Private credit specialist Zagga makes the case for steady income beyond the stock market

STOCKHEAD & THE AUSTRALIAN

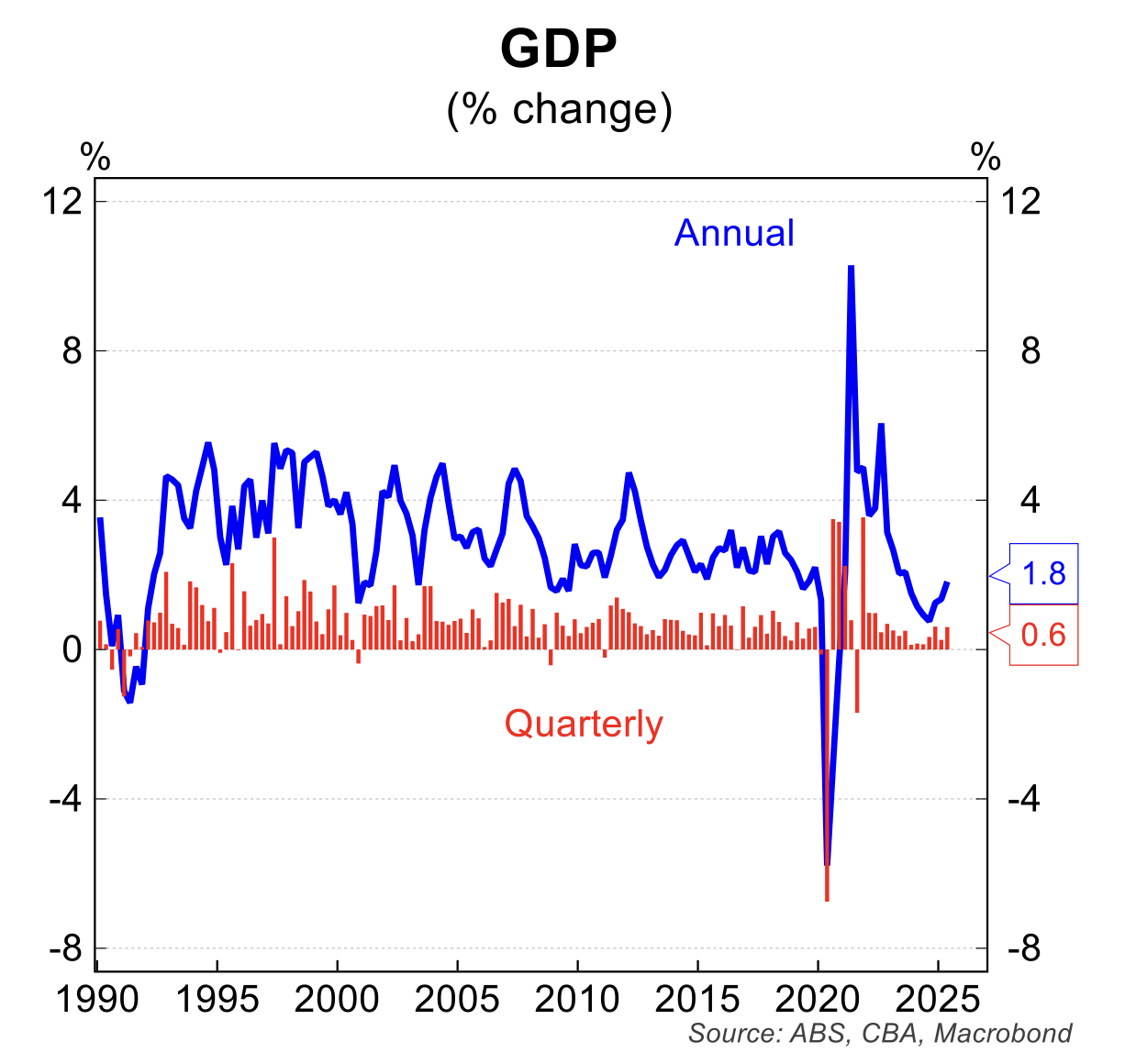

When share prices climb faster than profits, dividend yields naturally shrink. So while stocks look elevated, those once-reliable cheques don’t carry the weight they used to.

For income-hungry investors, the hunt is on for something steadier.

One corner of the market that’s quietly moving into the spotlight is private credit – and in particular, real estate-backed private credit.