The Anthony Albanese Labor Party won the Federal election with an increased majority.

The economic policy agenda from the re-elected government is largely business as usual, with the main reforms linked to a moderate cut in income taxes over the next two years, a focus on housing supply and affordability, further investment in renewables, higher defence spending and a range of investments in health and education.

The budget will remain in deficit of between 1 and 1.5 per cent over the next four years which is an issue that will be important for the government to manage.

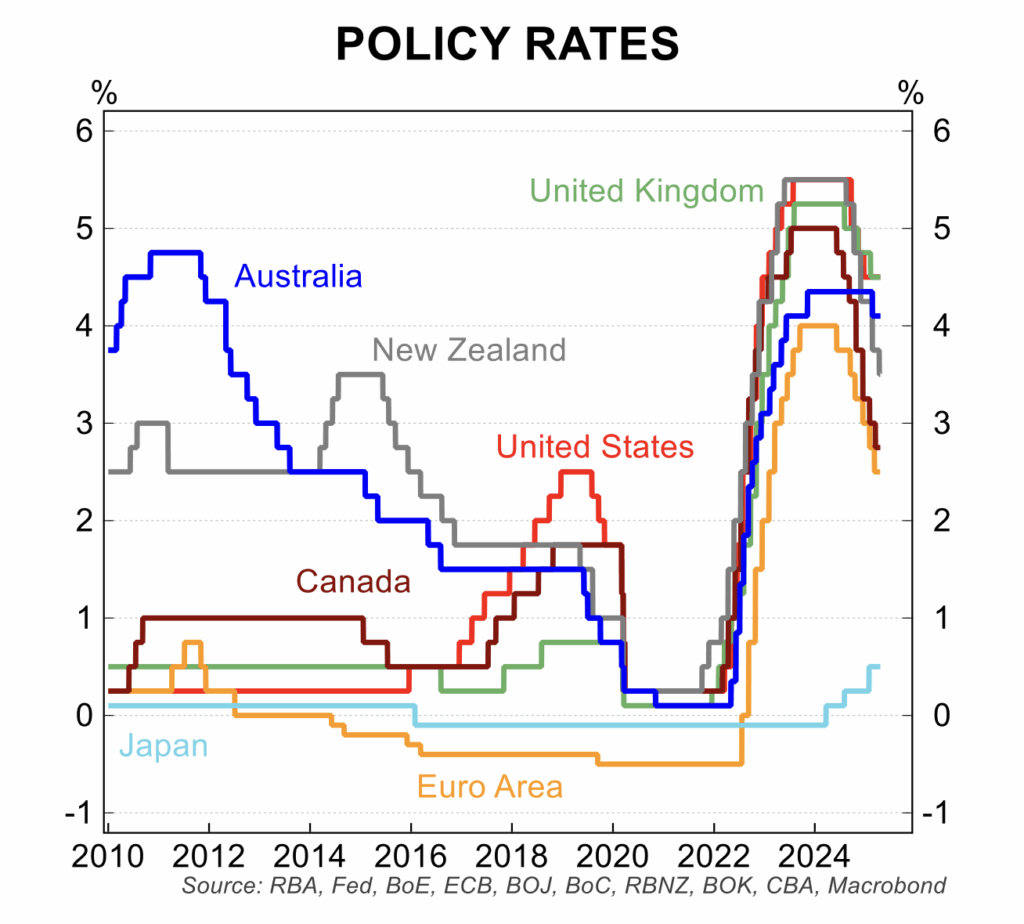

Given current economic conditions, there is near unanimity that the RBA will resume its interest rate cutting cycle on 20 May with further interest rate cuts expected over the following 12 months. Low inflation, a soft economy and signs of a weakening in the labour market are all factors that has markets pricing in a cash rate below 3 per cent in the first half of 2026, down from the current 4.10 per cent.

Global conditions remain fragile with the US on the cusp of a recession. March quarter GDP fell 0.3 per cent and this was before the effects of the US tariffs and cuts in government spending have a greater impact. China and the Eurozone are also slowing which is likely to act as a drag on Australia’s exports and business and consumer confidence.

Key data

Below is an update of key trends in the economy:

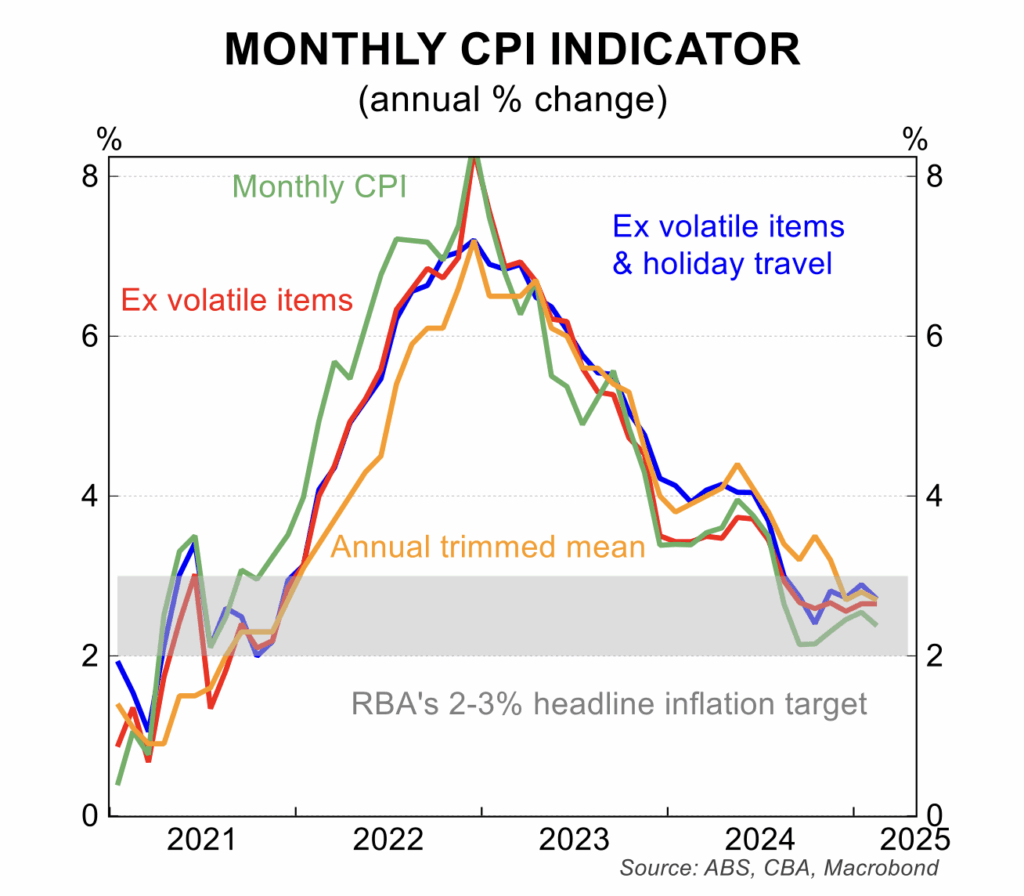

- The all important inflation data confirmed the good news that inflation is on target. Annual inflation was steady at 2.4 per cent in the March quarter while the trimmed mean inflation rate eased to 2.7 per cent. The monthly data was similarly favourable with 2.4 per cent in March with the trimmed mean measure at 2.7 per cent.

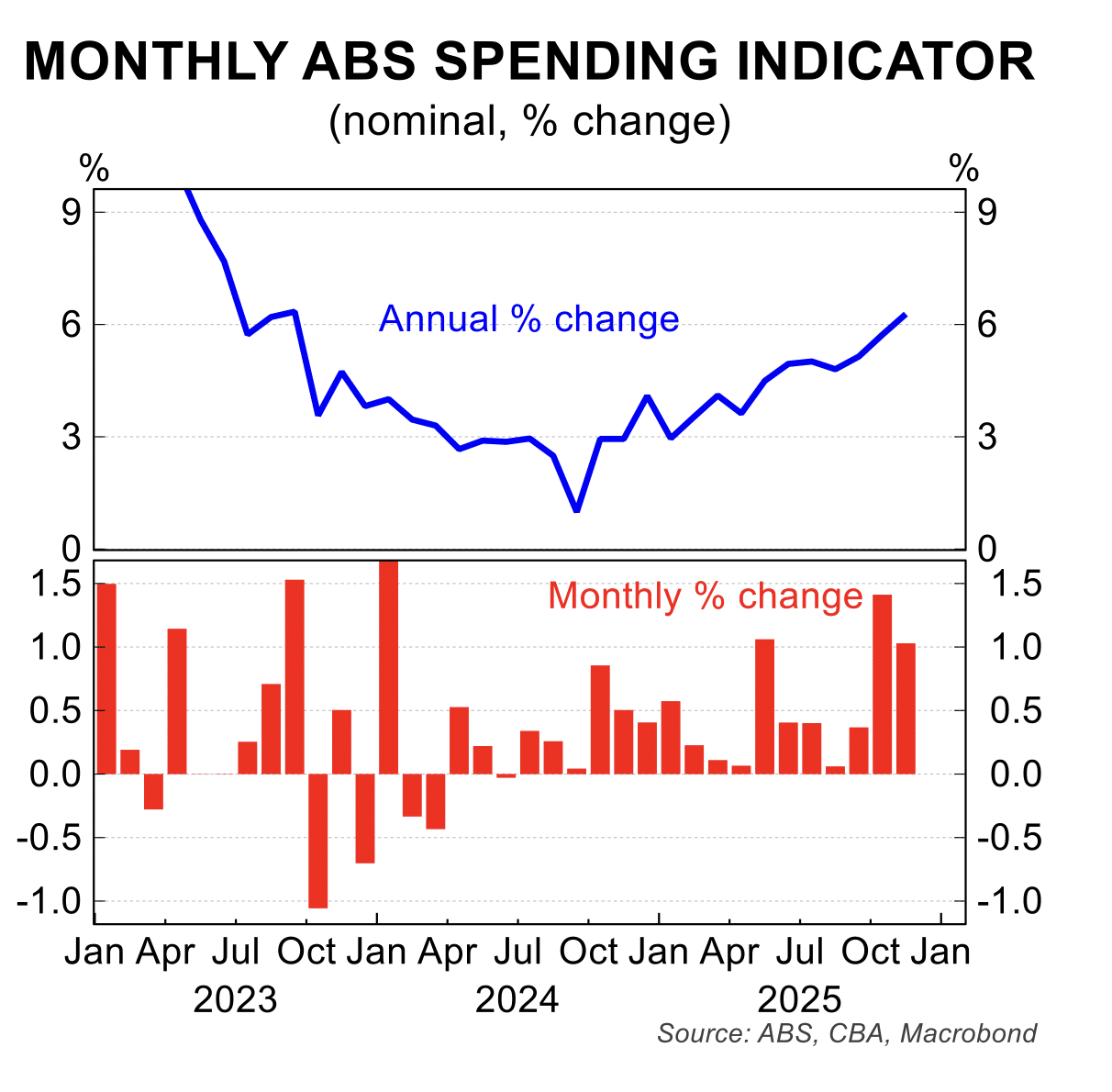

- There was a disappointing pull-back in retail spending in the March quarter with zero growth in real terms. In per capital terms, retail spending fell 0.4 per cent to unwind the stronger results from the second half of 2024.

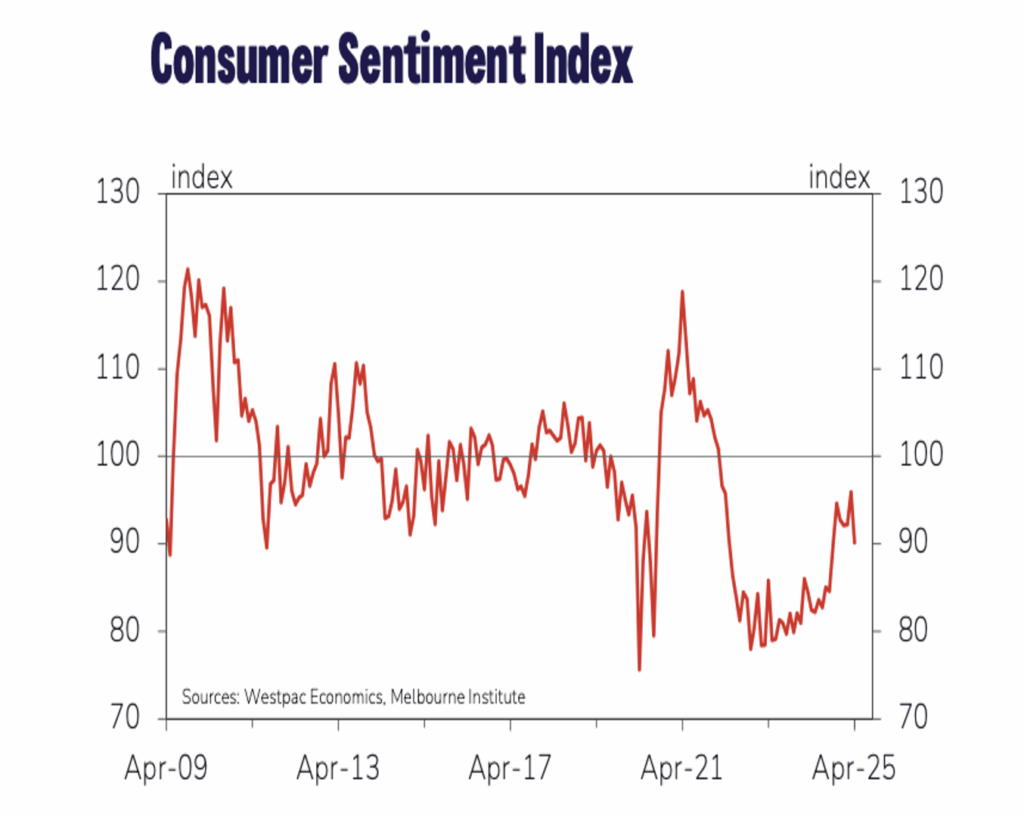

- After a solid pick up from the lows of the middle of 2024, the index of consumer sentiment dipped in April in reaction to the fall-out from US President Trump’s tariffs and the market volatility that followed. When sentiment is weak, consumers tend to ‘hunker down’ and pare back their spending.

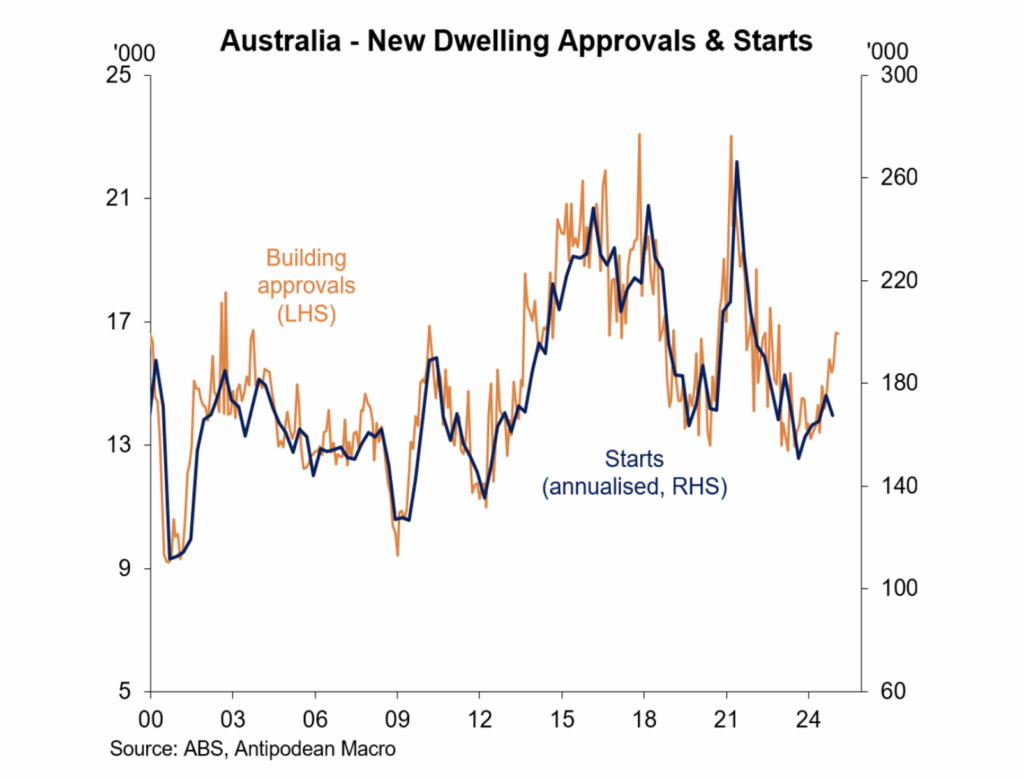

- One of the ‘sleeper’ issues for 2025 and into 2026 as interest rate cuts is the strong and now sustained increase the number of new dwelling building approvals. The number of approvals has risen by 27 per cent from the cyclical low in early 2024. In annualised terms, approvals are running at a rate of 200,000, which is still below the 240,000 per annum needed to meet the government objective of 1.2 million new dwellings in the next 5 years.

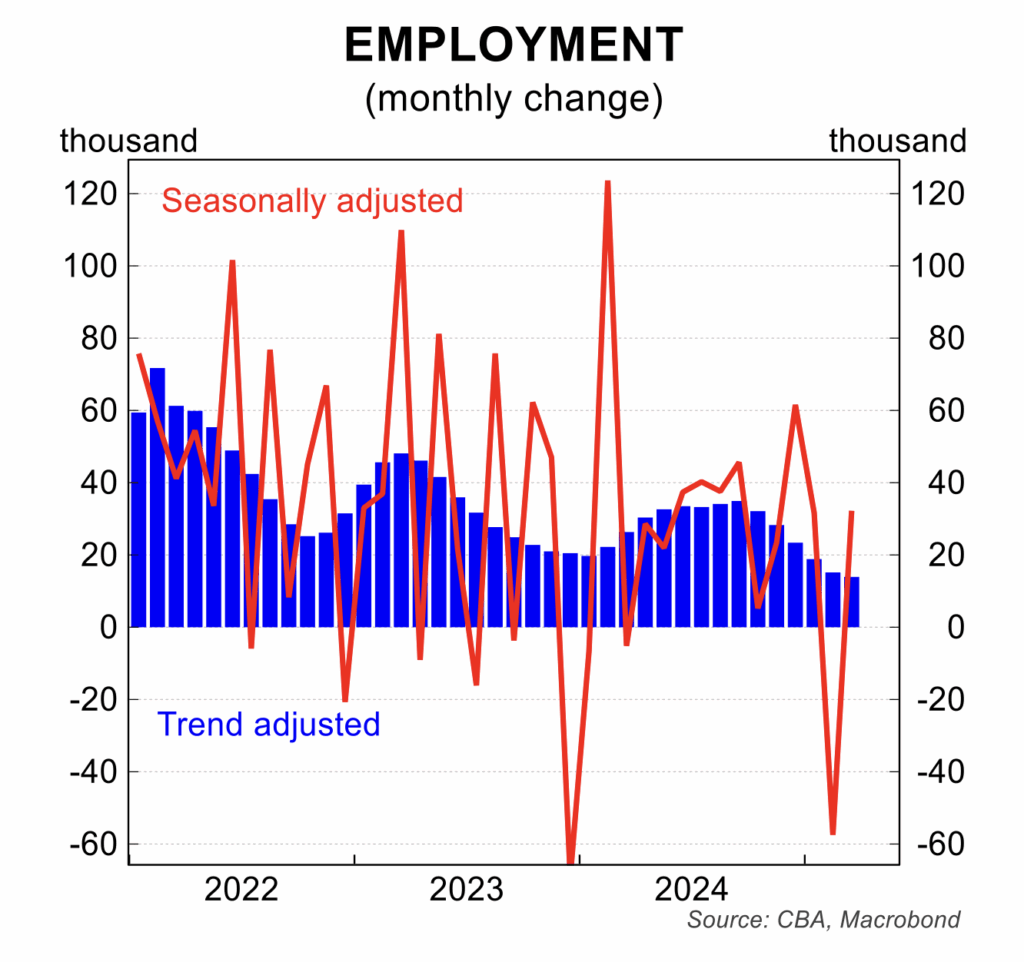

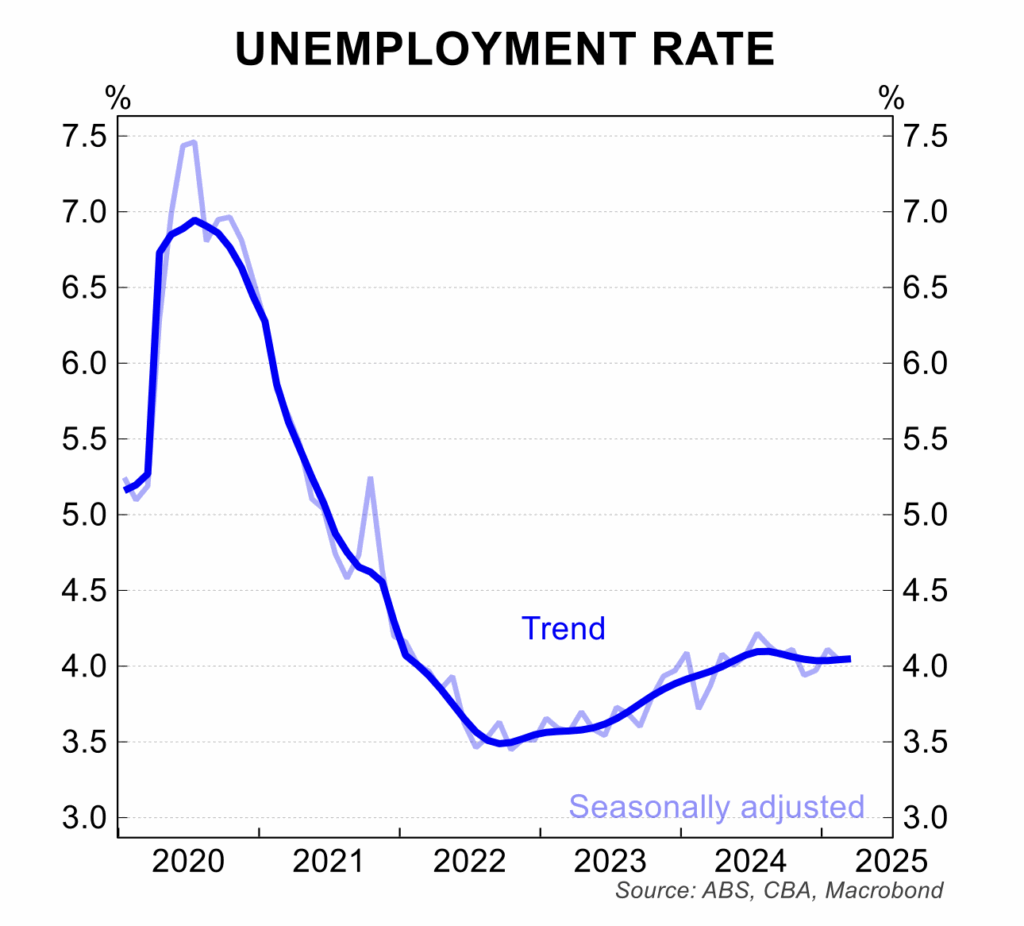

- While the monthly labour force data remains volatile, the trend in employment is weakening as the subdued level of economic growth and ending of the government employment strategy comes to an end. In March, employment rose 32,000 in March but this was after a fall of 57,000 in February. The unemployment rate was steady at 4.1 per cent in March but it likely to increase given the on-going weakness in job vacancies.

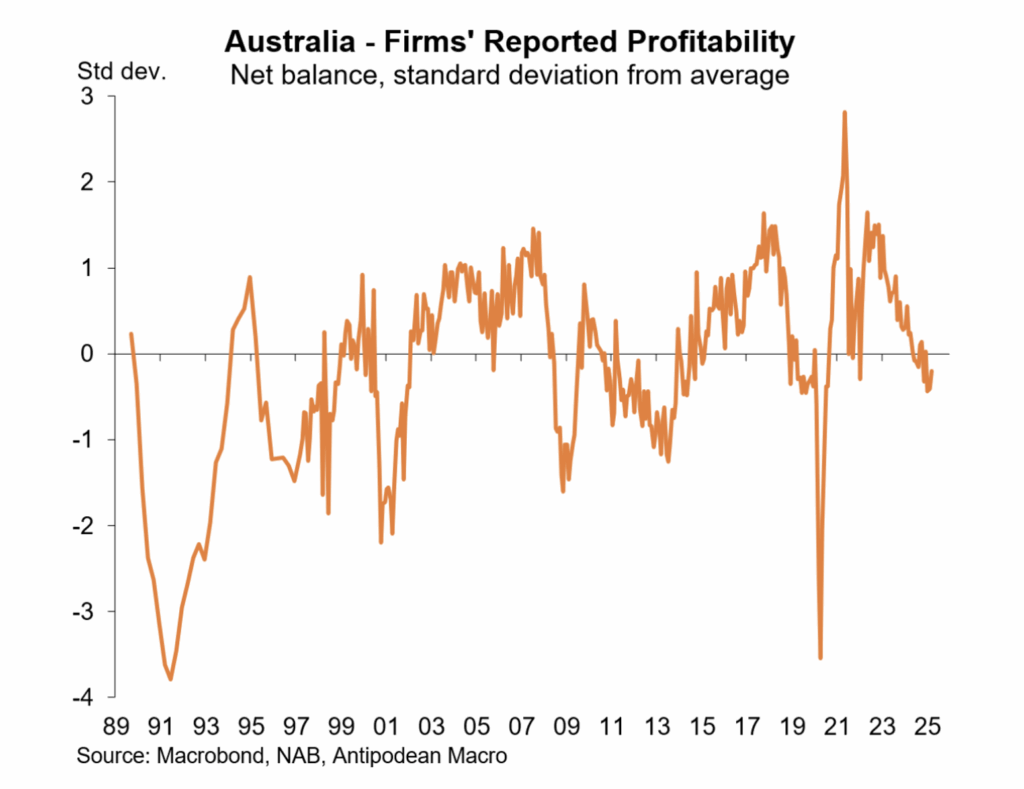

- Business confidence and conditions remained little changed in March but it was at a level consistent with the economy growing at a sub-trend pace. One important factor from the survey was the downgrade to profitability which, again, reflects the soft economy.

- The number of corporate insolvencies is rising strongly as the weak economy, interest rate hikes and tightening in credit conditions have impacted. While insolvencies were held artificially low during the COVID pandemic, some increase was always likely, but the rise is bordering on a concern.

House prices

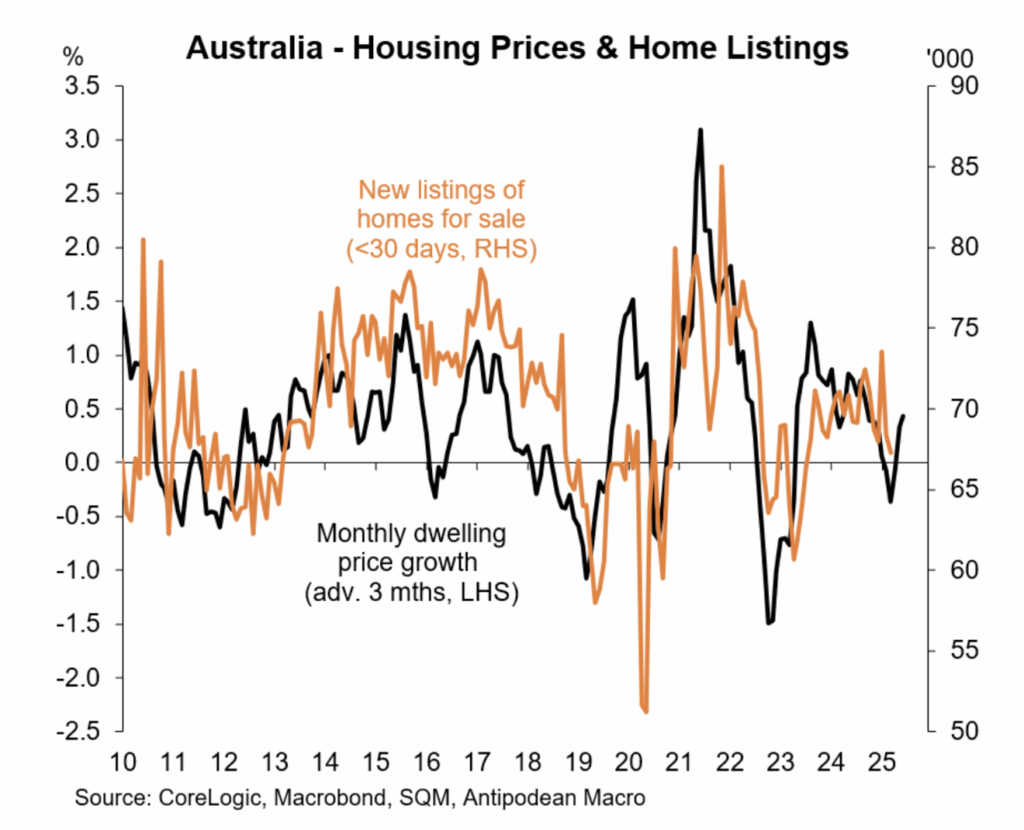

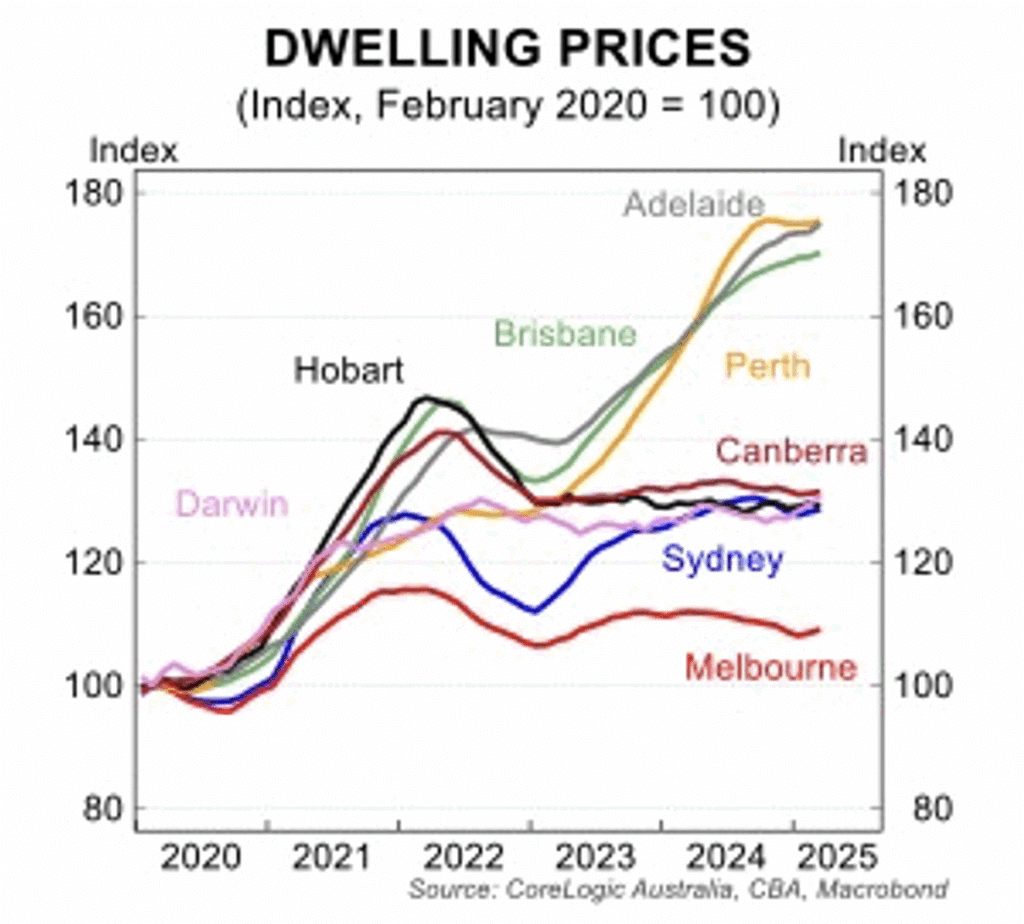

House prices are broadly flat with the small declines in late 2024 being followed by small rises in the early part of 2025. House prices rose 0.3 per cent in April, to be up just 3.2 per cent over the year.

Some of the weaker cities of late 2024 – Sydney, Melbourne, Canberra and Darwin – are now registering moderate increases while the ‘boom’ cities of 2023 and 2024 – Adelaide, Perth and Brisbane – are seeing price increases moderate. Broad price levels are being impacted by the slide in demand from lower immigration with new listings of properties for sale increasing.

That said, in the three months to April 2025, house prices rose in every city and in regional areas:

- Darwin +3.4 per cent;

- Melbourne +1.0 per cent.

- Sydney +1.0 per cent;

- Brisbane +1.0 per cent;

- Adelaide +0.9 per cent;

- Hobart +0.9 per cent;

- Perth +0.7 per cent;

- Canberra +0.6 per cent

- Regional Australia +1.5 per cent.

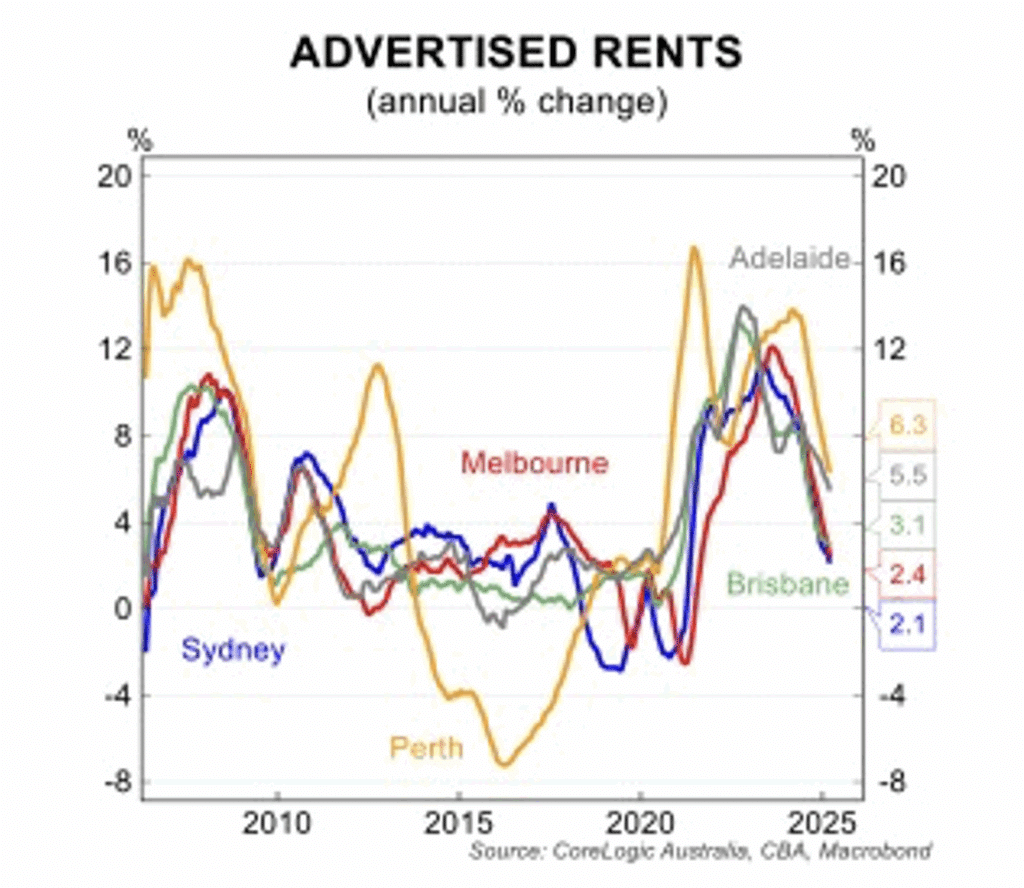

The rental market is continuing to weaken, as rental vacancy rates edge higher. Growth in advertised rents has weakened to a 4 year low in April and have decelerated sharply in all major cities. This will help in cost of living pressures for consumers and will feed into the lower inflation climate into 2026.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.