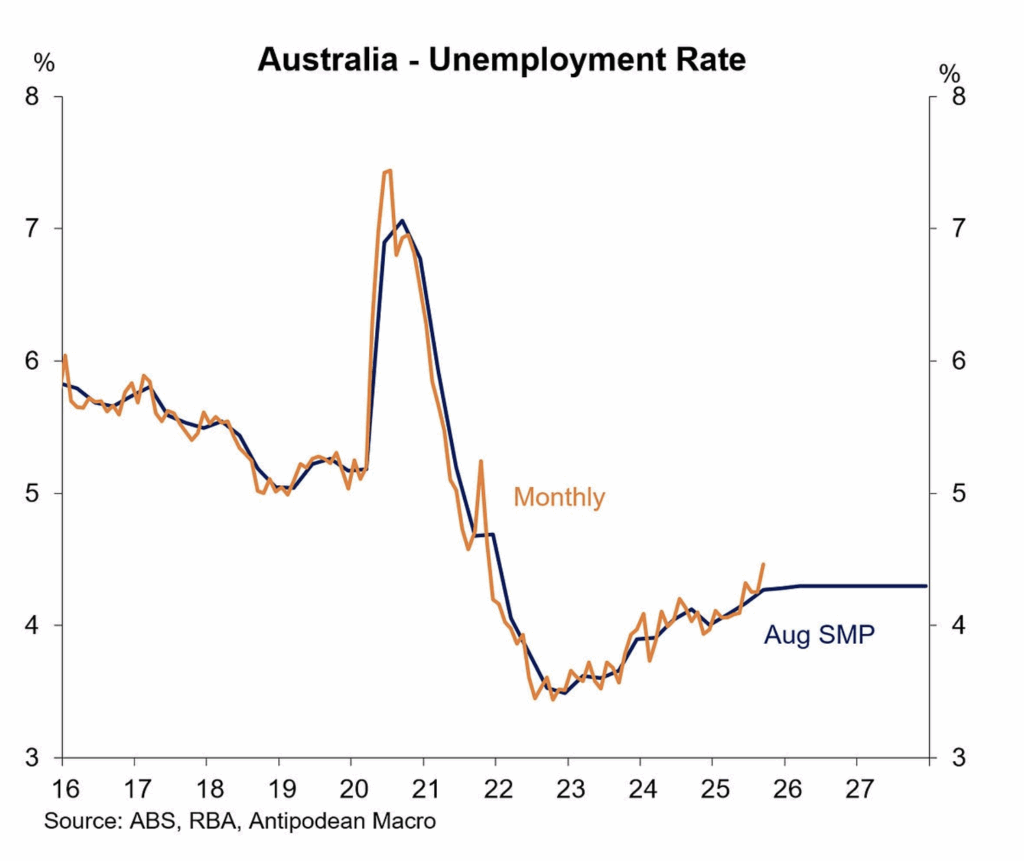

The unemployment rate spiked to a four year high of 4.5 per cent in September, up from 3.4 per cent at the low of the cycle and is now above the RBA’s forecast made in August for a peak of 4.3 per cent.

The result rekindled expectations for further interest rate cuts, as soon as its next meeting on 4 November.

Recall that under the revised mandate of the RBA, maintaining full employment sits along side the inflation target as a fundamental objective of the Bank. The key data ahead of the next RBA meeting is the September quarter inflation data which is scheduled for 29 October.

In addition to the weak labour market data, the run of economic news was mixed, with an economic recovery still in the central case, although the speed of that recovery is erring on the moderate side. Data on household spending, dwelling approvals, job vacancies and consumer sentiment were weaker than expected, while business confidence, house prices and the stock market remained robust.

In the international economy, tariff tensions remain a key influence, along with the US government shutdown which was triggered by the extremely parlous debt position of the Federal administration. For the moment, markets have remained orderly as those issues play out. Interest rate cuts from major central banks remain priced into futures markets, especially in the US.

Key data

Below is an update of key trends in the economy over the past month:

- There was a weak report for the labour market: employment rose 14,900 in September following a fall of 11,900 in August. Trend employment growth has slowed to the point where the unemployment rate is rising. It spiked to a four year high of 4.5 per cent which is above the RBA’s forecast peak of 4.3 per cent. Future job creation will be impacted by the slide in job vacancies, which have fallen 33 per cent from their 2022 peak.

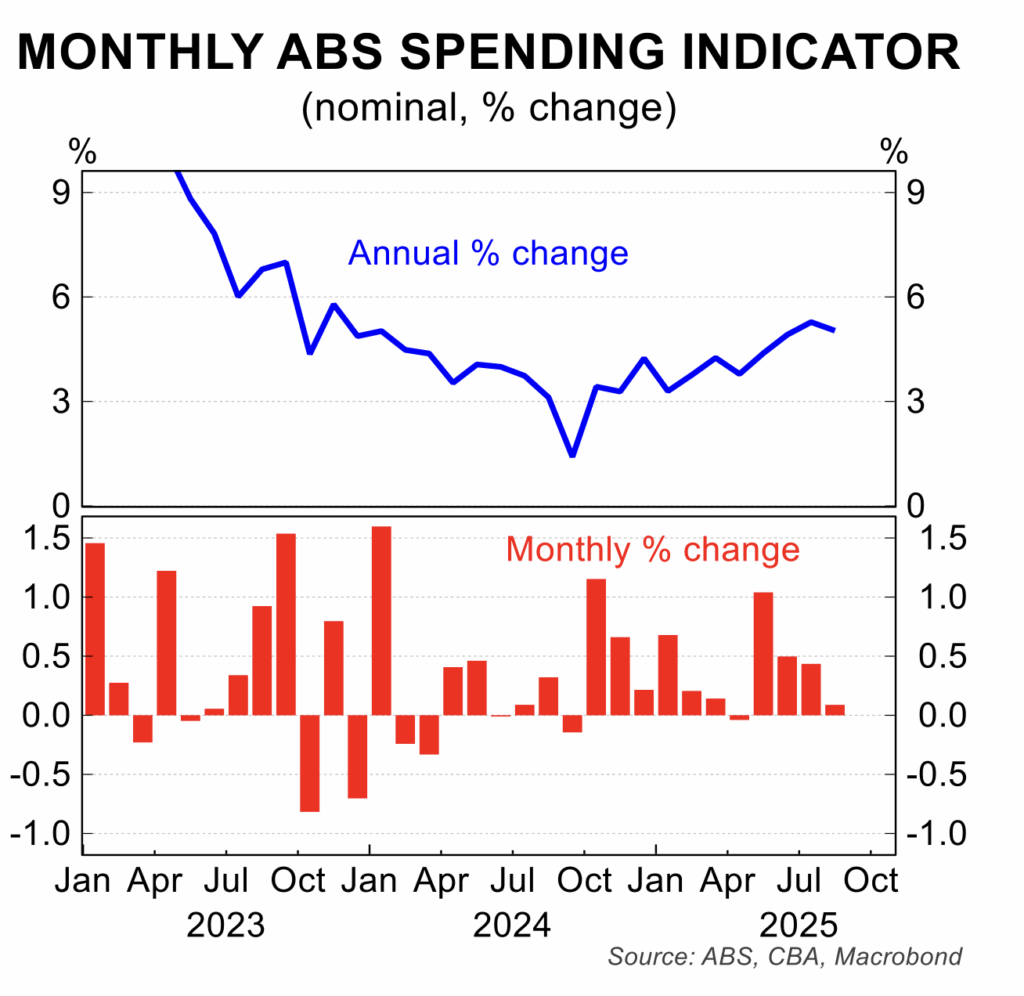

- After a solid lift in the first half of the year, household spending growth stalled, rising just 0.1 per cent in August. This saw the annual increase ease to 5.0 per cent from 5.3 per cent in July. The positives remain rising real wages and a strong wealth effect from house prices and the ASX; more neutral to negative influences are the delays from the RBA in returning official interest rates to an accommodative level and a softening in labour market conditions.

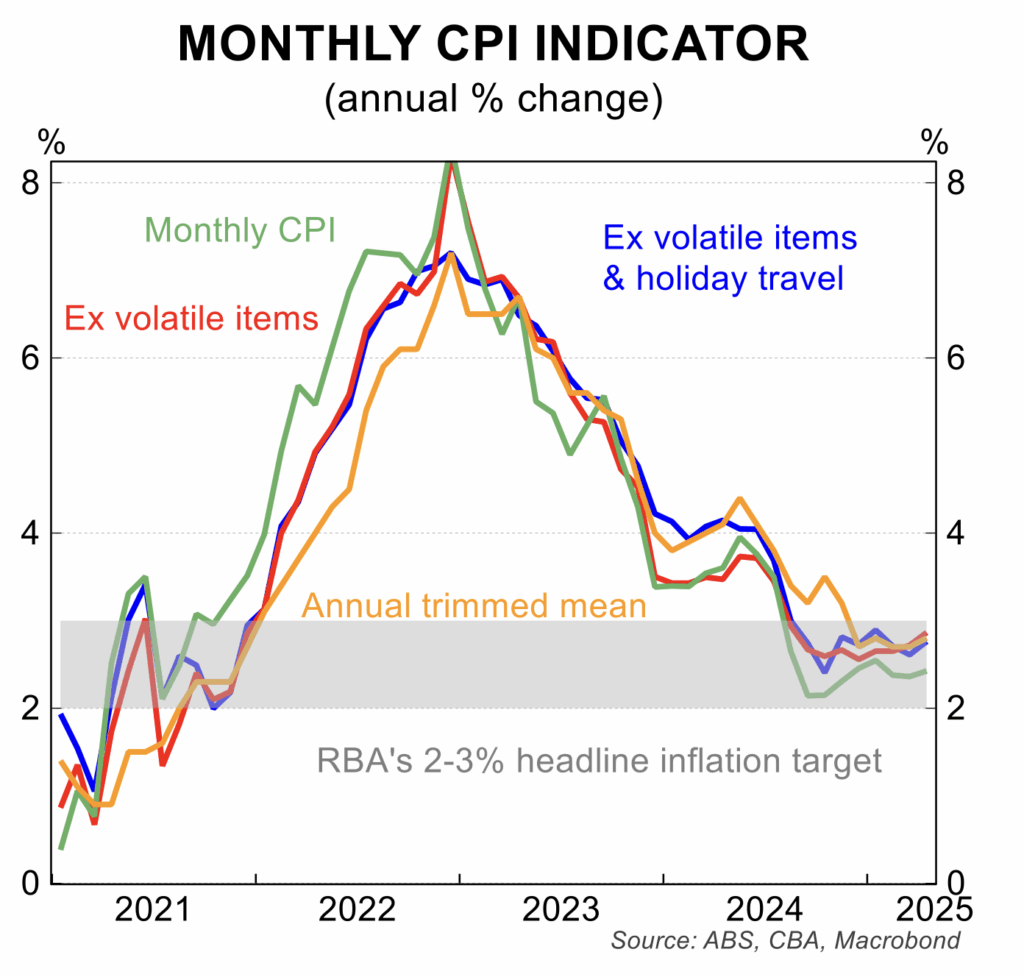

- Headline inflation edged up to 3.0 per cent in August, an upside surprise driven almost exclusively by the partial unwinding of government electricity subsidies and a rise in the excise on tobacco. The annual trimmed mean or underlying rate was well contained, easing to 2.6 per cent to effectively be in the middle of the RBA target band. The comprehensive September quarter inflation data will be released on 29 October, a week before the next RBA meeting.

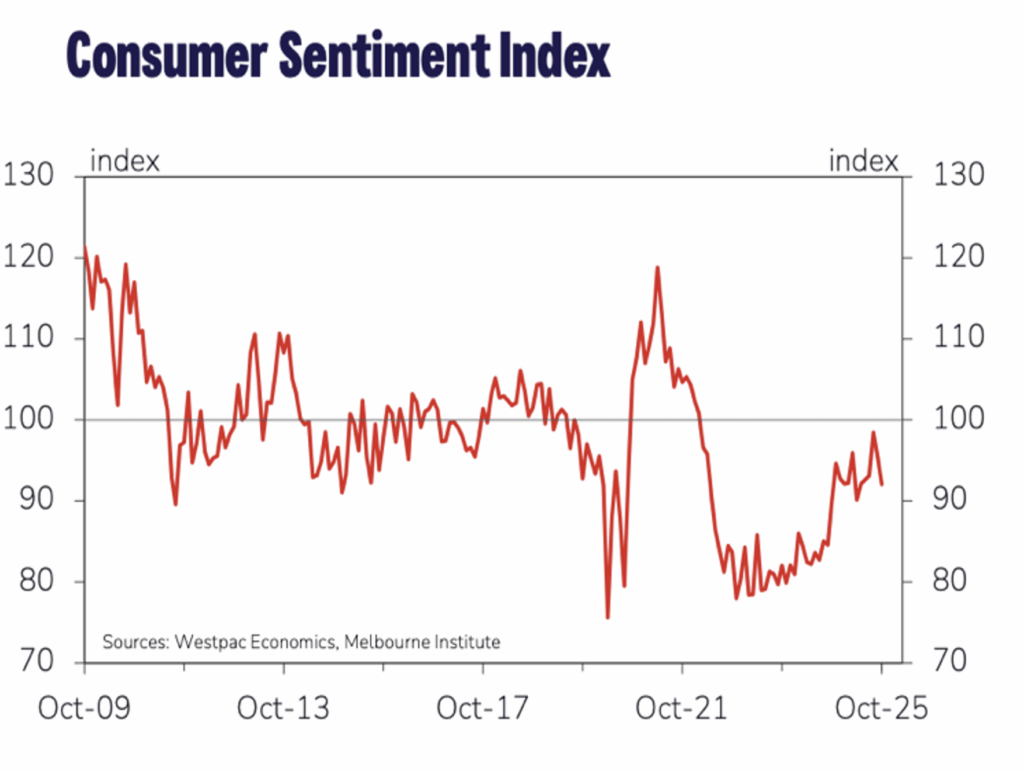

- Consumer sentiment fell for a second straight month in October to partly reverse what was a more positive tone earlier in 2025. The Westpac-Melbourne Institute index fell 3.5 per cent to 92.1 points, a level which has more pessimists than optimists in the household sector. The main area of recent weakness was in the outlook for family finances.

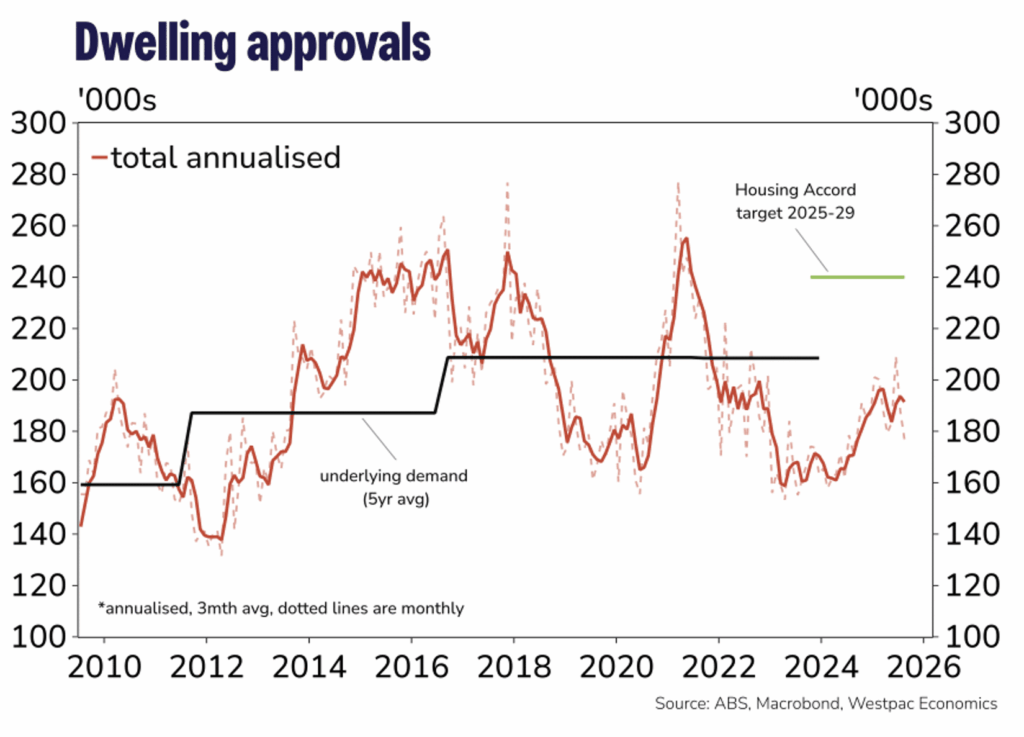

- There have been disappointing and sharp falls in the number of dwelling building approvals in last two months, with the falls totalling 15 per cent. This has unwound about half of the upturn that was evident earlier in 2025. The faltering of housing construction presents problems not just for economic activity but also for much needed housing supply. The government’s plan, for 1.2 million new dwellings in the 5 years to mid 2029, is unlikely to be met.

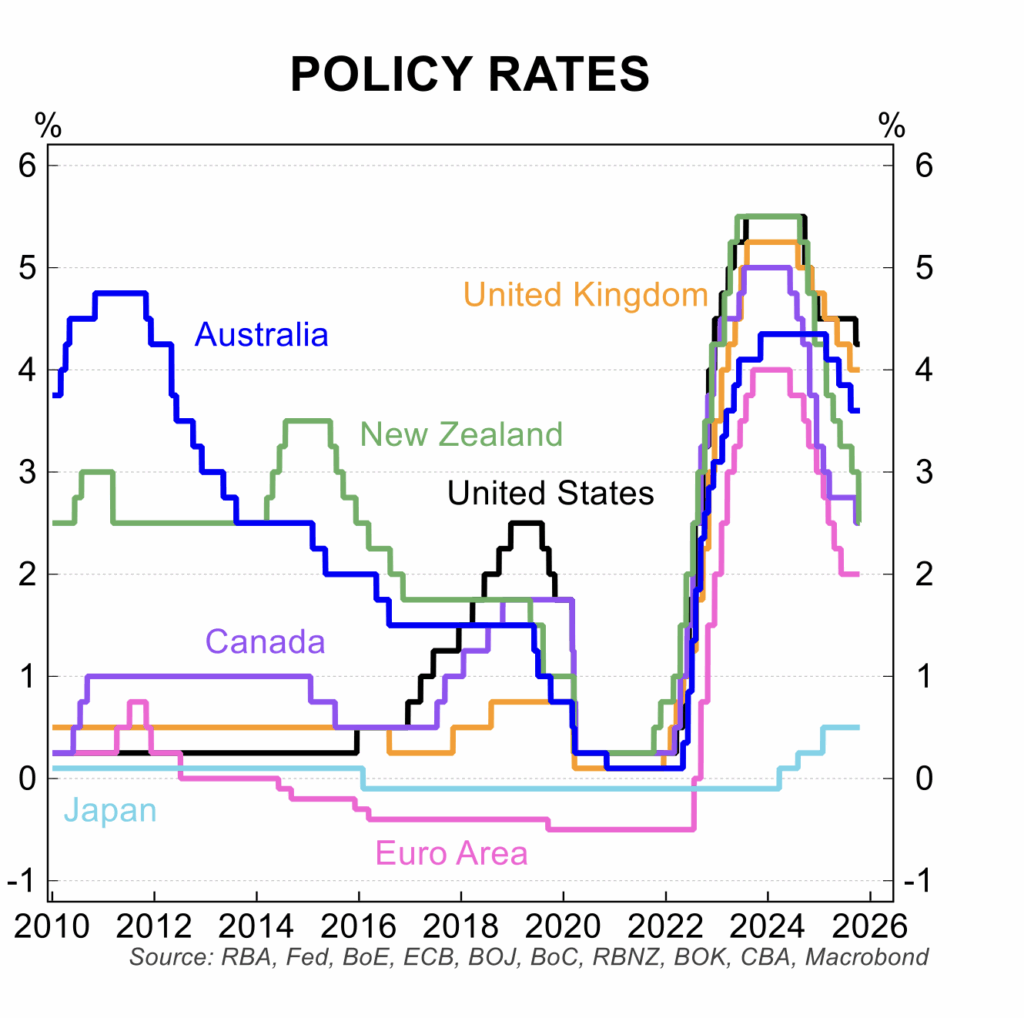

RBA monetary policy and current pricing for the cash rate

The unemployment data sparked a major repricing for interest rate futures. An interest rate cut on 4 November is now close to 75 per cent, with rates priced in to fall to 3.10 per cent from the current 3.60 per cent in the first half of 2026. Interest rate cuts continue to play out in the US, Canada, New Zealand and the UK.

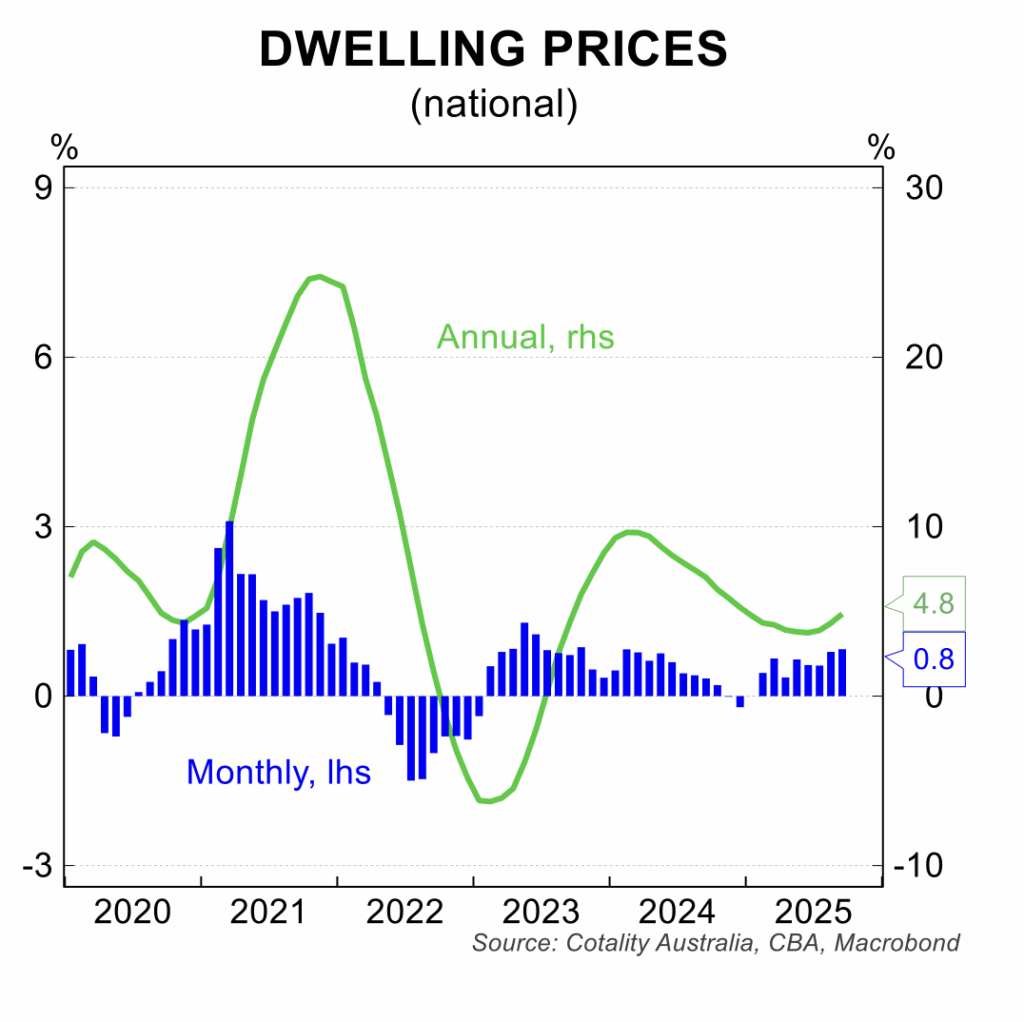

House prices

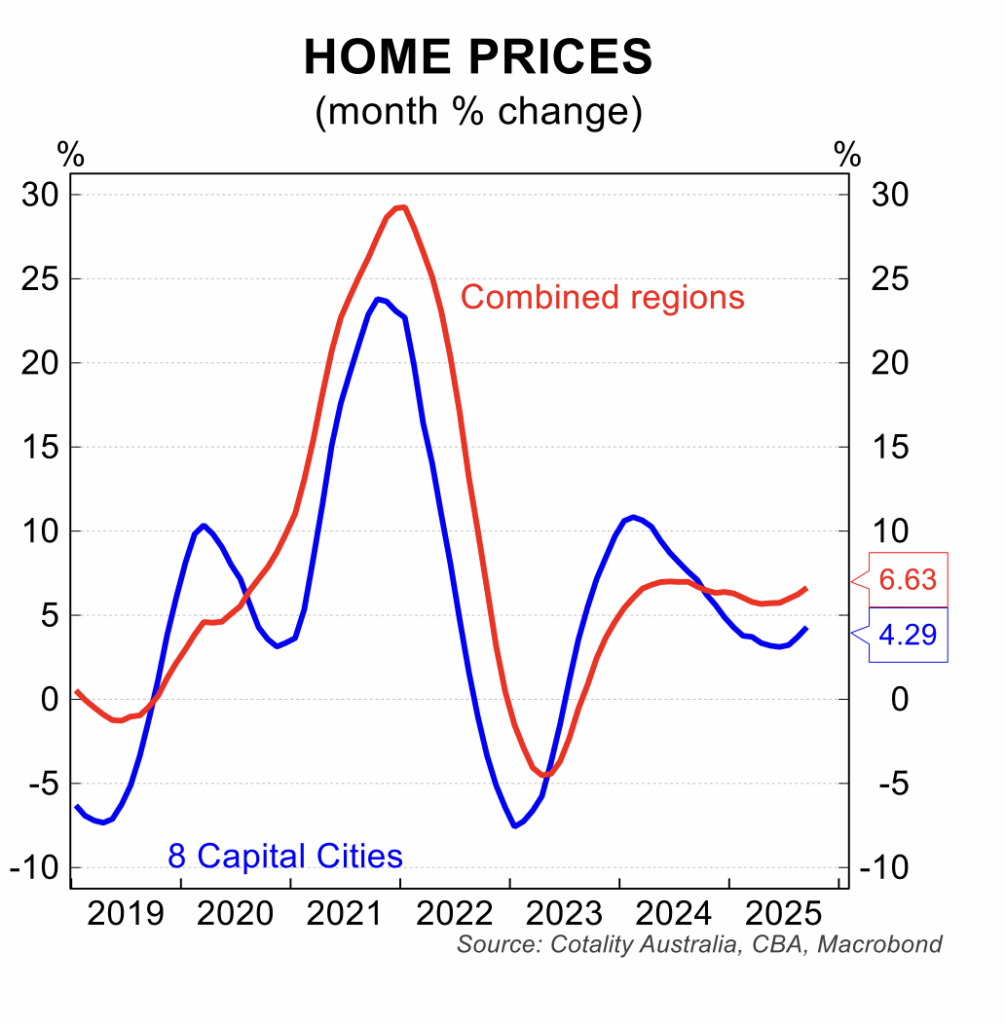

A fall in the number of new listings for sale has generated a shortage of dwellings for buyers who have also been buoyed by a return to rising real wages, lower interest rates and a tight rental market. A series of first home buyer incentives including the Federal government’s 5 per cent deposit scheme have added to demand.

The lift in house prices has gained further impetus in September, with prices rising 0.8 per cent to be 4.8 per cent higher than a year earlier. Price increases were registered in all capital cities with Darwin rising 1.7 per cent, Perth 1.6 per cent, Brisbane 1.2 per cent and Adelaide 0.9 per cent, the strongest. Regional areas continue to see solid price gains. The Cotality data for the first half of October points to further price gains.

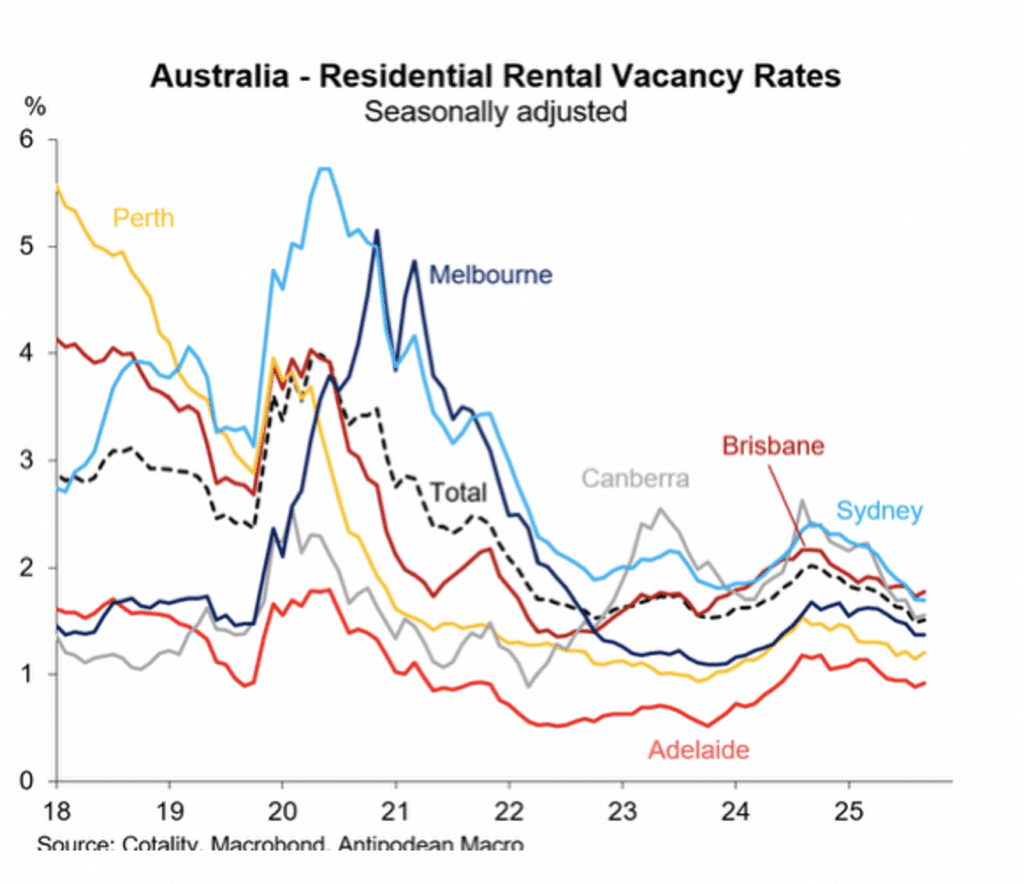

In line with the broader shortage of available dwellings, the rental market remains tight and if anything, has tightened further since early 2025. The deceleration in rents that was evident over the past two years appears to be reversing as a result.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.