Over the past three months, the run of economic news has been pointing to stronger activity with the composition of that growth increasingly favourable. Business investment and dwelling construction are stronger, while household consumption continues to recover.

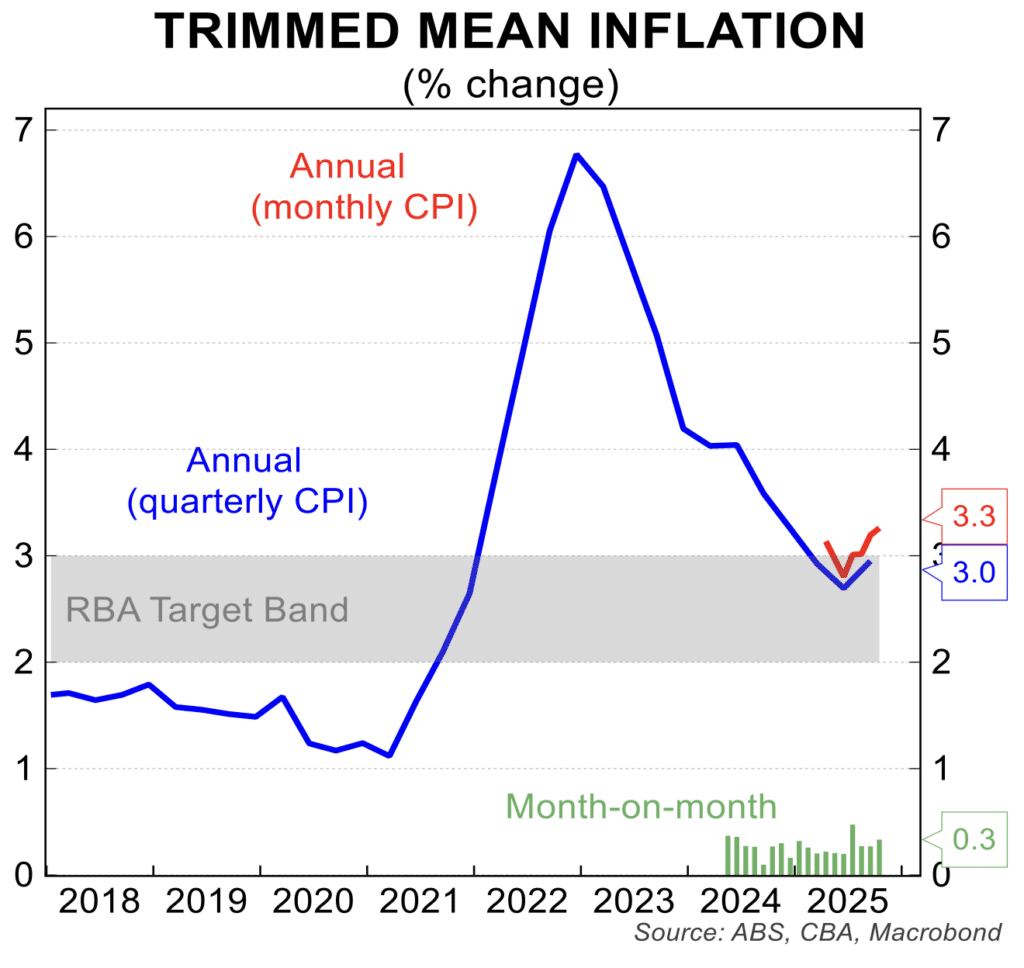

At the same time, and at odds with this better news, the labour market has shown signs of softness. The upturn in inflation is a concern for the RBA despite the fact that the drivers of the inflation increase appear to be one-offs.

The interest rate outlook has reversed from a position where three months ago, a cash rate below 3 per cent was priced in for 2026, to one now where the outlook is for the cash rate to be hiked above 4 per cent in late 2026. The current cash rate is 3.60 per cent. The RBA has reinforced this pricing, by indicating that the risks for interest rates are towards a hike.

Interest rate cuts remain the norm across the global economy with the US Fed continuing its rate cutting cycle in December. Since late 2023 / early 2024, all major central banks have embarked on interest rate cutting cycles – no central bank (other than Japan which is an odd exception) has started an interest rate hiking cycle.

Key data

Below is an update of key trends:

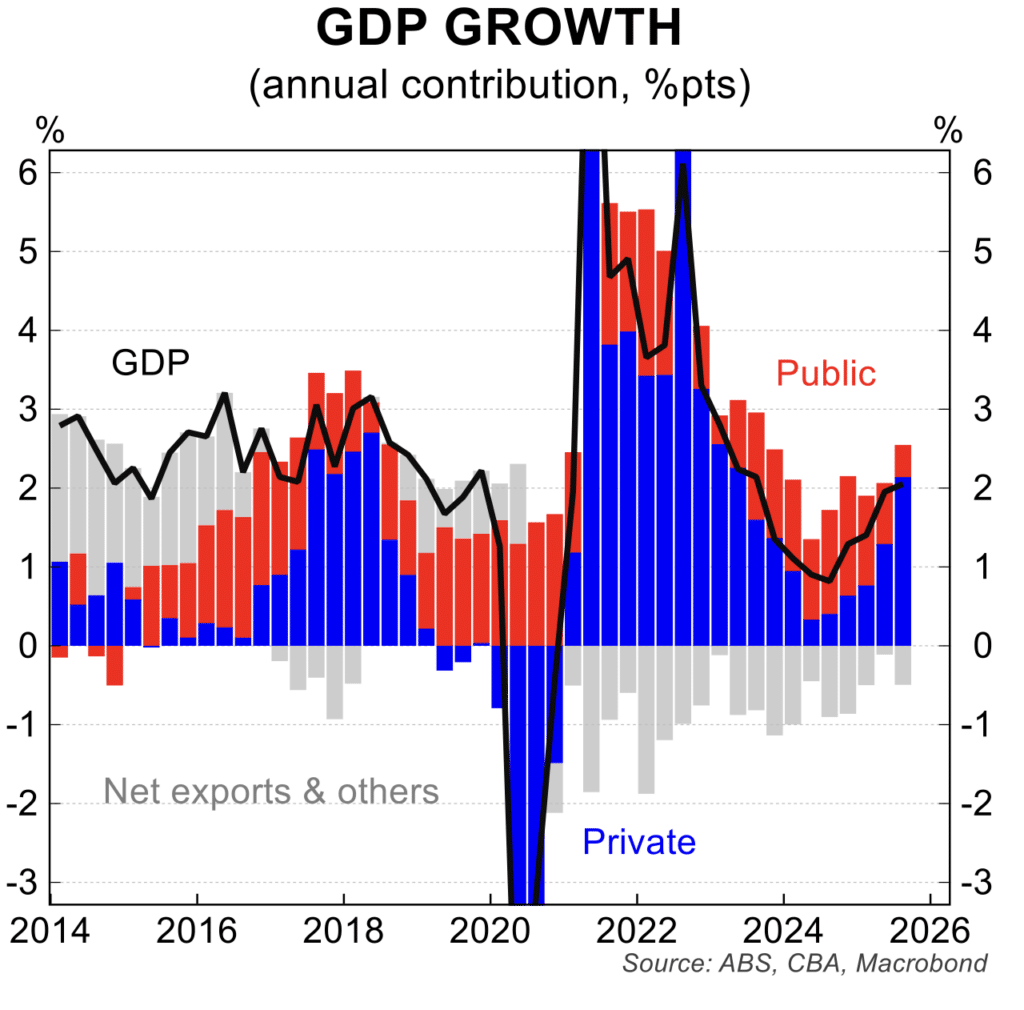

- GDP grew 0.4 per cent in the September quarter to be 2.1 per cent higher than a year ago. Annual GDP growth was the strongest since 2023, compared with the low of 0.8 per cent in 2024. The contribution to growth from the public sector is slowing.

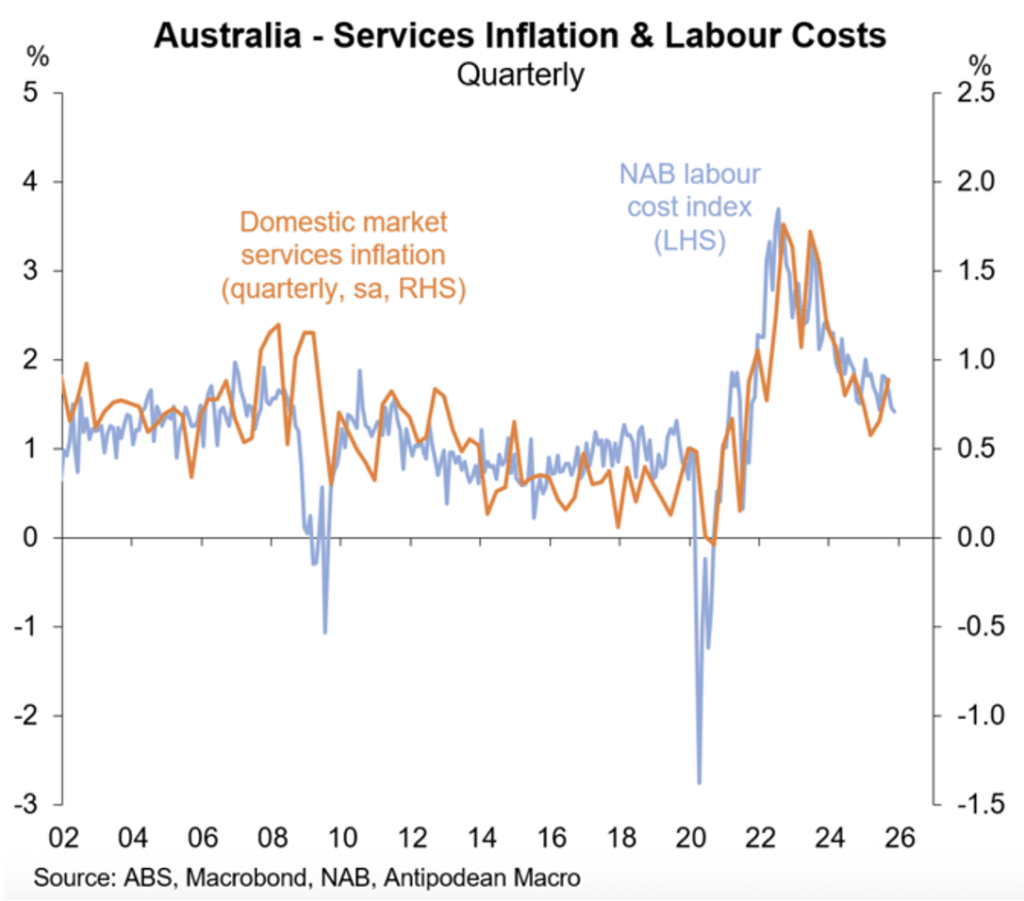

- Headline inflation rose 3.8 per cent in October with the trimmed mean rate rising to 3.3 per cent. The monthly inflation data are volatile and the RBA has warned against reading too much into monthly results. It remains the case that the bulk of the inflation pick up was due to increases in ‘administered prices’ which are heavily or totally influenced by government decisions – electricity and childcare subsidies, excise increases, public transport fares and postage costs by way of example.

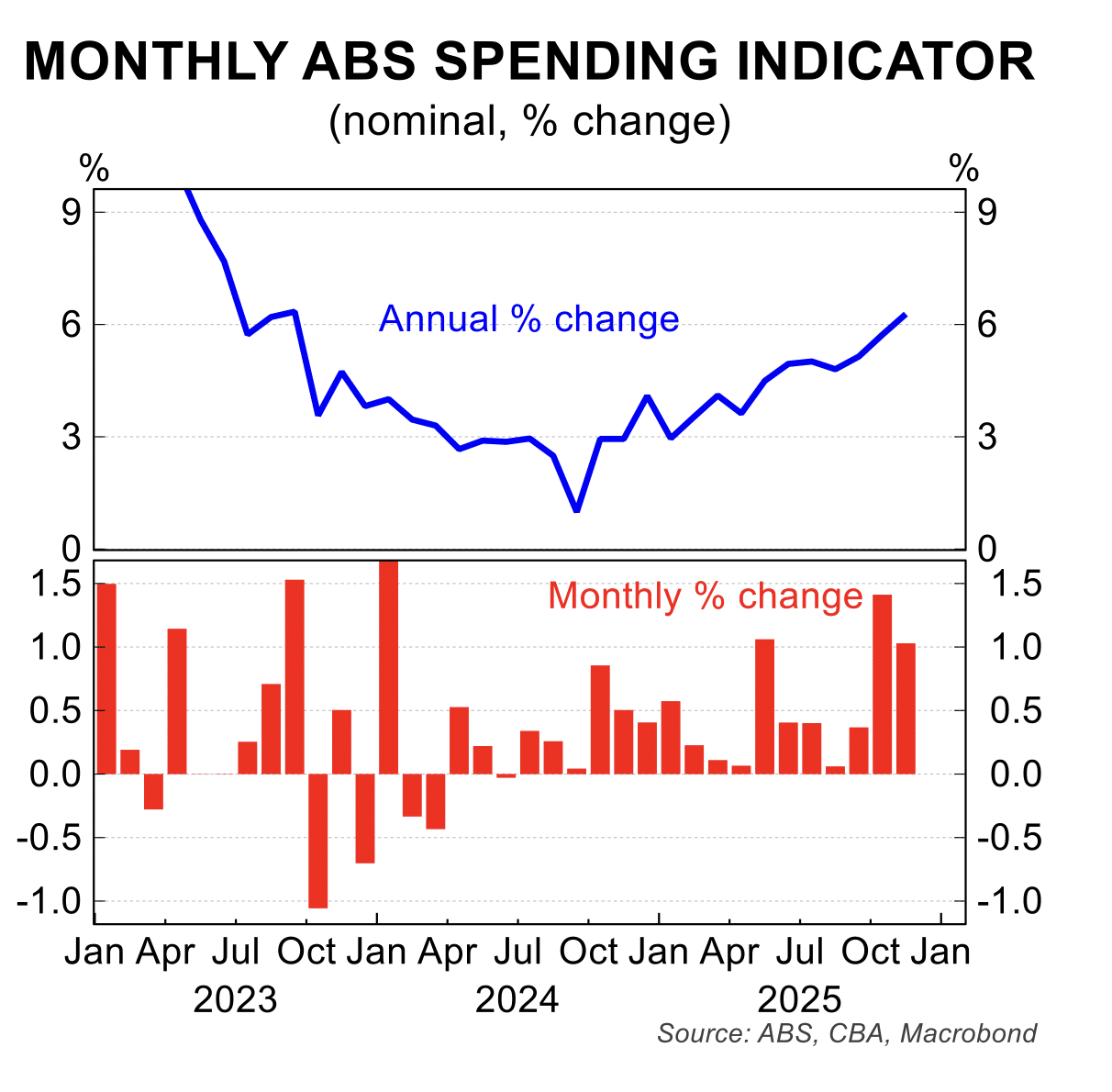

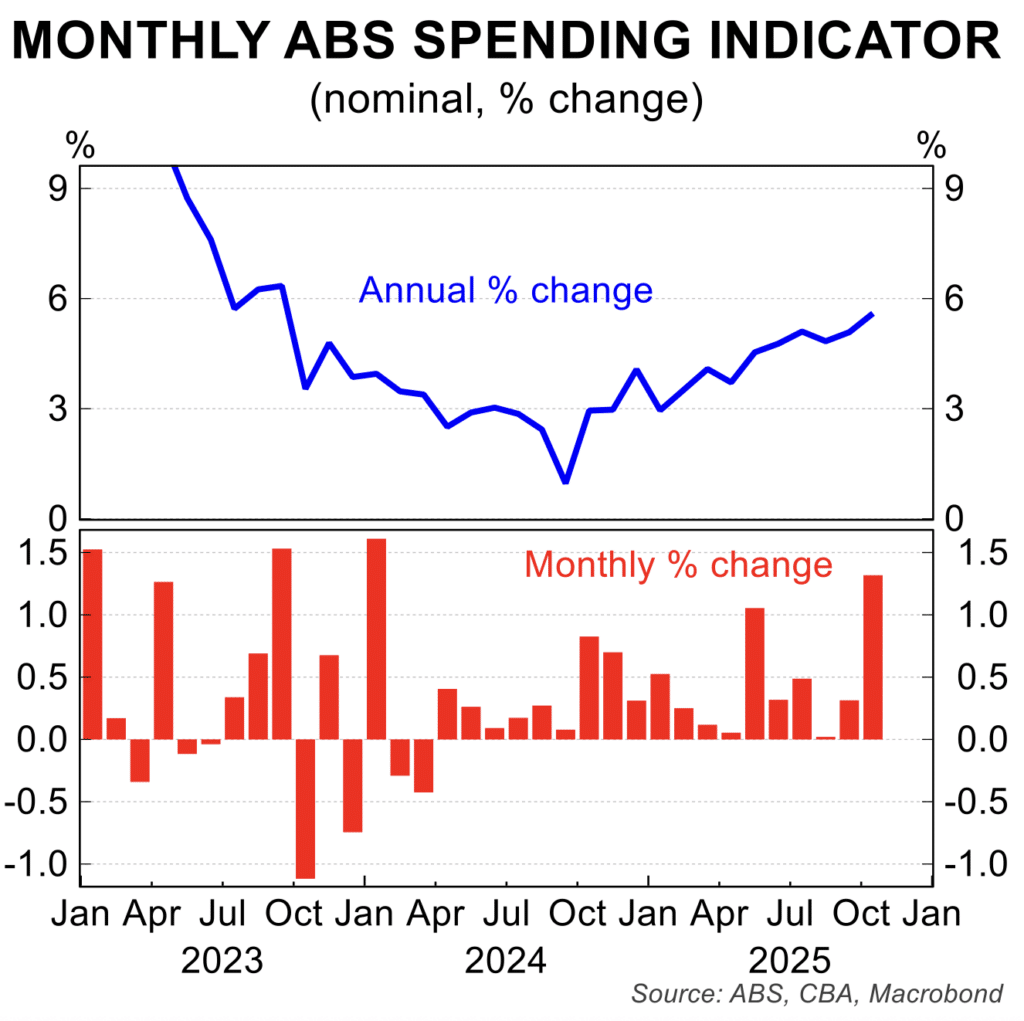

- After two months of softer results, household spending growth jumped a strong 1.3 per cent in October to be 5.6 per cent higher than a year ago. The annual growth rate was at a two year high. While the pick up was in part due to spending related to the black Friday sales, household finances are benefiting from the three rate cuts to date, steady wages growth and the wealth effect from rising house price and gains in the stock market.

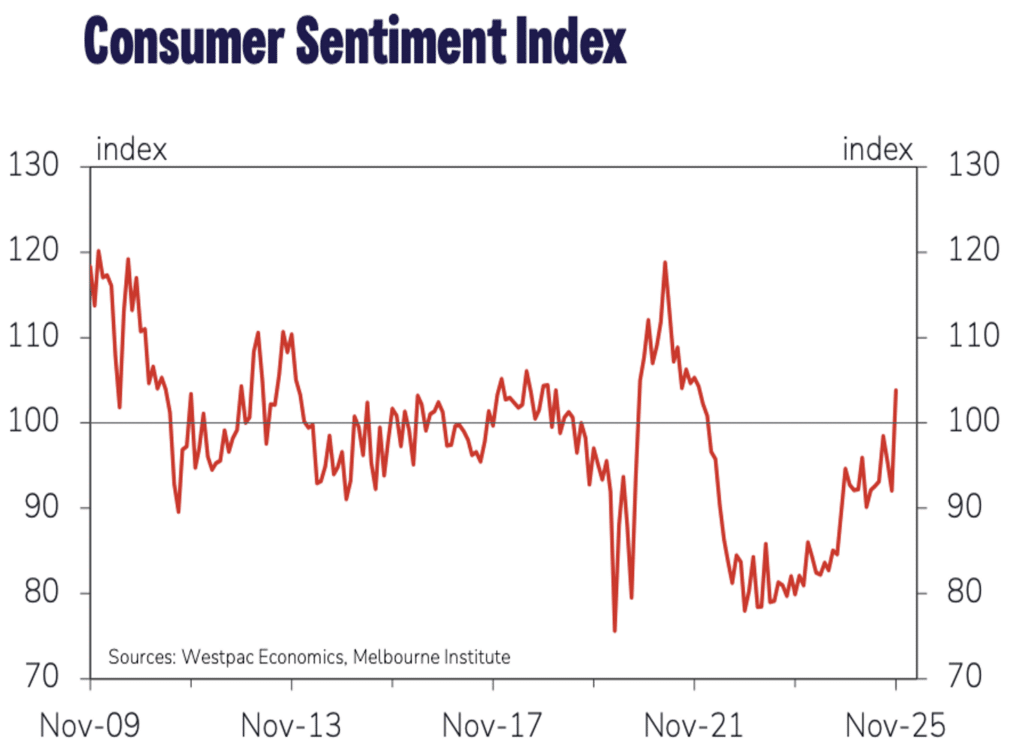

- The Westpac – Melbourne Institute index of consumer sentiment surged in November rising 12.8 per cent to a seven year higher (excluding COVID effects). Low unemployment, cash flow benefits from rate cuts and the wealth effect are all positive. Note: the ANZ measure for consumer confidence is lower than the Westpac measure – it is not clear why there is the divergence between the two series.

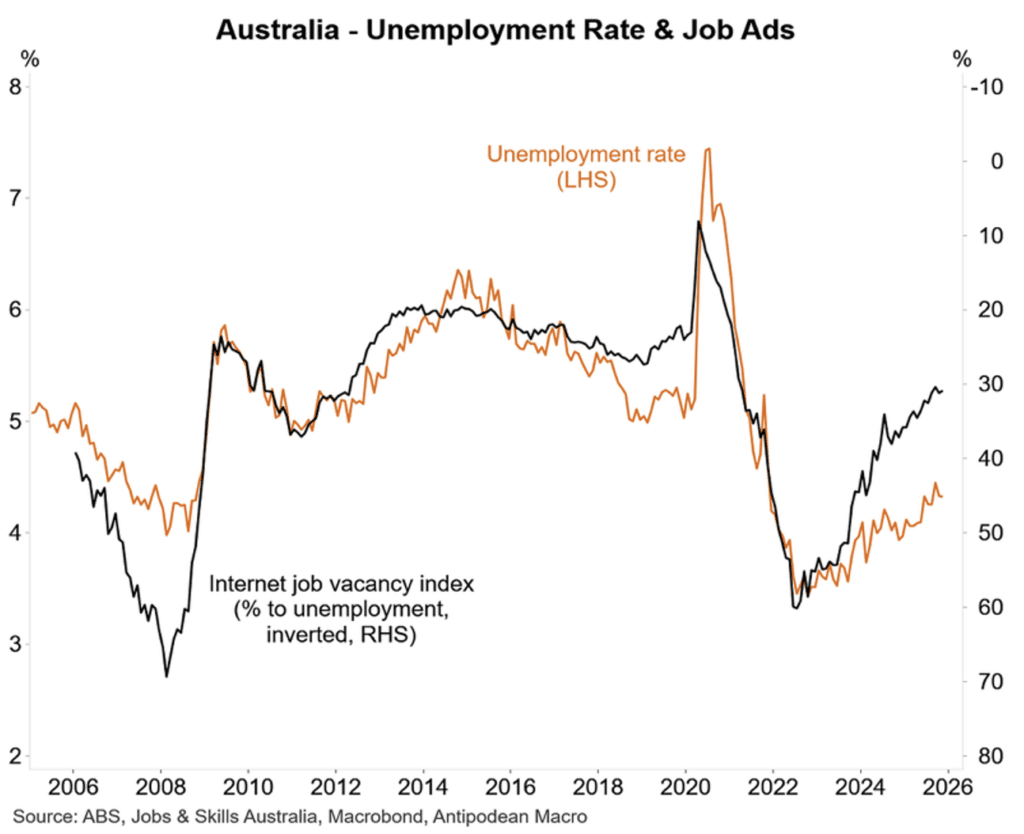

- The labour market data remain soft. Employment fell 21,000 in November, driven by a 57,000 fall in full time jobs. In the last four months, the average monthly increase in employment is just 5,000, the weakest result in the post pandemic era. While the unemployment rate was steady at 4.3 per cent, the underemployment rate rose to a 14 month high of 6.2 per cent. The number of hours worked in the economy continues to weaken. With job ads and vacancies still falling to fresh lows in the current cycle, the outlook is for further weakness in the labour market in the months ahead.

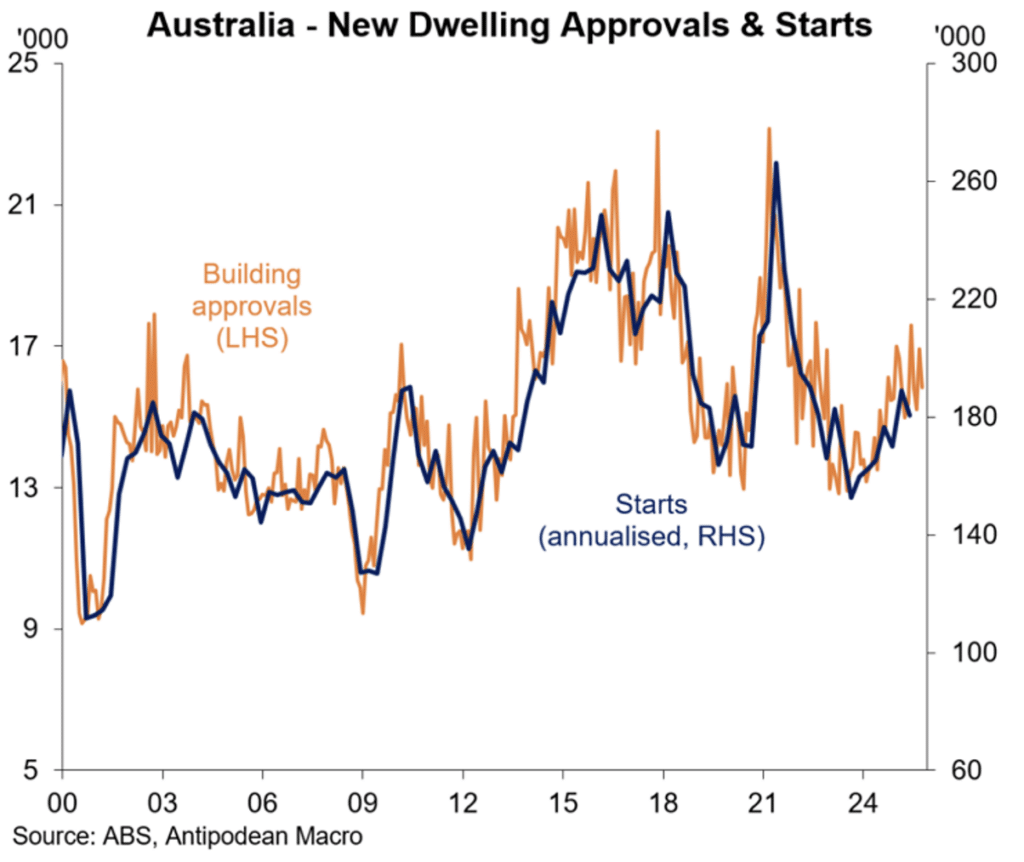

- There remains volatility in the monthly number of building approvals. After a rise of 12 per cent in September, building approvals dipped 6 per cent in October. The general trend remains towards an upturn, aided by lower interest rates and various measures from the government that are designed to fast track new building. 2026 looks like it will be a strong year for dwelling construction.

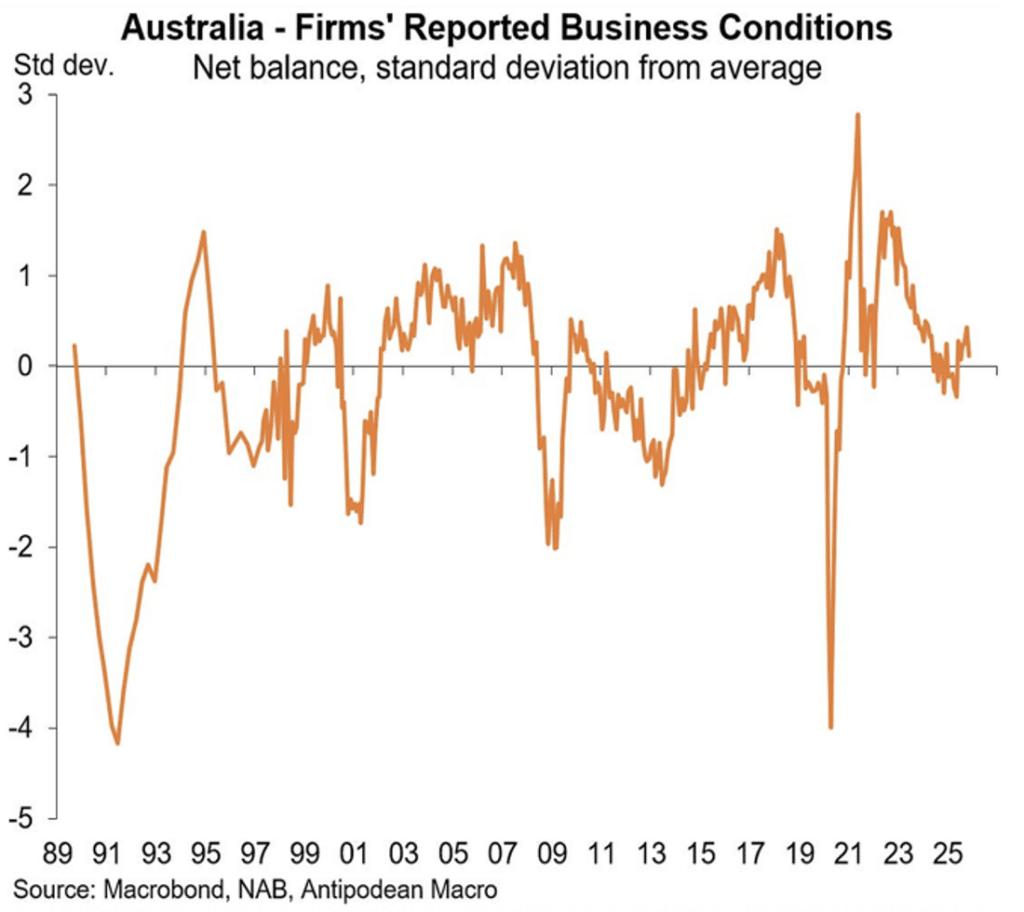

- There is only moderate news on the economy from the NAB business survey, which showed a sharp fall in business confidence and a smaller dip in business conditions in November. Inflation pressures in the business sector are well contained.

RBA monetary policy and the current market pricing for the cash rate

The about face on the outlook for interest rates has been extreme. Shortly after the third rate cut in the cycle from the RBA in August 2025, markets were pricing in a sub-3 per cent cash rate for the first half of 2026.

As noted, signs of a broader economic recovery and the surprising jump in inflation has seen the market price in two hikes in 2026, with the implied cash rate rising to around 4.10 per cent if that comes to fruition. RBA Governor Bullock noted that interest rate cuts were not on the Monetary Policy Board’s agenda at its December meeting, and that interest rates would be increased if inflation remained high in the months ahead.

House prices

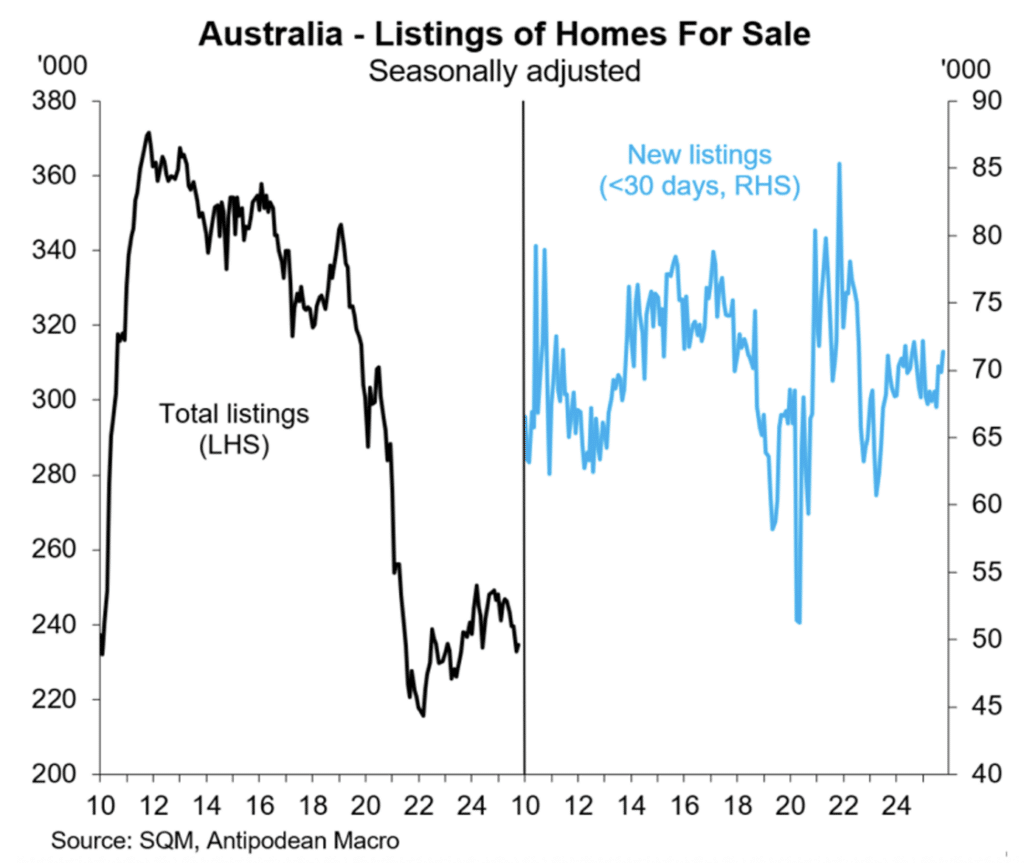

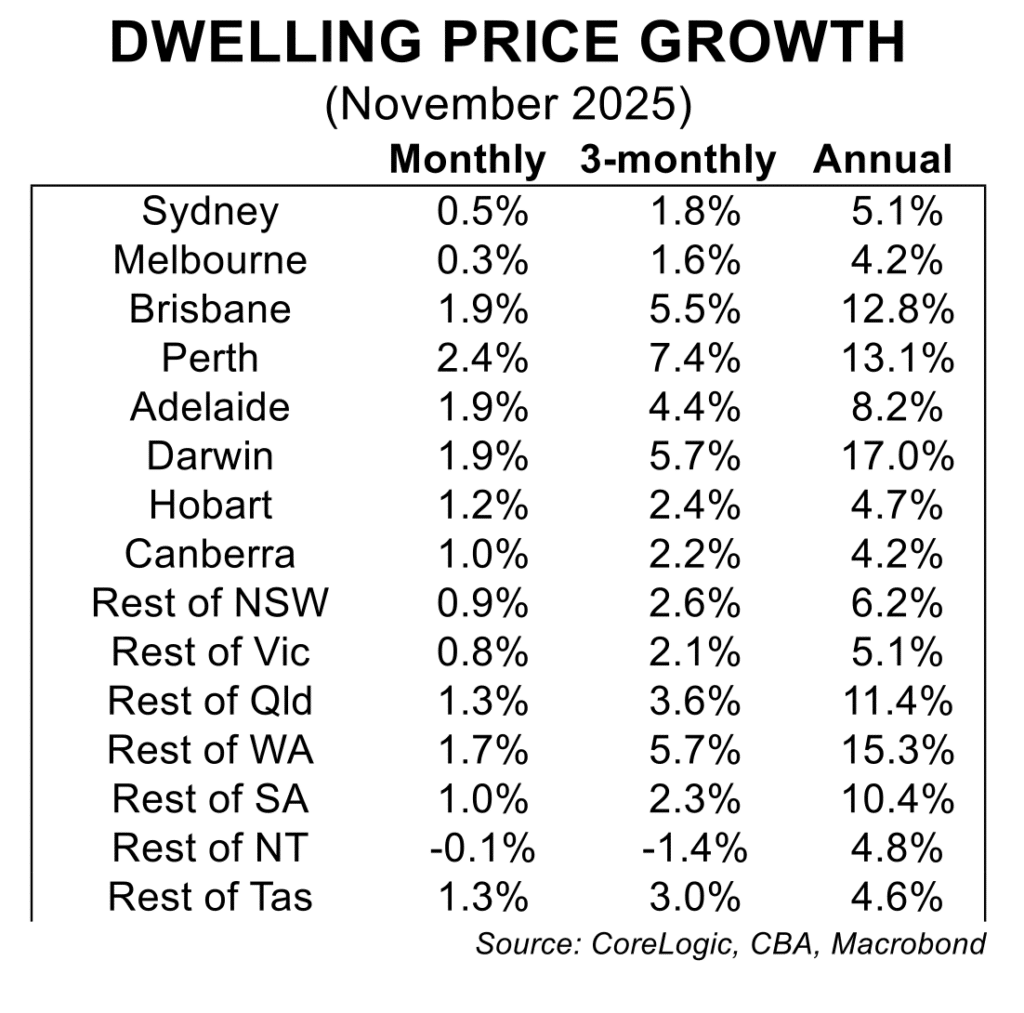

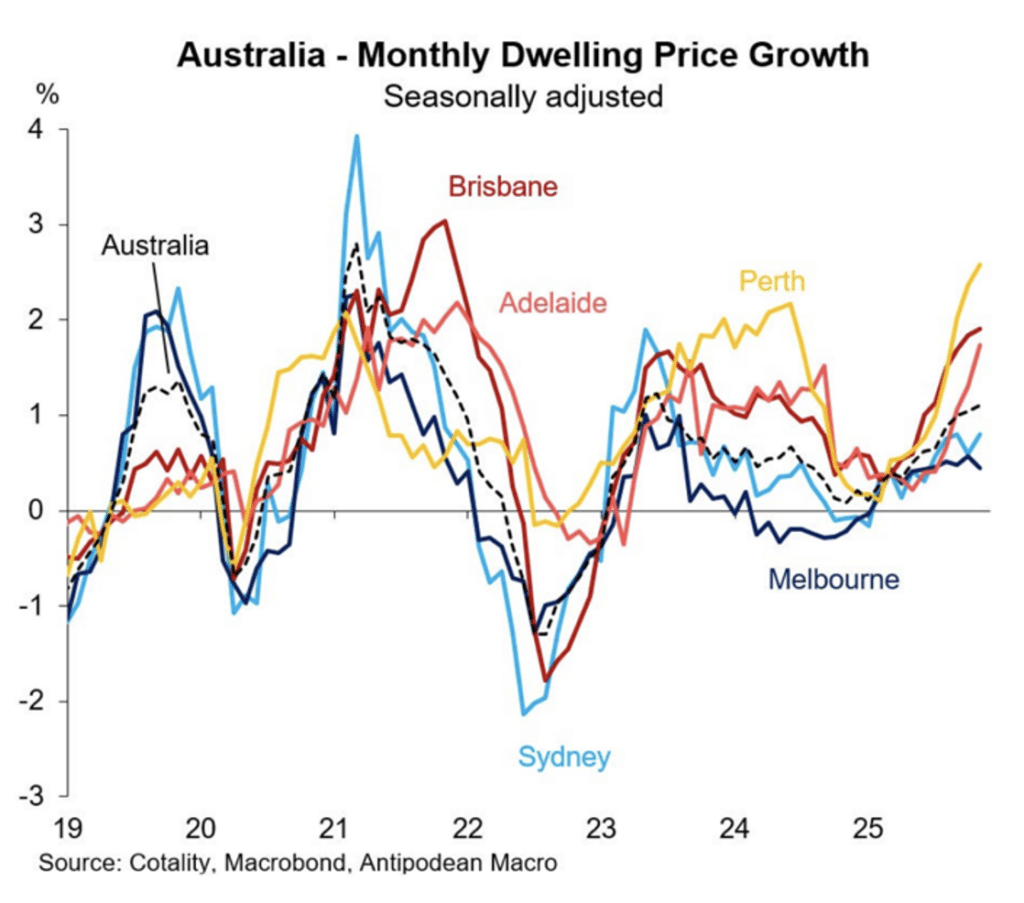

There is a fully-fledged upswing in house prices. Nation-wide house prices rose 1.0 per cent in November after rising 1.1 per cent in October with all cities experiencing gains. Prices have continued to lift in to early December albeit at a slower pace. In addition to the impact of strong demand from population growth, the chart below shows a shortage of dwellings listed for sale.

The Federal government’s 5 per cent deposit scheme has fuelled demand in the lower price segment at a time when investor activity has also increased. It remains the case that, despite the uptrend in new dwelling building approvals, there is a shortage of new dwellings relative to population growth.

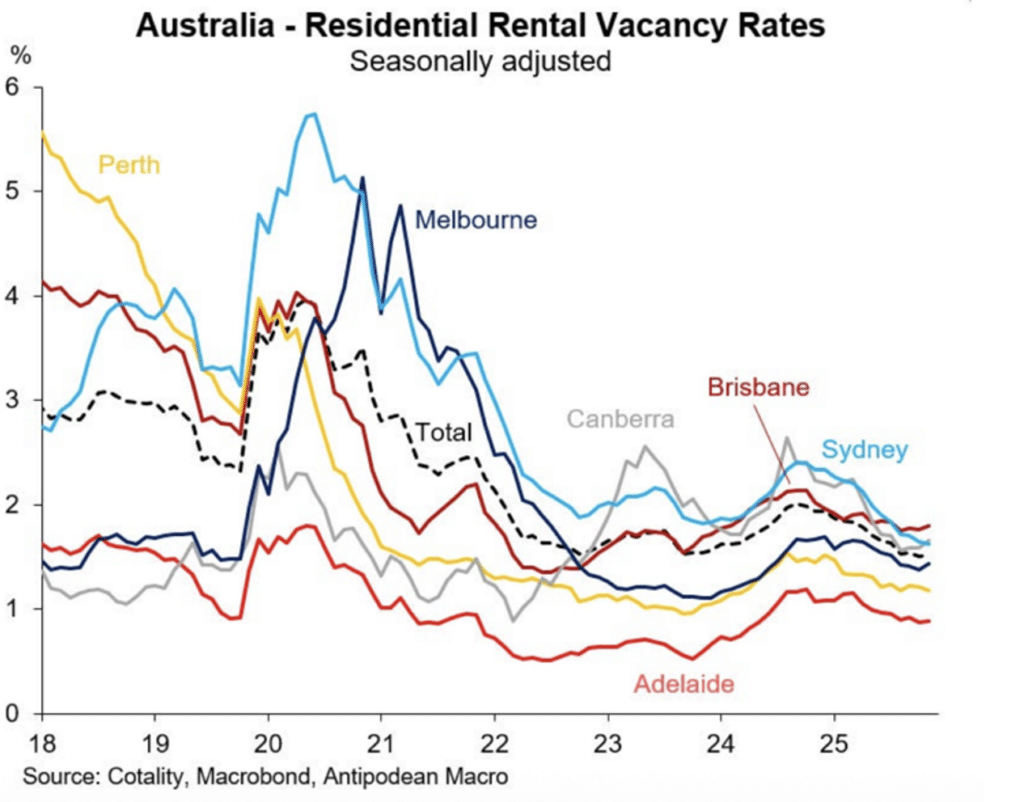

Rental vacancy rates remain low in most capital cities. This reflects the housing shortage. According to SQM Research, this is seeing higher asking rents from landlords. This follows a period where the growth in rents was easing. Rising rents are a signal that inflation pressures are building in the housing sector.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.