Summary: 'Two Minutes for Zagga' | February 2026

Stephen Koukoulas opens his February update with an important reminder: the economic landscape has shifted quickly since late last year. At that time, “rate cuts were being priced into the market, inflation was nice and low… and there was some sort of a pickup in economic activity.” But as he notes, conditions have now changed decisively.

RBA hikes rates as inflation lifts

In early February, the Reserve Bank raised the cash rate by 25 basis points to 3.85%. Recent inflation data showed services inflation running “a little higher than the RBA would like,” alongside price pressures in areas such as international travel.

As Stephen notes, the RBA judged inflation was likely to remain elevated for longer than expected, prompting the hike.

RBA Governor Michelle Bullock did not provide forward guidance, saying decisions will be data‑dependent — particularly pending upcoming inflation data, unemployment numbers, and developments in the global economy.

Economic growth strengthens

Despite the rate hike, Stephen highlights several pieces of good news. The economy is picking up, with GDP growth expected to move above 2%. The December quarter figures, due in early March, are likely to confirm growth of around 2.25% — “one of the strongest growth rates that we’ve seen in a few years.”

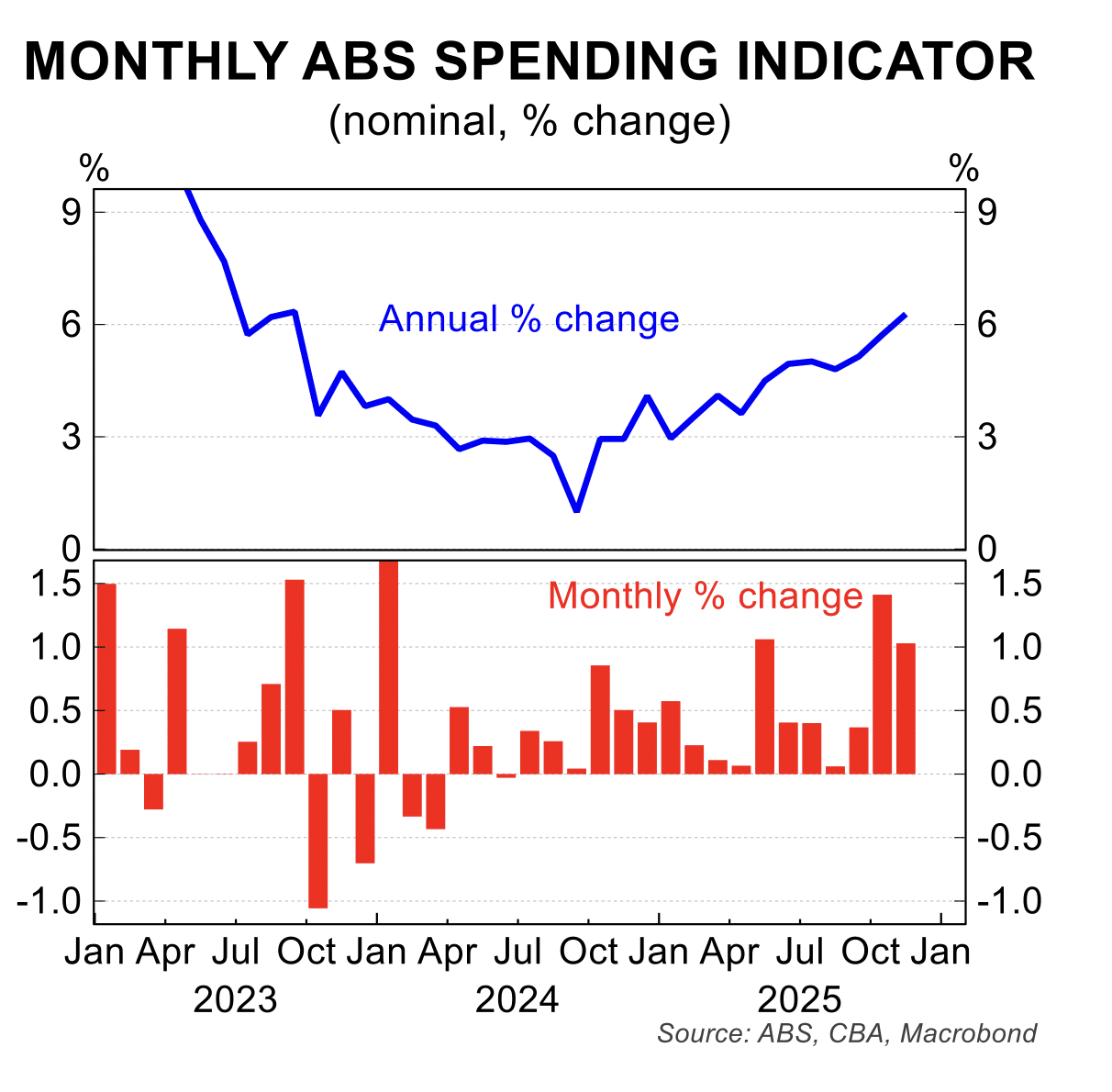

Household spending is a major driver, supported partly by last year’s rate cuts. And although it’s not booming, Stephen notes that the lift in spending represents a meaningful recovery.

Construction still essential — approvals volatile but elevated

On the housing front, Stephen reiterates the need for a strong construction response to ease affordability pressures.

Building approvals remain very volatile month-to-month due to apartment developments, but the overall trend is still generally high, even if momentum has softened slightly in recent months.

Governments across all levels are working to fast-track new construction by reducing red tape and supporting the “much needed” push toward a stronger year for dwelling construction in 2026.

Labour market firms unexpectedly

After a period of weaker employment growth, December brought a positive surprise — employment jumped by 65,000, and the unemployment rate dipped to 4.1%.

Stephen cautions that another month of data will be important before confirming the trend, but acknowledges that the improvement is indeed a sign of economic health.

Outlook for rates and the economy

Looking ahead, Stephen notes that rates are shifting higher, and further hikes remain possible if inflation continues in line with — or above — the RBA’s current forecasts. He anticipates that while one more increase could be on the table, any additional moves beyond that would push the cash rate to a “really restrictive level” above 4%.

Overall, he emphasises that the economy is improving. Consumer spending and construction are bright spots, the labour market is performing better than feared, and additionally, he acknowledges, “it’s nice to have an unemployment rate nearer 4% than 5%.”

Watch the full video below:

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.