Summary: 'Two Minutes for Zagga' | January 2026

Stephen Koukoulas kicks off 2026 with cautiously positive news: the steady economic recovery that emerged in the second half of 2025 “looks to be continuing.” While he emphasises that the pickup is “not a strong economic” surge, conditions are now clearly better than six or twelve months ago.

Hosuehold spending strengthens

Much of the improvement is coming from household spending, with consumption growth rising at an annual pace above 6%, despite weak sentiment.

Stephen notes that spending has continued to strengthen for “three or four months now”, with possible drivers being:

- spending tied to end of year events, such as Black Friday,

- cash freed up from the interest rate cuts that began in February last year, and

- wealth effects from strong house prices and equity markets.

Construction momentum builds

Dwelling construction activity is picking up, supported by a sharp rise in building approvals — up 15% in November, driven by apartment projects in major cities.

Stephen highlights the importance of this trend, noting that apartments will be central to addressing Australia’s housing shortage. Early signs of rezoning reforms, fast‑tracked approvals, and strong housing demand are helping lift new construction activity.

He describes dwelling construction as “the dark horse of the economy in 2026 and 2027,” noting that it’s likely to become a period we look back on as one of the standout areas of economic strength as activity accelerates.

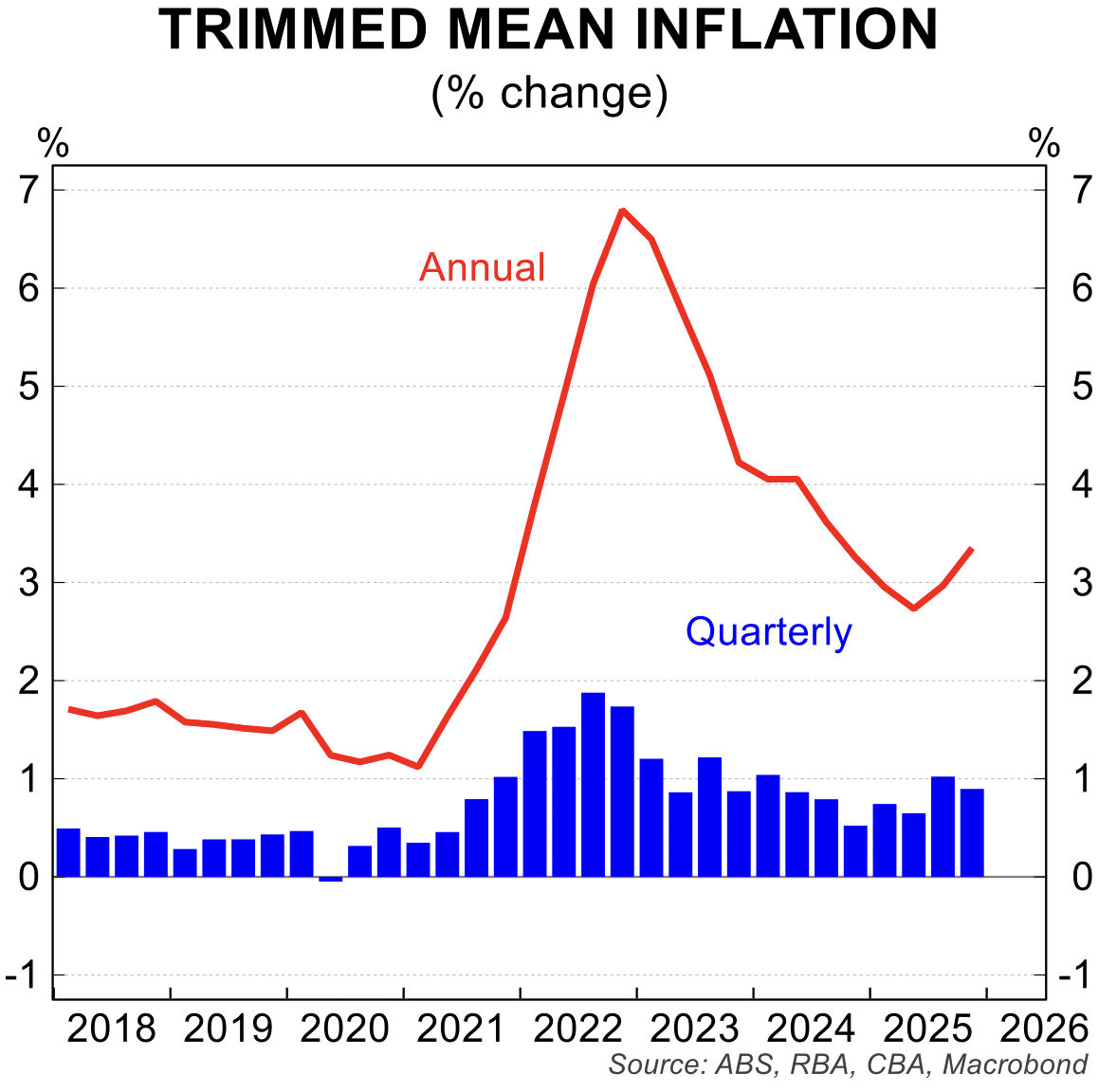

Inflation remains the wildcard

Late‑2025 inflation data showed a jump in prices, prompting debate about what caused the increase.

Stephen notes much of the rise came from ‘administered prices’, including:

- the ending of electricity subsidies

- higher public transport fares

- increases in council rates and charges

These factors sit outside the RBA’s influence — rate hikes or cuts “aren’t going to change any of those things.”

Still, the inflation jump unsettled markets and the RBA has made its position clear: it will wait for incoming monthly inflation data and labour market updates before deciding whether to hike, hold, or cut.

A softening labour market

Even with better economic data, the unemployment rate has been creeping up, while employment growth is creeping down.

A significant pullback in full‑time employment is linked to earlier government‑sector hiring sprees winding down, which had previously supported labour market strength.

Overall, Stephen notes the economy needs to grow “a little bit more” to prevent further increases in unemployment.

Global uncertainty lingers

He also points to a range of geopolitical issues, being “impossible to read” in terms of how they might unfold and that, for now, the impact on the Australian economy and capital markets has been relatively small but could change quickly.

Outlook

Stephen ends on a cautiously optimistic note:

“Kicking off 2026 on a pretty positive and optimistic note — let’s hope it can continue.”

Watch the full video below:

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.