Not just investment.

Responsible investment.

We understand that our investment decisions today have lasting consequences for

client portfolios, society and the generations of tomorrow.

The meaning of responsible investment at Zagga

We have developed a framework to integrate appropriate ESG protocols and procedures into our process. ESG considerations are embedded in our investment analysis and credit assessment.

These considerations enable us to assess the environmental and social impact of our counterparties to ensure they are committed to sustainable building practices and smart technology integration for long-term, positive impacts.

We will seek appropriate disclosure on ESG issues from the entitles to which we lend.

Governance and strategy

The independently-chaired ESG Advisory Committee will provide advice to the various Zagga Sub-Committees on all matters relating to Responsible Investment and Sustainable Finance in the commercial real estate market.

We have documented Zagga’s approach to ESG and sustainable business practices across a number of policies and we will continue to review best practice approaches, particularly in the CRED and investment management markets.

Zagga joins UN-backed Global Principles for Responsible Investment

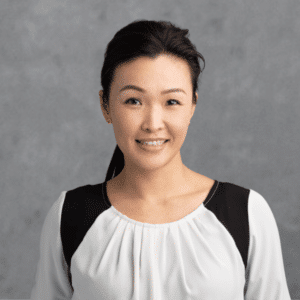

Nikki Kemp, Singapore-based Independent Chair of Zagga’s ESG Committee, Director of Singapore Green Finance Centre and former World Economic Forum Executive, said this was an important milestone signalling Zagga’s determination to integrate ESG at every level.

“We’re pleased to be recognised as a PRI signatory,” Ms Kemp said. “This affirms Zagga’s commitment to responsible investment practices, and reflects its belief that responsible investment considerations are essential to managing risk and delivering sustainable returns for investors.”

ESG Advisory

Committee

Alan Greenstein

Kevin Berkowitz

Frank Hageali

Marcus Morrison

Erica Tsang