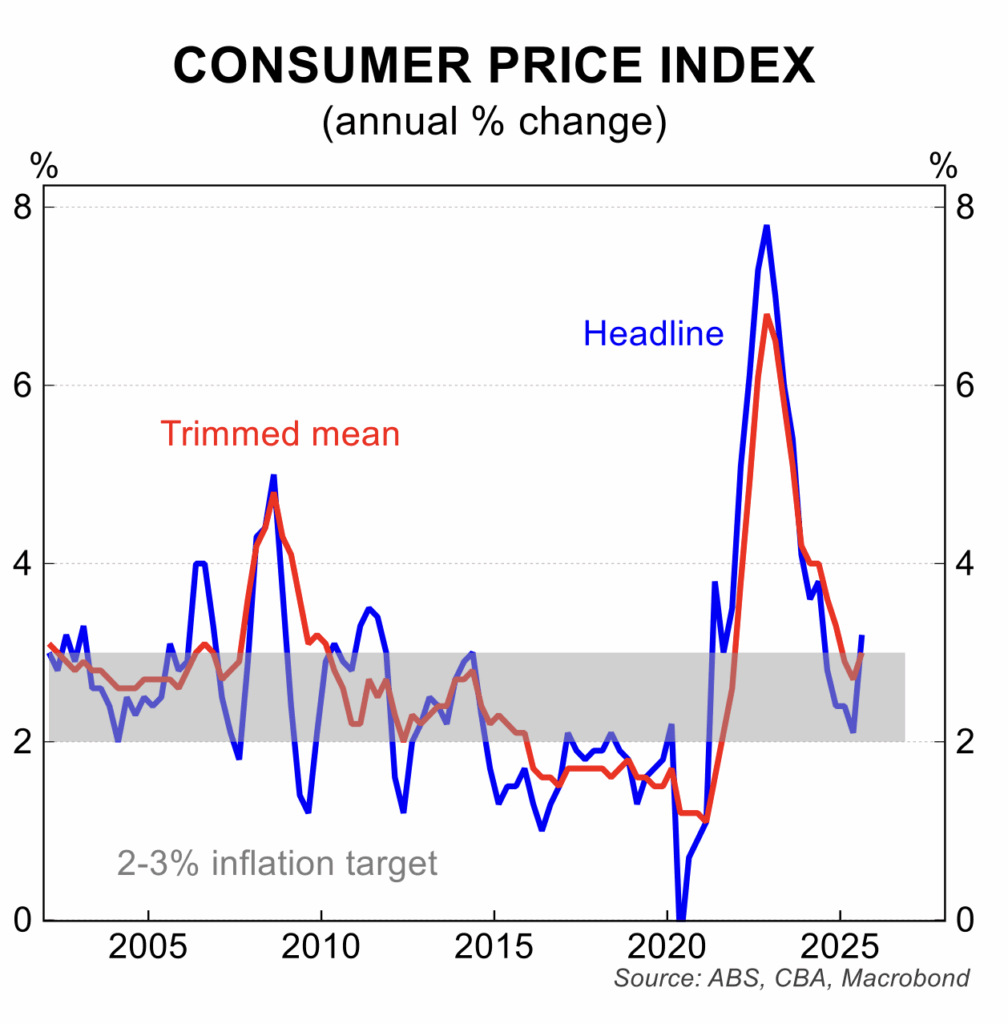

Mixed news on the economy and an uptick in inflation has seen the RBA move to a neutral bias for interest rates. This means that the medium turn outlook has switched from expectations for lower interest rates to one now steady interest rate settings are expected into 2026.

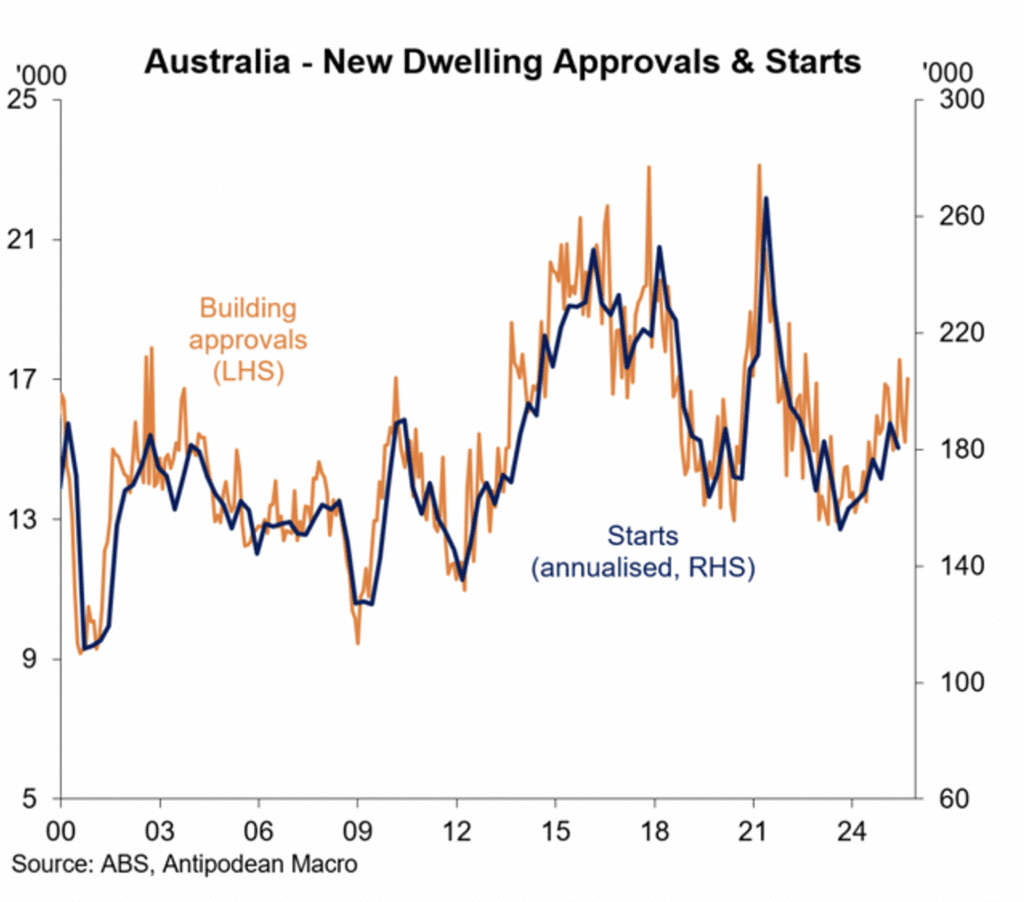

At the same time, the housing market is recovering. New dwelling building approvals have rebounded strongly although the level of activity remains below the rate needed to address the housing shortage.

The interest rates ‘on hold’ position from the RBA is likely to remain in place until the conflicting data showing higher inflation versus a trend increase in unemployment is resolved. Recall the RBA has a mandate of setting policy to achieve full employment whilst maintaining an annual inflation rate between 2 and 3 per cent.

Internationally, economic growth remains moderate with a lot of focus on sovereign debt levels and the stubbornness of inflation. That said, financial markets continue to trade relatively smoothly, with bond yields generally edging higher and most stocks markets edging lower from record highs.

There remains a strong tendency among central banks to cut or at least hold interest rates steady. In the past month, interest rates have been cut in the US, Canada and New Zealand.

Key data

Below is an update of key trends in the economy over the past month:

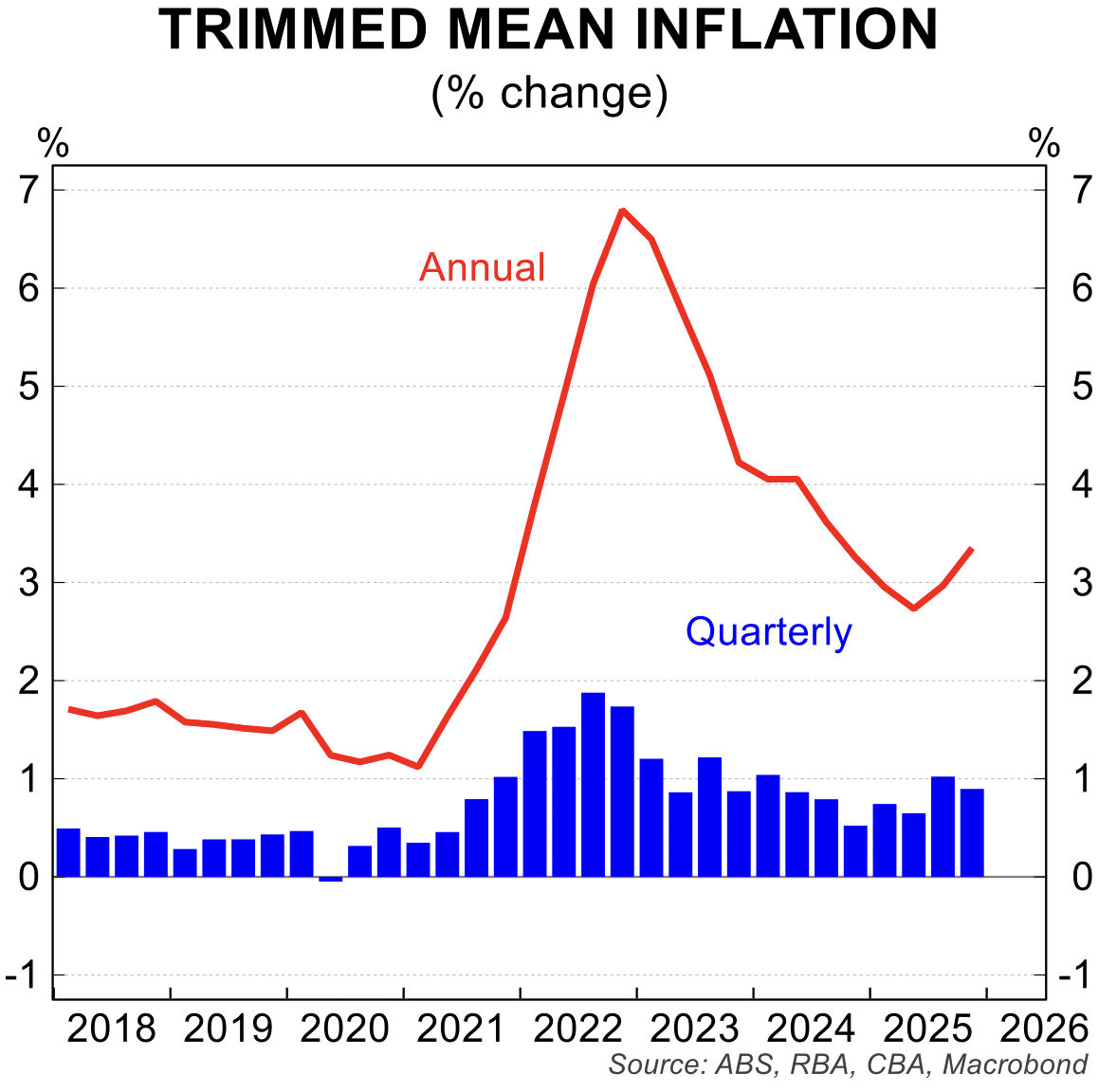

- Headline inflation rose to 3.2 per cent in the September quarter, with the trimmed mean rate rising to 3.0 per cent from 2.7 per cent in the June quarter. The bulk of the increase in inflation was in ‘administered prices’ while ‘market price’ pressures were well contained. ‘Administered prices’ are those heavily or totally influenced by government decisions – electricity and childcare subsidies, excise increases, public transport fares and postage costs for example. Monetary policy settings have little to no influence over these prices but does have a strong influence on market prices.

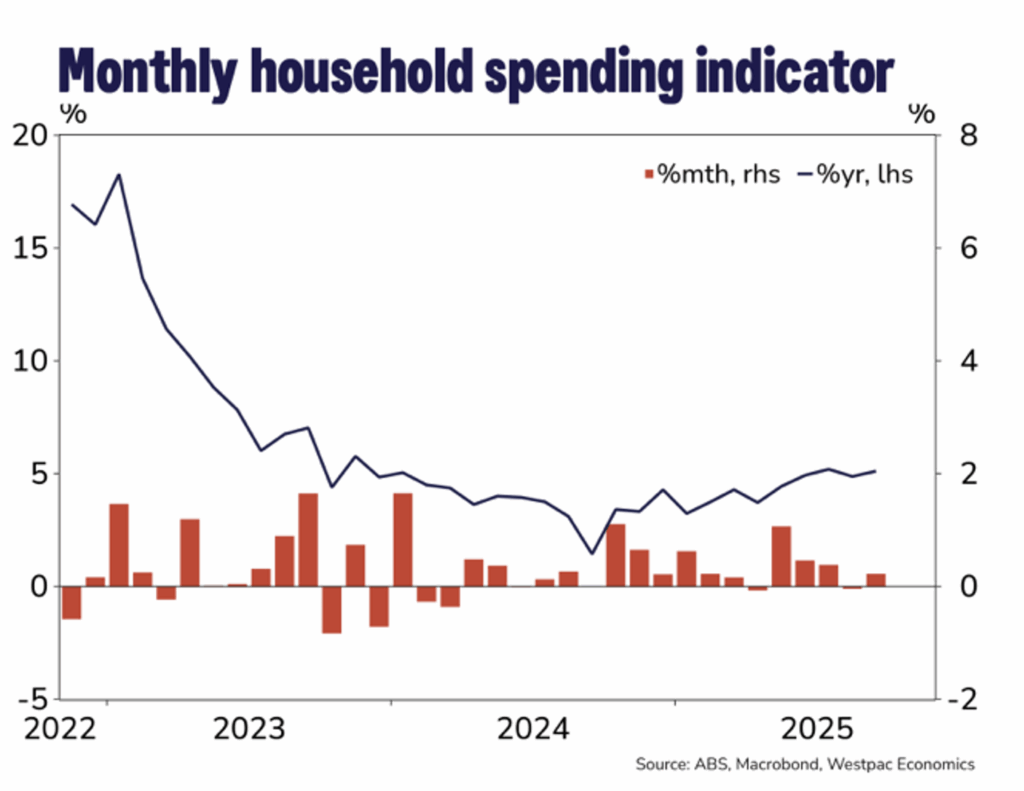

- Growth in household spending growth has moderated, rising 0.2 per cent in September after zero growth in August. This means that the real growth in household spending was just 0.2 per cent in the September quarter as a whole which is a fall in real per capita terms.

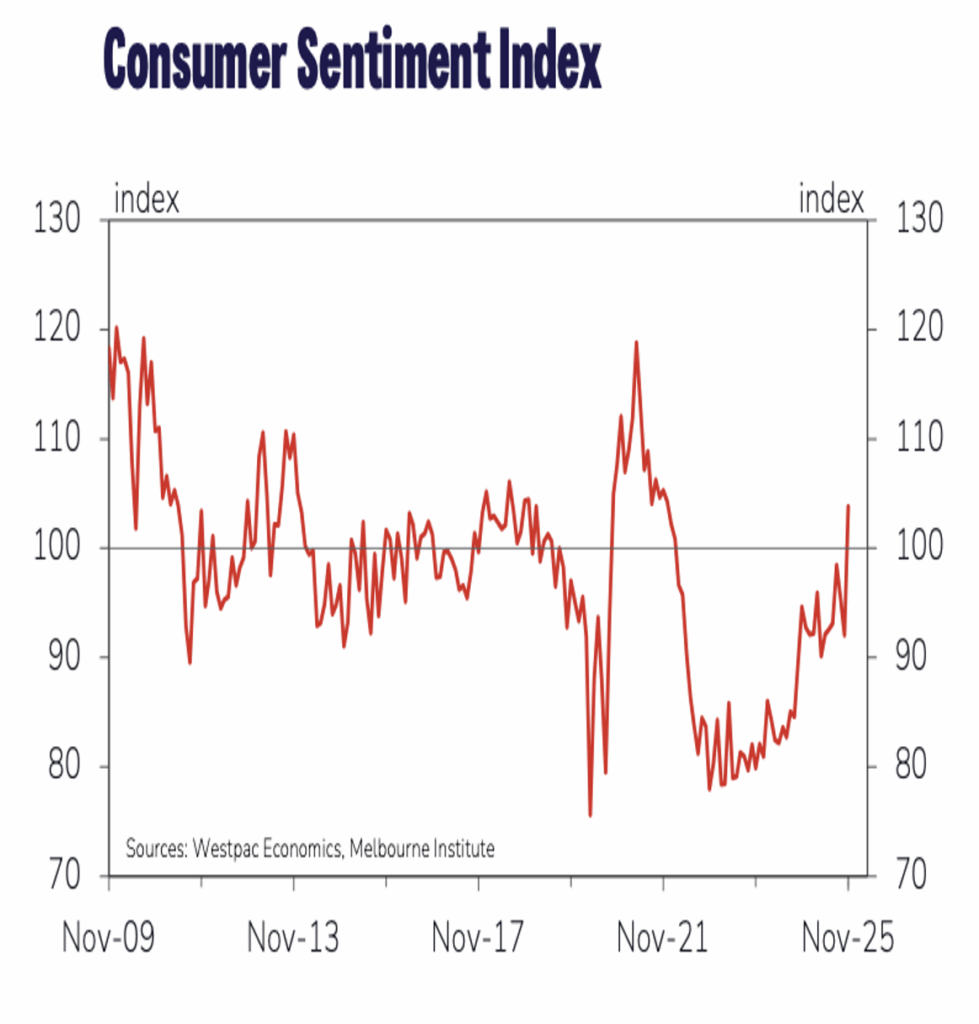

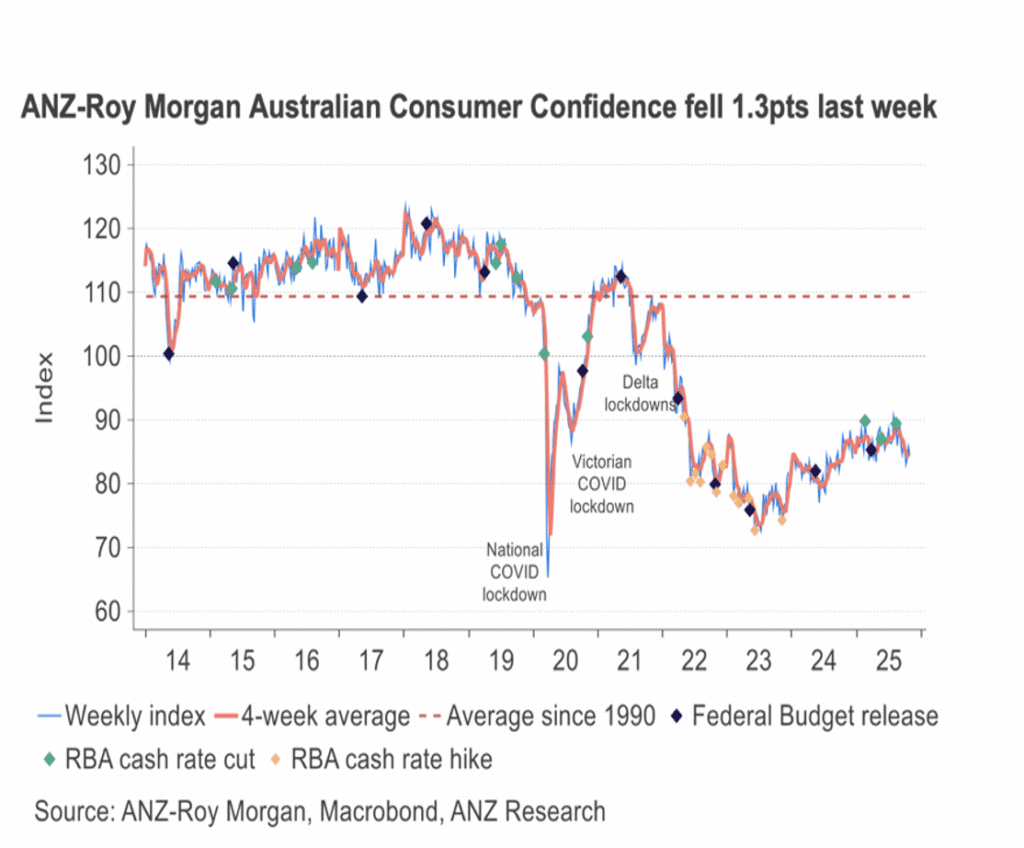

- Consumer confidence has been fickle with contrasting signals from the Westpac and ANZ estimates. According to Westpac, consumer sentiment surged 12.8 per cent in November to be at a 7 year high (excluding COVID). On the other hand, the ANZ measure remains weak having dipped in the past month. Factors impacting confidence are unemployment, softer wages growth and the absence of interest rate cuts which are being offset by strong house prices and the gradual improvement in the economy.

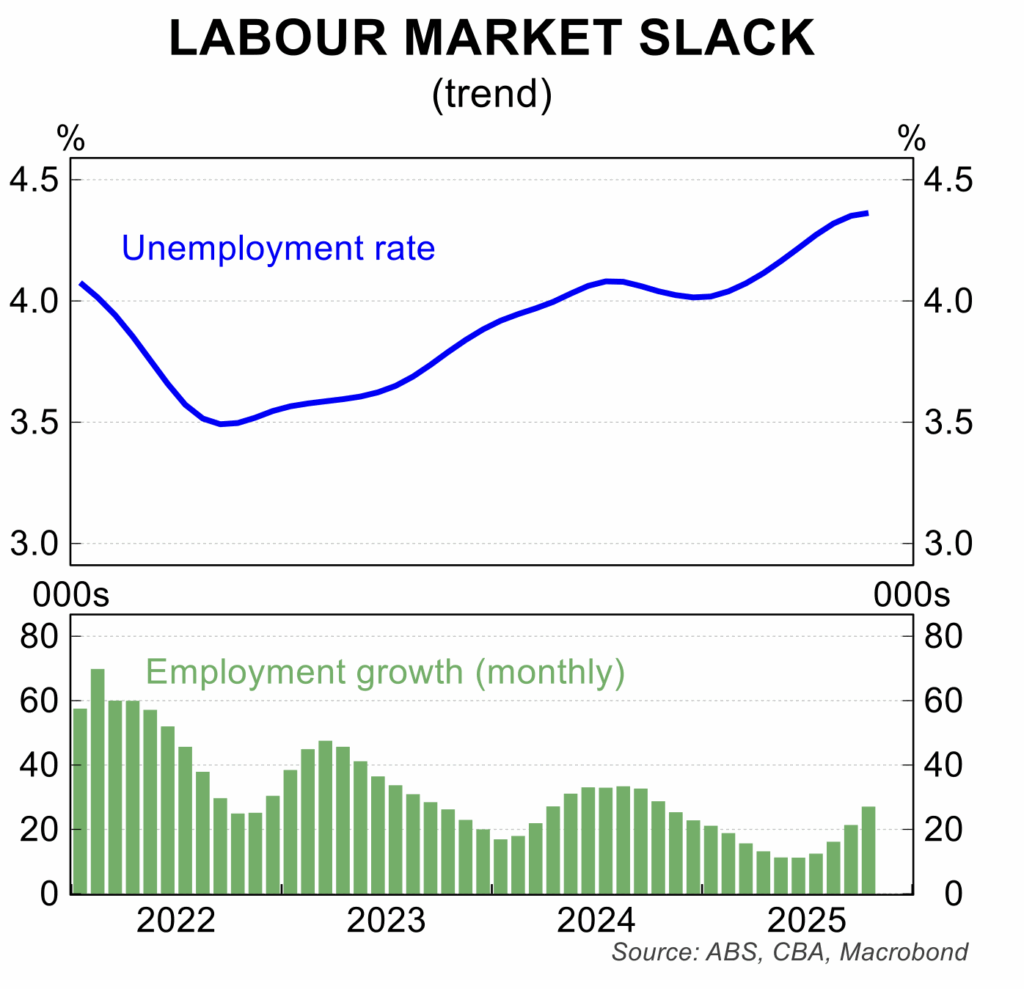

- The unemployment rate remains volatile – it fell to 4.3 per cent in October having spiked to 4.5 per cent in September. This is an increase from 4.0 per cent at the start of 2025. After five months of very moderate growth, employment rose 42,000 in October with the rise focussed on full time jobs. The outlook for the labour market remains problematic with job ads continuing to fall.

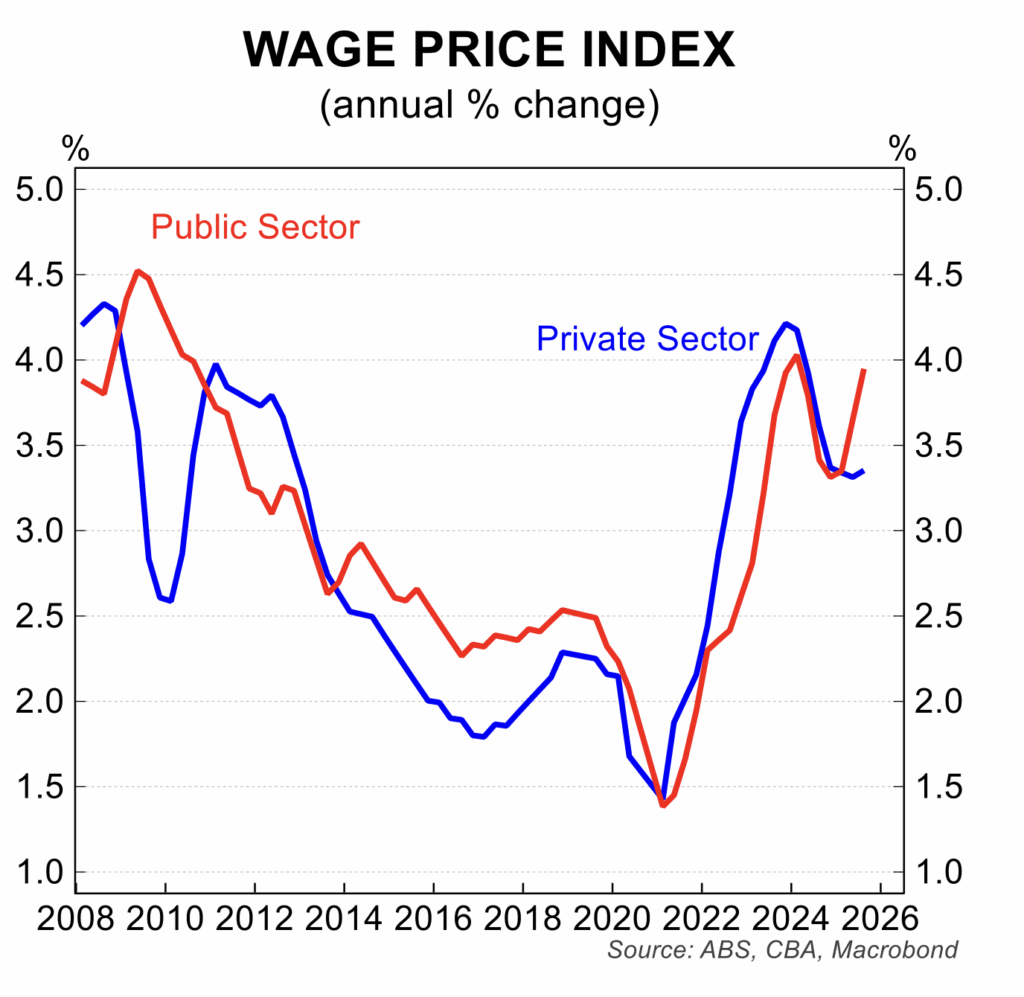

- Annual wages growth remained stable at 3.4 per cent in the September quarter to remain at a pace consistent with the RBA inflation target. Of note was the deceleration in private sector wages growth, which eased to 3.2 per cent, the slowest increase in over 3 years. This is consistent with a build-up of slack in the labour market.

- After two months of sharp falls, the number of building approvals rose 12 per cent in September to confirm a return to a more positive outlook for the dwelling construction sector. The bulk of the recovery was in multi-unit dwellings, which is a trend that is likely to continue given the lower construction costs and final selling prices of such dwellings. It remains a basic fact that to improve housing affordability over the medium term, a sustained lift in dwelling construction is essential.

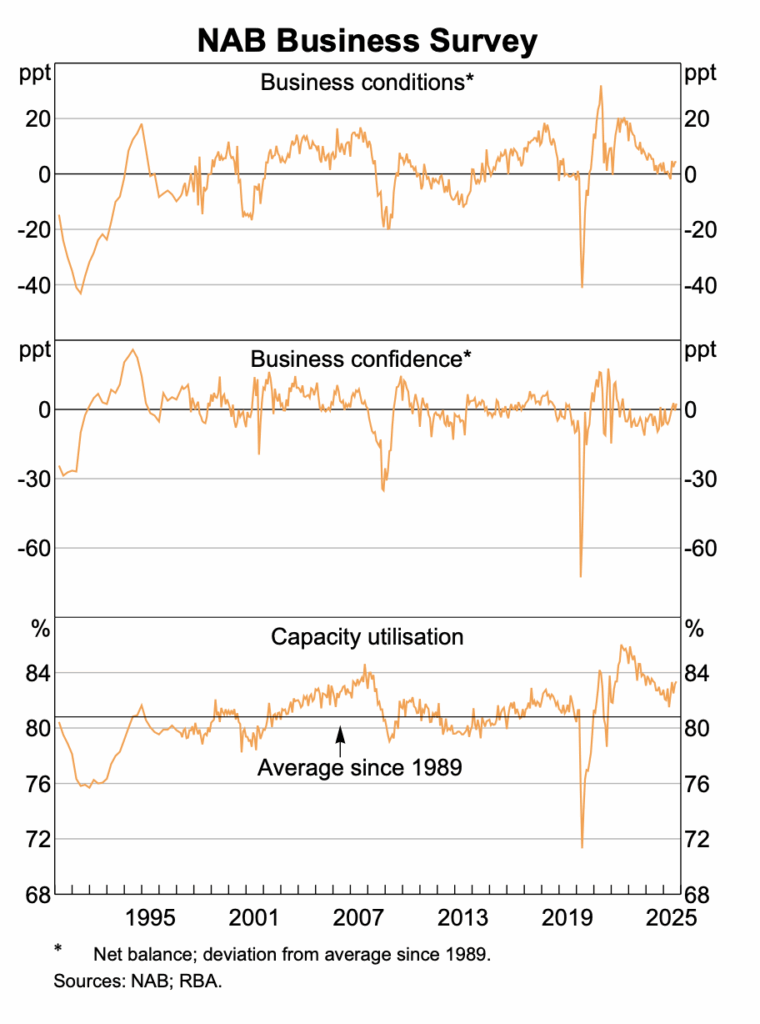

- The NAB business survey has been mixed but more positive than consumer sentiment. In September, business conditions were unchanged at +8 index points, to be around the long run average, while business confidence edged up 3 index points to +7 points to remain at around levels seen since mid-2025. There were moderate improvements in reported trading conditions and profitability, while expected employment continued to be subdued.

House prices

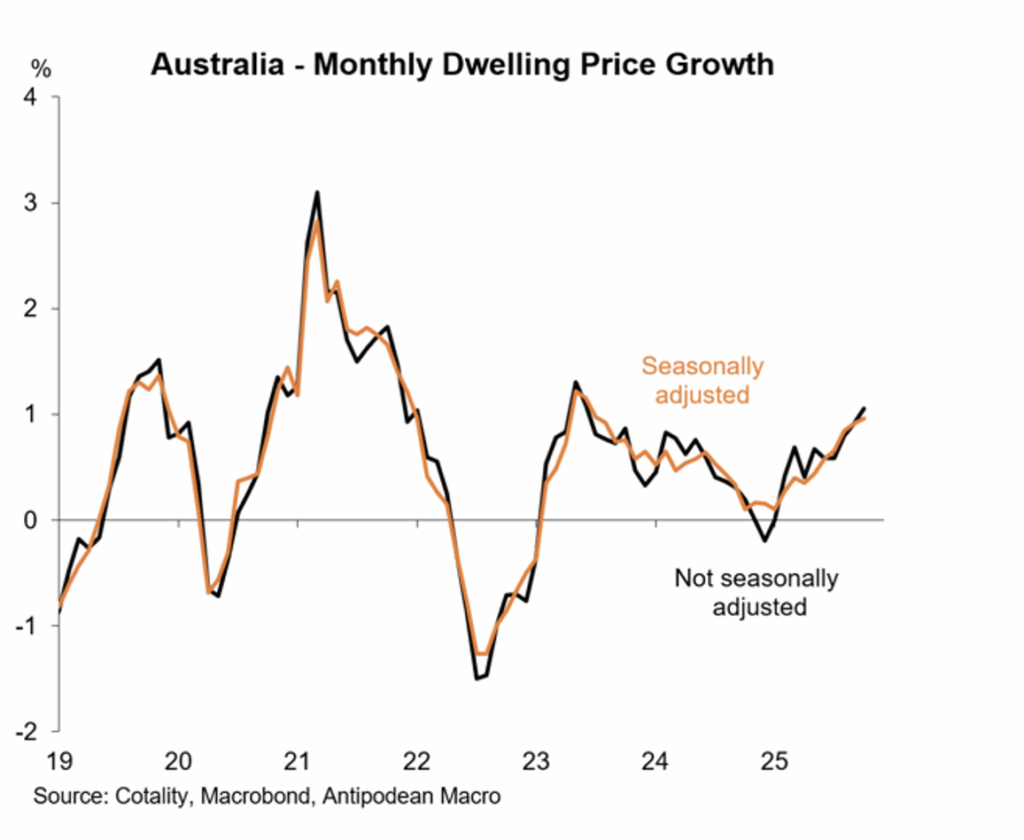

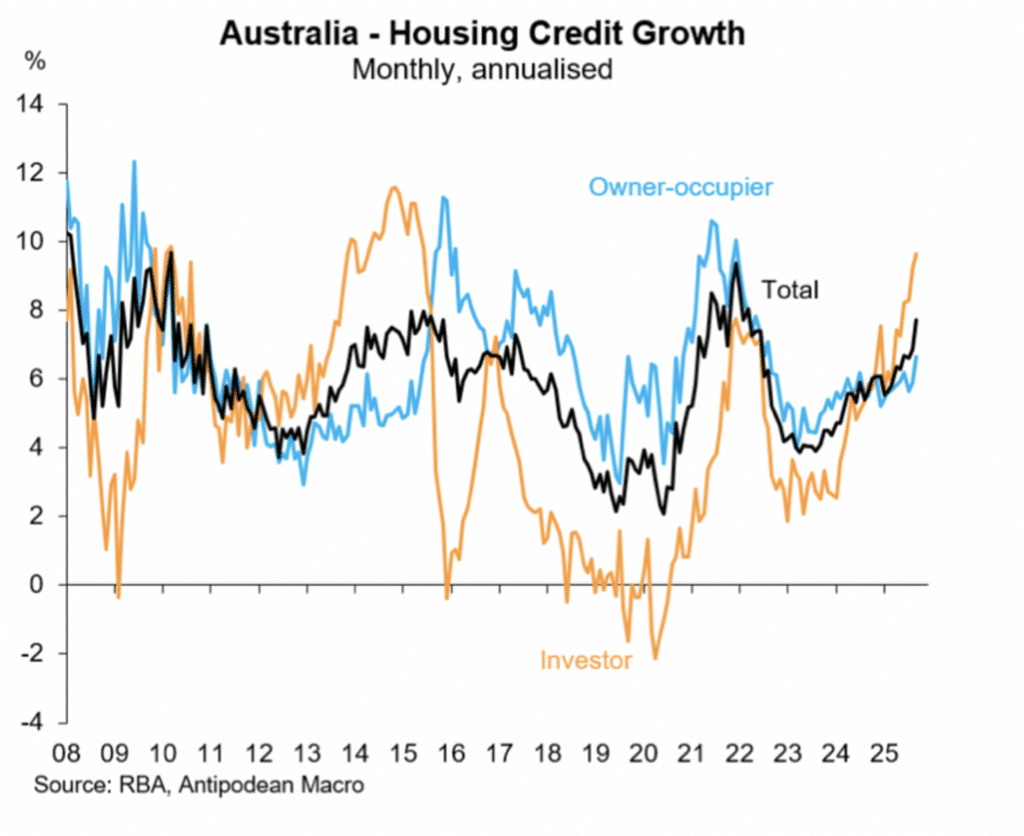

The pick-up in house prices accelerated into October, with nationwide prices rising 1.1 per cent, for an annual increase of 6.1 per cent. As has been evident for the past few months, there is a marked shortage of dwellings listed for sale, demand remains solid from strong immigration inflows, there has been a spark in first home buyer activity driven, in part, by the Federal government’s 5 per cent deposit scheme and lower interest rates, all of which have added to the capacity of borrowers to increase their loans.

For the near term, these trends are set to remain in place and house prices are likely to be skewed higher well into 2026.

Prices rose in all capital cities. In the past three months, the strongest gains were in Perth and Darwin (+5.4 per cent), Brisbane (+4.9 per cent), Adelaide (+3.2 per cent) while more moderate increases were seen in Sydney (+2.3 per cent), Canberra (+1.7 per cent), Melbourne (+1.6 per cent) and Hobart (+0.5 per cent).

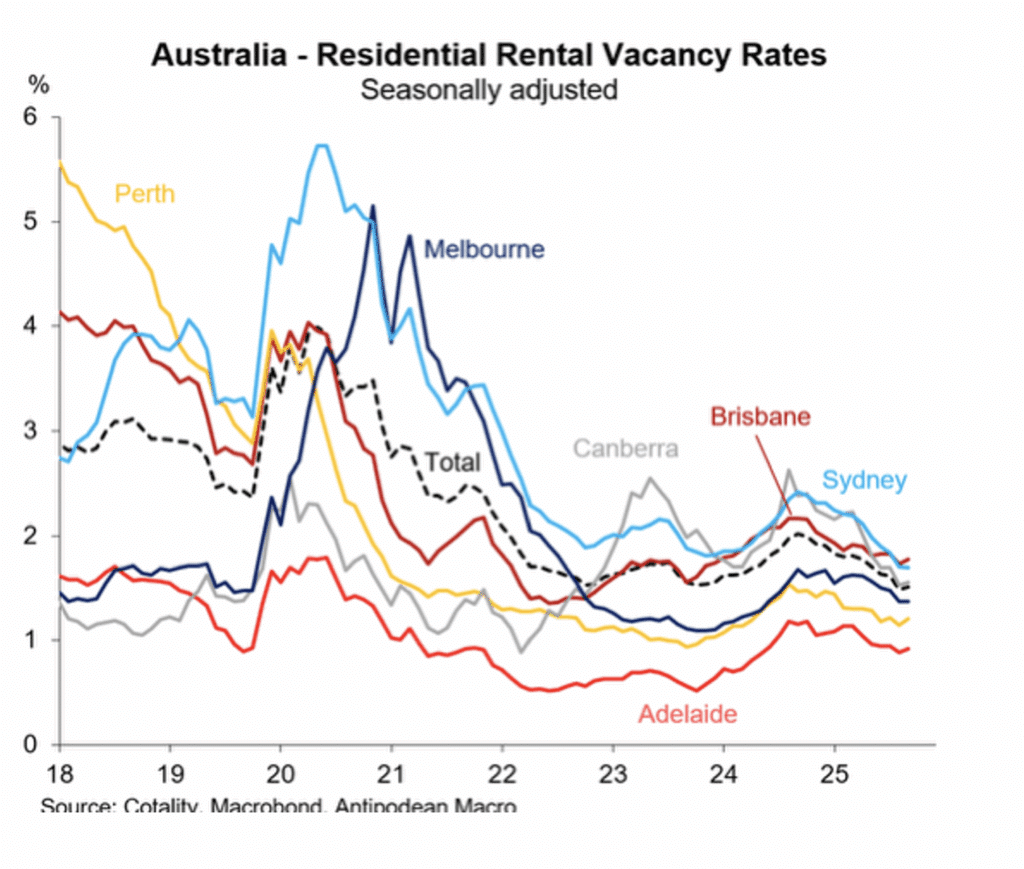

Rental vacancy rates remained low across all capital cities as the relative shortage of dwellings remained in place. The tight rental market has seen a lift in investor activity which is also feeding into prices.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.