Press Release

Source: Foresight Analytics

Date: 29 January 2026

Foresight Ratings has recently completed a ratings assessment of the Zagga CRED Fund.

The fund has been assigned a VERY STRONG investment rating, indicating a strong level of confidence that the fund can deliver a risk-adjusted return in line with its investment objectives. We note that Zagga is a high-quality, institutional-grade investment manager that continues to execute its long-term growth strategy thoughtfully.

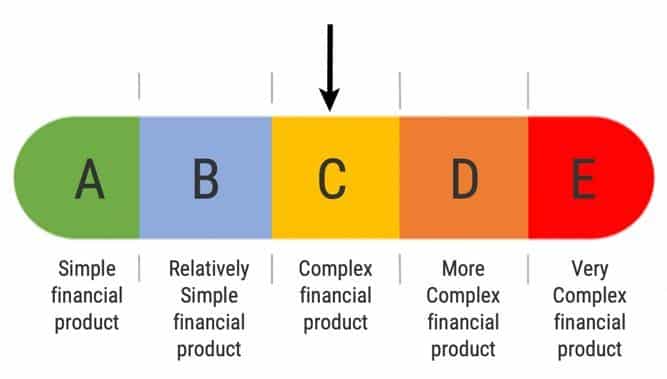

The Foresight Product Complexity Indicator (PCI), which considers the complexity of an investment product based on 10 risk factors, was assigned as COMPLEX for the Zagga CRED Fund. This rating primarily reflects that the underlying assets require specialist investment skills to acquire, and monitor. In addition, a large proportion of the Trust’s assets are illiquid, and investors should have a good understanding of the investment time horizon as well as the distribution characteristics of this type of fund.

The Zagga CRED Fund is a pooled mortgage trust established in January 2024 and managed by Zagga Investments Pty. Ltd. The underlying investments are direct loans secured by registered first mortgages on property development, land development and refinancing of completed stock. The Fund is effectively a floating-rate investment strategy.

The Fund sits at the more conservative end of the first-ranked mortgage trust segment. It has a first mortgage secured, senior loan-only mandate. The Manager’s preferred loan profile is for upmarket residential developments in city centres on the Australian eastern seaboard. The borrowers are highly experienced, reputable, and financially strong developers. Most of them are repeat borrowers with long-term relationships.

While Zagga was founded in 2017, the key members of the investment team are highly experienced, having been in this sector since before the GFC (Global Financial Crisis). Zagga currently has 4 funds operating in the non-bank Australian CRE debt (ACRED) space and has grown total FUM to over $1.1BN as at 31st October 2025.

While the Fund is relatively new and the current FUM is circa $26.5M, portfolio diversification has been achieved by making ‘fractionalised’ loans into larger credit-risk-parameter-appropriate loans originated by the Zagga group. The latter are typically in the $5M-$100M range. This interaction with other Zagga funds creates a liquidity waterfall. At the group level, the firm manages over $1.1BN FUM.

Foresight analyst Divya Balasubramanian commented on the Zagga CRED Fund, saying that ‘The investor base is loyal and growing, materially comprising high-net-worth individuals (HNWs), family offices, financial advisors and institutional investors. More recently, the firm had material success raising capital in Asia via its Singapore vehicle.’

About Foresight Analytics’ Investment Due Diligence Rating (IDD Rating)

The objective of Foresight Analytics’ Investment Due Diligence Rating (IDD Rating) is to identify the best funds and opportunities for future investment. We assess the fund’s historical risk-adjusted performance – compared to its peers – to form a holistic view of the manager’s ability to deliver future returns. The IDD rating indicates the quality of the investment option within the context of a diversified portfolio and full investment cycle.

Foresight’s analysts use a 5-point scale to determine how the fund will perform against a range of risk factors.

- SUPERIOR indicates the highest level of confidence that the fund can deliver a risk-adjusted return in line with its investment objectives and that it is highly suitable for inclusion on APLs.

- VERY STRONG indicates a very strong conviction that the fund can deliver a risk-adjusted return in line with its investment objectives and that it is suitable for inclusion on most APLs.

- STRONG indicates a strong likelihood that the fund can deliver a risk-adjusted return in line with its investment objectives and that it is suitable for inclusion on most APLs.

- COMPETENT indicates the fund may deliver a risk-adjusted return in line with its relevant benchmark and that it may be suitable for APLs.

- WEAK indicates the fund is unlikely to deliver a risk-adjusted return in line with its investment objective and that it is not suitable for most APLs.

A ‘Hold’ designation is applied to a fund’s rating if a material change impacts the fund manager, and we need to review the rating. A ‘Sell’ designation indicates the Foresight Investment Ratings Committee considers risk factors to be elevated enough that maintaining an investment in the fund as part of their diversified portfolio is questionable.

Foresight Complexity Indicator

A Foresight Complexity Indicator (FCI) highlights the complexity of an investment product based on a range of indicators. These typically include its terms and conditions, performance-based fees, liquidity structure, financial leverage, use of derivatives, rare and niche asset class/opportunity set, currency exposure and the level of transparency offered for investors. Foresight believes these factors can disproportionately affect risk-adjusted return outcomes for investors even if a manager is very skilled. Investors can use FCI as a guide to portfolio position sizing within a diversified portfolio context.