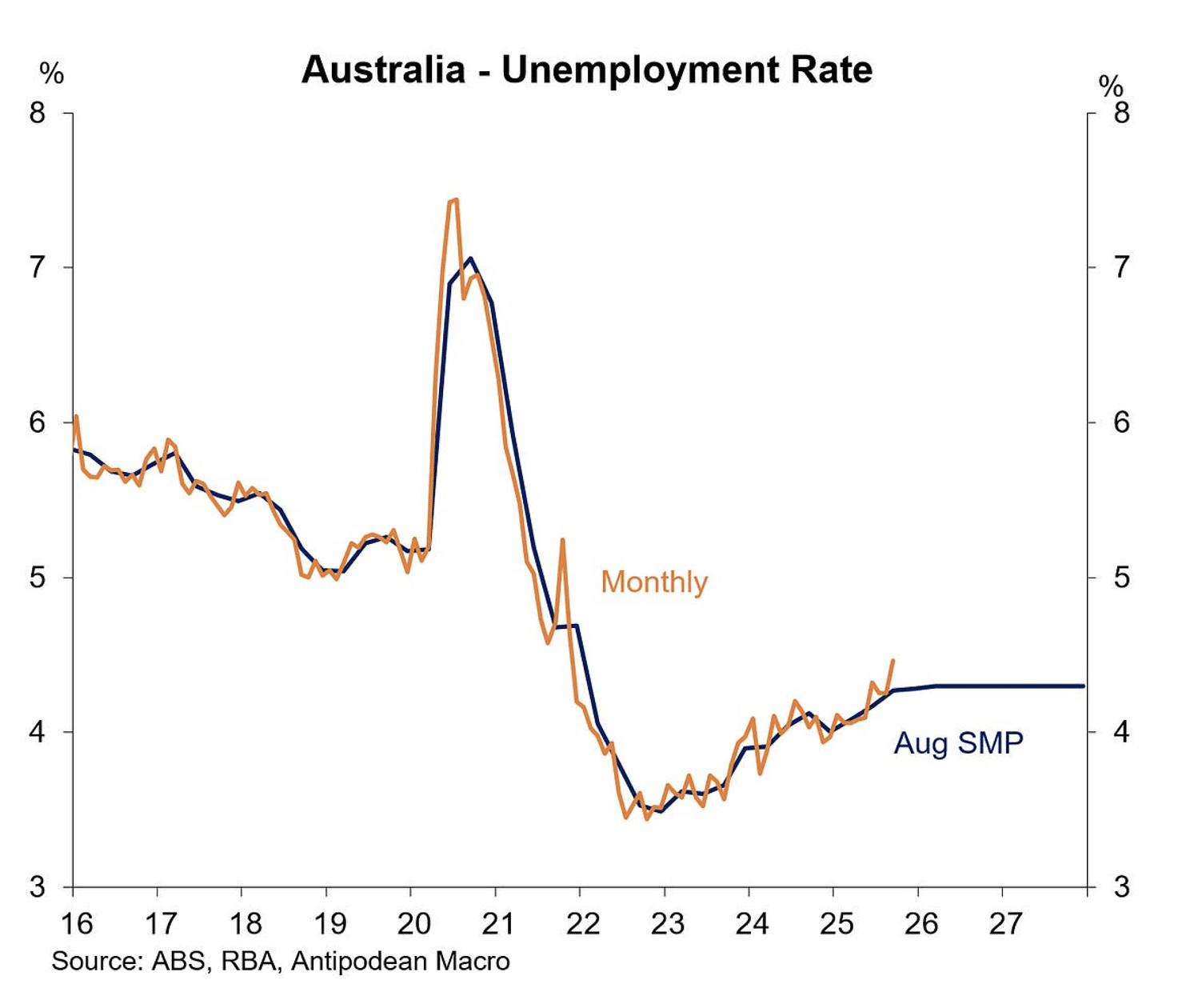

The economic recovery continues to unfold as geopolitical issues escalate

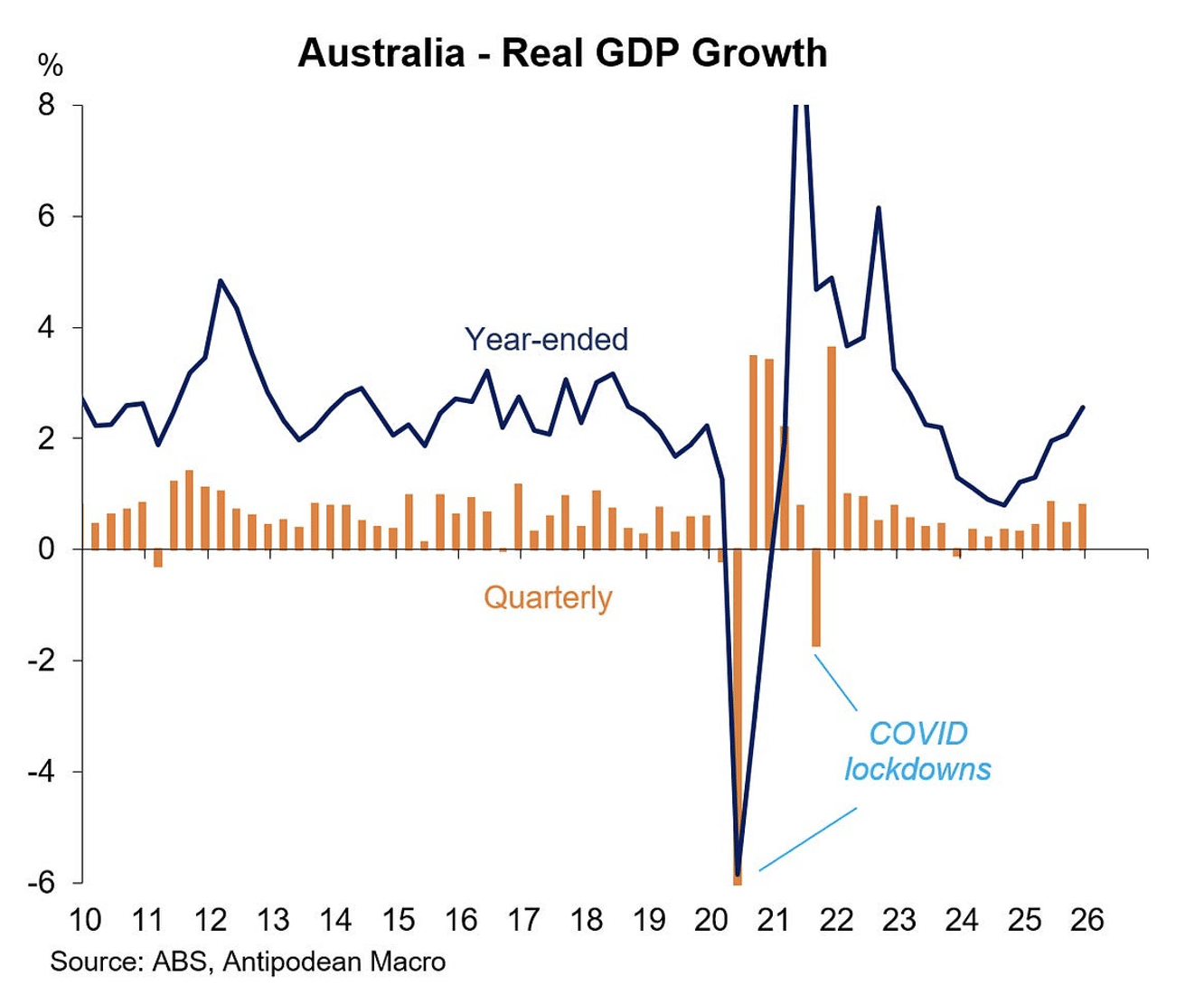

The earlier cautious optimism about an economic recovery is translating to confirmation about broader economic strength. While serious uncertainties dominate the global outlook amid elevated geopolitical threats to markets and economic activity, particularly in the Middle East, the domestic drivers of the economy are broadly positive.

A combination of prior interest rate cuts, moderate fiscal stimulus and an increase in commodity prices have helped to spark the more positive tone.