In finance, excitement drives headlines. Equity markets soar, crash, and recover, creating the stories that resonate. Yet, long-term wealth creation is rarely exciting.

Consistent, steady, predictable returns, along with the magic of compounding, are what protect, preserve, and build capital. When it comes to investing for long-term wealth, it pays to be boring.

As investors increasingly recognise the value of a conservative approach in times of volatility, real estate private credit has come to the fore. Across market cycles, over time, it has proven to be a consistent performer. While equity markets rise and fall, real estate private credit has delivered steady, uncorrelated returns.

While this may seem boring to some investors, for us, that very consistency is what makes real estate private credit worthy of consideration in every investor portfolio.

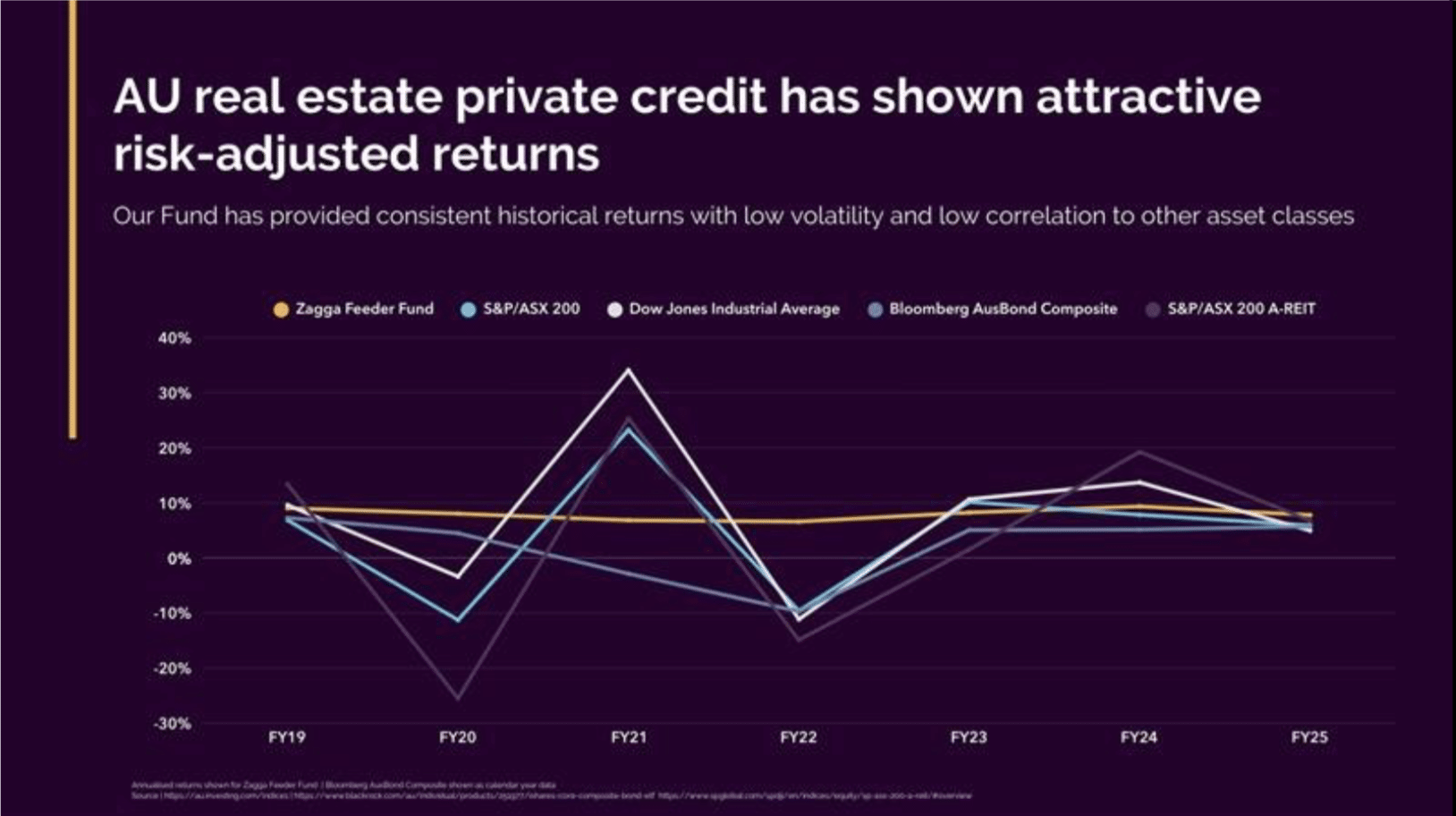

In fact, we’d argue the yellow line in the chart below is exactly what should excite investors.

The highs and lows of equity markets are what make the news but are challenging for investors. The consistent performance of our Funds across equity and interest rate cycles demonstrates the benefits of an uncorrelated asset class as a hedge in your portfolio.

This consistency is far from dull. In fact, it is exactly what many investors are really looking for: income without sleepless nights.

A proven approach

At its core, private credit is about lending money to borrowers. In the case of real estate private credit, funded by credible investment managers, that money is lent to experienced developers and is secured by physical property assets.

At Zagga, we focus on the deepest and most liquid segments of the market, predominantly mid-market residential property developments along Australia’s Eastern Seaboard. In practice, this means loans ranging from $5 million to $100 million, with developments valued up to $200 million. For example, our recently-funded development project in Rose Bay, NSW is an investment-grade transaction for the construction of four luxury boutique apartments. This is being delivered by a highly- experienced borrower who proactively chose private credit over traditional financing due to the bespoke loan terms, flexibility, and commerciality that a specialist manager brings to transactions.

Property is a predictable asset class with proven, long-term performance. Over the last three decades, Australian property has increased over 6% p.a, on average, with 20 years of sustained growth1. While short-term conditions can shift, property values have historically shown stability. This, coupled with the current trajectory of the real estate market, provides a stable foundation for our 18–24-month project horizon.

Despite this stability, Zagga maintains conservative lending standards – typically at or below 65% loan-to-value ratios (LVRs). This conservative LVR adds an extra layer of protection and acts as a shock absorber against market volatility. For us, capital preservation is as important as delivering returns.

The uncorrelated multiplier

Diversification has long been the cornerstone of portfolio construction. For decades, investors relied on the negative correlation between equities and bonds: when one faltered, the other typically provided ballast. But in recent years, as is visible in the above chart, traditional diversification strategies have faltered. Bonds and equities, once reliable counterweights, have often moved in tandem.

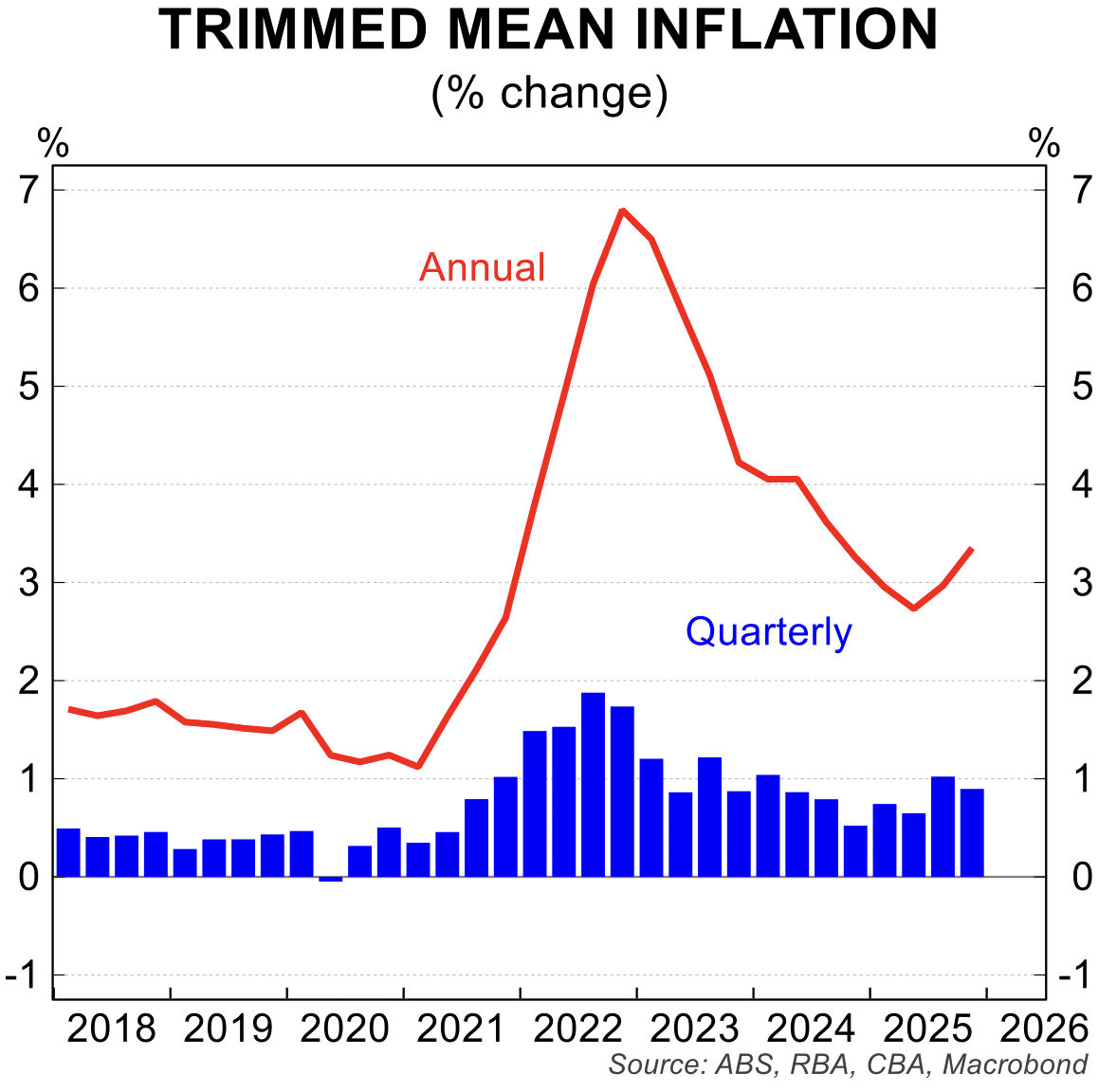

By contrast, private credit’s performance hinges more on interest rate cycles. Returns move in line with the cash rate plus a margin, offering investors reliable protection against inflation. For example, Zagga’s flagship Feeder Fund targets a return of 500 basis points above the RBA cash rate, returning 9.68% to investors as at end-June 20252.

This alignment to interest rates means investors are less exposed to the ebbs and flows of global markets and more attuned to the domestic credit cycle – an arguably more stable anchor.

For investors, this uncorrelated profile is invaluable: it delivers stability when traditional hedges fail, while adding a layer of genuine diversification at a time when portfolios need it most.

It pays to be boring

Investors are waking up to the appeal of being boring. Once considered niche, private credit has now become a core part of a well-diversified portfolio. Today, Australia’s private credit market is valued at more than AUD$200bn, with AUD$85b allocated to commercial real estate-related loans – approximately 17% of the total commercial real estate lending market3.

As banks continue to hold back due to capital constraints, private credit managers are stepping in to bridge the funding gap. Investors are rapidly recognising the sector’s defensive, income-generating appeal, and demand continues to grow. Institutional investors, from superannuation funds to global asset managers, are ramping up allocations, while SMSF and high-net-worth individuals are following suit.

Real estate private credit comes with a simple promise: dependable, stable, risk-adjusted returns. For Zagga, this means a proven ability to preserve capital, generate defensive income, and deliver consistency across cycles.

In a world where geopolitical shocks, equity volatility, and macro uncertainty dominate headlines, boring beats volatility. Private credit demonstrates this in practice. By focusing on fundamentals – credit quality, risk management, capital preservation – investors can build portfolios that thrive and deliver long-term wealth generation.

Sometimes, it truly pays to be boring.

- https://www.dpn.com.au/articles/house-price-growth-australia-over-30-years

- Assuming participation in the Distribution Reinvestment Plan

- Alvarez & Marsal Research Report, 2024