Summary: 'Two Minutes for Zagga' | September 2025

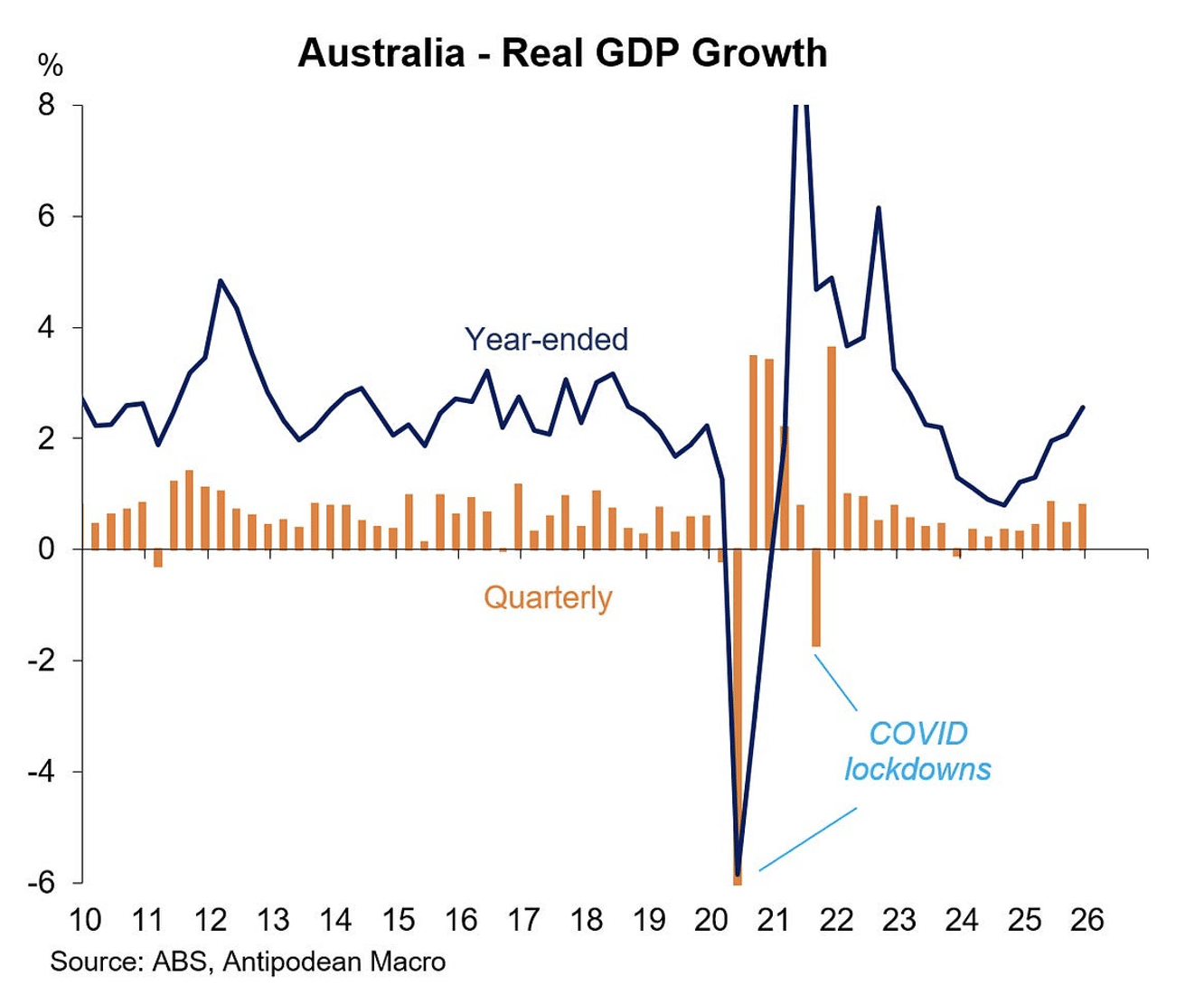

The Reserve Bank of Australia kept interest rates on hold in September, a widely expected decision that reflects growing stability in the economy. While conditions remain uneven, encouraging signs are emerging across household spending, sentiment, and housing.

Household spending lifts

Consumers are beginning to feel the benefits of earlier rate cuts, lower inflation, and modestly stronger wages growth. With real wages now rising, purchasing power has improved, and this is feeding into household consumption — a key driver of GDP. Consumer sentiment and business confidence have also lifted, offering positive signals for activity over the next 6–12 months.

Housing: a mixed picture

The housing story remains complex:

- Building approvals have dipped in recent months, particularly in apartments, although this may reflect the timing of larger projects. With three rate cuts already delivered in 2025, construction activity is still expected to pick up into 2026.

- House prices are rising strongly across all capital cities. Low listings — around 20% below the five-year average — combined with stronger-than-expected immigration are fuelling demand, even as affordability challenges persist.

Inflation on target

The inflation outlook continues to support the RBA’s current stance. While monthly headline figures are volatile, underlying (trimmed mean) inflation is steady at 2.6% — right in the middle of the target band.

Labour market cooling

Employment growth has slowed, with the unemployment rate nudging up to 4.2%. While not alarming, it does suggest some easing in labour market conditions, offsetting the stronger momentum in spending and housing.

What to expect next

The RBA appears content to leave policy on hold for the foreseeable future. With inflation under control and the economy showing cautious improvement, aggressive rate cuts are unlikely in the remainder of 2025. Any shift in policy is more likely to be down than up — but timing will depend on how consumer demand and the labour market evolve.

For now, the economy is tracking at “six out of ten.” Household spending will be the key variable to watch as we move into 2026, with retail and consumption trends likely to shape both growth and monetary policy.

Watch the full video below.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.