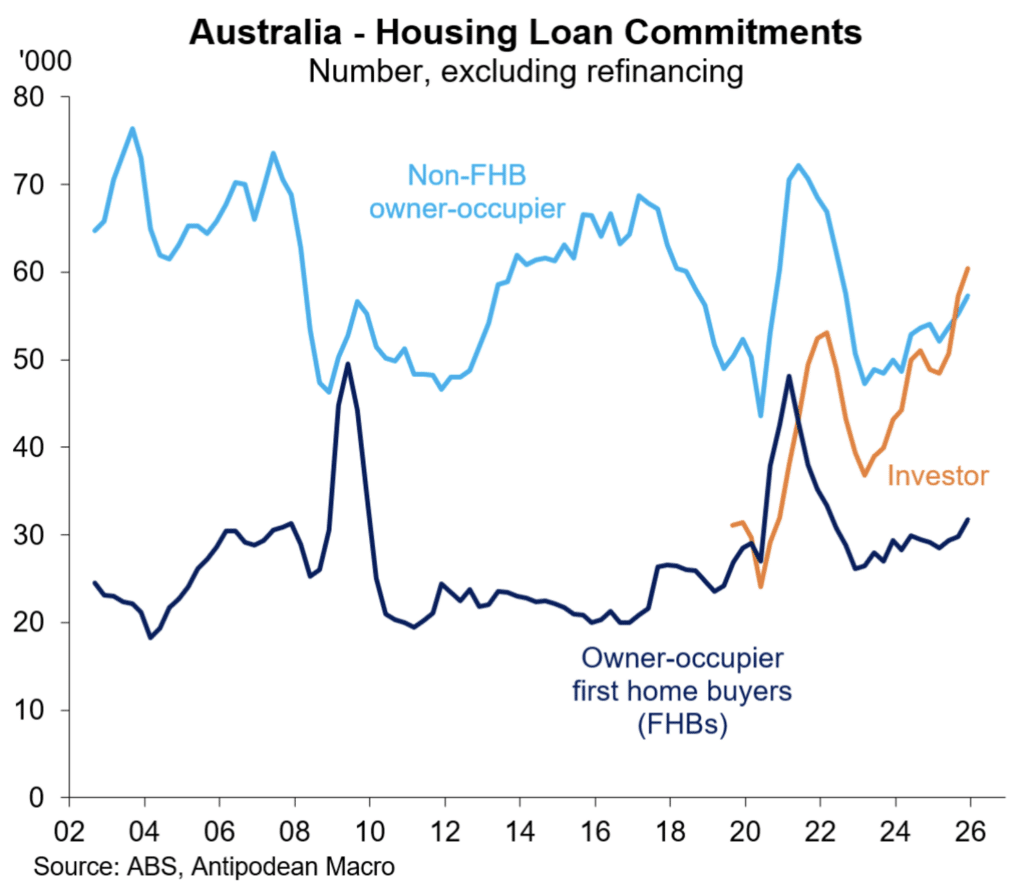

- The number of new housing finance commitments rose 5.1 per cent in the December quarter to be 13.4 per cent higher than a year ago. Within that strength, the number of loans for first home buyer jumped 6.8 per cent, with 119,400 first home buyers entering the dwelling market in 2025. There was also strength in investor activity, with the number of loans up 5.5 per cent in the quarter.

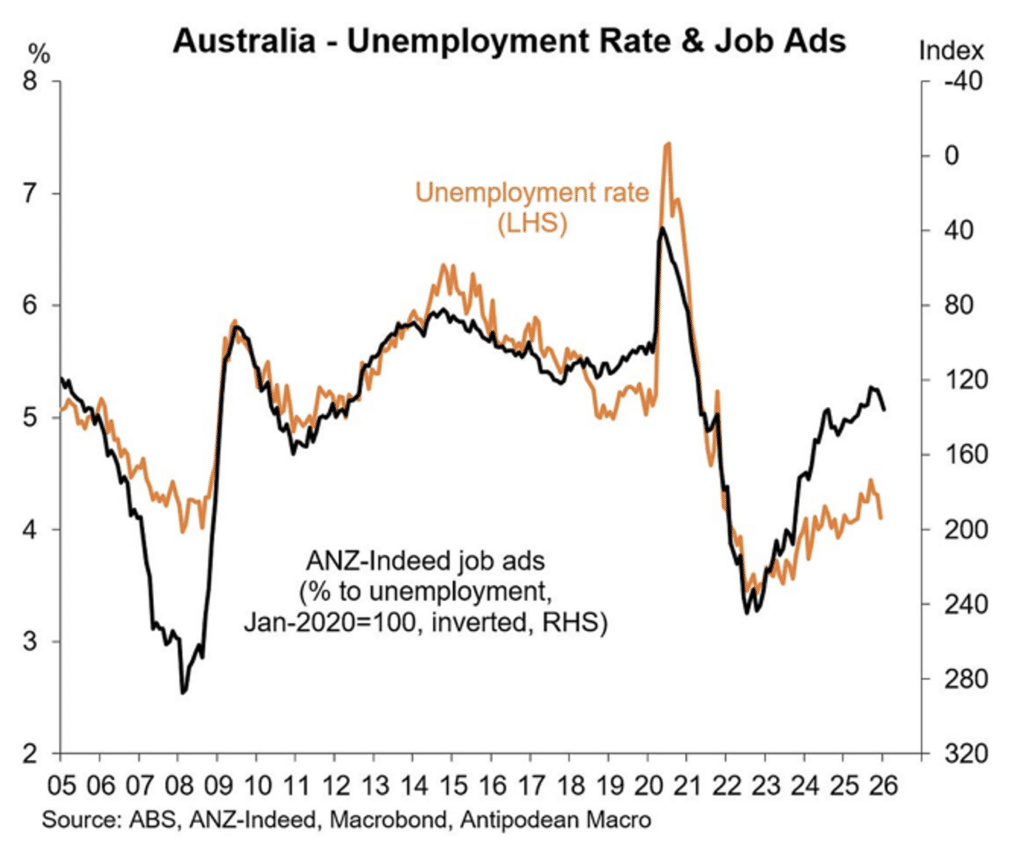

- After sharp falls in 2025, job vacancies and advertisements have consolidated at lower levels. Over the long run, there is a strong correlation between job advertisements and the unemployment rate. This relationship broke down in the last two years, largely because of strong increases in government employment in a range of care services. Given this source of jobs growth is slowing, the current level of job ads is consistent with the unemployment trending towards 5 per cent.

- Having risen strongly during 2025, the number of new building approvals has stalled. The number of dwelling building approvals fell 15 per cent in December after rising 13 per cent in November. This is a pattern in concentrated in approvals of multi-units and apartments. That said, the number of new dwelling approvals has risen in each of the last two years.

RBA monetary policy and the current market pricing for the cash rate

The hawkish assessment from the RBA following the February interest rate hike has seen the market price in approximately two further 25 basis point increases by early 2027, to a cash rate of 4.20 per cent. That said, there has been a moderate pull-back in hiking expectations given a range of softer data since the RBA hike.

Internationally, the interest rate cutting cycle is nearing an end. This is because of indications of inflation consolidating around central bank target levels and the lagged effect of earlier interest rate cuts. The notable exception is the US, where interest rate cuts are being hotly debated.

House prices

Supply shortage, strong underlying demand and resilience in the labour market continue to support rising house prices. Dwelling prices rose 0.8 per cent in January, a slight up tick from 0.6 per cent rise in December. Dwelling prices rose 9.4 per cent over the year to January.

There remains a major divergence in price pressures between cities – in the three months to January, dwelling prices rose just 0.1 per cent in Melbourne and 0.2 per cent in Sydney. This contrasts with the price booms in the last three months where Perth prices are up 7.0 per cent, Darwin 5.4 per cent, Brisbane 5.1 per cent and Adelaide 4.7 per cent.

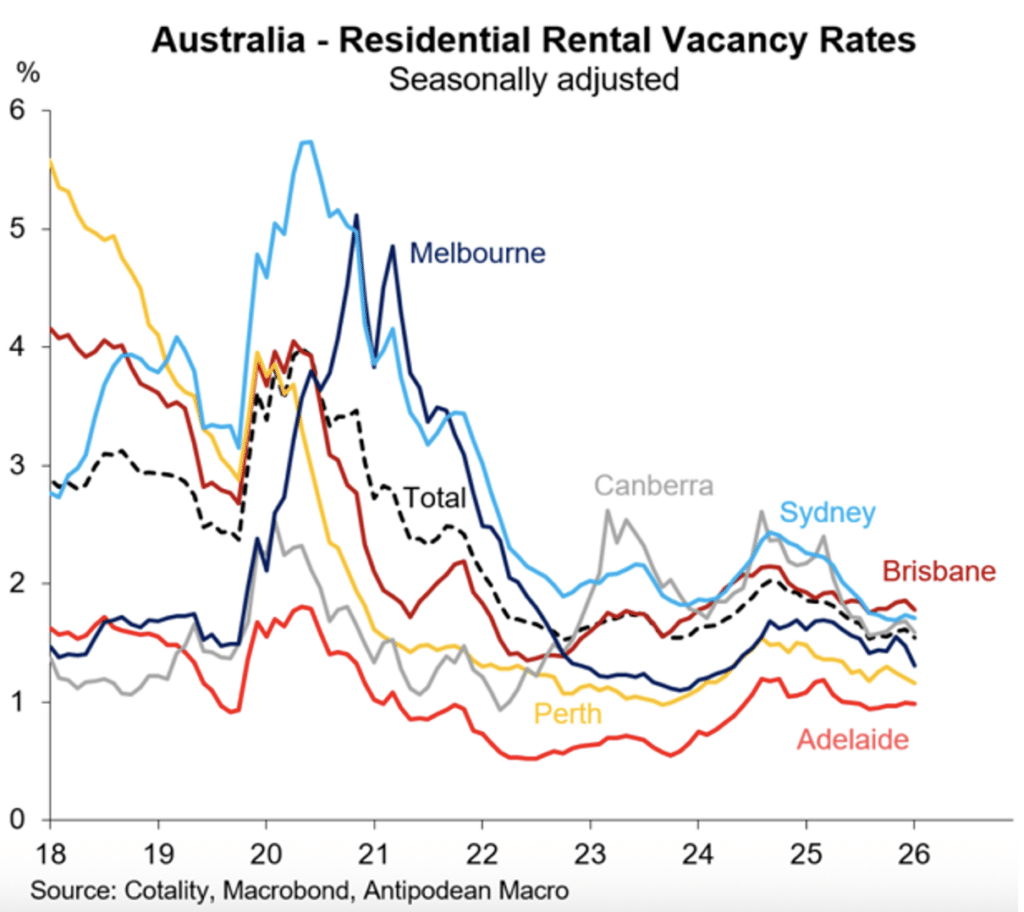

The pressures on dwelling prices remain little changed: there is solid demand from population growth, sluggish supply as construction remains below requirements and a relatively firm labour market. While upward pressure on dwelling prices from these factors is moderating, until they materially change dwelling prices are likely to be skewed higher.

The rental market remains tight – rental vacancy rates in the capital cities are near record lows. The same issues remain at play – strong demand for rental properties and a limited amount of new supply are underpinning rents. The tight rental market has seen a strong lift in investor demand.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.