As we reach the end of 2025, I want to take a moment to reflect on the year we've had at Zagga.

When we started Zagga back in June 2017, had you asked me to look into my crystal ball, I can confidently say that I would not have predicted that 8.5 years later our business would have:

- originated over 300 loans

- for more than $3 bn in total advances

- with current active AUM in excess of $1.5 bn

- with both direct- and fund-focused investment options

- a team of 50 across Australia, New Zealand, Hong Kong, Singapore and the Philippines.

What’s most important is that we have remained firmly loyal to our core pillars of trust, transparency, and integrity, as evidenced by our 80% reinvestment rate, 50% repeat borrower rate, and our unblemished record in paying borrower drawdowns, investment distributions, and returning investor capital.

For this calendar year, and by comparison with the prior year, we will have increased our loan originations by 55%, our investments by 49%, our number of investors by 36%, and our team by 57%. Our commitment to fostering strong relationships with investors and borrowers alike has been the cornerstone of our growth, which coupled with best in breed client service, and hard-nosed, value-adding expertise, has established Zagga as a trusted partner in Australian commercial real estate private debt.

As we have grown in terms of scale and sophistication, we have underpinned our investor-first approach with data driven analytics to facilitate decision-making and risk assessment. This commitment to innovation has enhanced our competitive edge, has led to a more streamlined approach to evaluating and managing our loan book, and has delivered enhanced investment information and reporting. Acknowledging the role of technology as an enabler, there remain certain activities which we feel are best left to humans rather than algorithms. Our commitment to high-touch client service and credit assessment and loan management by people rather than machines is sacrosanct.

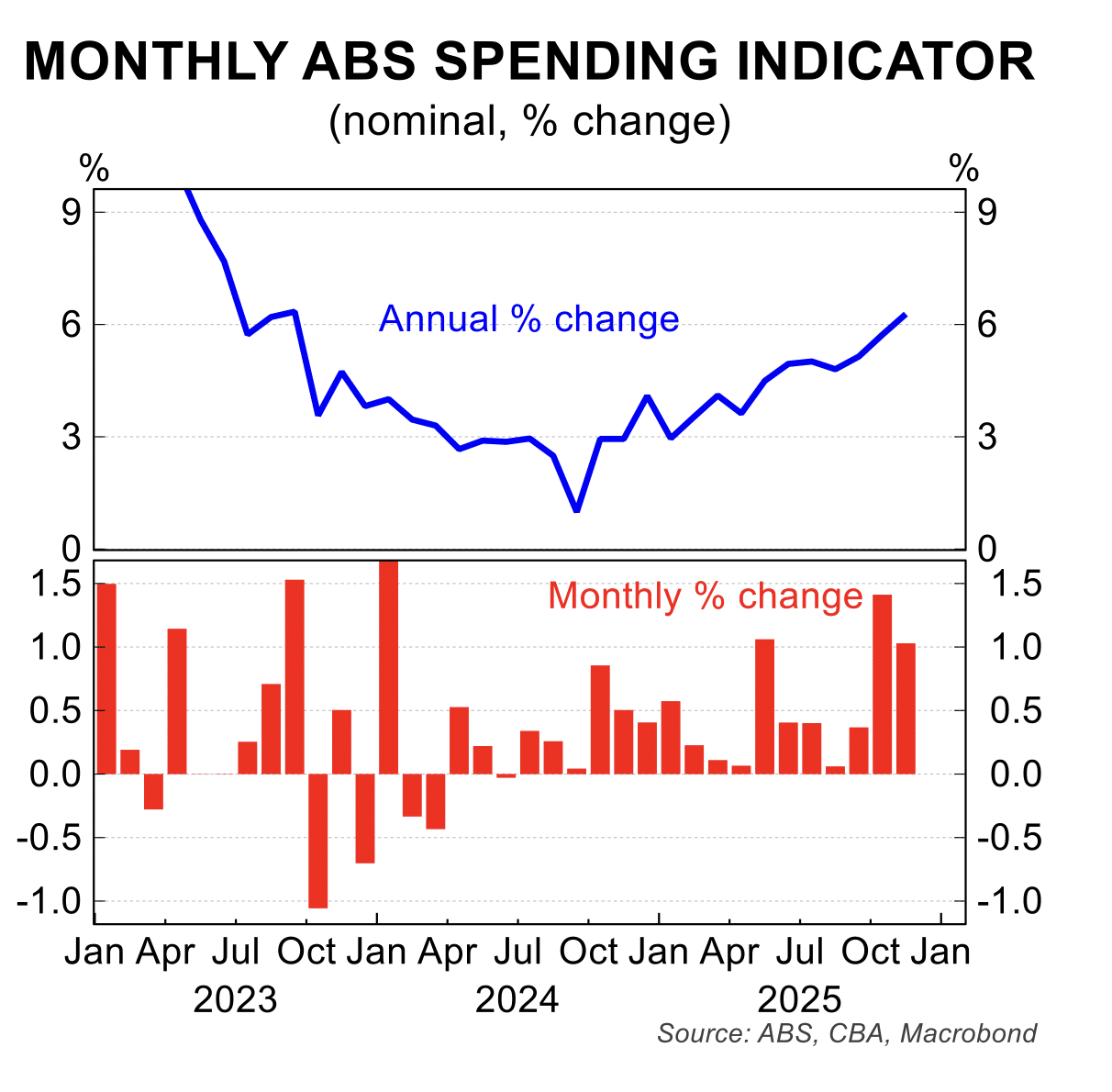

Whilst we are seeing significant capital inflows from abroad, competition in the sector is intense, and the increasing popularity of private credit as an investment class has attracted the attention of ASIC. Add to this, stubborn inflation, interest rate uncertainty, market volatility, and geo-political tension across key global markets, coupled with shifting economic policy settings both at home and abroad, all combine to deliver market conditions which must be navigated with a firm hand on the wheel and a clear eye on the horizon. Looking ahead, we retain a measured yet optimistic outlook for the Australian commercial real estate debt market, particularly that sector which is directed at funding into, and helping to solve for, the severe shortage of residential accommodation in Australia.

Our focus remains firmly on:

- scalable, measured growth underpinned by robust underwriting and risk management

- responsible capital preservation and deployment

- as has been the case since June 2017, delivering consistent, predictable returns for our investors,

- strengthening our origination channels, deepening relationships with high-quality borrowers, and expanding our investment offering in ways that enhance value for investors, and

- upholding the standards of transparency and integrity that define Zagga.

I want to take this opportunity to acknowledge those that have contributed to Zagga’s success throughout the year:

- our dedicated Zagga team, whose hard work, ingenuity, and passion have been instrumental in driving our achievements

- our investors, borrowers, service providers, and associates, whose unwavering support and trust fuels our commitment to keep doing what we do, better!

I am enormously proud of how we have continued to build on the achievements of previous years, adding even more noteworthy accomplishments in 2025. I look forward to the opportunities ahead in 2026 and beyond, and to your continued support of, trust in, and contribution to our business.

I cannot conclude this message without extending our sincere condolences and heartfelt sympathies to the families of those who were brutally murdered in the Bondi Beach Channukah attack on December 14. We wish all who were wounded and injured a speedy recovery and a complete return to good health.

Thank you to all who on the day, rushed to assist wherever and however they could, and for the many who are still offering assistance and support of all forms to the individuals, their families, and the communities generally.