The rapid evolution of Australia’s real estate private credit landscape is reshaping how property is funded and how investors think about the asset class.

In a recent Ausbiz interview, Zagga CEO and Co-Founder Alan Greenstein described a sector that has moved beyond its early identity as a niche alternative, gaining momentum as a mainstream component of the funding ecosystem. His comments offer insight into why real estate private credit is expanding so quickly, and why strong, repeat institutional partnerships are beginning to define private credit’s next phase of growth.

At the centre of this momentum is Zagga’s expanded corporate note with FIIG Securities, now increased from $43 million to $65 million and extended for another four years. The significance of this partnership lies not only in the size of the note, but in what it signals: growing confidence in the performance of real-estate-backed private credit, and increasing sophistication among both borrowers and investors.

Greenstein explained that FIIG first wrote a $43 million note backed by Zagga-originated loans four years ago. During the life of the note, Zagga delivered strong credit performance, including no defaults. On this basis, FIIG approached Zagga to roll and expand the note, reflecting a deepening level of trust in the quality and consistency of the underlying transactions. “They like what we’ve done, there’s been fantastic performance, and they like the kinds of deals that Zagga has been writing,” he said. The $65 million note will now form part of Zagga’s broader funding structure as the business continues its trajectory of growth in real estate private credit.

This confidence from FIIG is emblematic of a broader trend: real estate private credit has moved from peripheral to central in the funding waterfall.

“Private credit is now playing a much more important and powerful role,” Greenstein noted. Developers and borrowers increasingly see private credit as a place to access capital from funders who bring integrity, expertise, and a willingness to engage with more complex or time-sensitive transactions. As he put it, “Borrowers now regard private credit as a place to get money from funders with integrity and funders with expertise.”

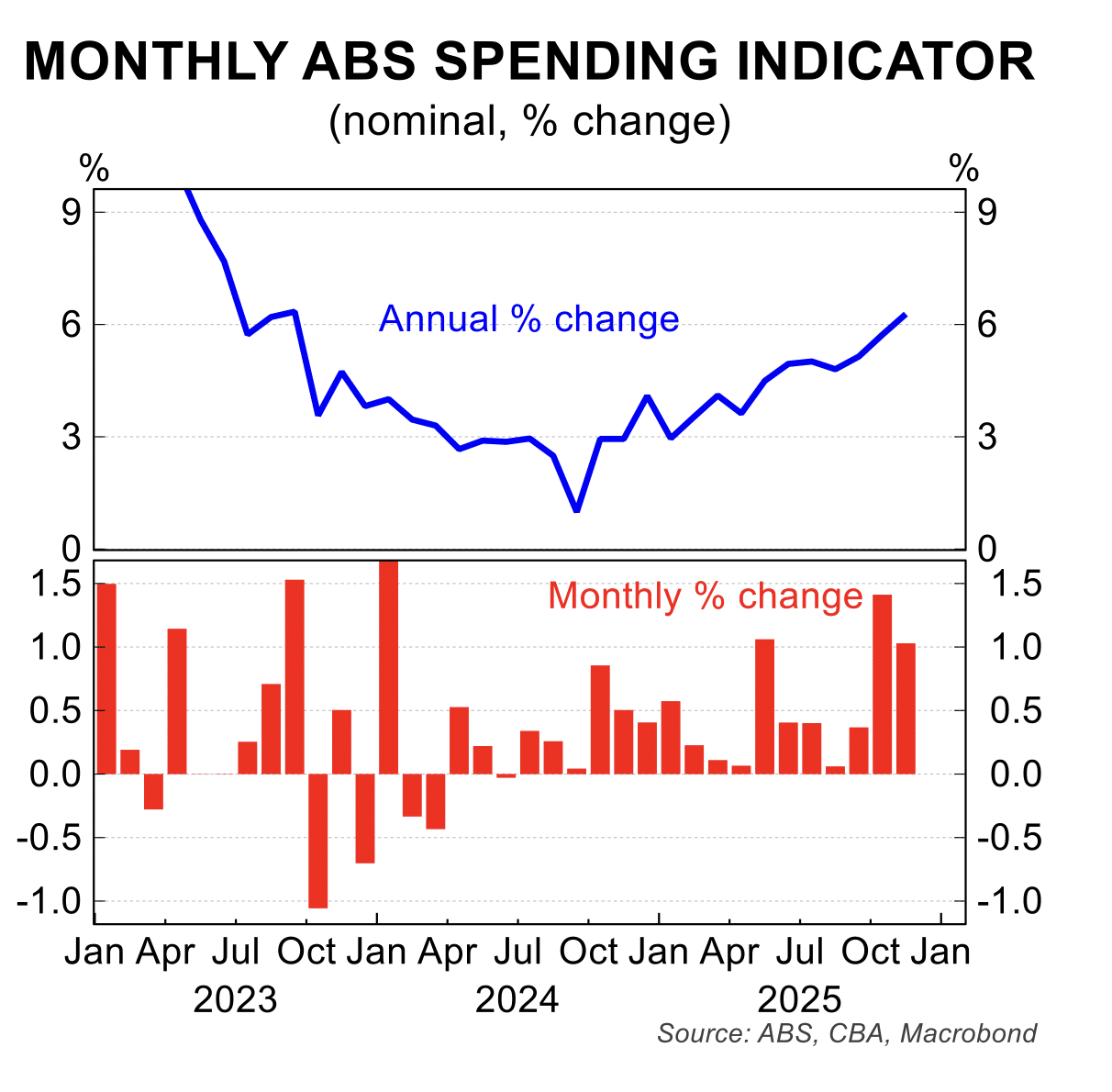

A number of forces have contributed to this shift. As Greenstein observed, the market is recognising real estate private credit’s role in addressing meaningful real-economy needs, including contributing to funding Australia’s housing shortfall. At the same time, private credit managers have scaled rapidly, in some cases becoming larger than traditional financial institutions such as regional banks or building societies. This evolution has expanded the industry’s capacity and, at the same time, raised expectations around discipline, transparency and governance.

Regulation is part of this story.

Greenstein notes that regulatory attention on private credit is intensifying, driven in part by concerns around retail investor participation. He welcomes the focus on transparency and structure, acknowledging that stronger frameworks can support better long-term outcomes. “We support the regulation,” he said. “However, we also believe that not all private credit is created equal… and you can’t really have a one rule suits all scenario.” As the real estate private credit sector grows, so too must the nuance with which regulation is applied.

Another force accelerating real estate private credit’s movement into the mainstream is the increasing flow of international capital into Australia. As money exits the US and Europe in search of stable economies and attractive opportunities, Australia is benefiting from renewed investor interest. Greenstein emphasised that while the capital inflow is welcome, it also lifts the bar for local managers. International investors often require higher levels of discipline and sophistication, and their presence can reshape standards across the entire market. “We welcome the money,” he said, “but we accept that that money is going to seek the highest level.”

Against this backdrop, Zagga is preparing for its next phase of expansion.

The strengthened FIIG note plays a role in supporting this journey as the business grows its funding pools and explores opportunities across other jurisdictions, including Singapore and Japan. Greenstein describes this next stage with characteristic clarity: more growth requires more structure, more discipline, and more transparency – precisely the attributes investor partners such as FIIG have affirmed through their continued support.

As real estate private credit continues its shift from niche to mainstream, partnerships like the FIIG note are more than funding mechanisms. They are indicators of market maturity, signalling where the industry is heading and which players are positioned to lead. With a strengthened balance of performance and discipline, Zagga is preparing for the opportunities – and expectations – that lie ahead.