Summary: 'Two Minutes for Zagga' | August 2025

The Reserve Bank of Australia has delivered its third interest rate cut of 2025, trimming the cash rate by another 25 basis points. Since the start of the year, cumulative rate reductions have begun to pack more of a punch — and the RBA hopes this momentum will help bolster economic growth and prevent unemployment from climbing too far.

Why the RBA is cutting

While each rate cut matters, the RBA is looking for the combined effect of successive reductions to lift economic activity. Inflation is now sitting comfortably within the RBA’s 2–3% target band — with both headline and underlying measures tracking near the midpoint — giving the RBA room to ease policy further.

That said, future cuts remain “data-dependent.” If unemployment continues to edge higher from its current 4.3% level, and inflation remains subdued, the market expectation of another one or two cuts before mid-2026 may well be realised.

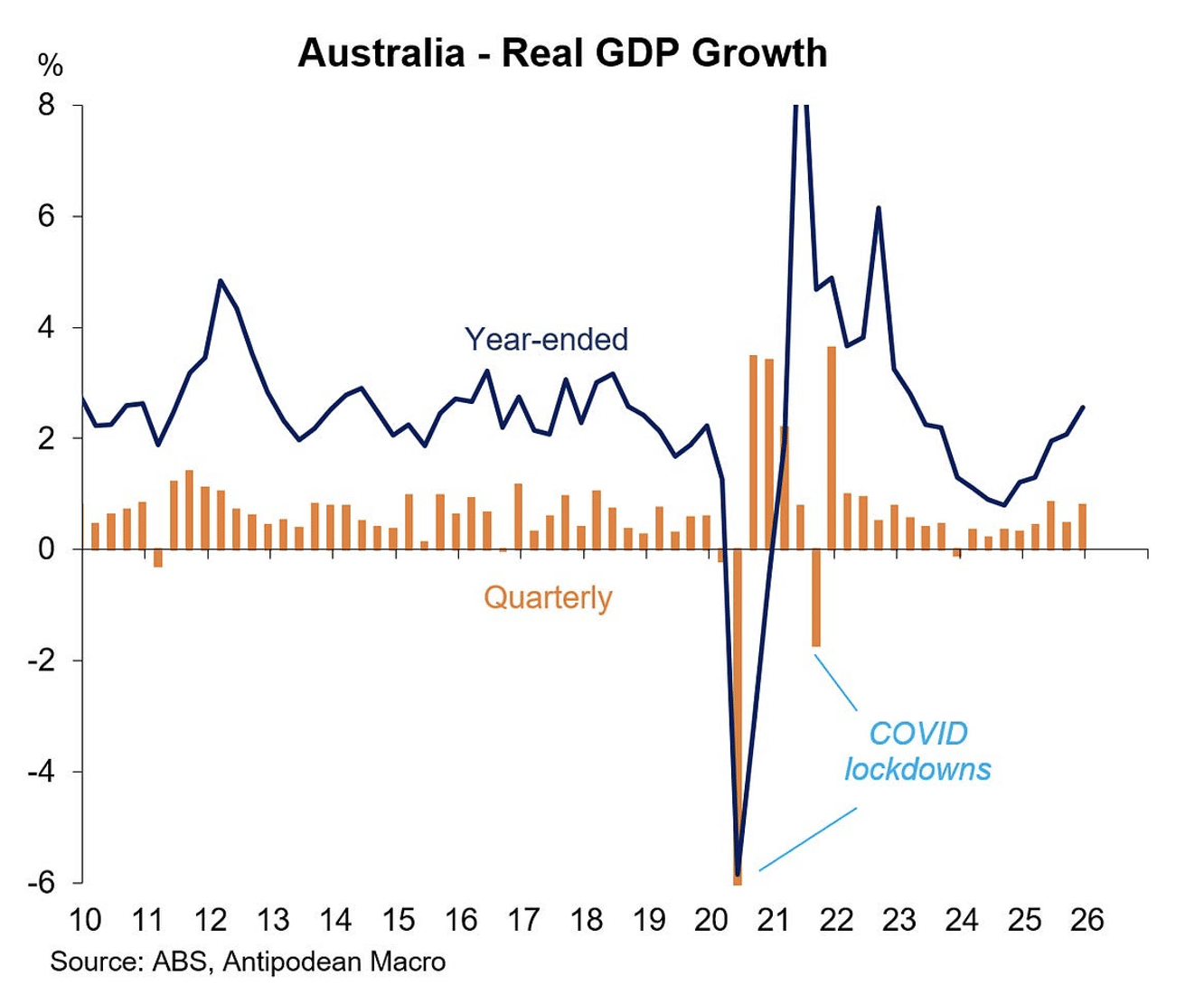

The state of the economy

Recent data has delivered more good news than bad:

- Inflation: Both headline and trimmed mean inflation are on target

- Housing: Building approvals have reached a 3½-year high, boosted by efforts to fast-track planning approvals, although supply constraints persist

- House prices: Continuing to edge higher — no boom, but steady growth on the back of shortages and improved affordability from lower borrowing costs

- Consumer sentiment: Retail spending and confidence have picked up modestly, hinting at emerging positive momentum

The one dampener? The labour market. Unemployment has crept to its highest level in over three years, and softer job ads suggest it could rise further — though likely only to around 4.5%.

What to expect next

If inflation holds steady and growth shows signs of strengthening, the RBA may deliver further cuts over the next six to nine months. For investors and private credit markets, this creates a cautiously optimistic backdrop — where supportive monetary policy meets a still-delicate economic balance.

Watch the full video below.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.