Signs of stronger economic activity have been tempered by softening labour market conditions, on going consumer pessimism and heightened global geo-political issues.

The recent data flow has confirmed a further pick up in economic activity, particularly household spending and dwelling construction. These are welcome outcomes after what has been more than two years of below trend growth. There are early but encouraging signs of a recovery in private sector business investment, which is vital to boost productivity. Growth in government demand is slowing as some key public sector projects are at or near completion.

Despite this encouraging news, the labour market continues to soften with employment growth easing to a 9 year low (outside the pandemic), job vacancies continue to decline and wages growth is positive but moderate. In the past half year, the unemployment rate has been between 4.25 and 4.5 per cent, which contrasts with the 2022 low of 3.4 per cent and a rate of 4 per cent at the start of 2025.

House prices are continuing to rise, although supply, demand and labour market drivers are seeing the pace of increase moderate.

After three interest rate cuts in 2025, the RBA has held the official cash rate at 3.60 per cent for five months as it judges the dynamics of economic growth, inflation, the labour market and global issues. The market is pricing in approximately one 25 basis point hike over the next 18 months.

The interest rate cutting cycle globally is nearing an end, with the notable exception of the US where interest rate cuts are in play for the remainder of 2026. Having cut aggressively over the past 18 to 24 months, major central banks are waiting for the effects of easier policy to kick into renewed economic activity.

Key data

Below is an update of key trends in the economy:

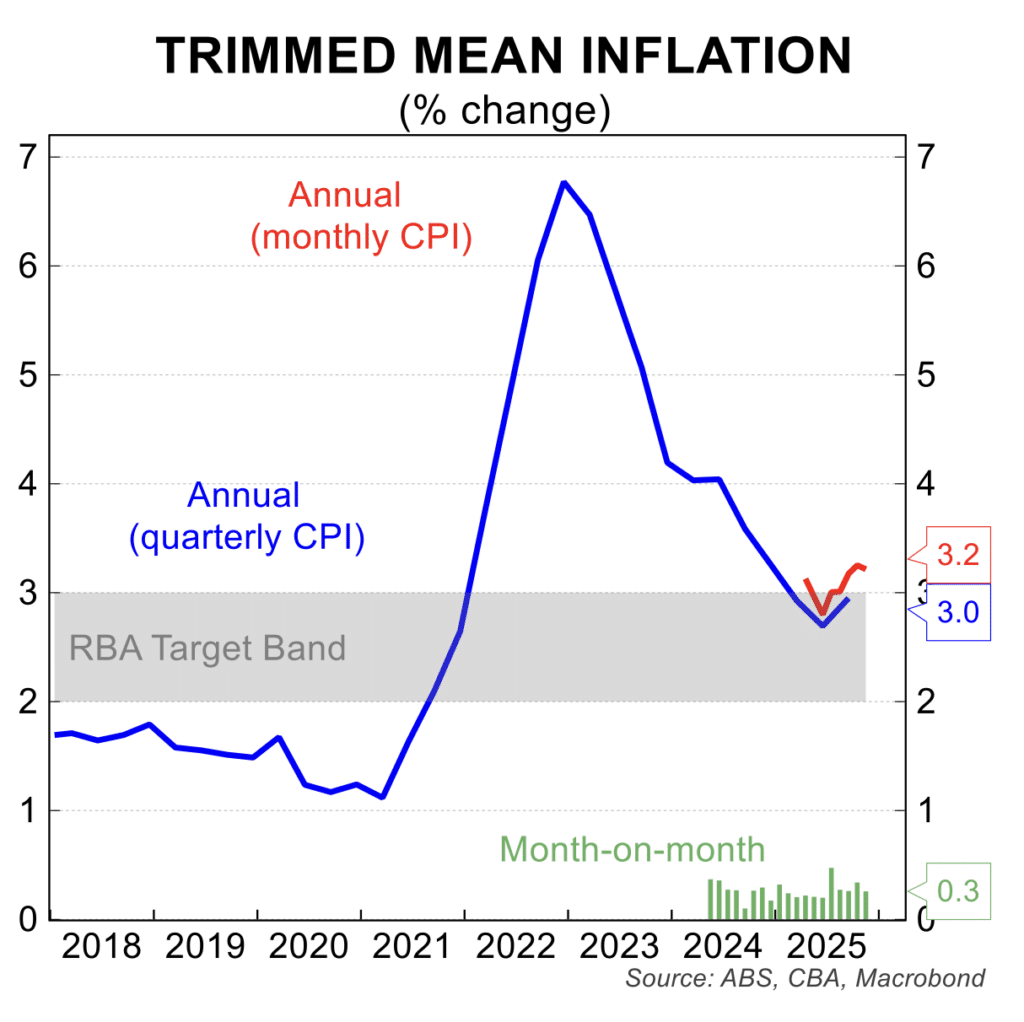

- Headline inflation eased to 3.4 per cent in November from 3.8 per cent in October with the trimmed mean rate easing to 3.2 per cent from 3.3 per cent. Despite the moderation in inflation, it remains above the RBA 2 to 3 per cent target. The release of the December quarter data on 28 January, just ahead of the RBA’s February meeting, will help confirm whether the pick up in inflation owes more to one-off increase in government administered prices or reflect an overheated economy.

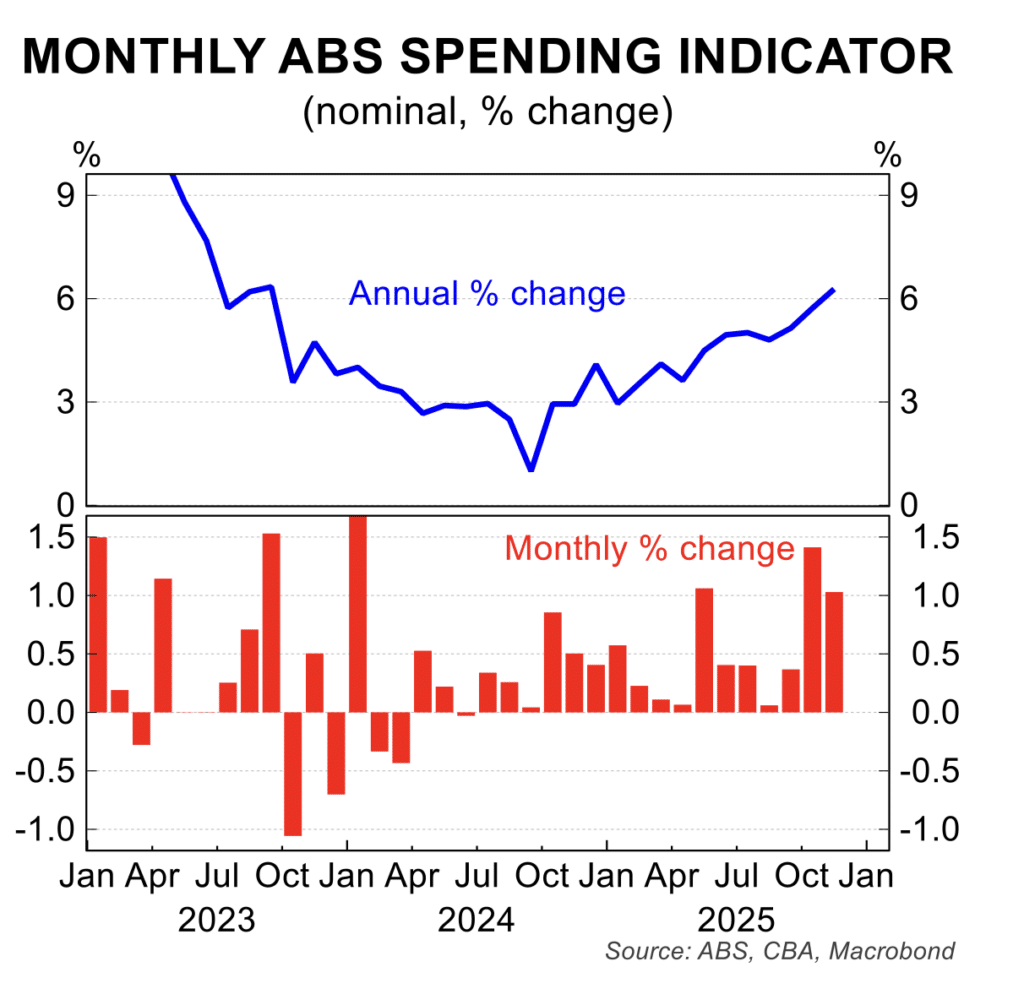

- The upturn in household spending continued in November with a 1.0 per rise, which followed a strong 1.4 per cent increase in October. Annual growth lifted to 6.3 per cent – a three year high. The strength in household spending is linked to positive cash flow as the effects of the 2025 rate cuts impact, a wealth effect from buoyant share and house prices and moderate wages growth.

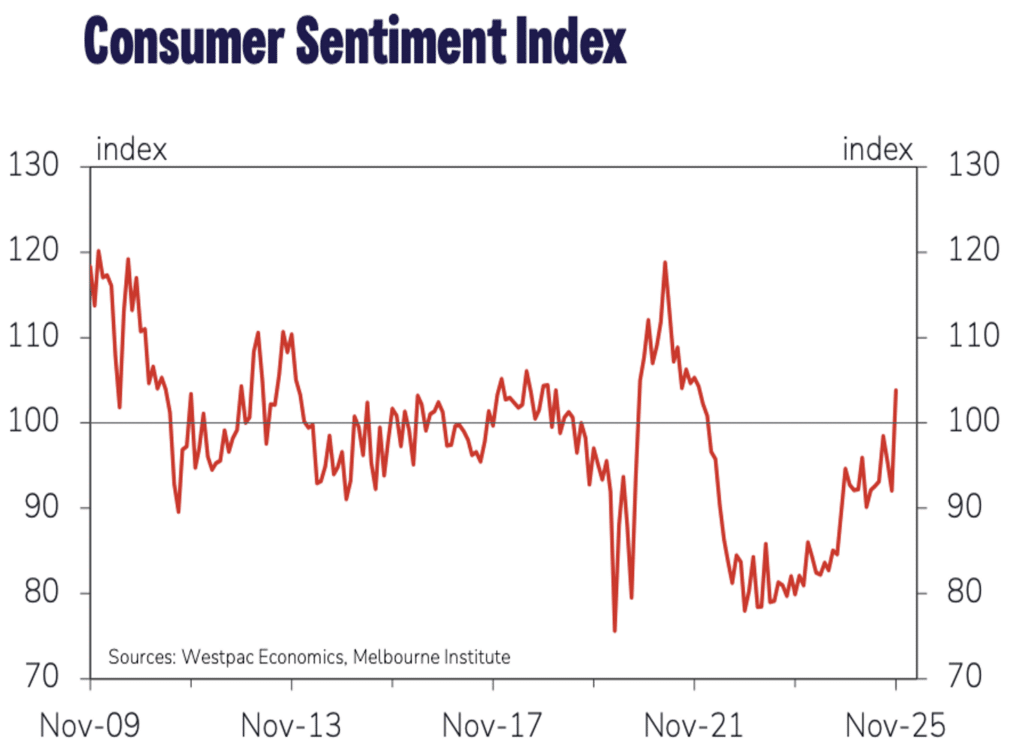

- Despite stronger household spending, consumer sentiment remains broadly pessimistic, albeit to be above the 2023 low. After what was a one-off spike in November, consumer sentiment has fallen by 14 per cent in the last two months. The ongoing pessimism for consumers appears linked to the pause in the rate cutting cycle.

- The various measures of job vacancies and advertisements continue to track lower, pointing to an increasing slack in the labour market. The main weakness is via a sharp fall in private sector vacancies – public vacancies are more resilient. The fall in vacancies is consistent with the unemployment rate rising to 4.75 per cent in 2026.

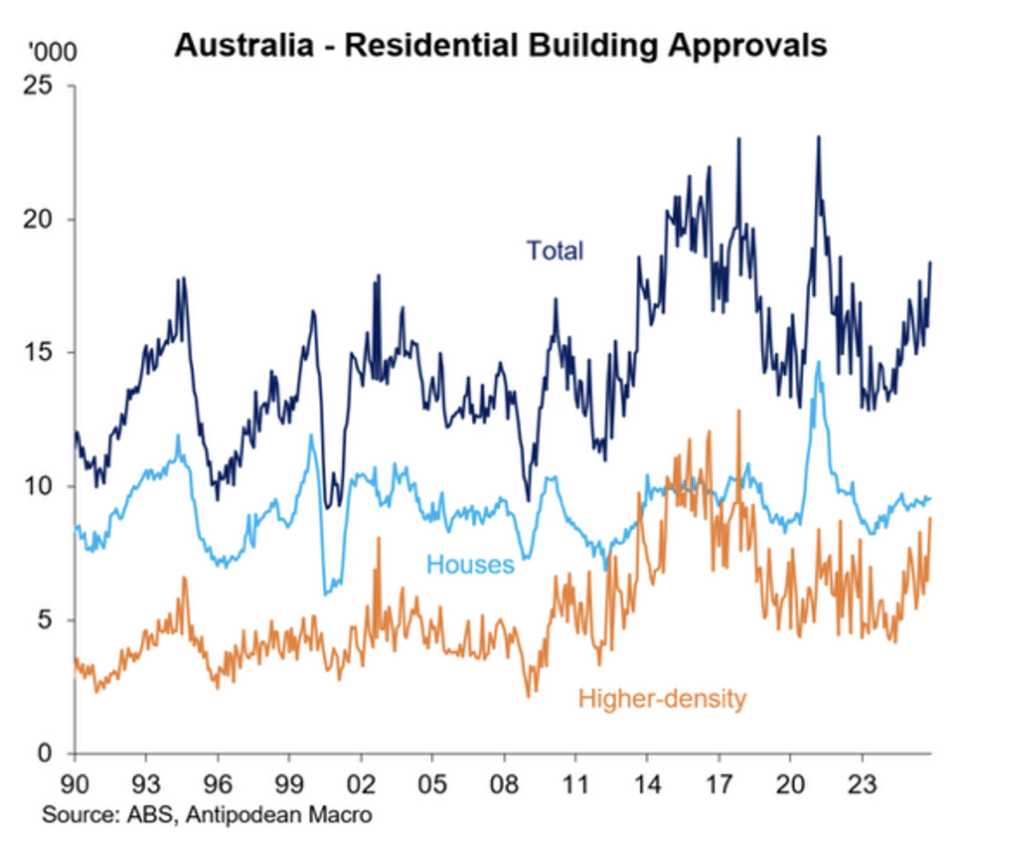

- In a good news sign for a much needed increase in housing supply, dwelling building approvals rose 15 per cent in November to reach a three year high. The number of building approvals has increased 43 per cent from the 2023 low. The bulk of the increase has been seen in higher density apartments. The government’s policy agenda of ramping up dwelling construction, in concert with low interest rates and solid demand, are behind the strong recovery.

RBA monetary policy and the current market pricing for the cash rate

The spike in inflation and signs of a moderate economic recovery have reinforced market pricing for an interest rate increase during 2026. At this stage, the market is pricing in approximately one 25 basis point hikes although as noted previously, this pricing can be fickle and volatile.

More likely, the RBA will be cautious because of the weakening in labour market conditions, noting that in addition to its inflation target, it has a mandate to maintain full employment. Premature interest rate increases would risk a sharper rise in the unemployment rate.

Internationally, the interest rate cutting cycle is nearing an end, with most central banks having cut more aggressively than the RBA over the past two years. The RBA notes that it did not hike as much in the tightening phase which means it does not have the same bias to cut as aggressively as its counterparts.

House prices

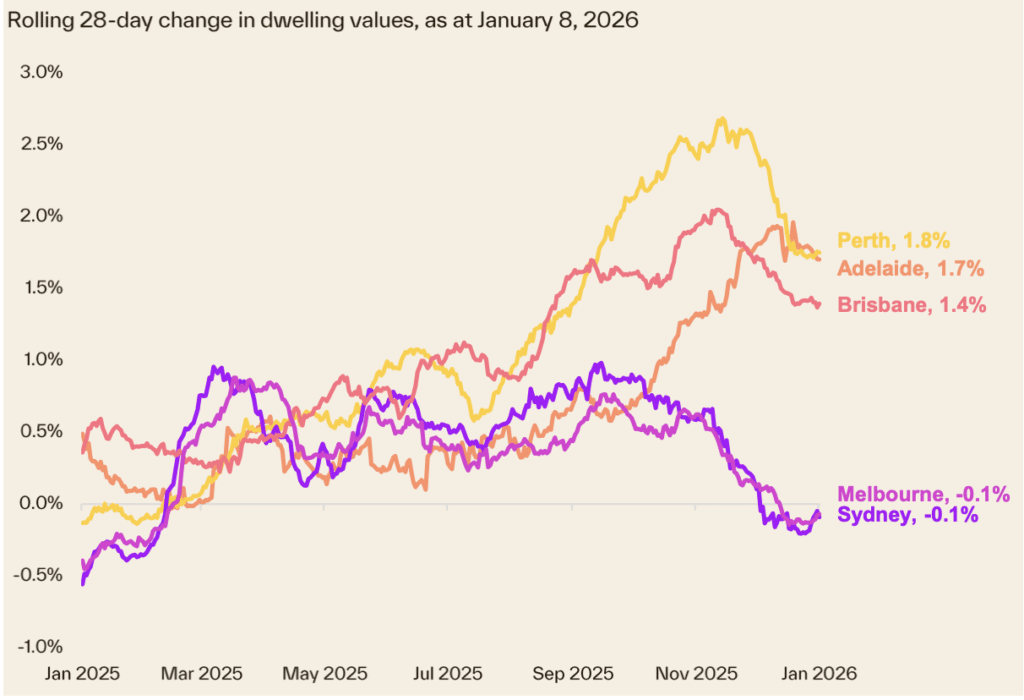

There remains upward momentum in house prices although there are signs of price fatigue. Capital city house prices rose 0.5 per cent in December after a rise of 0.9 per cent in November and strong increases of 1.2 per cent and 1.1 per cent in the previous two months.

The December rise was the slowest since April 2025 with 0.1 per cent price falls recorded in both Sydney and Melbourne. In the so-called boom cities, Perth, Brisbane and Adelaide, monthly increases are very strong with gains of between 1.5 and 1.75 per cent.

The divergence in price momentum between the strongest and weakest cities remains extreme.

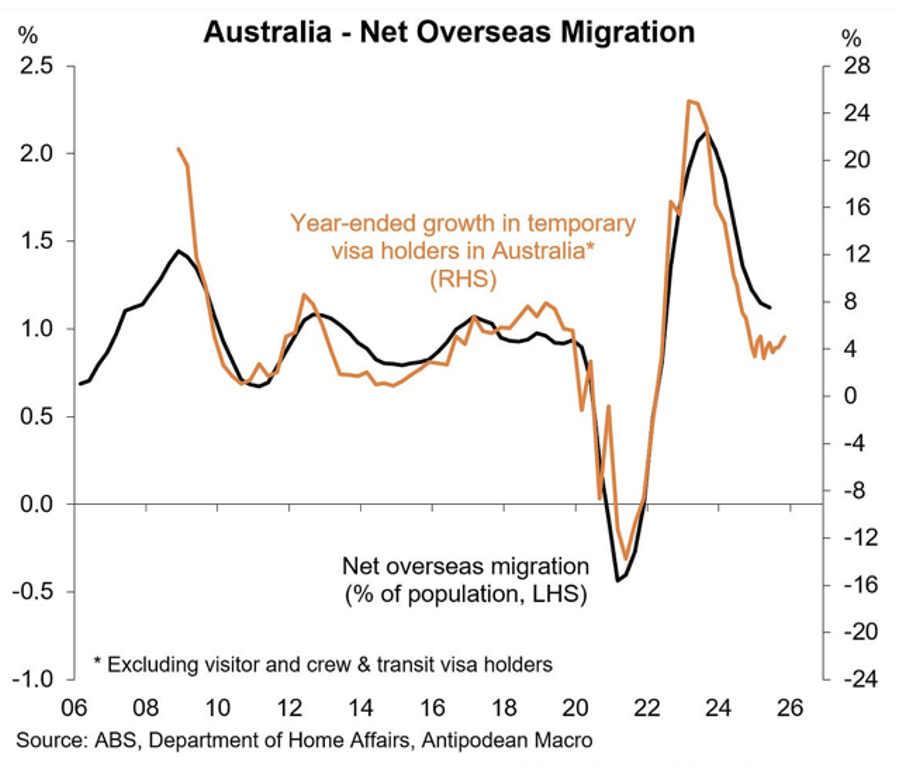

The shortage of dwellings for sale eased marginally, according to Cotality, while some further slowing in the population growth, via the net immigration intake, is taking some pressure off demand. If immigration continues to slow, a softening in demand will further dampen house price growth. The lift in the number of new building approvals will, with a 12 to 24 month lag, further add to new supply which should ease price pressures.

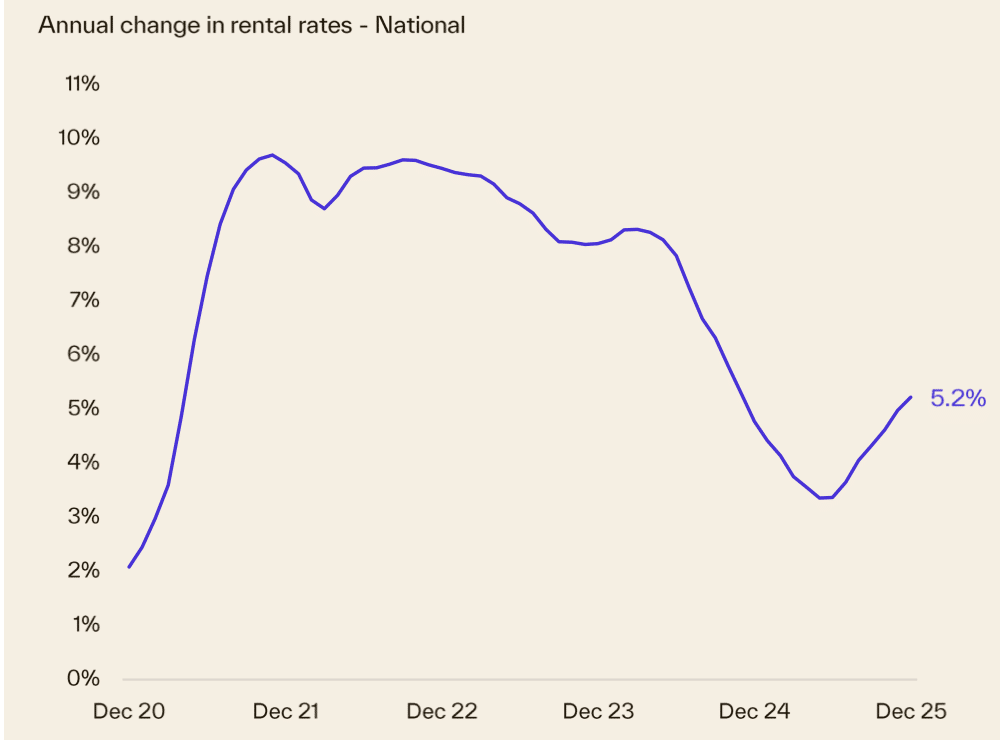

After a marked easing in the growth in rents during 2023, 2024 and the first half of 2025, the historically low rental vacancy rate has seen rents reaccelerate. This is likely to pressure the financial position of renters and in addition to adding to inflation pressures, it will act to dampen overall household spending growth.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.